D-Wave Quantum Inc. (QBTS) Stock Plunge: Understanding Monday's Crash

Table of Contents

Analyzing the QBTS Stock Plunge: Key Factors Contributing to the Drop

Several interconnected factors likely contributed to the QBTS stock plunge. Let's examine the most significant:

Disappointing Earnings Report and Revenue Shortfall

The QBTS stock price drop followed the release of D-Wave's latest earnings report, which revealed a significant shortfall in revenue compared to projections. The company missed earnings estimates, failing to meet the expectations of analysts and investors alike. This news immediately impacted investor confidence, triggering a sell-off.

- Lower-than-expected revenue: The actual revenue generated fell considerably short of the previously announced forecast, signaling potential challenges in the company's business model.

- Missed earnings estimates: The company failed to meet the anticipated profit margins, further eroding investor confidence in the short-term prospects of QBTS.

- Negative outlook on future growth: The earnings report may have included a less optimistic forecast for future growth, contributing to the negative market sentiment surrounding QBTS. This uncertainty fueled the stock's decline.

Overall Market Sentiment and Sector-Wide Downturn

The QBTS stock plunge didn't occur in isolation. Monday saw a general market sell-off, particularly impacting the technology sector. This broader market volatility exacerbated the negative impact of D-Wave's disappointing earnings. Increased investor risk aversion contributed to a widespread decline in tech stocks, with QBTS being particularly vulnerable due to its already volatile nature.

- General market sell-off: A negative overall market sentiment, possibly driven by macroeconomic factors or geopolitical events, contributed to the downward pressure on QBTS.

- Tech sector downturn: The technology sector, often more susceptible to market fluctuations, experienced a broader decline, dragging down QBTS along with other tech stocks.

- Investor risk aversion: Investors, wary of market uncertainty, opted to reduce their exposure to higher-risk investments, including quantum computing stocks like QBTS. This increased selling pressure further fueled the stock price drop.

Impact of Recent Company Announcements or News

While the earnings report was the most immediate catalyst, any recent company announcements or news might have also played a role. For example, news about competitors gaining market share or delays in product development could have negatively affected investor perception of D-Wave's long-term prospects, making them more susceptible to selling during the broader market downturn.

- New competitor announcements: Announcements from competing companies in the quantum computing space could have intensified investor concerns about D-Wave's competitive position.

- Delays in product development: Any delays in bringing new products or services to market could have negatively impacted investors' belief in D-Wave's growth trajectory.

- Concerns about future funding: Uncertainty surrounding future funding rounds or financial stability could also have contributed to the stock price drop, leading to increased selling pressure.

The Impact of the QBTS Stock Crash on Investors

The QBTS stock crash had significant implications for investors, both in the short term and long term.

Short-Term and Long-Term Implications for Investors

The immediate consequence for existing investors was a substantial loss of capital. This loss of value can trigger panic selling and further depress the stock price. However, the long-term outlook for QBTS and the quantum computing market remains a subject of debate. Some analysts maintain a positive long-term outlook, while others express caution due to the inherent risks associated with investing in nascent technologies.

- Potential loss of capital: Investors holding QBTS stock experienced a significant reduction in the value of their holdings.

- Reduced investor confidence: The stock plunge damaged investor confidence in the company's short-term prospects and overall stability.

- Opportunities for long-term investment: For some, the stock price drop might present a buying opportunity for long-term investors who believe in the potential of quantum computing.

Strategies for Mitigating Risk in Quantum Computing Investments

Investing in quantum computing stocks like QBTS involves substantial risk. Investors should employ several strategies to mitigate these risks:

- Diversification across different asset classes: Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes to reduce the impact of losses in any single investment.

- Setting stop-loss orders: Stop-loss orders automatically sell your shares when the price reaches a predetermined level, limiting potential losses.

- Thorough research and analysis: Before investing in QBTS or any other quantum computing stock, conduct extensive due diligence to understand the company's business model, financials, and competitive landscape.

Conclusion

The QBTS stock plunge on Monday was a multi-faceted event resulting from a combination of factors, including disappointing earnings, broader market sentiment, and potentially company-specific news. Understanding these factors is vital for investors navigating the volatile world of quantum computing investments. The future of D-Wave Quantum and the broader quantum computing sector remains uncertain, emphasizing the need for a cautious yet informed approach.

