Credit Card Companies Feel The Pinch As Consumers Cut Back On Spending

Table of Contents

Reduced Consumer Spending: The Core Issue

The significant decrease in consumer spending is the primary driver behind the challenges faced by credit card companies. Economic uncertainty, fueled by high inflation and rising interest rates, is prompting consumers to prioritize essential expenses and reduce discretionary spending. This shift represents a fundamental change in consumer behavior, with far-reaching consequences for businesses reliant on consumer credit.

Statistics paint a stark picture. Reports indicate a noticeable decline in credit card transactions, reflecting a broader trend of reduced overall spending. This is further evidenced by:

- Falling retail sales figures: Many retail sectors are experiencing a downturn, directly impacting the volume of credit card transactions.

- Decreased discretionary spending: Consumers are cutting back on non-essential purchases, such as entertainment, travel, and dining out, leading to a significant drop in credit card usage for these categories.

- Rising savings rates: As consumers grapple with economic uncertainty, many are prioritizing saving money for emergencies and future expenses, leading to a reduction in overall spending and credit card utilization.

Impact on Credit Card Company Revenue

The direct impact of decreased consumer spending on credit card companies' revenue is substantial. Their primary revenue streams—transaction fees, interest income, and annual fees—are all feeling the pressure.

- Lower merchant fees collected: Fewer credit card transactions mean credit card companies receive less revenue from merchant fees, a significant portion of their income.

- Reduced interest earned on outstanding balances: As consumers spend less and pay down existing balances, interest income, a crucial component of credit card company profits, is significantly reduced.

- Potential decline in annual fee revenue: While annual fees remain a consistent revenue source, a potential reduction in the number of active credit card accounts could negatively impact overall annual fee revenue.

- Impact on credit card company profits and share prices: The combined effect of these revenue stream reductions translates directly to lower profitability and, consequently, a potential decline in credit card company stock prices.

Strategies Credit Card Companies are Employing

Faced with reduced consumer spending, credit card companies are actively implementing various strategies to mitigate the impact and maintain profitability. However, the effectiveness and potential drawbacks of these strategies vary:

- Increased focus on rewards programs and cashback offers to incentivize spending: Attractive rewards programs aim to stimulate consumer spending by offering enticing benefits.

- Aggressive marketing campaigns targeting specific consumer segments: Companies are tailoring their marketing efforts to specific demographics and spending patterns to maximize engagement and drive transactions.

- Adjusting interest rates and fees (carefully, considering consumer backlash): While increasing interest rates can boost income, it also risks alienating customers and potentially increasing defaults.

- Exploring new revenue streams, such as buy now, pay later (BNPL) options: BNPL services represent a growing area of opportunity, offering alternative revenue streams beyond traditional credit cards.

- Investing in digital technologies and enhanced customer experience: Improving the user experience through technology and digital innovation aims to increase customer engagement and loyalty.

The Future Outlook for Credit Card Companies

Predicting the future of the credit card industry requires careful consideration of current economic indicators and consumer behavior. The outlook remains uncertain, with both potential for recovery and challenges:

- Predictions for consumer spending in the coming quarters: Analysts offer varying predictions, with some forecasting a gradual recovery while others anticipate sustained reduced spending.

- Potential for increased credit card defaults and loan delinquencies: As economic pressures persist, there is a potential increase in borrowers unable to meet their payment obligations.

- Long-term implications for credit card company profitability and market share: The long-term effects of this period of reduced spending will likely reshape the credit card industry, influencing market share and profitability.

- Opportunities for innovation and adaptation within the credit card industry: The challenges present significant opportunities for innovation and the development of new financial products and services.

Conclusion: Navigating the Pinch: The Future of Credit Card Companies

This article has highlighted the significant impact of reduced consumer spending on credit card companies. The decrease in transaction volume, interest income, and overall profitability is undeniable. Credit card companies are responding with a variety of strategies, from enhanced rewards programs to exploring new revenue streams like BNPL. However, the long-term effects remain uncertain, emphasizing the need for ongoing innovation and adaptation within the industry. Understand how the pinch on credit card companies affects you by staying informed about changes in credit card spending and the evolving economic landscape. This will allow you to make informed financial decisions and navigate this challenging period effectively.

