D-Wave Quantum Inc. (QBTS) Stock Plunge In 2025: Reasons And Analysis

Table of Contents

Market Sentiment and Investor Expectations

The plunge in QBTS stock price in 2025 may have been partly fueled by a mismatch between initial market expectations and the company's performance.

Overvalued Initial Public Offering (IPO)

D-Wave's IPO might have been overvalued, leading to inflated expectations.

- High initial valuation compared to competitors: The initial valuation might have been significantly higher than those of comparable companies in the quantum computing space, creating an immediate vulnerability to corrections.

- Lack of immediate profitability: Investors expecting rapid returns might have been disappointed by the lack of significant short-term profits, a common characteristic of early-stage technology companies.

- Reliance on future technological breakthroughs: The stock price likely depended heavily on future technological milestones, making it susceptible to market fluctuations based on perceived progress or setbacks.

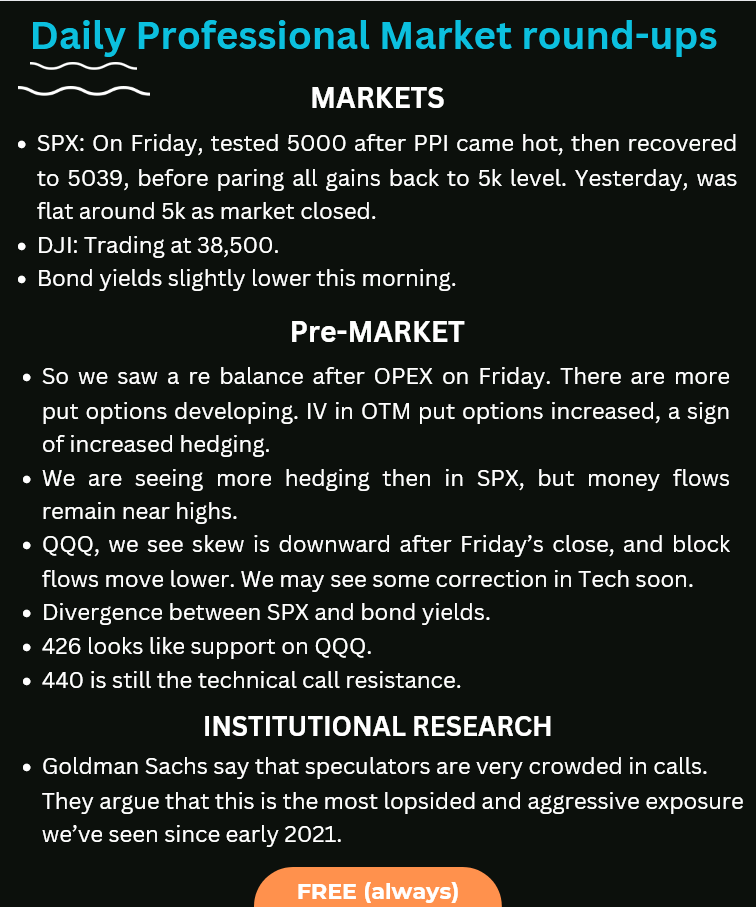

Broader Market Downturn

External market factors could have independently contributed to the QBTS stock price decrease.

- Correlation between QBTS performance and overall market indices: A general downturn in the stock market, particularly within the technology sector, could have dragged down even fundamentally sound companies like D-Wave.

- Impact of macroeconomic factors on investor risk appetite: Economic instability or increased risk aversion among investors could have triggered widespread selling, including QBTS shares.

Shifting Investor Focus

Investor attention might have shifted towards alternative technologies or competitors.

- Emergence of competitors with different technological approaches: The emergence of competitors employing different quantum computing technologies (such as gate-based systems) might have diverted investor interest and capital.

- Investor preference for companies closer to commercialization: Investors may favor companies demonstrating clear paths to commercialization and revenue generation over those focusing on long-term research and development.

Technological Challenges and Development Delays

Technological hurdles and slower-than-anticipated progress could have significantly impacted investor confidence.

Slower-than-Expected Progress

D-Wave's technological advancements might not have met initial projections.

- Delays in achieving key milestones: Missed deadlines in achieving crucial technological breakthroughs could have eroded investor trust and triggered selling pressure.

- Challenges in scaling up quantum annealing technology: Scaling up quantum annealing, D-Wave's core technology, may have proven more challenging than anticipated, impacting its potential for widespread adoption.

- Limitations in addressing certain types of problems: The limitations of quantum annealing in solving specific types of computational problems compared to other approaches could have dampened investor enthusiasm.

