Competition Heats Up: FMX's Treasury Futures Offering Takes On CME

Table of Contents

FMX's Treasury Futures Offering: A Detailed Look

FMX's foray into Treasury futures presents a compelling alternative to the established CME platform. Understanding the specifics of FMX's offering is crucial for traders considering diversification or a shift in their trading strategies.

- Contract Specifications: FMX offers Treasury futures contracts mirroring those available on CME, ensuring compatibility and allowing for easy comparison. Specific contract sizes and underlying assets will need to be compared directly on both platforms. This direct comparison allows traders to understand the nuances of each offering and make an informed decision.

- Trading Platform: FMX's trading platform is touted for its user-friendly interface, advanced charting tools, and high-speed execution capabilities. Traders should assess whether these features provide a competitive edge compared to their existing trading workflows. Technological superiority can be a significant draw for sophisticated traders.

- Margin Requirements: Margin requirements are a critical factor influencing trading costs and leverage. A comparison of FMX's margin requirements with CME's is essential. Lower margins could provide traders with increased leverage, though this should be carefully weighed against potential risk.

- Clearinghouse: The reliability and reputation of the clearinghouse are paramount. Traders should thoroughly research the clearinghouse used by FMX and evaluate its financial strength and track record. The security of transactions and the ability of the clearinghouse to meet its obligations are critical considerations.

- Potential Advantages: FMX's potential advantages might include lower fees, better technology, and potentially greater access to emerging market participants. These factors combined could attract a significant share of the market, particularly traders seeking lower trading costs or access to a more modern trading environment.

CME's Response and Market Position

CME Group, the long-standing leader in Treasury futures, holds a substantial market share built on decades of experience and a robust infrastructure. However, FMX's entry will undoubtedly force a reevaluation of its strategies.

- Market Share: CME currently enjoys a dominant market share in Treasury futures trading, driven by its established reputation, vast liquidity, and extensive network of market participants.

- Competitive Advantages: CME's advantages include its established brand recognition, deep liquidity, comprehensive range of products, and a highly efficient and reliable trading infrastructure. This established network effect is difficult to overcome for new entrants.

- Response to Competition: CME's response to FMX's challenge could involve price adjustments, technological upgrades, enhanced marketing campaigns, or the introduction of new products and services to further enhance its offerings.

- Impact on Profitability: Increased competition from FMX could put pressure on CME's profitability, potentially necessitating adjustments to its pricing and operational strategies to maintain its market dominance.

The Impact of Increased Competition on Liquidity and Pricing

The increased competition between CME and FMX is expected to have a profound impact on the dynamics of the Treasury futures market.

- Liquidity: Increased competition typically leads to greater liquidity as more trading volume is distributed across multiple exchanges. This enhanced liquidity can translate into tighter spreads and improved price discovery.

- Price Discovery: More efficient price discovery is a key benefit of increased competition. Multiple venues offering Treasury futures should lead to a fairer and more accurate reflection of market prices.

- Bid-Ask Spreads: Competition usually leads to narrower bid-ask spreads, benefiting traders who can execute trades at more favorable prices. The tighter spreads represent a direct cost savings for active traders.

- Market Efficiency: The overall impact should be a more efficient market, reflecting information more quickly and accurately, benefiting both institutional and retail investors.

Implications for Traders and Investors

The choice between CME and FMX presents traders and investors with new opportunities and considerations.

- Trader Choice: Traders now have a clear choice between two major platforms for trading Treasury futures, allowing them to select the exchange best suited to their individual needs and trading styles.

- Investment Strategy: The increased competition could lead to the development of new trading strategies tailored to take advantage of the diverse offerings of each exchange. Diversification across platforms should be considered.

- Risk Management: Traders need to adapt their risk management strategies to account for the nuances of each platform, including margin requirements and clearing procedures. Careful consideration of the associated risks is crucial.

- Trading Costs: A key consideration for traders is the overall cost of trading, including commissions, fees, and margin requirements. The competition may lead to a race to the bottom on trading costs.

Conclusion

The arrival of FMX as a significant competitor in the Treasury futures market marks a turning point. The increased competition promises to benefit traders and investors through enhanced liquidity, potentially tighter spreads, and more choices in trading platforms. CME will undoubtedly respond, leading to further innovations and improvements across the industry. This competitive environment fosters innovation, efficiency, and better value for participants in the market.

Call to Action: Stay informed about the evolving landscape of Treasury futures trading. Follow the developments of both FMX and CME to make the most informed decisions about your investment and trading strategies in the dynamic world of Treasury futures and related derivatives. Carefully evaluate the offerings of both platforms to optimize your trading strategy and minimize your costs.

