Congressional Stock Trading Ban: Trump's Time Interview Reveals His Position

Table of Contents

Trump's Stated Position on a Congressional Stock Trading Ban

During his "Trump's Time" interview, former President Trump expressed [insert Trump's stated position - support or opposition]. His reasoning centered around [summarize Trump's key arguments, referencing specific policy positions if possible]. This statement, delivered in the context of [mention the broader political climate during the interview], carries significant weight given his influence within the Republican party.

- Specific quotes from the interview: [Insert direct quotes from the interview supporting his position. Accurately attribute the quotes.]

- Potential conflicts of interest: [Discuss any potential conflicts of interest raised in the interview, or the lack thereof, related to his statement. Analyze any connections between his past actions and his current position.]

- Political context: [Analyze the political landscape and potential motivations behind Trump's statement. Consider his relationship with Congress and the potential impact on his political agenda.]

- Previous statements: [Compare this statement to any previous public statements Trump has made regarding a Congressional stock trading ban, noting any shifts or consistencies in his position.]

Arguments For a Congressional Stock Trading Ban

Ethical concerns surrounding members of Congress trading stocks are substantial. The potential for abuse and the erosion of public trust are key arguments driving the push for a ban.

- Insider trading: Lawmakers have access to non-public information that could give them an unfair advantage in the stock market. A ban would mitigate this risk.

- Appearance of conflicts of interest: Even if no illegal activity occurs, the appearance of a conflict of interest can severely damage public trust. The perception of favoritism or self-dealing undermines the integrity of the legislative process.

- Erosion of public trust: Public faith in government is crucial for a functioning democracy. Congressional stock trading scandals erode this trust and contribute to cynicism and political apathy.

- Examples of past scandals: [Cite specific examples of past Congressional stock trading scandals, linking to reliable news sources. Briefly describe the details of each scandal and its impact.]

- Related Legislation: Several bills aiming to prevent Congressional stock trading, such as [mention specific bill names and numbers], have been introduced, highlighting the ongoing legislative efforts to address this issue.

Arguments Against a Congressional Stock Trading Ban

Opponents of a ban raise concerns about individual liberties and potential unintended consequences.

- Individual financial freedom: Some argue that a ban infringes upon the financial freedom of members of Congress, limiting their ability to manage their personal investments.

- Unintended consequences: A ban could inadvertently discourage qualified individuals from seeking public office, limiting the pool of potential candidates.

- Enforcement difficulties: Enforcing a ban could prove challenging, potentially leading to loopholes and uneven application. Defining what constitutes a conflict of interest can also be problematic.

- Existing disclosure requirements: Critics point to existing disclosure requirements as a sufficient safeguard, arguing that increased transparency, rather than an outright ban, is a more effective approach.

The Role of Transparency in Congressional Finances

Even without a complete ban, increased transparency and disclosure are vital in mitigating concerns about Congressional stock trading.

- Strengthening disclosure laws: Existing laws mandating disclosure of financial transactions should be strengthened and their enforcement improved. Timelier and more detailed reporting would increase accountability.

- Independent oversight: An independent body should be tasked with monitoring and investigating Congressional financial dealings to ensure compliance with existing regulations and deter potential misconduct.

- Public databases: Creating publicly accessible databases of Congressional financial transactions would enhance transparency and allow for greater public scrutiny.

Conclusion

Trump's position on a Congressional Stock Trading Ban, as expressed in the "Trump's Time" interview, [reiterate Trump's position]. While arguments against a ban cite concerns about individual liberties and enforcement, the potential for insider trading, conflicts of interest, and the erosion of public trust underscore the need for strong measures to ensure ethical conduct in Congress. Ultimately, increased transparency and accountability, whether through a ban or strengthened disclosure requirements, are essential for maintaining public trust in government. The debate surrounding a Congressional stock trading ban continues to be a critical issue. Stay informed on this important topic and encourage your representatives to address the potential for conflicts of interest in Congress. Learn more about proposed legislation regarding a Congressional stock trading ban and voice your opinion to advocate for increased transparency and ethical conduct in government.

