Donald Trump's Billionaire Buddies: Post-Tariff Losses Since Liberation Day

Table of Contents

Identifying Trump's Key Billionaire Allies

Several billionaires enjoyed close relationships with Donald Trump, and their businesses were potentially vulnerable to the effects of his tariff policies. Let's profile a few key figures:

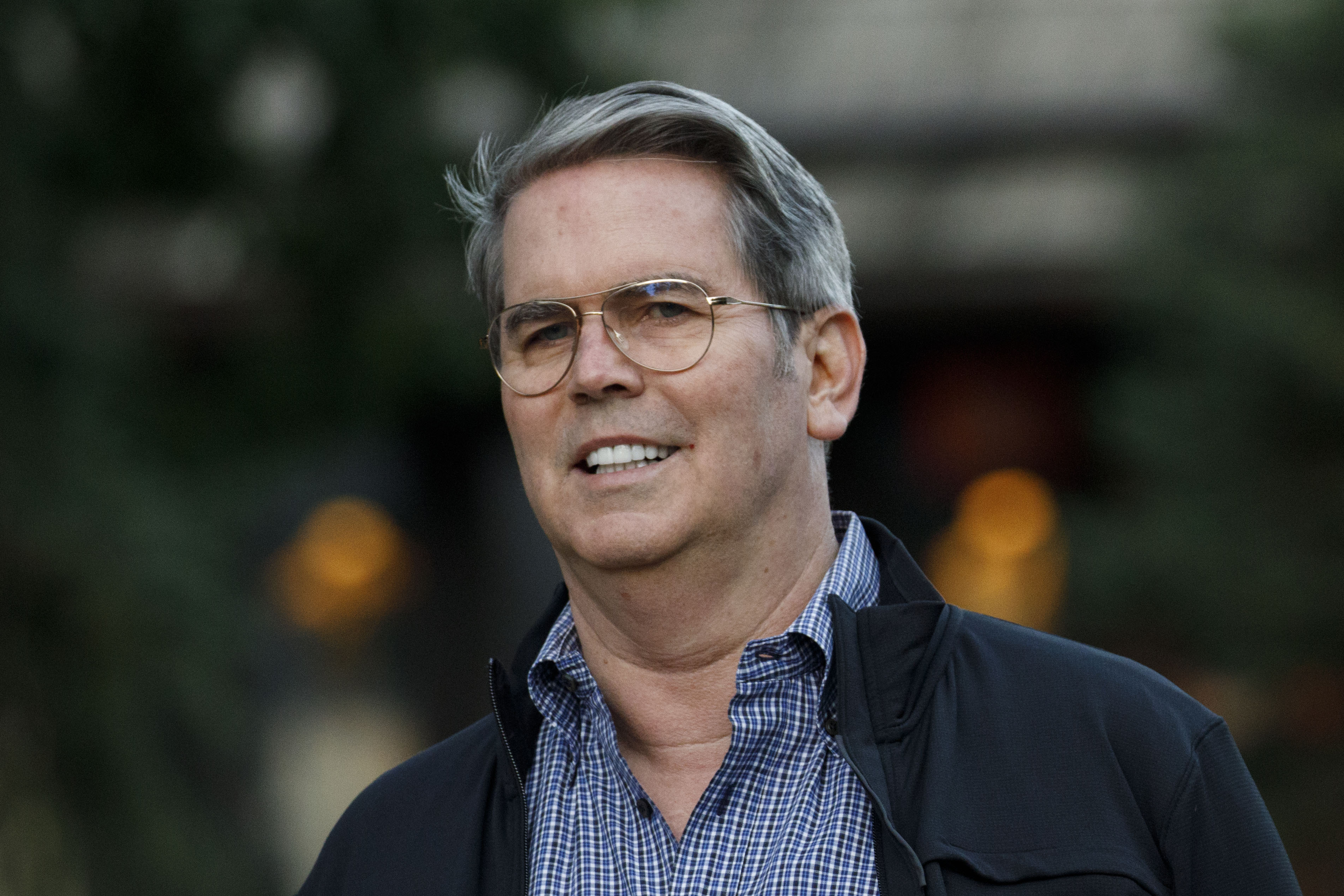

- Billionaire 1: Stephen Schwarzman, Blackstone Group: A prominent figure in the private equity world, Schwarzman has been a long-time supporter of Trump and has advised him on economic matters. Blackstone's vast global investments made it potentially susceptible to disruptions caused by tariffs. [Link to Schwarzman biography]

- Billionaire 2: Wilbur Ross, Investor: Ross, a former Commerce Secretary under Trump, is a well-known investor with holdings in various sectors. His deep involvement in the Trump administration gave him unique insights into tariff policies, but also exposed his investments to their potential consequences. [Link to Ross biography]

- Billionaire 3: Carl Icahn, Icahn Enterprises: A renowned corporate raider and activist investor, Icahn served as a special advisor to Trump. His diverse portfolio, encompassing various sectors, could have been affected by the broad scope of the tariff measures. [Link to Icahn biography]

- Billionaire 4: Robert Mercer, Renaissance Technologies: While less publicly known for his political connections than others on this list, Mercer's significant investments in various sectors would have been exposed to the ripples from the Trump administration’s trade policies. [Link to Mercer biography - note: information on Mercer may be limited due to his privacy]

These billionaires represent different sectors, including private equity, investment management, and broader financial interests. The impact of tariffs would have varied across these diverse holdings.

