Dogecoin Price And Elon Musk's Actions: Correlation Or Causation?

Table of Contents

A single tweet. A fleeting mention. These seemingly insignificant actions by Elon Musk have sent shockwaves through the volatile world of Dogecoin, causing its price to swing wildly. This article delves into the complex relationship between Dogecoin price fluctuations and Elon Musk's public statements and actions. Is the correlation a genuine causal relationship, or merely a coincidence amplified by market speculation? We'll explore the evidence, examining Musk's social media influence, market speculation, and other factors influencing Dogecoin's price to uncover the truth behind this fascinating dynamic. We'll also look at whether this correlation holds true for other cryptocurrencies influenced by Elon Musk.

2. Main Points:

H2: Elon Musk's Influence on Social Media

H3: The Power of a Tweet

Elon Musk's tweets mentioning Dogecoin have repeatedly triggered significant price swings. A simple "Doge" can send the cryptocurrency soaring, while a critical comment can lead to a sharp drop. This power stems from Musk's massive social media following and his reputation as a disruptive innovator.

- Examples: Recall Musk's April 2021 tweet featuring a picture of a Shiba Inu with the caption "Doge," immediately boosting Dogecoin's price. Conversely, his later comments questioning Dogecoin's energy consumption led to temporary price dips.

- Data Visualization: [Insert chart/graph here showing price spikes correlating with specific Musk tweets]. The visual representation clearly demonstrates the immediate impact of his pronouncements on Dogecoin's trading volume and price.

- Psychology of Influence: The psychology behind this is rooted in the herd mentality. Musk's endorsement creates FOMO (Fear Of Missing Out), encouraging retail investors to jump on the bandwagon, further driving up the price. Conversely, his negative comments can trigger panic selling.

H3: Musk's Public Persona and Brand Association

Musk's image as a visionary entrepreneur aligns perfectly with Dogecoin's meme-stock nature. His association with the cryptocurrency lends it credibility, attracting both seasoned investors and newcomers drawn to his disruptive brand.

- Meme-Stock Synergy: Dogecoin's inherent meme-based appeal synergizes with Musk's playful and often unconventional online persona. This symbiotic relationship fuels the hype surrounding the cryptocurrency.

- Media Amplification: News outlets constantly report on Musk's actions and their impact on Dogecoin, further amplifying the "Musk effect" and creating a self-perpetuating cycle of media attention and price volatility. This effect is seen also with other cryptocurrencies like Floki Inu.

- Broader Market Impact: Musk's influence extends beyond Dogecoin. His pronouncements on cryptocurrencies in general can significantly affect market sentiment and overall cryptocurrency prices. This highlights the influence of key individuals on market sentiment.

H2: Market Speculation and the Dogecoin Ecosystem

H3: Retail Investor Behavior

Individual investors, often driven by FOMO and social media trends, react strongly to Musk's actions, significantly contributing to Dogecoin's price volatility.

- FOMO Driven Trading: The rapid price swings following Musk's tweets clearly demonstrate the prevalence of FOMO among retail investors. The fear of missing out on potential gains leads to impulsive buying, further inflating the price.

- Trading Volume Analysis: [Insert chart/graph here showing trading volume spikes following Musk's pronouncements]. The data illustrates the direct correlation between Musk's actions and increased trading activity.

- Pump-and-Dump Concerns: The extreme volatility raises concerns about potential pump-and-dump schemes exploiting Musk's influence to manipulate the market. This is an important consideration when analyzing the Dogecoin price.

H3: The Role of News and Media

News outlets play a crucial role in amplifying the impact of Musk's actions on Dogecoin's price. Their coverage often frames the narrative, shaping public perception and investor sentiment.

- News Headlines and Price Movements: News articles directly mentioning Musk's involvement with Dogecoin often correlate with subsequent price changes, underscoring the media's powerful influence on investor behavior.

- Potential Media Bias: It's crucial to consider the potential for media bias in shaping the narrative around Musk's influence. Sensationalist headlines can exacerbate price volatility.

- News Cycles and Sentiment: The news cycle itself can significantly influence investor sentiment. Positive news coverage tends to boost the price, while negative coverage can lead to a downturn.

