Dragon's Den: A Guide To Securing Investment

Table of Contents

Crafting a Compelling Pitch Deck

A winning pitch deck is your first impression – and often your only chance – to secure Dragon's Den investment. It needs to be concise, compelling, and tailored to your specific audience.

Understanding Your Audience

Before you even start writing, research the investors you're targeting. Understanding their investment criteria is paramount. Who are they? What kind of businesses have they funded in the past? What are their priorities?

- Analyze investor profiles on LinkedIn and company websites: Look for clues about their investment preferences, past successes, and areas of expertise. What industries do they favor? What stage of company development are they typically interested in?

- Identify common themes in their past investments: Are they drawn to specific technologies, business models, or market sectors? Understanding their investment history provides valuable insight into their preferences.

- Understand their investment focus (e.g., early-stage startups, specific industries): Don't waste time pitching a mature company to a venture capitalist focused solely on seed funding. Tailoring your pitch to their interests significantly increases your chances of success.

The Essential Elements of a Winning Pitch Deck

Your pitch deck should tell a clear, concise story. Here are the key elements:

- A concise and compelling problem statement: Clearly define the problem your business solves and its impact on the market.

- A clear and innovative solution: Explain how your business uniquely addresses the problem and why it's superior to existing solutions. Highlight your competitive advantage.

- A strong market analysis demonstrating market size and potential: Show investors the potential for growth and profitability. Provide data and evidence to support your claims.

- A detailed financial projection outlining key metrics (revenue, expenses, profitability): Investors need to see a clear path to profitability. Be realistic and transparent in your projections.

- A well-defined team with relevant experience and expertise: Investors invest in people as much as ideas. Highlight your team's skills and experience.

- A clear ask – specify the amount of funding needed and how it will be used: Be specific about how the investment will be used to achieve your business goals. Show them a clear return on investment (ROI).

Mastering the Art of the Pitch

A strong pitch deck is only half the battle. Delivering it effectively is crucial for securing Dragon's Den investment.

Storytelling for Impact

Engage your audience emotionally by telling a compelling story about your business. Don't just present data; connect with investors on a human level.

- Focus on the problem, your solution, and the impact it will have: Paint a picture of the problem and how your business solves it. Show them the potential for positive change.

- Practice your pitch until it flows naturally and confidently: Rehearse your pitch multiple times until you're comfortable and confident. Practice in front of a mirror or with colleagues.

- Use visuals to enhance your presentation and maintain engagement: Use high-quality images and charts to illustrate your points and keep the audience engaged.

Handling Investor Questions

Be prepared for tough questions. Anticipate potential challenges and prepare thoughtful, concise answers.

- Practice responding to challenging questions with confidence and composure: Don't be caught off guard. Practice your responses to common investor questions.

- Be prepared to defend your assumptions and projections: Have data and evidence to back up your claims. Show that you've done your homework.

- Don't be afraid to admit what you don't know, but show a willingness to learn: Honesty is key. It's better to admit a lack of knowledge than to bluff your way through a question.

Negotiating the Deal

Securing funding is just the first step. Negotiating the terms of the investment is equally crucial.

