Stock Market Valuation Concerns: BofA's Response To Investor Anxiety

Table of Contents

BofA's Assessment of Current Stock Market Valuations

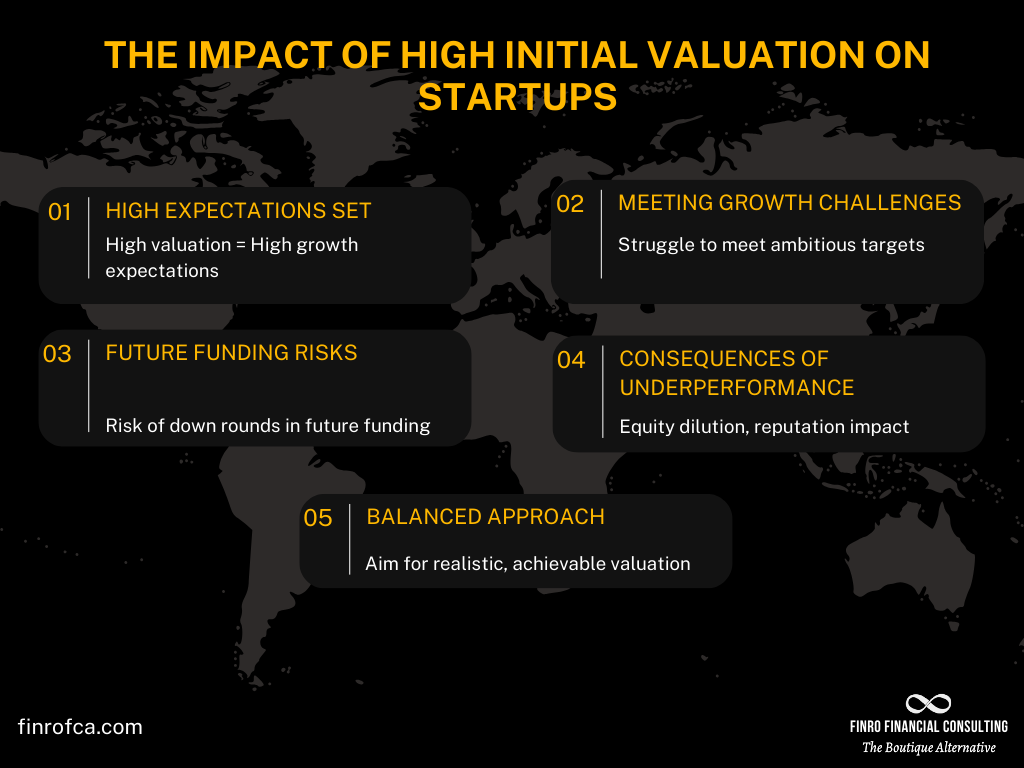

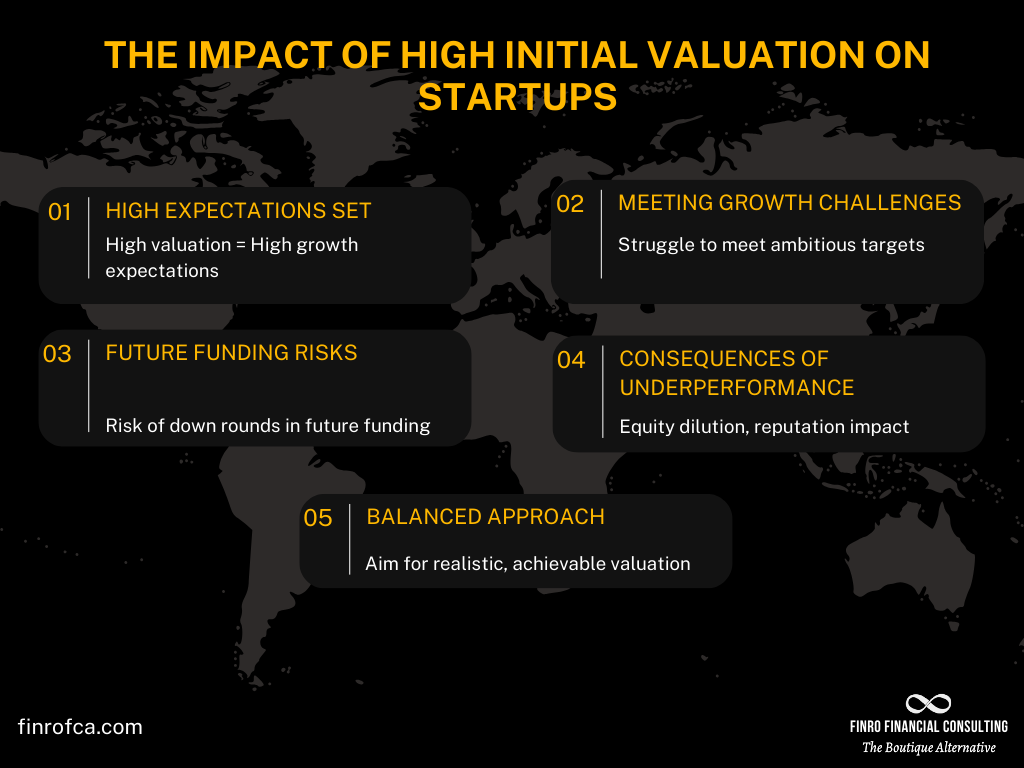

BofA's recent reports offer a nuanced perspective on current stock market valuations. While they haven't declared the market definitively overvalued, undervalued, or fairly valued with a single, blanket statement, their analysis points to a complex picture. Their assessment incorporates a range of factors and utilizes several key metrics to reach their conclusions.

BofA's methodology leans heavily on a combination of traditional valuation metrics and a forward-looking approach. They consider factors beyond simple Price-to-Earnings (P/E) ratios, incorporating metrics such as the Shiller PE (CAPE ratio), which smooths earnings over a longer period to account for cyclical fluctuations. This more comprehensive approach allows them to paint a richer picture of the market's health.

- Key metrics used by BofA in their valuation analysis: P/E ratios, Shiller PE (CAPE ratio), dividend yields, price-to-sales ratios, and various growth rate projections.

- Specific sectors BofA highlights as potentially overvalued or undervalued: (Note: Specific sectors will need to be filled in with current BofA reports. This section requires up-to-date information.) For instance, they may point to certain technology sectors as potentially overvalued based on their growth prospects versus current valuations, while highlighting value opportunities in other sectors.

- Comparison of current valuations to historical averages: BofA's analysis likely compares current valuation metrics to long-term historical averages, providing context for current levels. This historical perspective helps gauge whether current valuations are unusually high or low compared to historical norms.

BofA's Strategies for Addressing Investor Anxiety

Given the current market uncertainty regarding stock market valuation, BofA advocates for a cautious yet proactive approach. They emphasize the importance of strategic planning and risk mitigation to help investors navigate this complex landscape.

BofA's advice centers around thoughtful portfolio management and a long-term perspective. They strongly discourage knee-jerk reactions based on short-term market fluctuations.

- Diversification recommendations from BofA: BofA likely recommends diversifying across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce overall portfolio risk. This is a cornerstone of sound investment strategy, especially during periods of uncertainty.