H2: Correlation vs. Causation: Separating Fact from Fiction

H3: Statistical Analysis

While anecdotal evidence strongly suggests a correlation between Musk's actions and Dogecoin's price, statistically proving causation is challenging.

- Limitations of Statistical Analysis: Numerous factors influence cryptocurrency prices, making it difficult to isolate Musk's influence completely through statistical analysis.

- Counterarguments and Alternative Explanations: Dogecoin's price fluctuations could also be attributed to broader market trends, regulatory changes, or technological developments, independent of Musk's actions.

- Further Research Needed: More rigorous statistical analysis is needed to definitively determine the extent of Musk's causal influence on Dogecoin's price.

H3: Other Factors Influencing Dogecoin Price

Focusing solely on Musk's influence overlooks other important factors shaping Dogecoin's price.

- Broader Market Trends: Overall cryptocurrency market trends and the performance of Bitcoin significantly impact Dogecoin's price.

- Regulatory Changes: Government regulations and policies concerning cryptocurrencies can also influence Dogecoin's value.

- Technological Developments: Advancements in Dogecoin's underlying technology or the adoption of new features can affect its price.

3. Conclusion: Decoding the Dogecoin-Musk Dynamic

The relationship between Dogecoin's price and Elon Musk's actions is undeniably complex. While a strong correlation exists, definitively proving causation requires further research. Musk's social media influence, coupled with market speculation and media amplification, contributes significantly to Dogecoin's volatility. However, other factors, including broader market trends and regulatory changes, also play crucial roles. To truly understand the Dogecoin price, a holistic approach is needed, considering all influencing variables. Continue your research into Dogecoin price analysis, Elon Musk's impact on Dogecoin, and develop a sound Dogecoin investment strategy based on a comprehensive understanding of the market.

