Did Target's DEI Retrenchment Hurt The Bottom Line? A Data-Driven Look

Table of Contents

1. Target's DEI Initiatives and the Subsequent Backlash

1.1 The Initial DEI Strategy: Target, like many large corporations, made significant commitments to DEI, aiming to foster a more inclusive and representative workplace and customer experience. This involved several key initiatives: the creation of employee resource groups (ERGs) focusing on LGBTQ+ inclusion, partnerships with minority-owned businesses, and the promotion of products celebrating diverse communities. These diversity initiatives were intended to improve both employee morale and brand image, ultimately driving sales and boosting shareholder value.

1.2 The Controversy and Public Response: However, Target’s Pride month collection, featuring clothing items from LGBTQ+ designers, sparked significant controversy. Conservative groups launched boycotts, fueled by social media campaigns that amplified negative sentiments. The resulting consumer backlash led to a visible decline in store traffic and online sales for certain product categories. This negative public opinion forced Target to adjust its approach, leading to what many termed a "DEI retrenchment".

- Specific examples of products/campaigns: The 2023 Pride collection, featuring items from designer Abprallen, was a central point of contention.

- Key dates/events: The launch of the Pride collection in May 2023 and the subsequent surge in negative media coverage and boycotts marked a turning point.

- Quantification of negative press: While precise quantification is difficult, the volume of negative news articles and social media posts during this period was substantial, significantly impacting Target's brand perception.

2. Analyzing Target's Financial Performance

2.1 Sales Figures Before and After the Controversy: To assess the impact of Target's DEI retrenchment, we need to compare sales figures. While precise data isolating the impact of the controversy is unavailable, publicly reported quarterly earnings reveal a slowdown in sales growth in Q2 2023 compared to the previous year. While several factors contribute to this, the negative publicity surrounding the Pride collection likely played a role in the decline.

2.2 Stock Performance Analysis: Target's stock price experienced volatility during this period. While a direct causal link is hard to establish, the negative publicity likely contributed to investor uncertainty, resulting in some share price fluctuation. Further analysis is needed to separate this impact from broader market trends.

2.3 Other Relevant Financial Metrics: Analyzing customer satisfaction scores and brand perception surveys could provide additional insights. While such data is often proprietary, publicly available data on social media sentiment and online reviews can offer a glimpse into how consumers perceived Target during this period.

- Specific sales data: Target's Q2 2023 earnings reports show a slowing of revenue growth compared to previous quarters. (Source: [Insert Target's official financial reports here])

- Stock price charts: (Insert a chart or graph showing Target's stock price fluctuations during the relevant period. Source: [e.g., Yahoo Finance, Google Finance])

- Confounding factors: Broader economic factors, including inflation and changes in consumer spending, must be considered when assessing Target's financial performance.

3. Correlation vs. Causation

3.1 Attributing Financial Changes to DEI Retrenchment: It’s crucial to acknowledge the difficulty of directly linking any financial downturn solely to Target's adjustments to its DEI strategy. Correlation does not equal causation. Several other factors, including overall economic conditions, could have contributed to the changes in sales and stock performance.

3.2 Alternative Explanations for Financial Performance: The decline in sales and stock price could be attributed to various factors unrelated to the DEI controversy, including general economic slowdown, increased competition, or shifts in consumer preferences. These confounding variables complicate any attempt to isolate the effect of Target's DEI retrenchment.

- Potential confounding factors: Inflation, shifting consumer spending habits, increased competition from other retailers.

- Difficulty establishing causality: The lack of controlled experiments and the presence of many confounding factors make it difficult to isolate the impact of Target's DEI adjustments.

- Further research: Longitudinal studies tracking consumer behavior and sales data following the controversy could offer a clearer picture.

3. Conclusion

Our analysis suggests a correlation between the negative publicity surrounding Target's DEI initiatives and a slowdown in sales growth and stock price volatility. However, establishing a direct causal link between Target's DEI retrenchment and a significant, quantifiable impact on its bottom line proves challenging due to the presence of various confounding economic and market factors. While the controversy undoubtedly impacted brand perception and caused short-term fluctuations, definitively proving it "hurt" the bottom line requires further, more nuanced research. Analyzing Target's DEI strategy's financial impact is an ongoing process, requiring a multifaceted approach to account for all contributing factors. Further research is needed to determine the long-term consequences of this approach for Target and other companies grappling with similar challenges.

Featured Posts

-

Klas Recognizes Nrc Health As The Leading Healthcare Experience Management Provider

May 01, 2025

Klas Recognizes Nrc Health As The Leading Healthcare Experience Management Provider

