Dragon's Den Pitfalls: Avoiding Common Mistakes In Your Pitch

Table of Contents

Underestimating the Due Diligence

The Dragons aren't just impressed by a flashy presentation; they demand rigorous due diligence. Failing to demonstrate thorough research and robust financial planning is a major Dragon's Den pitfall.

Lack of Market Research

Thorough market analysis is paramount. You need to showcase a deep understanding of your target audience, the overall market size, your competition, and prevailing market trends. Without this, your pitch lacks credibility.

- Effective Market Research Methods: Conduct surveys, analyze competitor offerings, study industry reports, and utilize market research databases.

- Quantify Your Market Opportunity: Don't just say your market is "large." Provide specific numbers demonstrating the potential market size and your share of that market. This shows you understand the potential for growth and ROI.

- Demonstrate Deep Understanding: Your pitch should reveal a comprehensive grasp of the competitive landscape, including the strengths and weaknesses of your competitors and your unique selling proposition (USP) that differentiates you.

Insufficient Financial Projections

Realistic and well-supported financial projections are crucial. This includes detailed revenue models, a thorough cost analysis, and believable profitability forecasts. Vague estimations won't cut it with the Dragons.

- Create Believable Projections: Base your projections on sound assumptions, supported by data and market research. Explain your methodology clearly.

- Justify Your Assumptions: Don't just state numbers; explain the reasoning behind them. For example, if you project 20% growth, explain why you believe this is achievable.

- Demonstrate a Clear Path to Profitability: Show the Dragons how your business will become profitable and how they will see a return on their investment (ROI). This includes outlining key milestones and timelines.

Poorly Defined Value Proposition

A compelling value proposition is the cornerstone of any successful pitch. Failing to clearly articulate your unique selling points is a recipe for rejection.

Unclear Problem/Solution Fit

Clearly articulate the problem your product or service solves and how it uniquely addresses that problem. The Dragons need to understand the "why" behind your business.

- Strong Value Proposition Examples: "Our software automates tedious tasks, saving businesses X hours per week and increasing productivity by Y%."

- Weak Value Proposition Examples: "Our product is innovative and unique." (This lacks specificity and quantifiable results).

- Concise and Impactful Communication: Your value proposition should be clear, concise, and memorable. Practice delivering it succinctly.

Weak Presentation Skills

Even the best business idea can fail with a poor presentation. Effective communication is essential.

- Practice, Practice, Practice: Rehearse your pitch extensively, focusing on clarity, flow, and engagement.

- Handle Tough Questions: Anticipate tough questions from the Dragons and prepare thoughtful, concise answers.

- Confident Delivery & Body Language: Maintain eye contact, speak clearly and confidently, and use engaging body language. Visual aids can enhance your presentation.

Ignoring the Dragons' Expertise

The Dragons are experienced investors with diverse backgrounds. Failing to tailor your pitch to their individual interests is a significant mistake.

Failing to Tailor Your Pitch

Research each Dragon's investment history and interests. Tailor your pitch to resonate with their expertise and preferences.

- Identify Dragons' Areas of Expertise: Research their past investments and publicly available information to identify their areas of interest.

- Align Your Pitch: Highlight aspects of your business that align with their specific investment preferences. Show that you've done your homework.

- Show Examples: Incorporate examples of how your business aligns with their past successes and investment strategies.

Not Anticipating Questions

Anticipate potential questions and prepare comprehensive answers. Demonstrate foresight and a deep understanding of your business.

- Brainstorm Potential Questions: Consider what questions the Dragons might ask about your market, financials, team, or competition.

- Rehearse Responses: Practice answering these questions confidently and concisely.

- Show Understanding of Challenges and Risks: Addressing potential challenges head-on demonstrates your preparedness and reduces investor apprehension.