Call to Action: Stay informed on the latest developments impacting D-Wave Quantum (QBTS) stock and the quantum computing market. Conduct thorough research and consider diversifying your investments to mitigate risk effectively. Understanding the intricacies of QBTS stock and the broader quantum computing sector is crucial for making well-informed investment decisions. Don't hesitate to consult with a financial advisor before investing in QBTS or any other high-risk, high-reward stocks.

Featured Posts

-

Real Madrid In Gelecegi Ancelotti Den Klopp A Gecis Muemkuen Mue

May 21, 2025

Real Madrid In Gelecegi Ancelotti Den Klopp A Gecis Muemkuen Mue

May 21, 2025 -

The D Wave Quantum Qbts Stock Crash Causes And Implications

May 21, 2025

The D Wave Quantum Qbts Stock Crash Causes And Implications

May 21, 2025 -

The Construction Of Chinas Space Supercomputer A Detailed Overview

May 21, 2025

The Construction Of Chinas Space Supercomputer A Detailed Overview

May 21, 2025 -

Rtl Groups Streaming Business Progress Towards Profitability

May 21, 2025

Rtl Groups Streaming Business Progress Towards Profitability

May 21, 2025 -

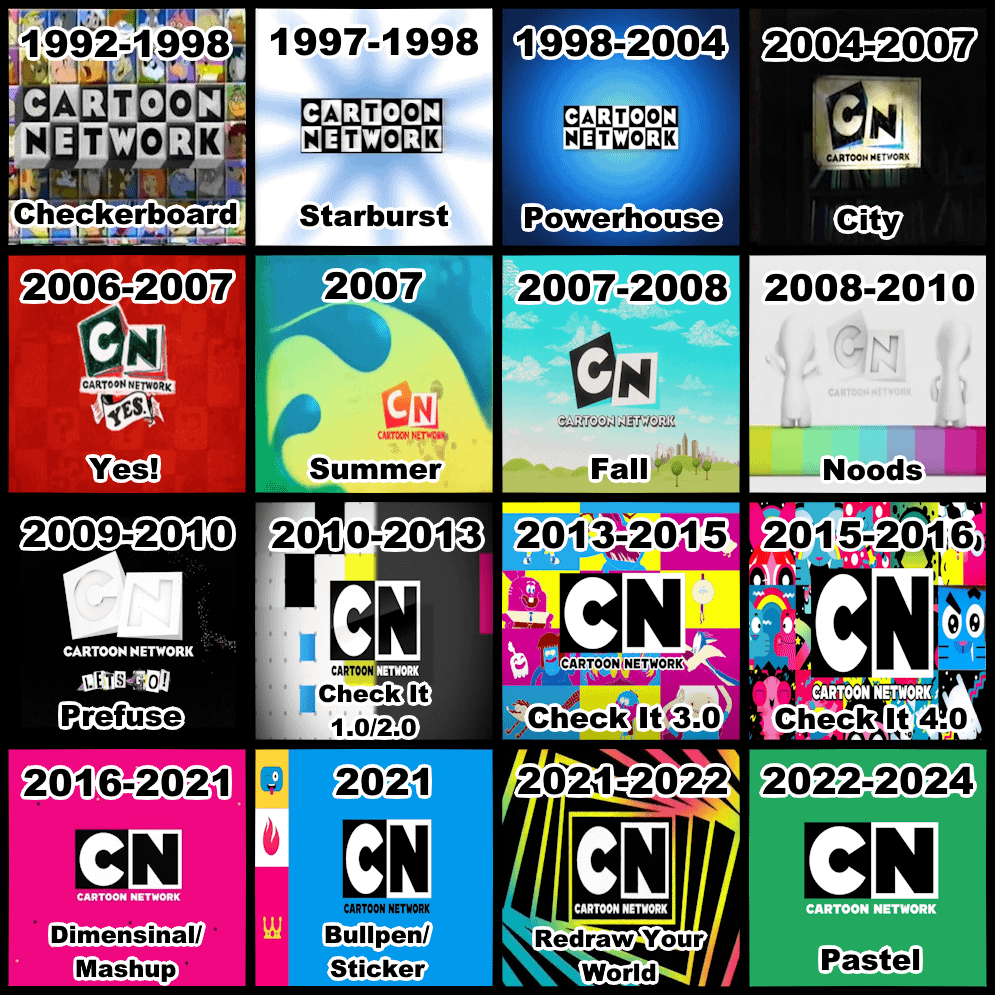

Cartoon Network Stars Join Looney Tunes In New 2025 Animated Short

May 21, 2025

Cartoon Network Stars Join Looney Tunes In New 2025 Animated Short

May 21, 2025

Latest Posts

-

David Walliams Fing Stans Greenlight And Production Details

May 21, 2025

David Walliams Fing Stans Greenlight And Production Details

May 21, 2025 -

Stan Greenlights David Walliams Fantasy Project Fing

May 21, 2025

Stan Greenlights David Walliams Fantasy Project Fing

May 21, 2025 -

Awkward Exchange Lorraine Kelly And David Walliams Cancelled Comment Controversy

May 21, 2025

Awkward Exchange Lorraine Kelly And David Walliams Cancelled Comment Controversy

May 21, 2025 -

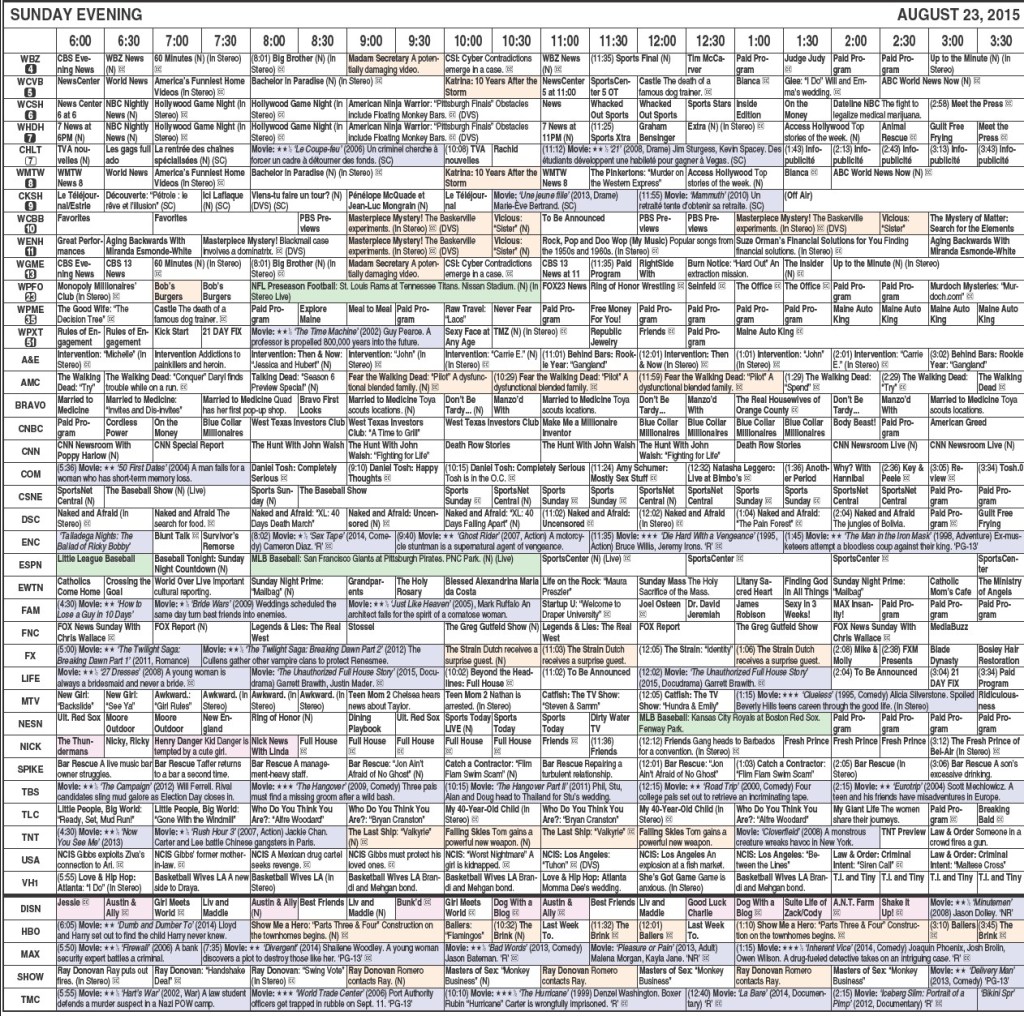

When Is Sandylands U On Tv Full Schedule Here

May 21, 2025

When Is Sandylands U On Tv Full Schedule Here

May 21, 2025 -

Lorraine Kelly Reacts To David Walliams Controversial Cancelled Remark

May 21, 2025

Lorraine Kelly Reacts To David Walliams Controversial Cancelled Remark

May 21, 2025