- Suggested asset allocation strategies: The specific asset allocation strategies suggested by BofA will depend on an investor's risk tolerance, time horizon, and financial goals. They will likely tailor recommendations to individual circumstances, suggesting adjustments based on risk appetite.

- Advice on hedging against potential market downturns: BofA may suggest hedging strategies, such as using options or inverse ETFs, to mitigate potential losses in a downturn. However, they will likely stress the importance of carefully weighing the costs and risks associated with hedging.

- Mention of any specific investment products or services BofA offers related to managing valuation risk: (Note: This section requires knowledge of BofA's specific offerings and should be updated with current information.)

Factors Influencing BofA's Valuation Perspective

BofA's valuation perspective is shaped by a complex interplay of economic factors and prevailing market trends. Their analysis isn't done in a vacuum; it considers the broader macroeconomic environment.

- Impact of inflation on stock valuations: High inflation erodes purchasing power and can impact corporate earnings, potentially affecting stock valuations negatively. BofA's analysis likely accounts for the inflationary environment and its potential influence.

- Influence of interest rate hikes: Interest rate increases by central banks aim to curb inflation, but they can also slow economic growth and impact corporate borrowing costs, potentially influencing stock prices. BofA's assessment accounts for the Federal Reserve's monetary policy decisions.

- Geopolitical risks and their effects on market valuations: Global geopolitical events, such as conflicts or trade disputes, introduce significant uncertainty and can dramatically impact market valuations. BofA likely considers these global factors in its analysis.

Alternative Perspectives on Stock Market Valuation

It's crucial to acknowledge that BofA's perspective isn't the only viewpoint on stock market valuation. Other financial institutions and experts may offer differing opinions. Considering these alternative perspectives provides a more comprehensive understanding.

- Summary of alternative viewpoints: (Note: This section requires research into the opinions of other financial institutions. Include citations where possible.) Some experts might argue that the market is significantly overvalued, emphasizing specific risks, while others might see opportunities for growth despite the current volatility.