Featured Posts

-

Zhizn I Tvorchestvo Innokentiya Smoktunovskogo Yubileyniy Dokumentalniy Film

May 25, 2025

Zhizn I Tvorchestvo Innokentiya Smoktunovskogo Yubileyniy Dokumentalniy Film

May 25, 2025 -

Ai Digest Transforming Repetitive Data Into Compelling Audio Content

May 25, 2025

Ai Digest Transforming Repetitive Data Into Compelling Audio Content

May 25, 2025 -

The Thames Water Executive Bonus Scandal What Went Wrong

May 25, 2025

The Thames Water Executive Bonus Scandal What Went Wrong

May 25, 2025 -

Europese Aandelen Vs Wall Street Vervolg Op De Snelle Marktdraai

May 25, 2025

Europese Aandelen Vs Wall Street Vervolg Op De Snelle Marktdraai

May 25, 2025 -

Jordan Bardella A Profile Of A Rising French Politician

May 25, 2025

Jordan Bardella A Profile Of A Rising French Politician

May 25, 2025

Latest Posts

-

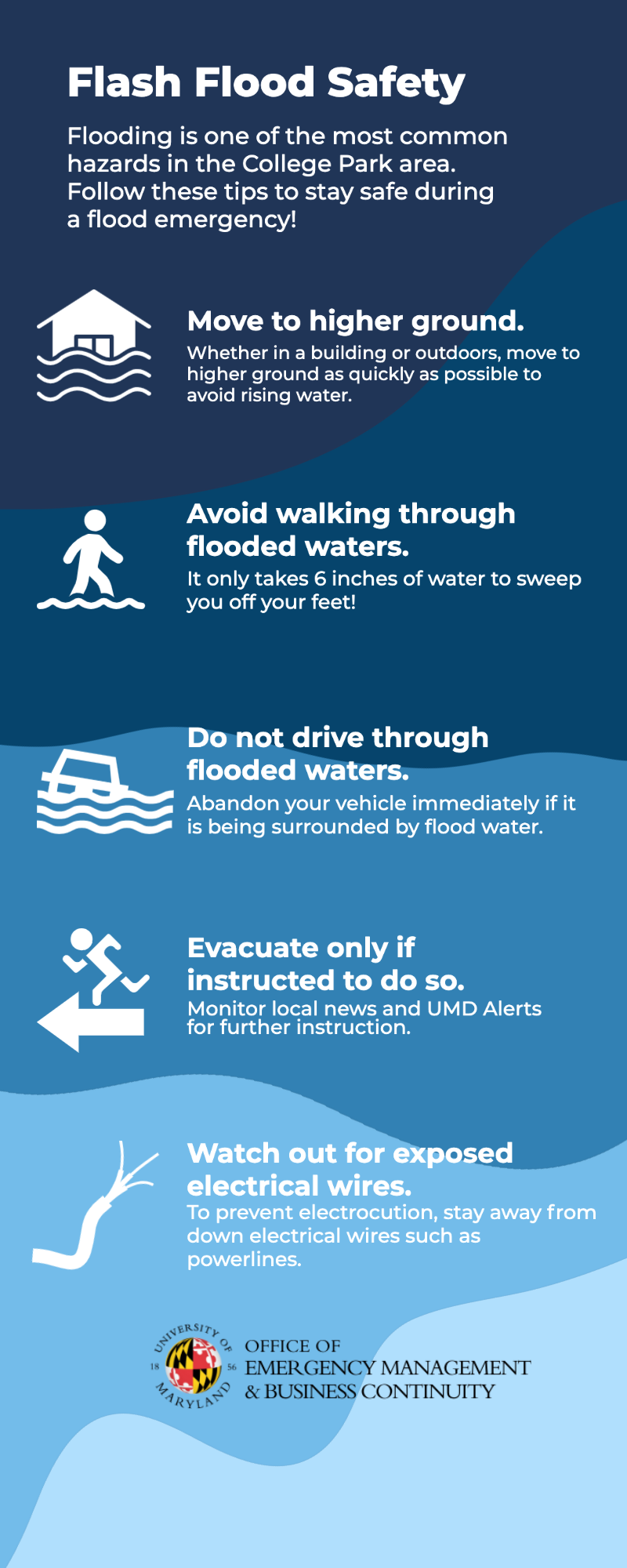

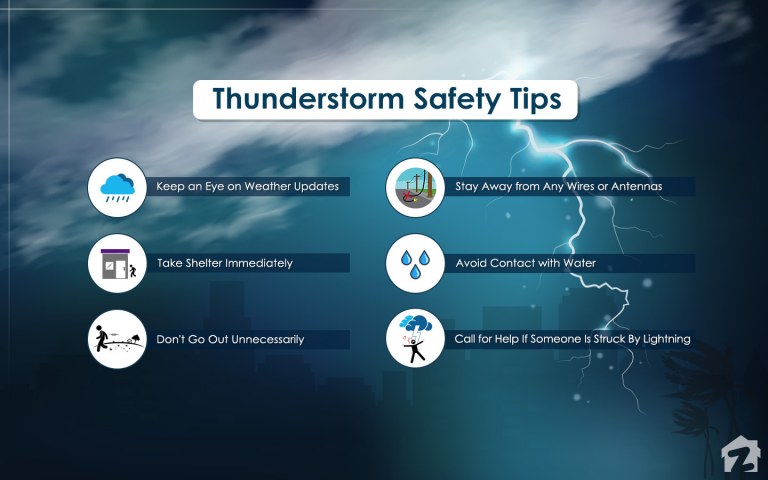

Surviving A Flash Flood Emergency Essential Safety Tips And Advice

May 25, 2025

Surviving A Flash Flood Emergency Essential Safety Tips And Advice

May 25, 2025 -

Nws Flood Warning Your Guide To Staying Safe This Morning

May 25, 2025

Nws Flood Warning Your Guide To Staying Safe This Morning

May 25, 2025 -

Flash Flood Emergency Preparedness Protecting Yourself And Your Family

May 25, 2025

Flash Flood Emergency Preparedness Protecting Yourself And Your Family

May 25, 2025 -

Flood Warning Stay Safe With Nws Safety Tips

May 25, 2025

Flood Warning Stay Safe With Nws Safety Tips

May 25, 2025 -

Understanding Flash Flood Emergencies A Comprehensive Guide

May 25, 2025

Understanding Flash Flood Emergencies A Comprehensive Guide

May 25, 2025