Featured Posts

-

Alka Yagnk Ky Khwdnwsht Asamh Bn Ladn Ka Dhkr

May 18, 2025

Alka Yagnk Ky Khwdnwsht Asamh Bn Ladn Ka Dhkr

May 18, 2025 -

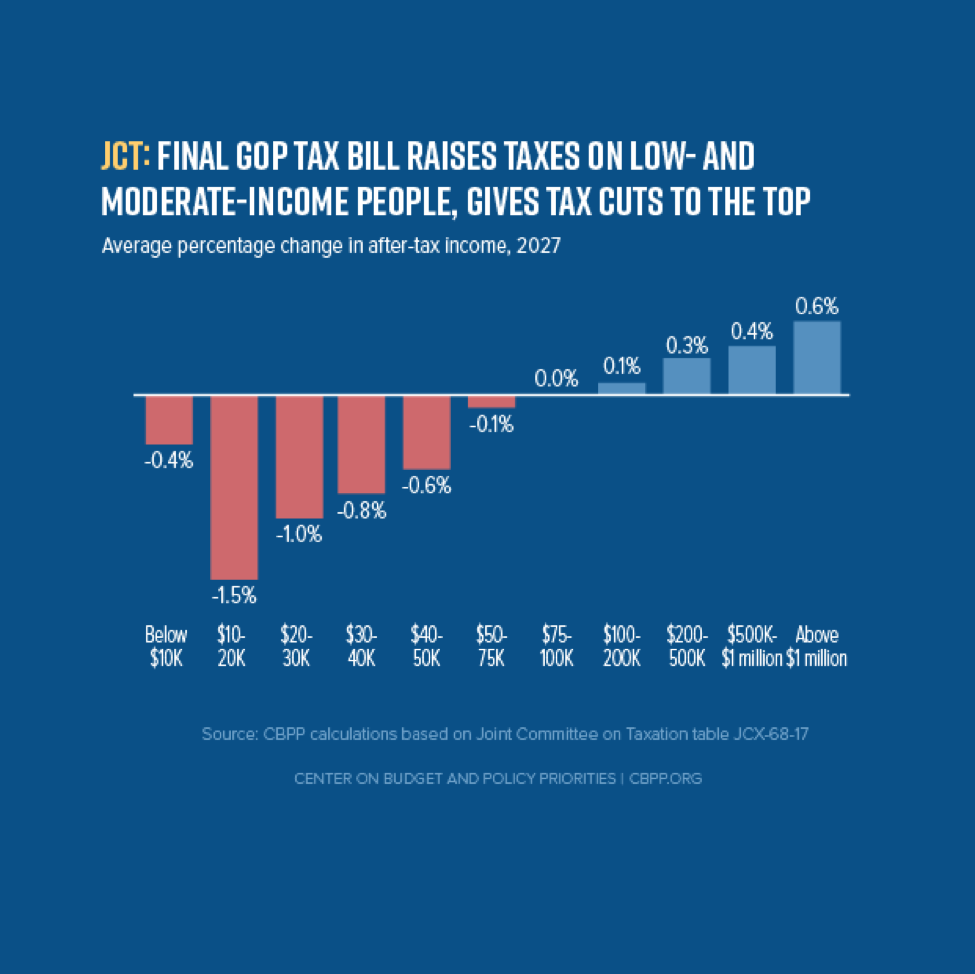

Gop Tax Bill Faces Setback Conservative Push For Medicaid And Clean Energy Changes

May 18, 2025

Gop Tax Bill Faces Setback Conservative Push For Medicaid And Clean Energy Changes

May 18, 2025 -

Snls Ego Nwodim And The Weekend Update Controversy Bowen Yangs Response

May 18, 2025

Snls Ego Nwodim And The Weekend Update Controversy Bowen Yangs Response

May 18, 2025 -

Selena Gomez Claims Victory Was She Right About Blake Lively All Along A Wake Up Call For Taylor Swift

May 18, 2025

Selena Gomez Claims Victory Was She Right About Blake Lively All Along A Wake Up Call For Taylor Swift