Competition from Other Quantum Computing Technologies

The competitive landscape, particularly the rise of gate-based quantum computing, poses a threat.

- Comparison of D-Wave's annealing approach with gate-based quantum computing: Gate-based systems are generally considered more versatile and potentially more powerful in the long run, creating competitive pressure for D-Wave.

- Advantages and disadvantages of each approach: A thorough comparison of the strengths and weaknesses of different quantum computing technologies is crucial for understanding the market dynamics.

- Market share predictions: Forecasts predicting market share dominance by alternative technologies could have negatively impacted D-Wave's valuation.

Challenges in Practical Application and Commercialization

Difficulties in transitioning from research to commercial applications could have been a major factor.

- Limited number of successful commercial deployments: A lack of substantial real-world applications showcasing the benefits of D-Wave's technology could have discouraged investors.

- Difficulties in demonstrating a clear return on investment for clients: Failure to demonstrate clear cost-benefit analyses for potential customers could have hampered adoption and commercial success.

- Hurdles in developing user-friendly software and algorithms: Developing user-friendly software and algorithms to interface with D-Wave's systems may have posed significant challenges, hindering broader usage.

Financial Performance and Company Strategy

D-Wave's financial performance and strategic choices also played a role in the stock price decline.

Financial Results

Analyzing D-Wave's hypothetical 2025 financial statements reveals potential weaknesses.

- Comparison with previous years: A comparison of 2025 financial results with previous years highlights any significant deterioration in revenue, profitability, or other key metrics.

- Analysis of key financial ratios: Analyzing key financial ratios (e.g., debt-to-equity ratio, profit margins) reveals underlying financial health and potential vulnerabilities.

- Explanation of any unexpected results: Any unexpected deviations from projected financial performance require careful analysis to understand the contributing factors.

Strategic Decisions and Their Impact

Critical company decisions could have either helped or hindered the stock price.

- Assessment of the success or failure of key strategic initiatives: Evaluating the outcome of major strategic decisions (acquisitions, partnerships, etc.) determines their impact on the overall financial health and market perception of D-Wave.

- Explanation of how these decisions contributed to the stock plunge: An in-depth analysis of the decision-making process and its consequences is crucial for understanding the stock price decline.

Conclusion

The significant drop in D-Wave Quantum Inc. (QBTS) stock in 2025 likely stemmed from a combination of market sentiment, technological challenges, and potentially company-specific issues. Understanding these factors is crucial for investors in the quantum computing market. While the future of QBTS remains uncertain, analyzing these potential causes offers valuable insights for future investment decisions. Further research into D-Wave Quantum Inc. (QBTS) and its competitors is recommended before making any investment decisions. Keep a close watch on D-Wave Quantum Inc. (QBTS) stock and the broader quantum computing market for future updates and analysis.

Featured Posts

-

Best Wireless Headphones Key Improvements And Innovations

May 20, 2025

Best Wireless Headphones Key Improvements And Innovations

May 20, 2025 -

Politicko Sarajevo I Posljedice Ignoriranja Daytonskog Sporazuma

May 20, 2025

Politicko Sarajevo I Posljedice Ignoriranja Daytonskog Sporazuma

May 20, 2025 -

Market Reaction To D Wave Quantum Qbts On Thursday A Comprehensive Review

May 20, 2025

Market Reaction To D Wave Quantum Qbts On Thursday A Comprehensive Review

May 20, 2025 -

Tonci Tadic O Putinovim Pregovarackim Taktikama

May 20, 2025

Tonci Tadic O Putinovim Pregovarackim Taktikama

May 20, 2025 -

Will Trumps Promised Factory Jobs Return To America A Realistic Look

May 20, 2025

Will Trumps Promised Factory Jobs Return To America A Realistic Look

May 20, 2025

Latest Posts

-

Wwe News Ronda Rousey Logan Paul Jey Uso And Big Es Engagement Rumors

May 20, 2025

Wwe News Ronda Rousey Logan Paul Jey Uso And Big Es Engagement Rumors

May 20, 2025 -

Big E Engaged Ronda Rousey Logan Paul And Jey Uso Wwe Speculation

May 20, 2025

Big E Engaged Ronda Rousey Logan Paul And Jey Uso Wwe Speculation

May 20, 2025 -

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025 -

Ronda Rousey Logan Paul Jey Uso And Big E Latest Wwe Rumors And News

May 20, 2025

Ronda Rousey Logan Paul Jey Uso And Big E Latest Wwe Rumors And News

May 20, 2025 -

Review Wwe Raw Winners And Grades May 19 2025

May 20, 2025

Review Wwe Raw Winners And Grades May 19 2025

May 20, 2025