Controversial Dragon Den Deal: Businessman Chooses Lower Offer, Leaving Investors Speechless

Table of Contents

The Pitch: Unveiling the EcoPod System and its Potential

The entrepreneur, Alex Walker, presented EcoPod, a revolutionary system designed to recycle single-serve coffee pods. Unlike existing solutions, EcoPod uses a patented technology to separate the coffee grounds from the aluminum or plastic, enabling 100% recyclable materials. This addresses a significant environmental concern, as millions of coffee pods end up in landfills annually.

EcoPod's unique selling points (USPs) include its high recycling efficiency, ease of use for consumers, and potential for partnerships with major coffee brands. Walker projected significant market share within the burgeoning sustainable packaging sector. His business model hinges on licensing the technology to recycling facilities and coffee producers, generating revenue through licensing fees and a small percentage of the recycled materials' value.

- Key features: Patented separation technology, ease of use, high recycling efficiency, scalability.

- Target market: Recycling facilities, coffee producers, environmentally conscious consumers.

- Projected revenue: $5 million in year three, with substantial growth potential.

- Current stage of development: Fully functional prototype, seeking investment for large-scale manufacturing and marketing.

The Dragons' Offers: A Tale of Two Investments

Two Dragons made offers: Deborah Meaden offered £250,000 for 30% equity, highlighting the considerable risk involved in a relatively new technology. Peter Jones, however, offered £150,000 for a more modest 15% stake, emphasizing the potential for long-term growth and his experience in scaling similar businesses.

- Dragon 1 (Deborah Meaden): £250,000 for 30% equity, emphasizing market validation and rapid growth.

- Dragon 2 (Peter Jones): £150,000 for 15% equity, emphasizing long-term potential and mentorship.

- Reasons for different offers: Meaden viewed the higher risk as justifying a larger equity stake, while Jones saw more potential for significant returns with a lower equity investment and active mentorship.

The Controversial Decision: Why Choose the Lower Offer?

Walker's decision to accept Jones's lower offer stunned the Dragons and viewers. He cited Jones's extensive experience in building and scaling businesses as the primary reason. He felt that Jones's guidance and network were more valuable than the additional £100,000. Walker argued that maintaining a larger equity stake would give him greater control over the company's direction, allowing him to pursue a more sustainable long-term vision.

- Businessman's stated reasons: Value of mentorship, greater control over the business, long-term vision.

- Potential strategic advantages: Maintaining majority ownership, greater flexibility in decision-making, stronger alignment with Jones's business expertise.

- Analysis of risks and rewards: Higher risk with a lower investment but potentially greater long-term rewards through mentorship and control.

The Aftermath: Reactions and Analysis of the Controversial Dragon's Den Deal

The Dragons were visibly surprised, with Meaden expressing some disappointment. However, Jones defended his approach, emphasizing the importance of the mentorship component. Social media exploded with reactions, with many praising Walker's bold move, while others questioned his financial acumen. Several business commentators have analyzed the deal, some suggesting it was a strategically sound move, prioritizing long-term growth and control. Others have cautioned about the risks involved in rejecting a larger upfront investment.

- Dragons' immediate reactions: Surprise, disappointment from Meaden, justification from Jones.

- Public reaction: Divided opinions on social media, with a significant debate on the merits of the decision.

- Potential long-term consequences: Success or failure hinges on the effectiveness of the mentorship and execution of the business plan.

- Expert analysis: Mixed opinions, reflecting the inherent uncertainty involved in such a decision.

Conclusion

This controversial Dragon's Den deal highlights the complexities of investment decisions. Walker's unexpected choice to prioritize mentorship and control over immediate financial gains underscores the importance of long-term vision in entrepreneurship. While the risks are undeniable, his strategic decision could potentially yield greater rewards in the long run. The deal remains a fascinating case study in the interplay between finance and strategic partnerships. What are your thoughts on this controversial Dragon's Den deal? Share your opinions in the comments below and let's debate the merits of this unconventional investment strategy! #DragonsDen #ControversialDeal #BusinessDecisions #EcoPod #SustainableBusiness

