Decoding X's Finances: Key Takeaways From Musk's Recent Debt Offering

Table of Contents

The Scale of the Debt and its Structure

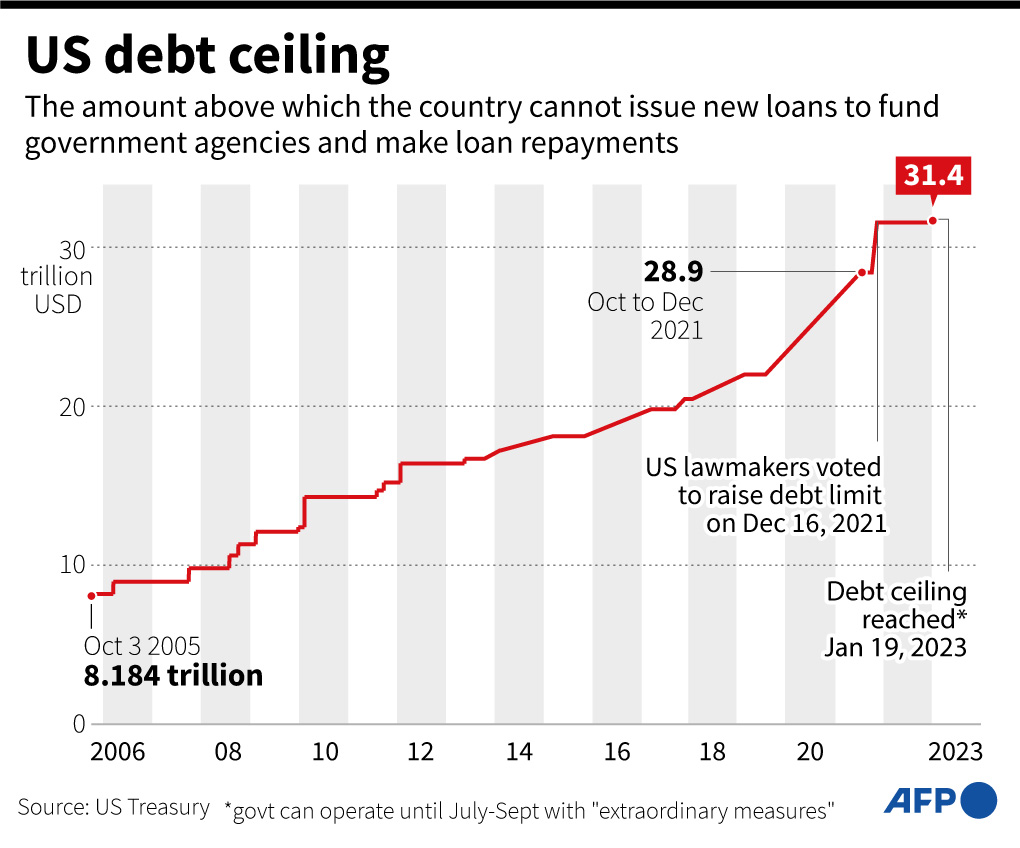

The debt incurred to acquire X represents a substantial financial burden. Understanding the structure of this debt is crucial to assessing the platform's financial stability. The financing involved a complex mix of high-yield debt, leveraged loans, and potentially other forms of financing. This high-yield debt, often referred to as "junk bonds," carries a significantly higher interest rate than more conventional financing options, reflecting the increased risk involved. This increased risk is directly linked to the high debt-to-equity ratio that X now faces.

- Breakdown of debt types: A precise breakdown is difficult to obtain publicly, but the deal involved a significant portion of high-yield bonds, alongside potentially secured and unsecured loans from various financial institutions.

- Analysis of the debt-to-equity ratio: The debt-to-equity ratio is a key indicator of financial leverage. A high ratio suggests a greater reliance on debt financing, making the company more vulnerable to economic downturns. X's current ratio is likely extremely high, posing considerable financial risk.

- Comparison to similar companies: Comparing X's debt structure to similar-sized tech companies reveals a substantially higher level of leverage, underscoring the unusual nature of Musk's acquisition strategy.

- Discussion of potential collateral for secured debts: The specifics of collateral used to secure portions of the debt remain undisclosed, but it likely includes some of X's assets, adding another layer of complexity to the financial picture.

