Dismissing High Stock Market Valuations: Insights From BofA For Investors

Table of Contents

BofA's Stance on Current High Stock Market Valuations

BofA's stock market outlook is nuanced, acknowledging the elevated valuations but not necessarily predicting an imminent crash. Their analysis doesn't simply dismiss high stock prices; instead, it encourages a more thorough and sophisticated approach to evaluating the market. BofA's investment strategy is built on a multi-faceted assessment, combining traditional valuation metrics with an understanding of the macroeconomic environment.

- Key arguments: BofA's arguments often center on the interplay between robust corporate earnings, low interest rates (historically speaking), and the potential for continued economic growth. While acknowledging the high P/E ratios in certain sectors, they highlight the resilience of many companies and the potential for future earnings growth to justify current valuations.

- Specific sectors: BofA's analysts often highlight specific sectors, identifying some as potentially overvalued (perhaps those with high growth expectations but limited proven track records) and others as relatively undervalued (those showing strong fundamentals and steady growth). Specific examples are often found in their research reports.

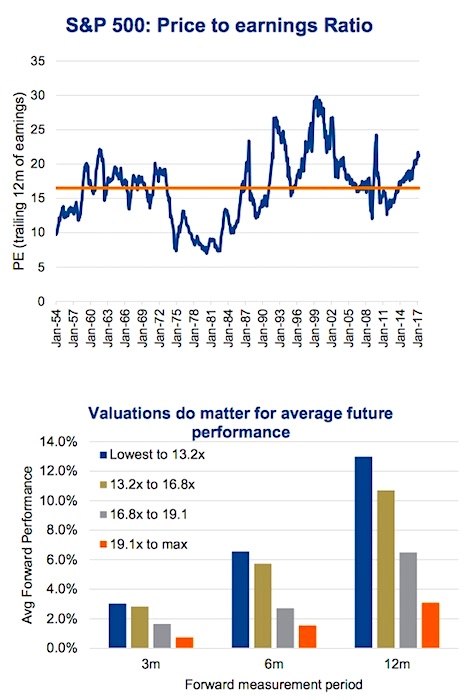

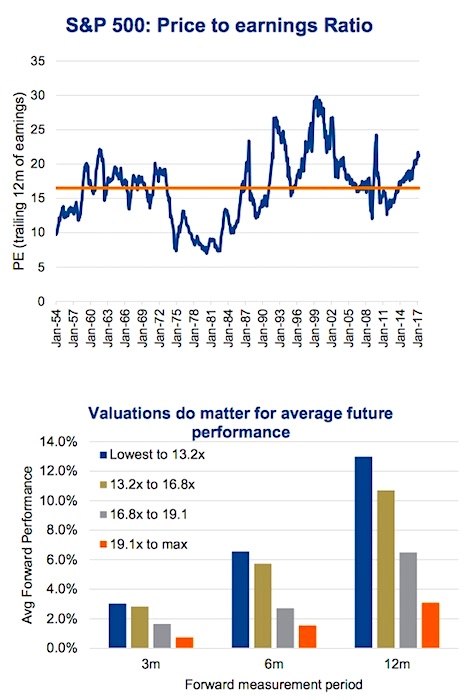

- Valuation metrics used: Their analyses frequently utilize a combination of metrics, including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and other forward-looking measures that attempt to project future earnings growth. They may also incorporate Discounted Cash Flow (DCF) analysis to arrive at an intrinsic value estimate.

Analyzing Valuation Metrics: Beyond Simple P/E Ratios

Relying solely on a single metric like the P/E ratio is inherently risky. The P/E ratio, while a useful starting point for stock market analysis, fails to capture the nuances of individual company performance and future growth potential. A high P/E ratio might be justified if a company is experiencing rapid growth and expansion.

- Industry-specific metrics: It's crucial to consider industry-specific valuation metrics. A high P/E ratio in the technology sector might be normal, while the same ratio in a more mature industry might signal overvaluation.

- Growth prospects: The importance of growth prospects in justifying higher valuations cannot be overstated. Companies with strong growth potential can command higher valuations than those with slower or stagnant growth.

- Relative vs. Intrinsic Value: Understanding the difference between relative and intrinsic value is vital. Relative valuation compares a company's valuation to its peers, while intrinsic value attempts to determine the underlying worth of a company based on its fundamentals. BofA often uses a blend of both approaches.

Macroeconomic Factors Influencing Stock Market Valuations

Macroeconomic conditions significantly impact stock market valuations. BofA carefully considers these factors when forming its investment strategy, understanding that fluctuations in interest rates, inflation, and geopolitical stability affect both investor sentiment and corporate profitability.

- Interest rates and discount rates: Rising interest rates generally lead to higher discount rates used in valuation models, reducing the present value of future earnings and potentially lowering valuations.

- Inflation's effect: High inflation erodes corporate earnings and can negatively impact investor confidence, leading to lower valuations. Conversely, controlled inflation can be less of a concern.

- Geopolitical uncertainty: Geopolitical events, such as wars or trade disputes, introduce uncertainty into the market, leading to increased volatility and potentially impacting valuations.

Developing an Informed Investment Strategy Based on BofA's Insights

BofA's analysis provides a framework for developing a robust investment strategy. However, investors must remember that no single analysis can perfectly predict market movements.

- Strategies for high-valuation markets: Investors might explore value investing strategies, focusing on companies with strong fundamentals trading below their intrinsic value. Alternatively, a "growth at a reasonable price" strategy balances growth potential with valuation concerns.

- Risk tolerance and timeline: Your investment strategy should align with your individual risk tolerance and investment timeline. Long-term investors might be more comfortable riding out short-term market fluctuations.

- Professional financial advice: Seeking professional financial advice is always prudent, particularly in navigating complex market conditions. A financial advisor can help you tailor an investment portfolio that aligns with your individual circumstances and goals.

Conclusion

BofA's perspective on high stock market valuations highlights the need for a sophisticated, multi-faceted approach to investment decision-making. While acknowledging elevated valuations, their analysis doesn't necessarily signal an imminent market crash. Instead, it emphasizes the crucial role of understanding valuation metrics beyond simple P/E ratios, considering macroeconomic factors, and developing a well-diversified investment strategy. Remember to conduct thorough research and consider seeking professional financial advice before making investment decisions. Use BofA's insights, along with your own due diligence, to navigate the complexities of high stock market valuations and make sound investment choices. Continue your education on stock market valuation and investment strategies to refine your approach.

Featured Posts

-

A Critical Military Installation The Epicenter Of Us China Influence

Apr 26, 2025

A Critical Military Installation The Epicenter Of Us China Influence

Apr 26, 2025 -

Ceos Sound Alarm Trump Tariffs Economic Uncertainty And Consumer Impact

Apr 26, 2025

Ceos Sound Alarm Trump Tariffs Economic Uncertainty And Consumer Impact

Apr 26, 2025 -

Preordering My Nintendo Switch 2 A Game Stop Adventure

Apr 26, 2025

Preordering My Nintendo Switch 2 A Game Stop Adventure

Apr 26, 2025 -

High Stock Market Valuations A Bof A Analysis And Reasons For Investor Calm

Apr 26, 2025

High Stock Market Valuations A Bof A Analysis And Reasons For Investor Calm

Apr 26, 2025 -

Exclusive Access A Side Hustle Trading Stakes In Elon Musks Private Companies

Apr 26, 2025

Exclusive Access A Side Hustle Trading Stakes In Elon Musks Private Companies

Apr 26, 2025