Featured Posts

-

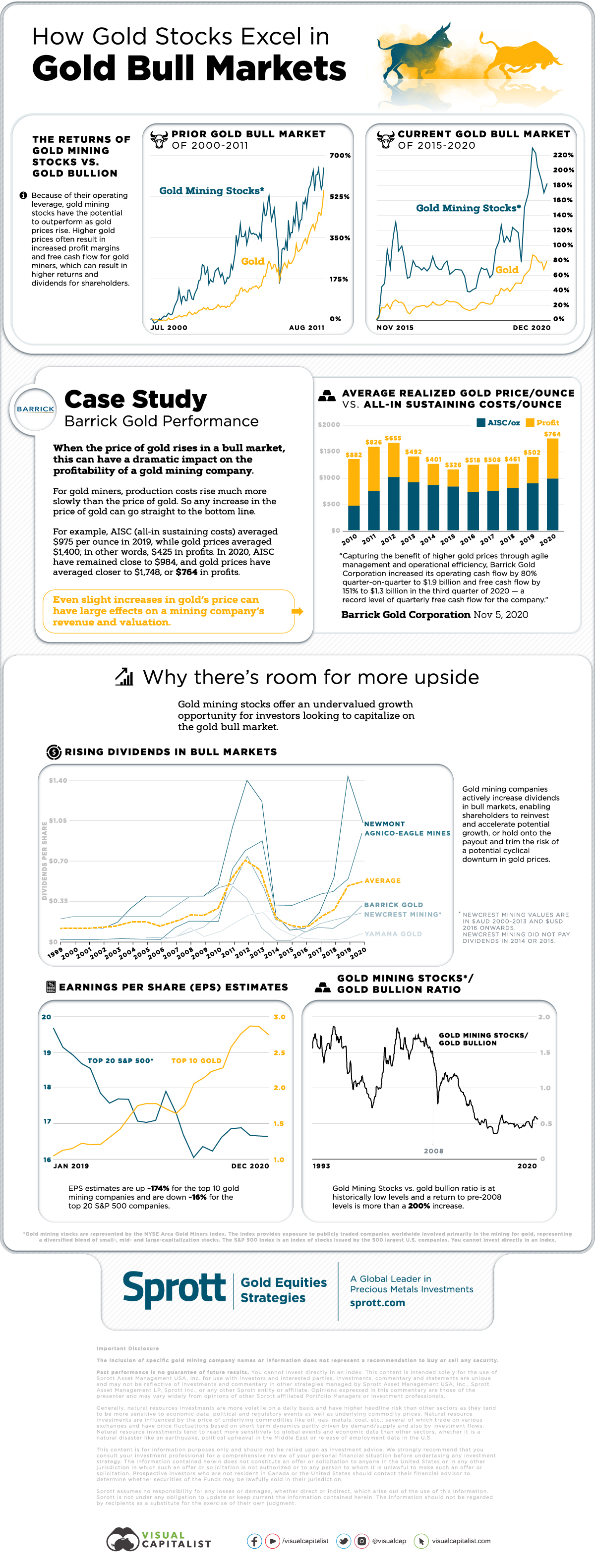

Why Is Gold Soaring Trade Wars And The Bullion Market Explained

Apr 26, 2025

Why Is Gold Soaring Trade Wars And The Bullion Market Explained

Apr 26, 2025 -

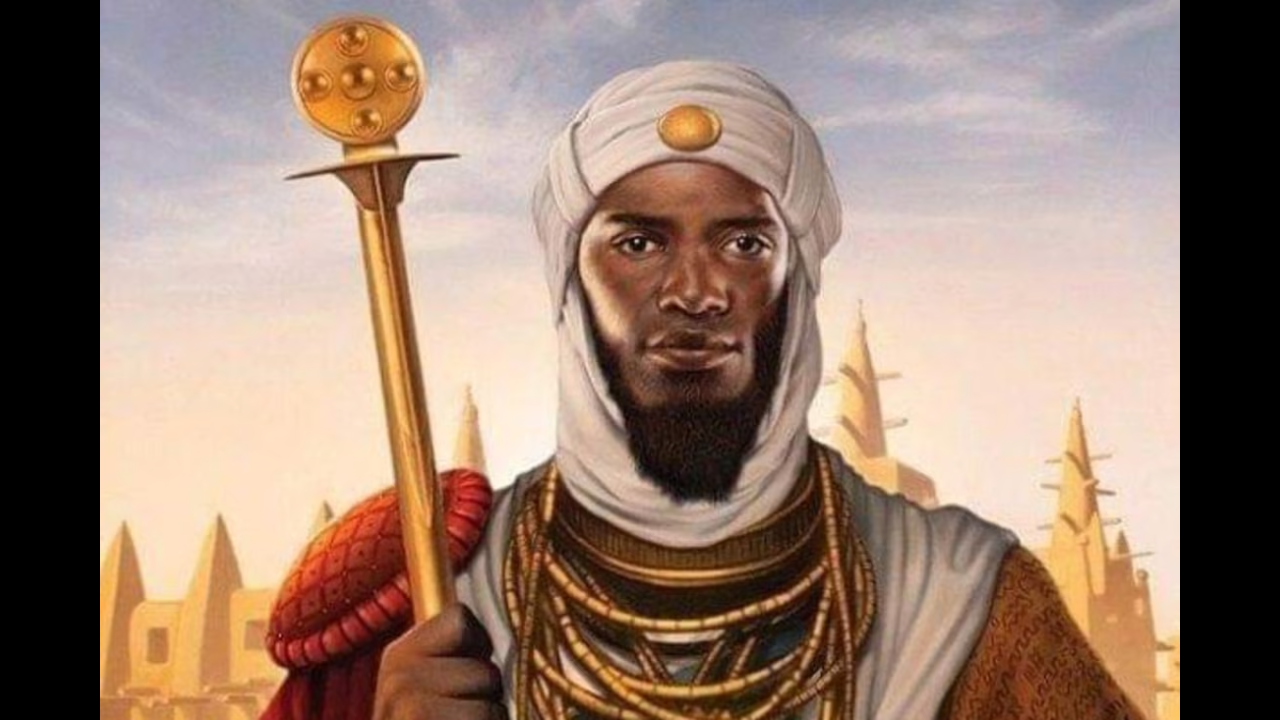

The Richest Man Vs America A Defining Battleground

Apr 26, 2025

The Richest Man Vs America A Defining Battleground

Apr 26, 2025 -

Office365 Executive Account Compromise Leads To Multi Million Dollar Theft

Apr 26, 2025

Office365 Executive Account Compromise Leads To Multi Million Dollar Theft

Apr 26, 2025 -

Anchor Brewing Company To Shutter A Legacy Ends After 127 Years

Apr 26, 2025

Anchor Brewing Company To Shutter A Legacy Ends After 127 Years

Apr 26, 2025 -

Cybercriminal Makes Millions From Executive Office365 Breaches Fbi

Apr 26, 2025

