Exclusive Access: A Side Hustle Trading Stakes In Elon Musk's Private Companies

Table of Contents

Identifying Potential Investment Opportunities in Musk's Private Companies

Accessing investments in Elon Musk's private companies requires diligent effort and a keen eye for opportunity. The rewards can be substantial, but only with careful planning and due diligence.

Due Diligence: Researching the Companies and Their Potential

Before investing a single dollar, thorough research is paramount. This isn't about impulsive decisions; it's about informed strategic investment.

- Sources of Information: Leverage financial news outlets (Bloomberg, Reuters, etc.), industry-specific reports, and SEC filings (where applicable). Look for reputable sources that offer insights into the financial performance and future prospects of the companies.

- Analyzing Financials: Scrutinize available financial data, focusing on revenue projections, market share, and profitability. Even limited data can offer clues about the company's potential for growth.

- Understanding the Company's Mission and Competitive Landscape: Analyze the company's overall goals and how it stacks up against competitors. A strong mission and a competitive edge are essential for success.

The importance of exhaustive research cannot be overstated. Thorough due diligence is the bedrock of responsible investing.

Accessing Information: Finding Reliable Sources for Private Company Valuations and Investment Opportunities

Gaining access to reliable information about private company valuations and investment opportunities can be challenging. It often requires more than just online searches.

- Networking Strategies: Attend industry events, conferences, and workshops to connect with investors and individuals involved in private equity. Networking is crucial in this space.

- Utilizing Specialized Financial Databases: Explore specialized databases and platforms that provide information on private companies. These resources often require subscriptions or memberships.

- Understanding the Limitations of Public Information: Be aware that information on private companies is inherently less accessible than public company information. Transparency is limited, making research even more crucial.

The difficulty in obtaining reliable data necessitates a proactive and well-connected approach.

Navigating the Legal and Regulatory Landscape

Trading stakes in private companies is subject to various legal and regulatory frameworks. Understanding these regulations is not optional; it's essential.

Understanding Securities Laws: Regulations Surrounding the Trading of Private Company Stakes

Navigating the legal landscape surrounding private company investments requires understanding several key aspects of securities law.

- Key Legislation: Familiarize yourself with the relevant securities laws in your jurisdiction. These laws vary considerably by country and region.

- Accredited Investor Status: Depending on your location and the investment opportunity, you may need to meet specific criteria to be considered an accredited investor. Understanding these requirements is critical.

- Implications of Insider Trading: Strict regulations against insider trading apply to private companies as well. Any activity that appears to exploit non-public information to gain an unfair advantage is illegal and carries severe consequences.

Legal compliance is not merely a box to check; it’s a fundamental requirement for responsible and ethical investing.

Seeking Expert Advice: Utilizing Legal and Financial Professionals for Guidance

Given the complexity of private equity investments, seeking professional advice is strongly recommended.

- Securities Law Lawyers: Consulting with lawyers specializing in securities law can provide invaluable guidance on navigating legal complexities and ensuring compliance.

- Financial Advisors: Working with financial advisors experienced in alternative investments can offer insights into investment strategies, risk management, and portfolio diversification.

Professional guidance minimizes risk and promotes informed decision-making.

Building a Successful Side Hustle Trading Stakes

Building a successful side hustle trading stakes in private companies requires careful planning, risk mitigation, and a long-term perspective.

Risk Management Strategies: Mitigating Potential Losses and Diversifying Investments

The high-risk nature of private equity necessitates robust risk management strategies.

- Realistic Investment Goals: Set achievable investment goals and avoid chasing unrealistic returns. Understand your risk tolerance.

- Diversification: Diversify your investments across different companies and asset classes to reduce overall portfolio risk. Don't put all your eggs in one basket.

- Stop-Loss Orders (Where Possible): While not always feasible with private investments, consider stop-loss mechanisms where available to limit potential losses.

- Illiquidity: Be aware that private investments are generally illiquid, meaning they cannot be easily converted into cash. Factor this into your investment strategy.

A calculated approach to risk mitigation is critical for long-term success.

Long-Term Investment Strategy: Building a Portfolio for Sustained Growth

Building a successful portfolio requires a long-term perspective. Private equity investments often require patience.

- Growth Potential: Focus on companies with demonstrable growth potential and a strong track record.

- Investment Horizon: Understand that private company investments typically have longer investment horizons compared to publicly traded stocks.

- Regular Review and Adjustment: Regularly review your investment strategy and make adjustments as needed based on market conditions and company performance.

Patience, perseverance, and a long-term outlook are key components of a winning strategy.