May 18, 2025 -

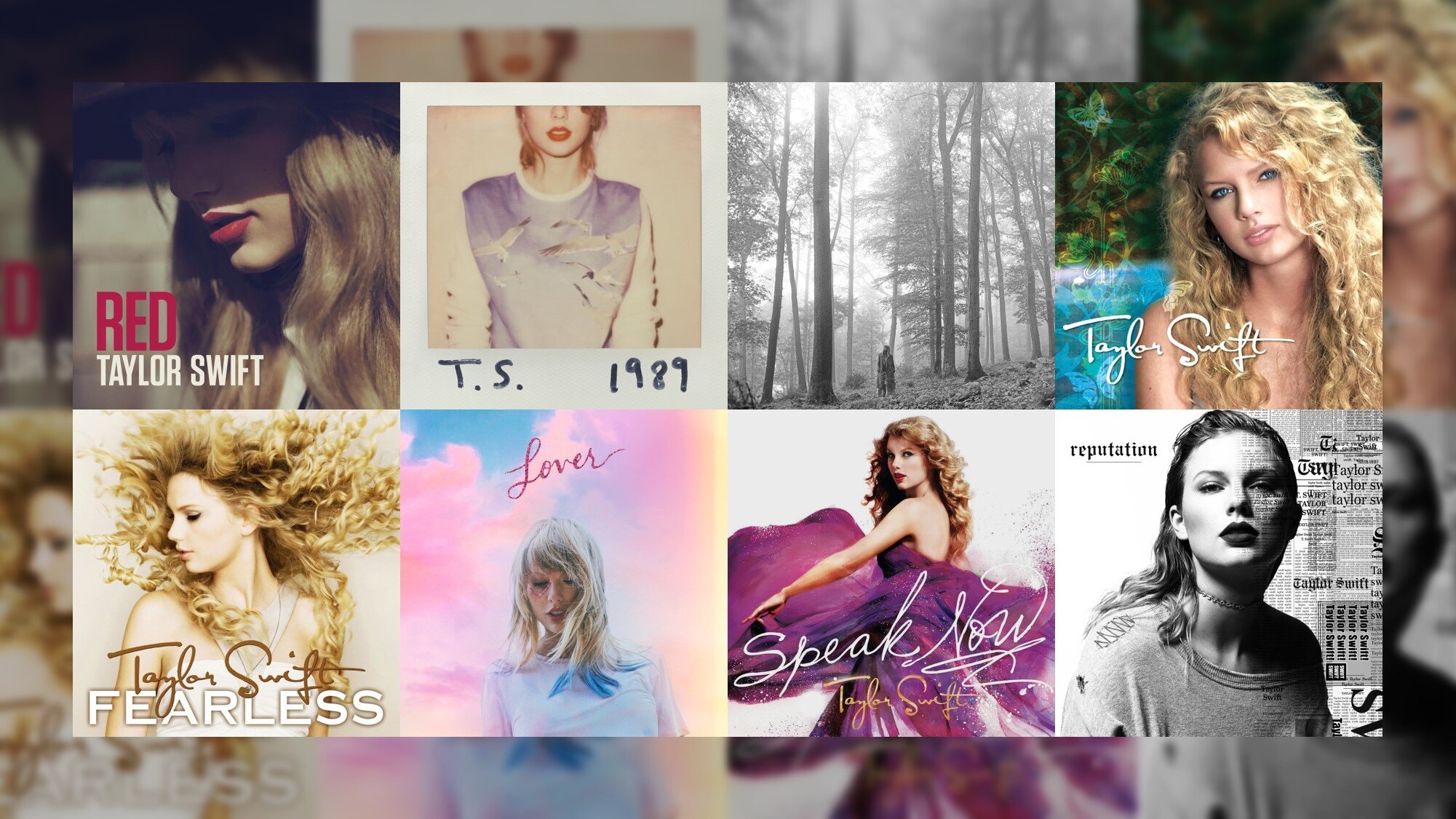

Ranking Taylor Swifts Albums A Critical Analysis Of Her Discography

May 18, 2025

Ranking Taylor Swifts Albums A Critical Analysis Of Her Discography

May 18, 2025

Latest Posts

-

Weekend Update Interrupted Snl Audience Outburst Sparks Controversy

May 18, 2025

Weekend Update Interrupted Snl Audience Outburst Sparks Controversy

May 18, 2025 -

Snl Audience Interruption Casts Shocked Reaction Goes Viral

May 18, 2025

Snl Audience Interruption Casts Shocked Reaction Goes Viral

May 18, 2025 -

Live From New York Jack Blacks Snl Show Ego Nwodims Standout Performance

May 18, 2025

Live From New York Jack Blacks Snl Show Ego Nwodims Standout Performance

May 18, 2025 -

Should Snl Embrace Stronger Language Bowen Yang Weighs In

May 18, 2025

Should Snl Embrace Stronger Language Bowen Yang Weighs In

May 18, 2025 -

Snl Audience Outburst Stuns Ego Nwodim And Weekend Update Hosts

May 18, 2025

Snl Audience Outburst Stuns Ego Nwodim And Weekend Update Hosts

May 18, 2025