Featured Posts

-

Xrps Big Moment Will Etf Listings And Sec Resolutions Change Everything

May 01, 2025

Xrps Big Moment Will Etf Listings And Sec Resolutions Change Everything

May 01, 2025 -

Michael Sheens Million Pound Giveaway Details Revealed

May 01, 2025

Michael Sheens Million Pound Giveaway Details Revealed

May 01, 2025 -

German Spd Faces Youth Backlash During Coalition Agreement Talks

May 01, 2025

German Spd Faces Youth Backlash During Coalition Agreement Talks

May 01, 2025 -

Pasifika Sipoti Key Events Of April 4th

May 01, 2025

Pasifika Sipoti Key Events Of April 4th

May 01, 2025 -

Kampen Dagvaardt Enexis Strijd Om Stroomnet Aansluiting

May 01, 2025

Kampen Dagvaardt Enexis Strijd Om Stroomnet Aansluiting

May 01, 2025

Latest Posts

-

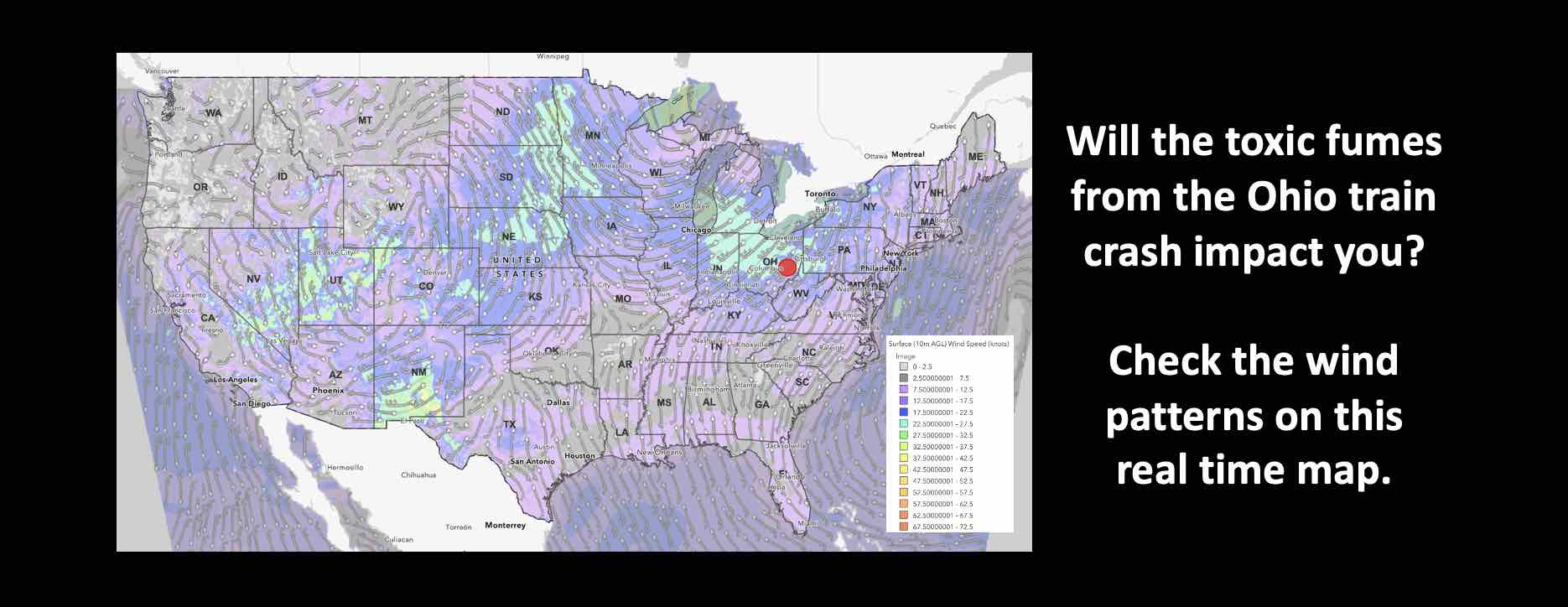

Lingering Effects Ohio Derailments Toxic Chemicals Remain In Buildings For Months

May 02, 2025

Lingering Effects Ohio Derailments Toxic Chemicals Remain In Buildings For Months

May 02, 2025 -

Ohio Train Disaster Prolonged Presence Of Toxic Chemicals In Nearby Structures

May 02, 2025

Ohio Train Disaster Prolonged Presence Of Toxic Chemicals In Nearby Structures

May 02, 2025 -

Toxic Chemical Residues From Ohio Derailment Months Long Building Contamination

May 02, 2025

Toxic Chemical Residues From Ohio Derailment Months Long Building Contamination

May 02, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months After

May 02, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months After

May 02, 2025 -

Crooks Office365 Exploit Millions In Losses For Executives

May 02, 2025

Crooks Office365 Exploit Millions In Losses For Executives

May 02, 2025