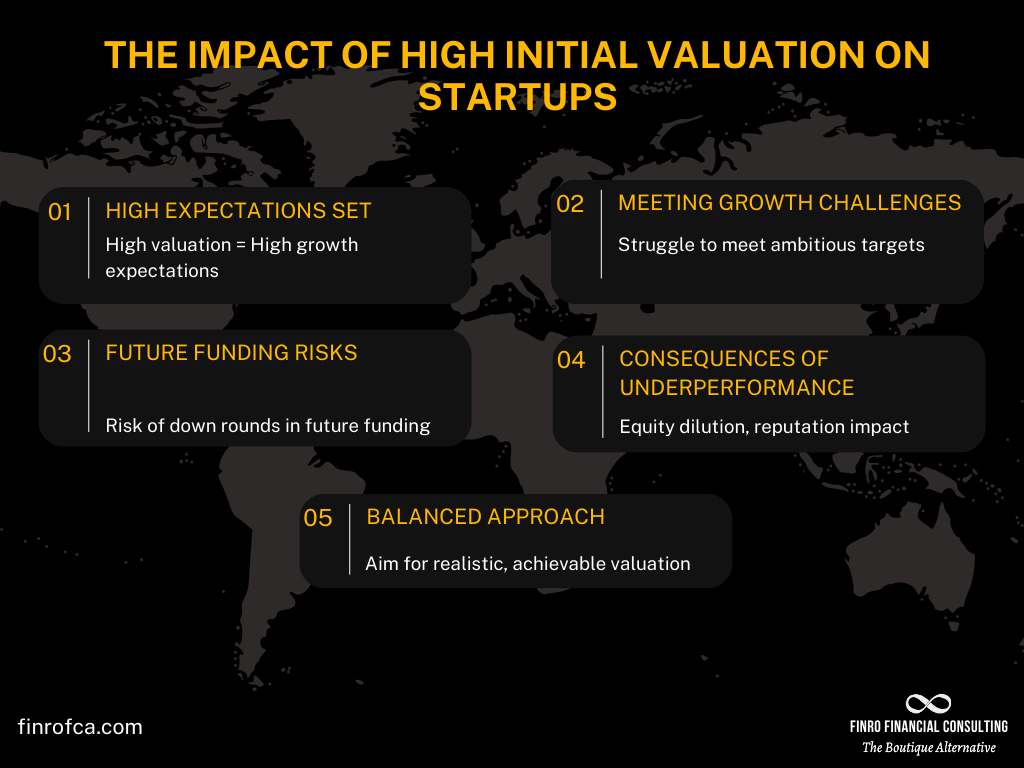

Understanding Investment Terms

Familiarize yourself with common investment terms, such as equity, valuation, and dilution. Understand what you're giving up in exchange for the investment.

- Seek professional advice from a lawyer or financial advisor: Negotiating investment terms can be complex. Seek expert guidance.

- Know your bottom line and be prepared to walk away if necessary: Don't compromise your vision or your company's long-term success.

Protecting Your Intellectual Property

Safeguard your company's valuable assets through airtight legal agreements.

- Consult with an intellectual property lawyer to understand the implications of your investment agreement: Protect your intellectual property rights.

- Ensure all agreements protect your interests and the value of your company: Thoroughly review all legal documents before signing.

Conclusion

Securing Dragon's Den investment or any significant funding is a challenging yet rewarding process. By mastering the art of the pitch, crafting a compelling pitch deck, and skillfully navigating negotiations, you significantly enhance your chances of success. Remember to thoroughly research your potential investors, understand your business inside and out, and always seek professional guidance. Don't let the prospect of securing Dragon's Den investment intimidate you – with thorough preparation and the right approach, you can turn your dream into a reality. Start working on your pitch today and unlock the potential of securing lucrative Dragon's Den investment!

Featured Posts

-

Becciu E Il Complotto Domani Pubblica Chat Compromettenti Accuse Ai Miei Danni

May 01, 2025

Becciu E Il Complotto Domani Pubblica Chat Compromettenti Accuse Ai Miei Danni

May 01, 2025 -

1 500 Flight Credit Incentive Selling Paul Gauguin Cruises With Ponant

May 01, 2025

1 500 Flight Credit Incentive Selling Paul Gauguin Cruises With Ponant

May 01, 2025 -

Caso Becciu Nuove Rivelazioni Dalle Chat Segrete Vaticane

May 01, 2025

Caso Becciu Nuove Rivelazioni Dalle Chat Segrete Vaticane

May 01, 2025 -

Six Nations Dalys Late Score Secures Englands Win Against France

May 01, 2025

Six Nations Dalys Late Score Secures Englands Win Against France

May 01, 2025 -

High Profile Office365 Hack Leads To Millions In Losses

May 01, 2025

High Profile Office365 Hack Leads To Millions In Losses

May 01, 2025

Latest Posts

-

Pinpointing Success A Geographic Analysis Of The Countrys New Business Hot Spots

May 02, 2025

Pinpointing Success A Geographic Analysis Of The Countrys New Business Hot Spots

May 02, 2025 -

Rust A Retrospective Review Following The On Set Accident

May 02, 2025

Rust A Retrospective Review Following The On Set Accident

May 02, 2025 -

Stock Market Valuation Concerns Bof As Response To Investor Anxiety

May 02, 2025

Stock Market Valuation Concerns Bof As Response To Investor Anxiety

May 02, 2025 -

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025 -

Us Vaccine Safety And The Current Measles Epidemic

May 02, 2025

Us Vaccine Safety And The Current Measles Epidemic

May 02, 2025