D-Wave Quantum (QBTS) Stock: Monday's Significant Drop Explained

Table of Contents

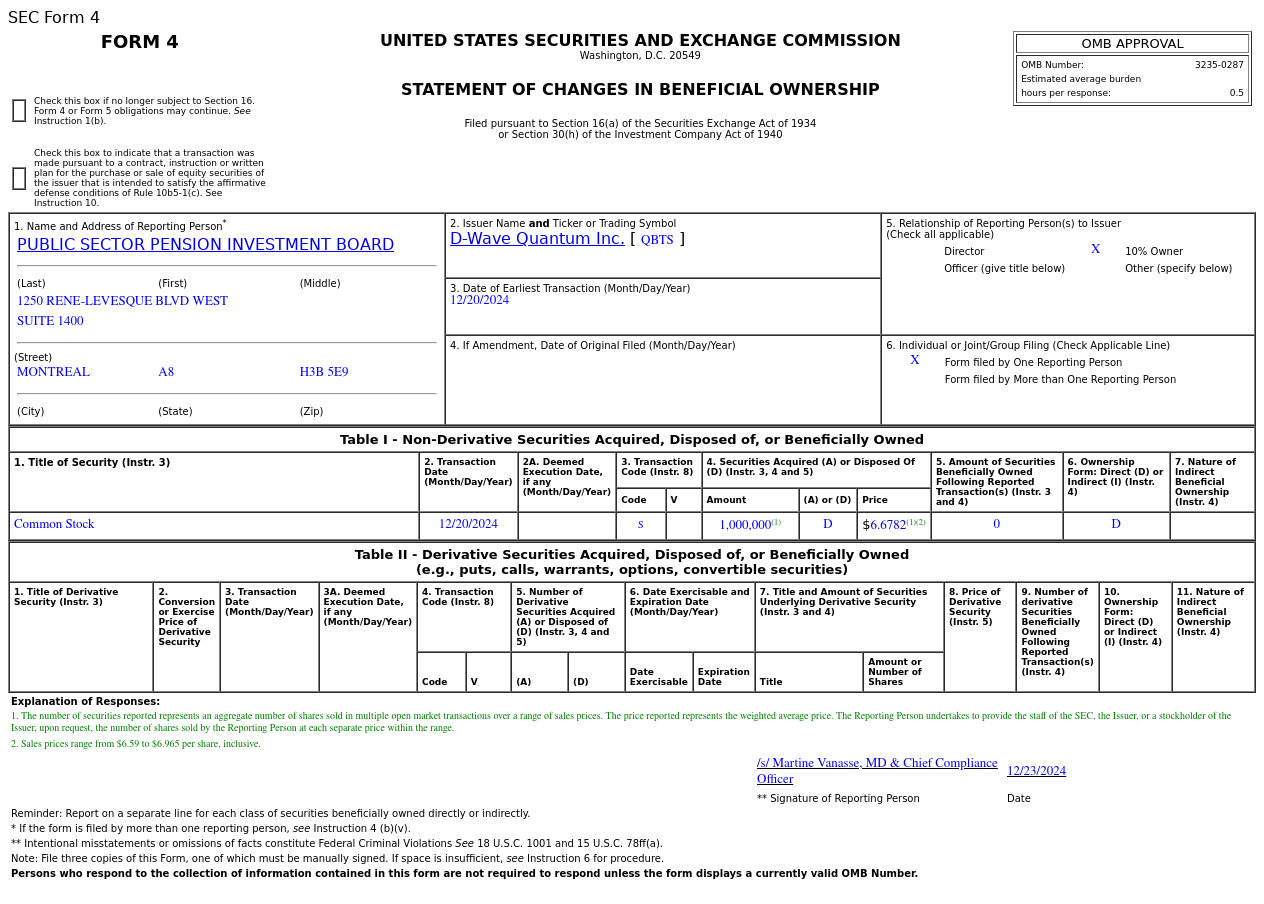

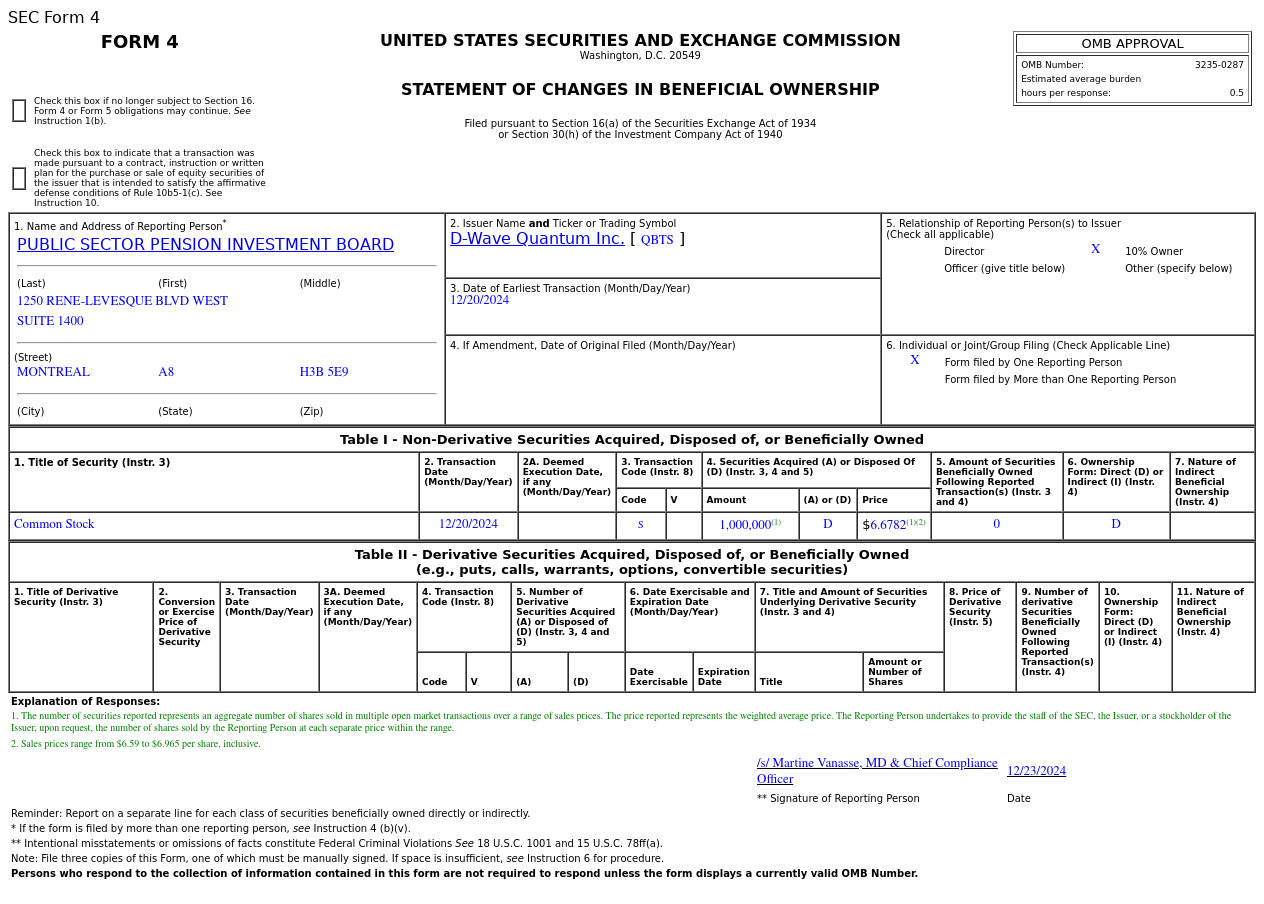

Monday saw a significant drop in D-Wave Quantum (QBTS) stock, leaving many investors scrambling to understand the reasons behind this sudden market reaction. This article will analyze the potential factors contributing to the decline in QBTS stock, examining both short-term market influences and the long-term prospects of this pioneering quantum computing company. We'll explore the broader market context, company-specific news, and the inherent risks and rewards of investing in this emerging technology sector.

Analyzing the Market Conditions Preceding Monday's Drop

Overall Market Sentiment

The days leading up to Monday's QBTS stock drop saw a general air of uncertainty in the broader stock market. While the overall market wasn't experiencing a drastic downturn, a negative sentiment was brewing, particularly within the technology sector. This general apprehension could have contributed to the sell-off in QBTS stock.

- The Nasdaq Composite, a key indicator of technology stock performance, experienced a slight dip in the preceding week, signaling a potential shift in investor confidence.

- Several news reports highlighted concerns about rising interest rates and their potential impact on high-growth technology companies.

- Negative sentiment toward the broader tech sector, fueled by concerns about inflation and potential economic slowdown, likely impacted investor confidence in riskier investments like quantum computing stocks.

Performance of Competitor Stocks

Comparing D-Wave Quantum's performance to its competitors in the quantum computing sector provides valuable context. While a comprehensive analysis requires examining numerous factors, it's crucial to note whether competitor stocks experienced similar drops. This helps determine if the decline was specific to D-Wave or indicative of broader industry trends.

- Competitors such as IonQ (IONQ) and Rigetti Computing (RGTI) also experienced some degree of volatility around the same time, suggesting that the broader quantum computing sector might have faced investor uncertainty. However, the magnitude of their drops varied significantly.

- The competitive landscape of the quantum computing industry is rapidly evolving. Investor confidence is heavily influenced by the perceived success and market positioning of each company within this dynamic environment.

Potential Factors Contributing to the QBTS Stock Decline

Lack of Recent Positive News or Announcements

The absence of positive news or significant announcements from D-Wave Quantum could have contributed to the stock drop. Investors often react negatively to periods of silence, particularly in a volatile sector like quantum computing.

- A review of D-Wave Quantum's recent press releases and financial reports revealed no major announcements immediately preceding the stock decline. The lack of positive news might have led to profit-taking by some investors.