Featured Posts

-

Ftc Challenges Microsoft Activision Merger A Legal Battle Ahead

Apr 24, 2025

Ftc Challenges Microsoft Activision Merger A Legal Battle Ahead

Apr 24, 2025 -

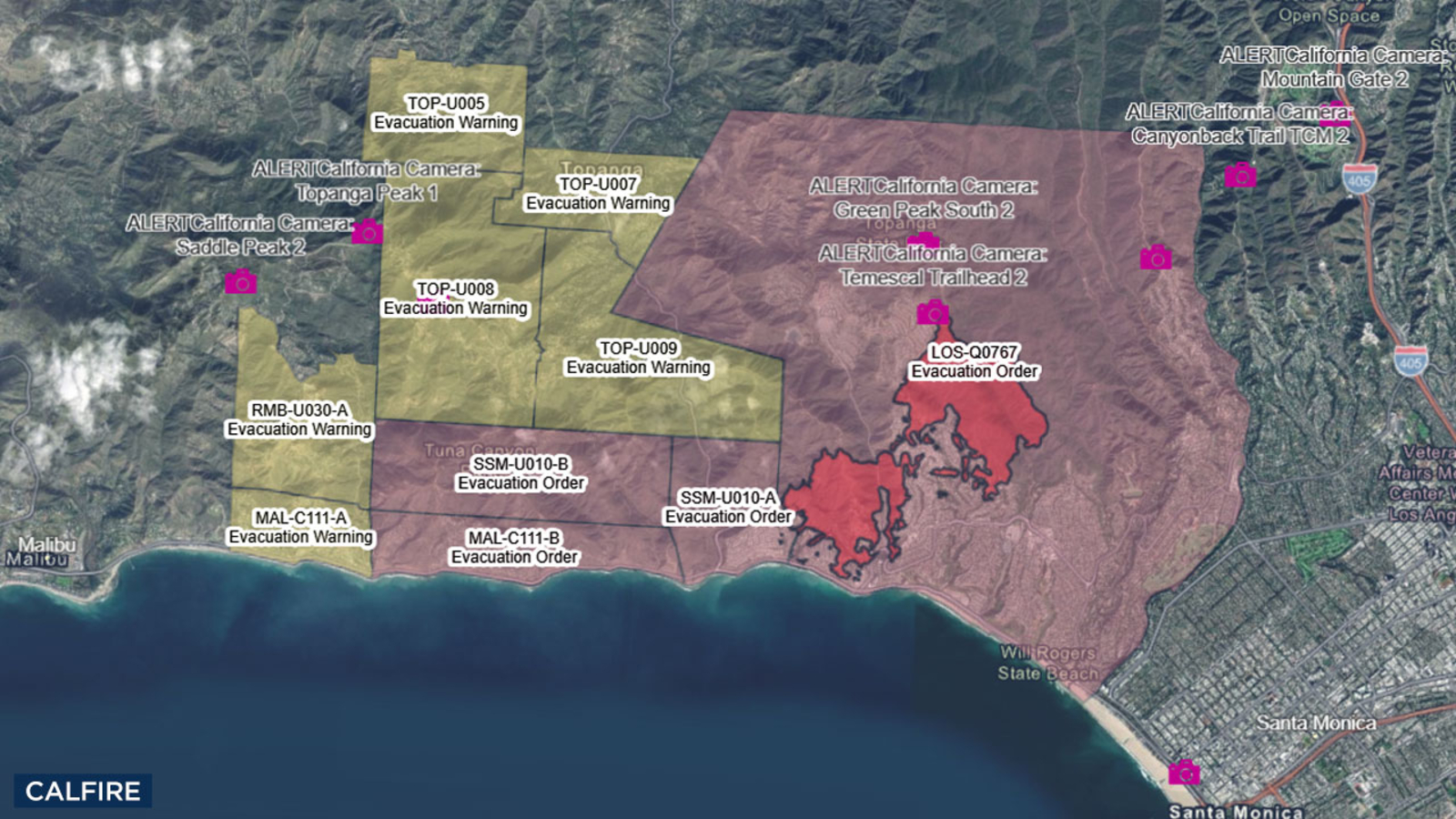

La Palisades Fire Victims A List Of Affected Celebrities

Apr 24, 2025

La Palisades Fire Victims A List Of Affected Celebrities

Apr 24, 2025 -

Hisd Mariachi Headed To Uil State Competition After Viral Whataburger Video

Apr 24, 2025

Hisd Mariachi Headed To Uil State Competition After Viral Whataburger Video

Apr 24, 2025 -

Las Vegas Airport Faa Scrutinizes Collision Avoidance Systems

Apr 24, 2025

Las Vegas Airport Faa Scrutinizes Collision Avoidance Systems

Apr 24, 2025 -

La Fires Price Gouging Allegations Surface Amidst Housing Crisis

Apr 24, 2025

La Fires Price Gouging Allegations Surface Amidst Housing Crisis

Apr 24, 2025