Tariff Impacts Across Different Sectors

Trump's administration implemented several significant tariffs, impacting various sectors of the US economy. Key examples include:

- Steel and Aluminum Tariffs: These tariffs, imposed in 2018, aimed to protect domestic steel and aluminum industries. However, they increased input costs for many businesses, potentially affecting companies in sectors like construction and manufacturing where these billionaires had significant investments.

- China Tariffs: The escalating trade war with China led to tariffs on a vast range of goods imported from China. This had a widespread impact on numerous industries, including retail, technology, and manufacturing, all areas where these billionaires held interests. This led to increased prices for consumers and uncertainty for businesses.

- Other Tariffs: Various other tariffs were imposed on goods from other countries, further adding complexity and potential risk to the investment portfolios of Trump’s billionaire allies.

The economic consequences of these tariffs included decreased profits, market share losses, and stock value fluctuations for many companies. For example, the increase in steel prices due to tariffs could have negatively impacted construction projects in which these billionaires had financial stakes. Detailed financial analysis from reputable sources is necessary to quantify the precise impact on each individual.

Post-Presidency Financial Performance

Analyzing the financial performance of these billionaires' businesses since the end of Trump's presidency requires a careful review of their holdings. This would involve:

- Stock price changes: Tracking the stock price changes of the major companies in which these billionaires held substantial stakes would be crucial to assessing the post-tariff impact.

- Comparative analysis: Comparing the performance of these companies to industry benchmarks would provide context and help isolate the effects of tariffs from broader economic trends.

- Financial reports: Examining the financial reports of these companies, looking for specific mentions of the impact of tariffs on revenues, profits, and operational costs would be necessary for a complete picture.

It's crucial to note that attributing any financial changes solely to tariff changes would be an oversimplification. The post-Trump economic environment, global market fluctuations, and company-specific factors would all have contributed to the observed results.

Alternative Explanations for Financial Changes

While tariffs played a role, other factors contributed to the financial performance of these billionaires' businesses since the end of the Trump presidency:

- Global economic slowdown: The global economy experienced various challenges after 2021, including supply chain disruptions and inflation. These factors independently influenced financial outcomes.

- Changes in consumer demand: Shifts in consumer preferences and spending habits, partially fueled by the pandemic and economic uncertainty, affected various sectors.

- Internal company decisions: Independent company restructuring, mergers and acquisitions, and internal management decisions would also have contributed to their financial performance.

Any complete analysis needs to consider these diverse influences, making it challenging to isolate the exact effect of tariffs.

Conclusion

Assessing the precise financial impact of Donald Trump's tariffs on his billionaire buddies requires a deep dive into individual company performance, considering numerous confounding factors. While the tariffs undoubtedly created economic uncertainty and potentially increased costs in various sectors, it is difficult to isolate their specific impact from the multitude of other influences on these billionaires' financial situations. Determining whether post-tariff losses were directly attributable to the policies implemented during Trump's presidency is a complex undertaking. Further research focusing on in-depth financial analysis for each of these individuals and their relevant business ventures is strongly recommended to gain a clearer understanding of the long-term consequences of Trump's trade policies. To continue exploring this complex topic, we encourage you to research the financial reports of the companies mentioned and search for further analyses on "Donald Trump's Billionaire Buddies" and the long-term effects of his economic policies.

Featured Posts

-

Solving The Nyt Strands Puzzle April 12 2025 Edition

May 10, 2025

Solving The Nyt Strands Puzzle April 12 2025 Edition

May 10, 2025 -

Palantir Stock Forecast Revised A Deep Dive Into The Market Rally

May 10, 2025

Palantir Stock Forecast Revised A Deep Dive Into The Market Rally

May 10, 2025 -

Declaration Du Ministre Francais De L Europe Sur Le Partage Du Bouclier Nucleaire

May 10, 2025

Declaration Du Ministre Francais De L Europe Sur Le Partage Du Bouclier Nucleaire

May 10, 2025 -

Dijon Accident Mortel Sur Chantier Un Jeune Ouvrier Perd La Vie

May 10, 2025

Dijon Accident Mortel Sur Chantier Un Jeune Ouvrier Perd La Vie

May 10, 2025 -

Us Debt Limit Could Expire In August Treasurys Bessent Sounds Alarm

May 10, 2025

Us Debt Limit Could Expire In August Treasurys Bessent Sounds Alarm

May 10, 2025