- In the fast-paced world of technology, positive news and consistent progress are essential for maintaining investor confidence. A lack of such updates can trigger uncertainty and potentially lead to selling pressure.

Analyst Ratings and Price Target Changes

Changes in analyst ratings and price targets can significantly influence investor sentiment and stock prices. Negative revisions by influential analysts might have triggered the sell-off.

- While no significant downgrades were publicly reported immediately before Monday's drop, a subtle shift in analyst sentiment could have contributed to the overall downward pressure. A thorough investigation of analyst reports is crucial for a complete understanding.

- Analyst opinions play a significant role in shaping investor perceptions and influencing investment decisions. Negative commentary can create a ripple effect, leading to further selling.

Profit Taking and Speculative Trading

The drop in QBTS stock might be partially attributed to profit-taking by investors who had acquired shares at higher prices. This is a common phenomenon in speculative markets.

- The quantum computing sector is still considered relatively speculative. Short-term investors often buy and sell based on short-term price movements, leading to increased volatility.

- Short selling, where investors borrow and sell shares hoping to buy them back at a lower price, could also have amplified the downward pressure on QBTS stock.

Long-Term Outlook for D-Wave Quantum (QBTS) Stock

The Potential of Quantum Computing

Despite the recent volatility, the long-term potential of the quantum computing industry remains substantial. This cutting-edge technology promises to revolutionize various fields, driving significant future growth.

- Quantum computing has the potential to solve complex problems currently intractable for classical computers, impacting fields like drug discovery, materials science, and artificial intelligence.

- Market research indicates substantial growth potential for the quantum computing market in the coming years, suggesting significant long-term opportunities.

D-Wave Quantum's Competitive Advantages

D-Wave Quantum possesses unique technologies and strategies that could give it a competitive edge in the long run. Its focus on annealing-based quantum computers offers a distinct approach to problem-solving.

- D-Wave's focus on developing and deploying its quantum annealing technology provides a unique pathway for accessing quantum computing capabilities, offering advantages in specific applications.

- Continuous research and development efforts are crucial for D-Wave Quantum's future success, enhancing its ability to compete in the dynamic quantum computing landscape.

Risks and Challenges Facing the Company

Investing in a quantum computing company like D-Wave Quantum involves inherent risks. The technology is still relatively nascent, facing technological, financial, and competitive hurdles.

- Competition in the quantum computing sector is fierce, with numerous companies vying for market share. Maintaining a competitive advantage requires significant ongoing investment and innovation.

- Financial risks include the substantial capital investment required for research, development, and deployment of quantum computing technologies.

Conclusion

Monday's significant drop in D-Wave Quantum (QBTS) stock was likely a confluence of factors, including broader market trends, a lack of recent positive company news, and potential profit-taking. While short-term volatility is inherent in the quantum computing sector, the long-term potential of the industry and D-Wave Quantum's unique position remain promising. Investors should carefully assess their risk tolerance and conduct thorough due diligence before investing in D-Wave Quantum (QBTS) stock. Keep monitoring news and analysis regarding QBTS stock and the quantum computing sector to make informed, long-term investment decisions.

Featured Posts

-

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal Decision Delayed

May 21, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal Decision Delayed

May 21, 2025 -

Colombian Models Murder Femicide Condemnation After Mexican Influencers Live Stream Killing

May 21, 2025

Colombian Models Murder Femicide Condemnation After Mexican Influencers Live Stream Killing

May 21, 2025 -

Chat Gpt Maker Open Ai Faces Ftc Investigation

May 21, 2025

Chat Gpt Maker Open Ai Faces Ftc Investigation

May 21, 2025 -

Is Big Bear Ai Holdings Inc Nyse Bbai A Top Penny Stock To Watch

May 21, 2025

Is Big Bear Ai Holdings Inc Nyse Bbai A Top Penny Stock To Watch

May 21, 2025 -

Dennis Quaid Meg Ryan And James Caan An Obscure Western Neo Noir

May 21, 2025

Dennis Quaid Meg Ryan And James Caan An Obscure Western Neo Noir

May 21, 2025

Latest Posts

-

Almntkhb Alamryky Andmam Thlathy Jdyd Lawl Mrt

May 22, 2025

Almntkhb Alamryky Andmam Thlathy Jdyd Lawl Mrt

May 22, 2025 -

Qaymt Mntkhb Amryka Ttdmn Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Qaymt Mntkhb Amryka Ttdmn Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025 -

Bwtshytynw Ydm Thlathy Jdyd Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ydm Thlathy Jdyd Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025 -

Mfajat Bwtshytynw Thlathy Jdyd Fy Qaymt Mntkhb Amryka

May 22, 2025

Mfajat Bwtshytynw Thlathy Jdyd Fy Qaymt Mntkhb Amryka

May 22, 2025 -

Thlatht Laebyn Ysharkwn Lawl Mrt Me Mntkhb Alwlayat Almthdt Bqyadt Bwtshytynw

May 22, 2025

Thlatht Laebyn Ysharkwn Lawl Mrt Me Mntkhb Alwlayat Almthdt Bqyadt Bwtshytynw

May 22, 2025