Conclusion: Maximize Your Returns with a Side Hustle Trading Stakes in Elon Musk's Private Companies

Trading stakes in Elon Musk's private companies offers a unique and potentially lucrative side hustle, but it necessitates thorough research, strict adherence to legal regulations, and well-defined risk management strategies. By conducting diligent due diligence, seeking professional advice, and developing a long-term investment strategy, you can significantly increase your chances of success. Start your research today and begin building your portfolio. Explore opportunities to invest in Elon Musk's companies responsibly, remembering that while the potential for high returns exists, so do significant risks. Don’t hesitate to seek professional guidance before trading stakes in private companies founded by Elon Musk or other high-profile entrepreneurs.

Featured Posts

-

7 Must Try Orlando Restaurants In 2025 A Disney Alternative

Apr 26, 2025

7 Must Try Orlando Restaurants In 2025 A Disney Alternative

Apr 26, 2025 -

January 6th Ray Epps Defamation Case Against Fox News Explained

Apr 26, 2025

January 6th Ray Epps Defamation Case Against Fox News Explained

Apr 26, 2025 -

Us China Geopolitical Competition A Focus On A Key Military Base

Apr 26, 2025

Us China Geopolitical Competition A Focus On A Key Military Base

Apr 26, 2025 -

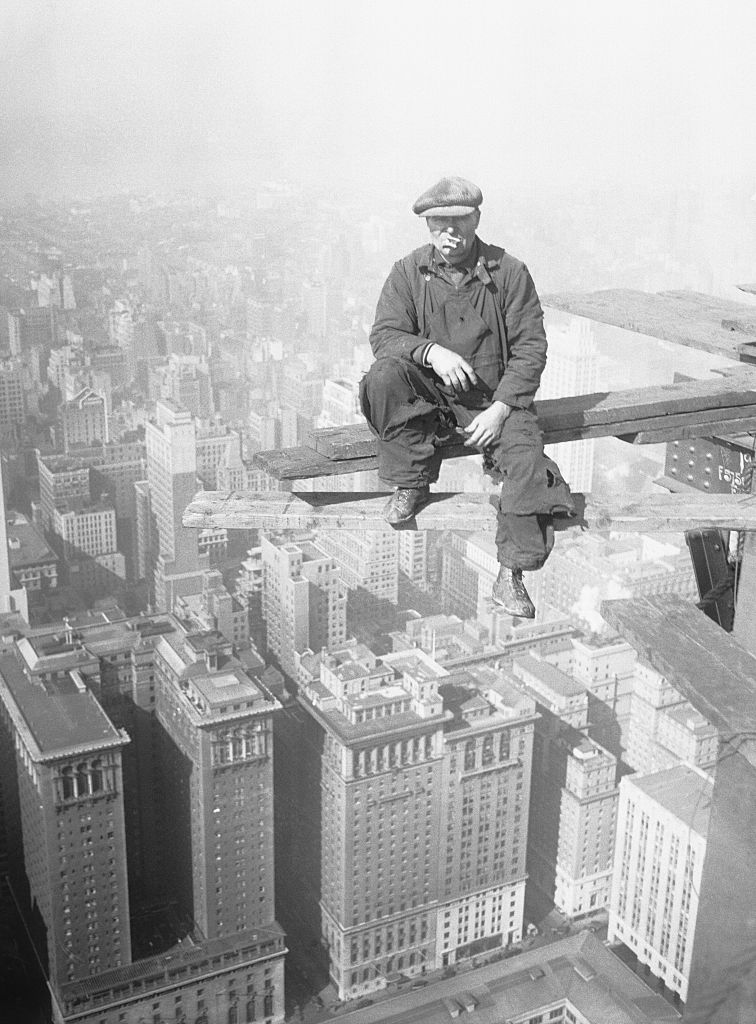

Construction Of Worlds Tallest Abandoned Skyscraper To Resume

Apr 26, 2025

Construction Of Worlds Tallest Abandoned Skyscraper To Resume

Apr 26, 2025 -

Bullions Safe Haven Status Analyzing The Gold Price Rally During Trade Wars

Apr 26, 2025

Bullions Safe Haven Status Analyzing The Gold Price Rally During Trade Wars

Apr 26, 2025

Latest Posts

-

Erfassung Der Herpetofauna Thueringens Der Neue Amphibien Und Reptilienatlas

Apr 27, 2025

Erfassung Der Herpetofauna Thueringens Der Neue Amphibien Und Reptilienatlas

Apr 27, 2025 -

Reptilien Und Amphibien In Thueringen Ein Detaillierter Atlas

Apr 27, 2025

Reptilien Und Amphibien In Thueringen Ein Detaillierter Atlas

Apr 27, 2025 -

Thueringen Artenvielfalt Von Eidechsen Und Molchen Im Neuen Atlas

Apr 27, 2025

Thueringen Artenvielfalt Von Eidechsen Und Molchen Im Neuen Atlas

Apr 27, 2025 -

Neuer Atlas Dokumentiert Amphibien Und Reptilien In Thueringen

Apr 27, 2025

Neuer Atlas Dokumentiert Amphibien Und Reptilien In Thueringen

Apr 27, 2025 -

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025