- Key differences in analysis and conclusions: Highlight the differences in methodologies, key metrics used, and the conclusions reached by other institutions compared to BofA's analysis.

- Discussion of the range of possible scenarios: Present a range of potential scenarios for the future, reflecting the uncertainty inherent in stock market forecasting.

Conclusion: Understanding and Managing Stock Market Valuation Concerns

BofA's analysis provides valuable insights into current stock market valuation concerns. Their recommendations emphasize a balanced approach, advocating for diversification, risk mitigation, and a long-term perspective. However, it’s critical to remember that market predictions are inherently uncertain. Understanding stock market valuation is crucial for making informed investment decisions, but it shouldn't be the sole basis for action.

Stay informed about stock market valuation trends and consult with financial professionals to develop a strategy that addresses your investor anxiety and aligns with your risk tolerance. Learn more about BofA's insights on stock market analysis to navigate the current market effectively. Conduct your own thorough research and consult a financial advisor before making any significant investment decisions. Remember, investing involves risk, and past performance is not indicative of future results.

Featured Posts

-

Remembering Priscilla Pointer Dalla Star Dead At 100

May 02, 2025

Remembering Priscilla Pointer Dalla Star Dead At 100

May 02, 2025 -

Government Approved Mental Health Training Programs A Comprehensive Guide

May 02, 2025

Government Approved Mental Health Training Programs A Comprehensive Guide

May 02, 2025 -

Ai Driven Podcast Creation Analyzing Repetitive Scatological Documents

May 02, 2025

Ai Driven Podcast Creation Analyzing Repetitive Scatological Documents

May 02, 2025 -

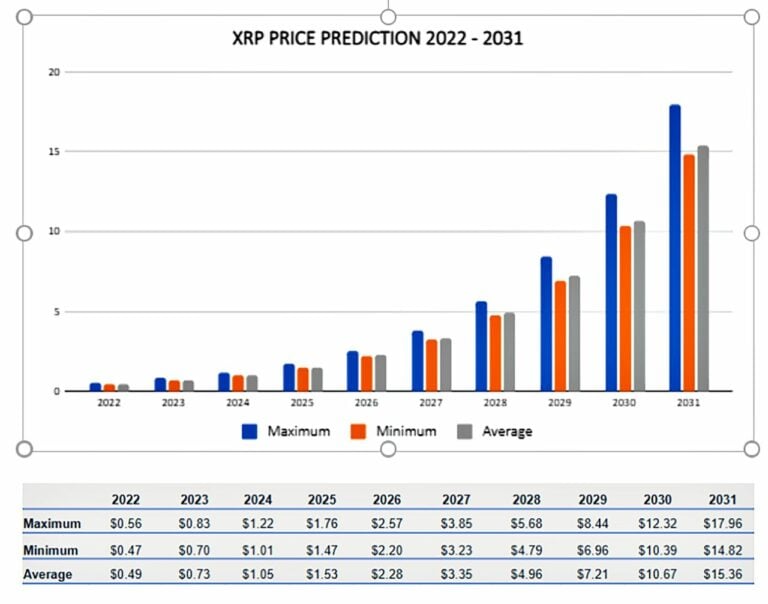

Xrps Price Prediction Evaluating The Potential For Millionaire Making Returns

May 02, 2025

Xrps Price Prediction Evaluating The Potential For Millionaire Making Returns

May 02, 2025 -

A Tanyerodon A Kivalosag Kme Vedjegyes Baromfi A Mecsek Baromfi Kft Tol

May 02, 2025

A Tanyerodon A Kivalosag Kme Vedjegyes Baromfi A Mecsek Baromfi Kft Tol

May 02, 2025

Latest Posts

-

Newsround Airtimes Full Bbc Two Hd Tv Guide

May 02, 2025

Newsround Airtimes Full Bbc Two Hd Tv Guide

May 02, 2025 -

Doctor Who On Hold Showrunners Pause Announcement Sparks Concern

May 02, 2025

Doctor Who On Hold Showrunners Pause Announcement Sparks Concern

May 02, 2025 -

Check The Bbc Two Hd Schedule For Newsround

May 02, 2025

Check The Bbc Two Hd Schedule For Newsround

May 02, 2025 -

Doctor Who Star Responds To Criticism Show Is Reflecting The Times

May 02, 2025

Doctor Who Star Responds To Criticism Show Is Reflecting The Times

May 02, 2025 -

Where To Watch Newsround Bbc Two Hd Listings

May 02, 2025

Where To Watch Newsround Bbc Two Hd Listings

May 02, 2025