The Risks Associated with Musk's Financial Strategy

Musk's highly leveraged buyout of X introduces several significant financial risks. The sheer scale of the debt poses considerable challenges, particularly in the face of economic uncertainty. Failure to meet debt obligations could lead to severe consequences, including default and potential bankruptcy.

- Explanation of interest rate risk: The high-yield bonds carry a floating interest rate, meaning that fluctuations in interest rates will directly impact X's debt servicing costs. Rising interest rates significantly increase the burden of debt repayment.

- Analysis of the refinancing risk: Refinancing the debt in the future will be challenging given the current economic climate and X's high-risk profile. The company may face difficulties securing favorable terms, leading to further financial strain.

- Discussion of potential liquidity issues: If X struggles to generate sufficient revenue to cover its debt obligations and operational expenses, it could face liquidity issues, potentially leading to default.

- Assessment of the default risk: The default risk is substantial. A default could trigger a cascade of negative consequences, potentially impacting X's operations, credit rating, and ultimately, its survival.

The Impact on X's Operations and Future Strategy

The substantial debt burden will undoubtedly influence X's operational decisions and future strategies. The pressure to service the debt will likely necessitate aggressive cost-cutting measures and a renewed focus on revenue generation.

- Examination of X's revenue streams: X's revenue streams primarily consist of advertising revenue and its nascent subscription model. The success of these revenue streams will be critical to X's financial stability.

- Discussion of potential cost-cutting measures: To manage the debt load, X may implement further cost-cutting measures, including staff reductions or decreased investment in new features.

- Analysis of the effectiveness of X's subscription model: The success of the subscription model will be a crucial factor in X's ability to alleviate its debt burden. The platform's ability to attract and retain paying subscribers will be paramount.

- Assessment of the reliance on advertising revenue: X remains heavily reliant on advertising revenue. Diversification of its revenue streams is crucial to mitigate the risks associated with advertising market volatility.

The Long-Term Outlook for X's Financial Health

The long-term outlook for X's financial health is uncertain. While the platform has a large user base, its ability to generate sufficient revenue to service its massive debt load and achieve profitability remains a significant question.

- Projection of X's profitability: Based on current trends, predicting X's profitability is difficult. Significant improvements in revenue generation or aggressive cost-cutting are necessary for long-term viability.

- Assessment of the potential for increased revenue generation: X's future revenue hinges on the success of its subscription model and its ability to attract and retain advertisers. Innovations and strategic partnerships will be crucial for growth.

- Evaluation of the sustainability of Musk's financial strategy: Musk's strategy relies heavily on aggressive growth and revenue generation to overcome the considerable debt burden. The sustainability of this approach remains to be seen.

- Discussion of potential scenarios: The future holds both positive and negative possibilities. Success depends on effective management, strategic innovation, and favorable economic conditions.

Conclusion

This article has explored the complex financial landscape of X following Musk's recent debt offering. We've analyzed the scale and structure of the debt, identified associated risks, and examined the implications for X's future operations. The high level of leverage introduces significant risk, demanding careful management and a robust revenue generation strategy. The path to financial stability for X is fraught with challenges, and the coming years will be crucial in determining its long-term viability.

Call to Action: Understanding X's finances is crucial for anyone interested in the future of the platform. Stay informed about developments in X's financial performance by continuing to follow our analysis on Decoding X's Finances. We’ll continue to provide insightful coverage on the intricacies of Musk's financial strategies and their impact on the platform.