Cybercriminal Makes Millions From Executive Office365 Breaches Fbi

Apr 26, 2025

Latest Posts

-

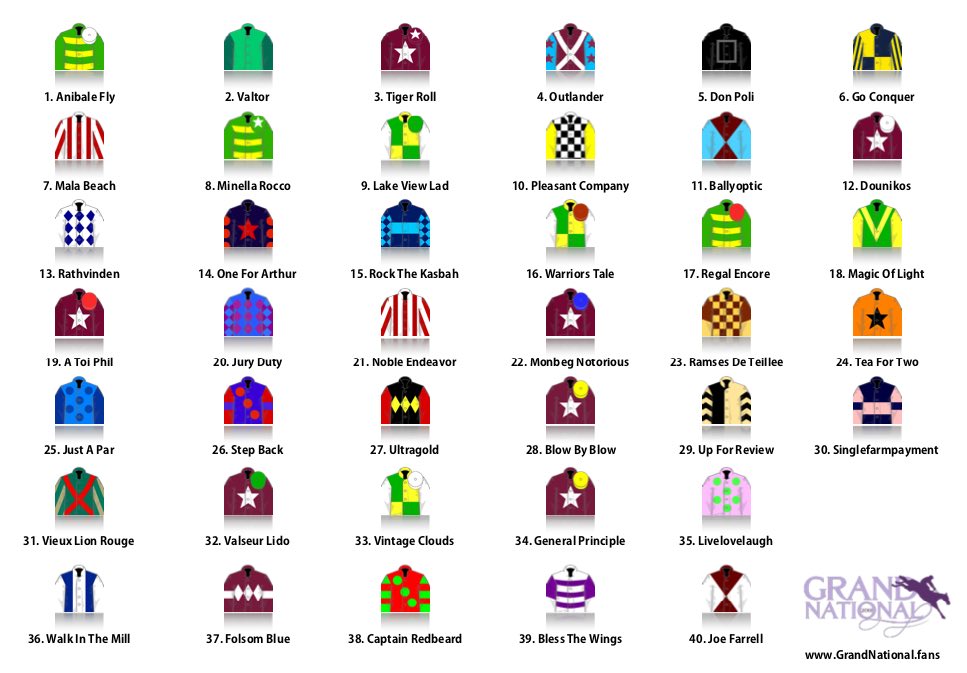

Your Guide To The Grand National 2025 Runners At Aintree

Apr 27, 2025

Your Guide To The Grand National 2025 Runners At Aintree

Apr 27, 2025 -

Grand National 2025 Key Runners And Aintree Race Preview

Apr 27, 2025

Grand National 2025 Key Runners And Aintree Race Preview

Apr 27, 2025 -

Aintree Grand National 2025 Runners Analysis And Predictions

Apr 27, 2025

Aintree Grand National 2025 Runners Analysis And Predictions

Apr 27, 2025 -

Vancouver Whitecaps And Pne In Stadium Construction Talks

Apr 27, 2025

Vancouver Whitecaps And Pne In Stadium Construction Talks

Apr 27, 2025 -

Grand National 2025 A Complete Guide To The Runners At Aintree

Apr 27, 2025

Grand National 2025 A Complete Guide To The Runners At Aintree

Apr 27, 2025