May 01, 2025 -

Nrc Announces Resumption Of Warri Itakpe Rail Service

May 01, 2025

Nrc Announces Resumption Of Warri Itakpe Rail Service

May 01, 2025 -

German Coalition Deal Midday Announcement Expected

May 01, 2025

German Coalition Deal Midday Announcement Expected

May 01, 2025 -

Boxeo En Saltillo Un Motor De Transformacion A Traves Del Deporte

May 01, 2025

Boxeo En Saltillo Un Motor De Transformacion A Traves Del Deporte

May 01, 2025 -

Caso Becciu Nuove Rivelazioni Dalle Chat Segrete Vaticane

May 01, 2025

Caso Becciu Nuove Rivelazioni Dalle Chat Segrete Vaticane

May 01, 2025

Latest Posts

-

Pinpointing Success A Geographic Analysis Of The Countrys New Business Hot Spots

May 02, 2025

Pinpointing Success A Geographic Analysis Of The Countrys New Business Hot Spots

May 02, 2025 -

Rust A Retrospective Review Following The On Set Accident

May 02, 2025

Rust A Retrospective Review Following The On Set Accident

May 02, 2025 -

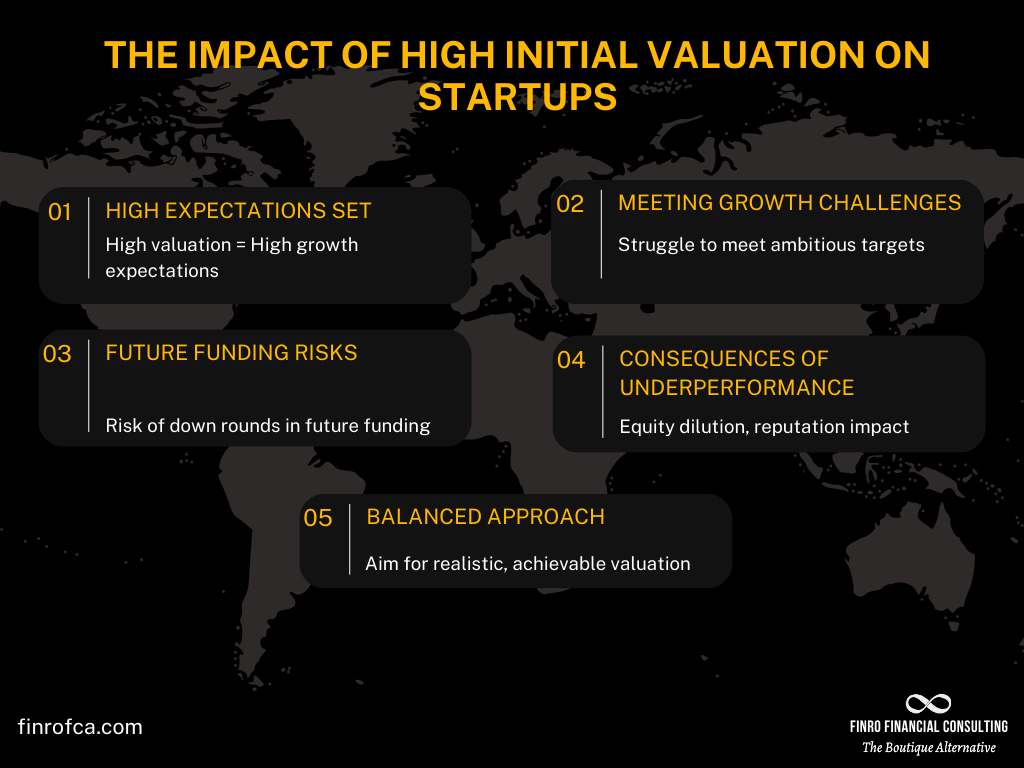

Stock Market Valuation Concerns Bof As Response To Investor Anxiety

May 02, 2025

Stock Market Valuation Concerns Bof As Response To Investor Anxiety

May 02, 2025 -

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025 -

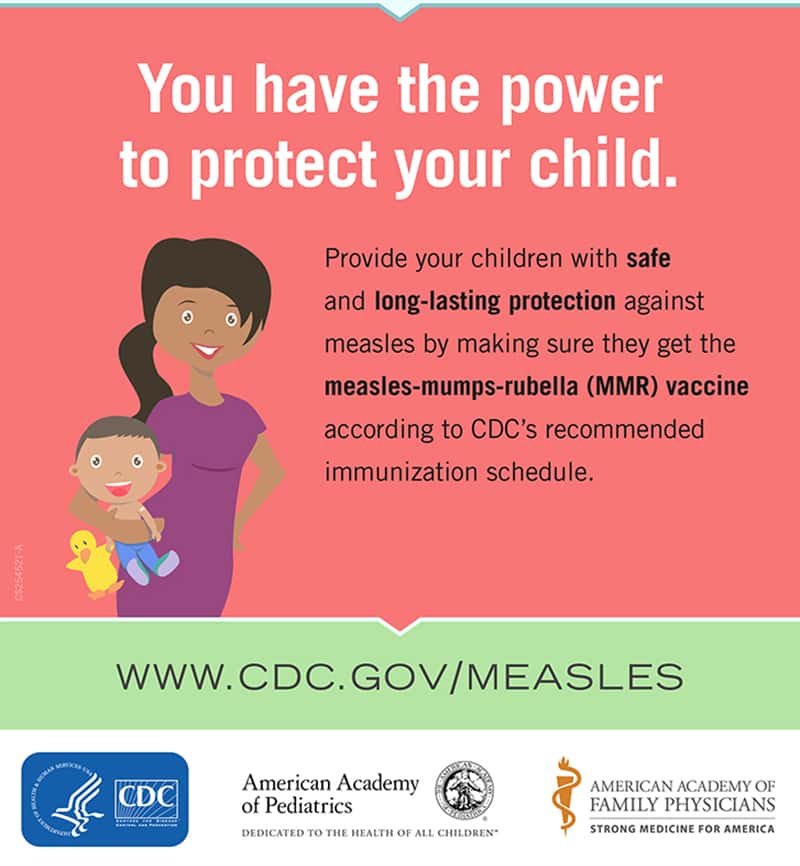

Us Vaccine Safety And The Current Measles Epidemic

May 02, 2025

Us Vaccine Safety And The Current Measles Epidemic

May 02, 2025