Featured Posts

-

Aaron Judges 2026 Wbc Bid A Look At His Chances

Apr 28, 2025

Aaron Judges 2026 Wbc Bid A Look At His Chances

Apr 28, 2025 -

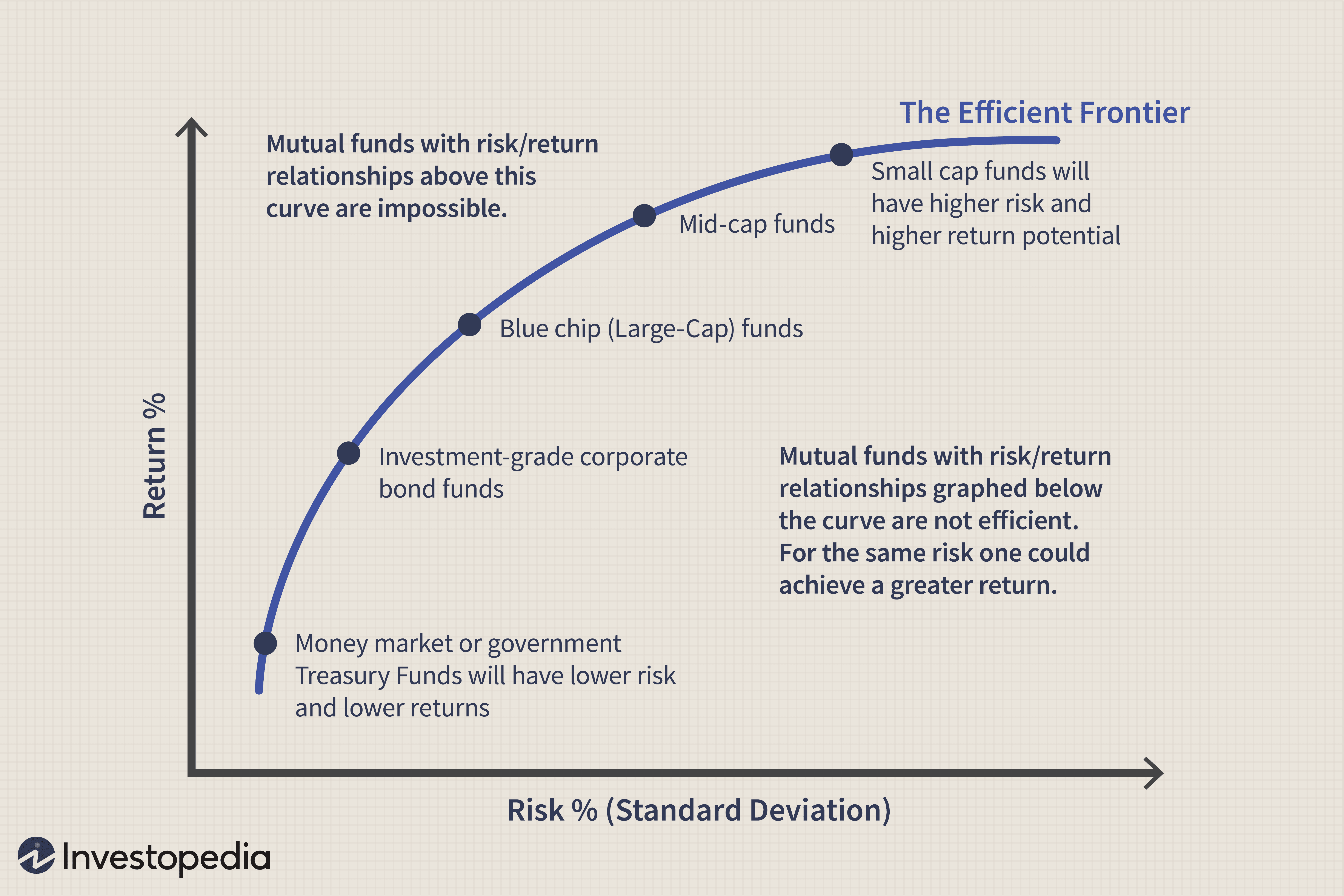

When Professionals Sell Individuals Buy Understanding Market Volatility

Apr 28, 2025

When Professionals Sell Individuals Buy Understanding Market Volatility

Apr 28, 2025 -

Aaron Judges 2025 On Field Goal Prediction The Push Up Revelation

Apr 28, 2025

Aaron Judges 2025 On Field Goal Prediction The Push Up Revelation

Apr 28, 2025 -

Shedeur Sanders Drafted By Cleveland Browns In 5th Round

Apr 28, 2025

Shedeur Sanders Drafted By Cleveland Browns In 5th Round

Apr 28, 2025 -

Mets 2024 Opening Day Roster Early Predictions Based On Spring Training Games

Apr 28, 2025

Mets 2024 Opening Day Roster Early Predictions Based On Spring Training Games

Apr 28, 2025