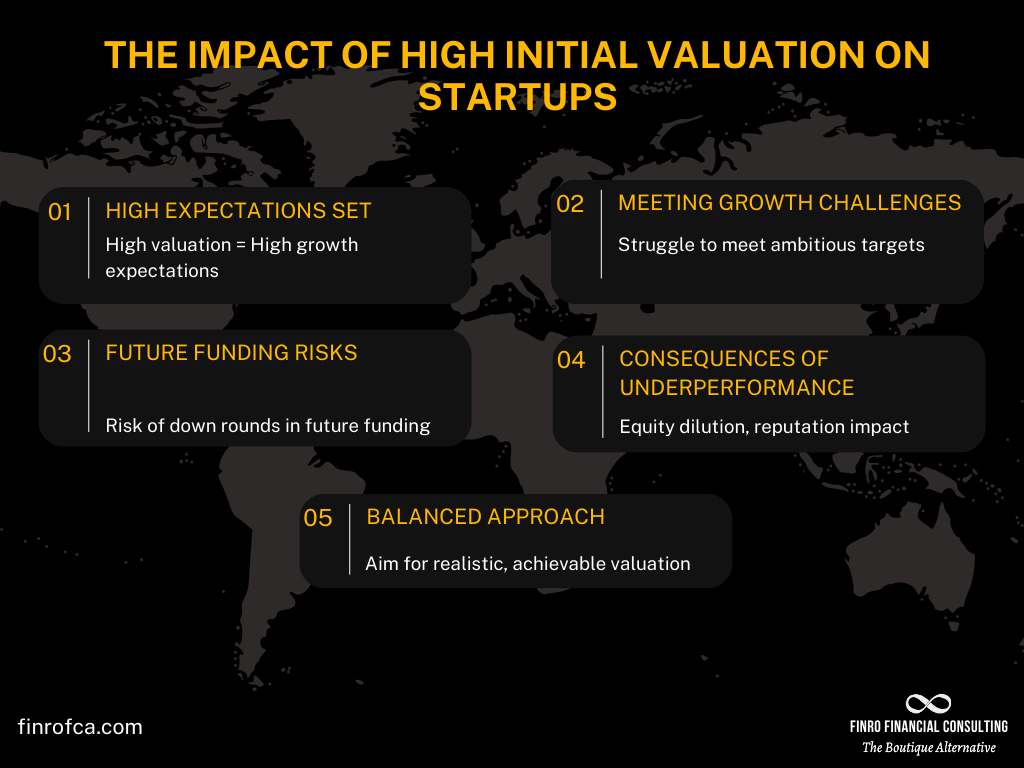

Overvaluing Your Company

An unrealistic valuation is a major red flag. The Dragons are shrewd negotiators who expect a reasonable return on investment.

Unrealistic Valuation

Base your valuation on sound market data and your financial projections. Justify your valuation and be open to negotiation.

- Valuation Methods: Research different valuation methods and choose the one that best fits your business model and stage of development.

- Justify Your Valuation: Clearly explain the rationale behind your valuation, using data and market comparables to support your claims.

- Be Open to Negotiation: Be prepared to negotiate your valuation and demonstrate flexibility.

Lack of Exit Strategy

Show the Dragons a clear path for them to recoup their investment. This demonstrates your long-term vision and reduces their risk.

- Potential Exit Strategies: Outline potential exit strategies, such as acquisition by a larger company, an initial public offering (IPO), or a strategic partnership.

- Present a Convincing Exit Strategy: Explain how each potential exit strategy could generate a significant return on investment for the Dragons.

Conclusion

Avoiding the common pitfalls of a Dragon's Den pitch requires thorough preparation, a clear understanding of your market, and a well-crafted presentation. By mastering your financial projections, refining your value proposition, and tailoring your approach to the specific investors, you significantly increase your chances of securing funding. Remember, a successful Dragon's Den pitch isn't just about luck; it’s about strategic planning and execution. So, refine your pitch, address the potential Dragon's Den pitfalls we've highlighted, and confidently step into the Den! Master your Dragon's Den pitch and secure the investment you deserve.

Featured Posts

-

Juridische Strijd Kampen Dagvaardt Enexis Voor Problemen Met Stroom

May 01, 2025

Juridische Strijd Kampen Dagvaardt Enexis Voor Problemen Met Stroom

May 01, 2025 -

Project Muse Cultivating Shared Reading Experiences

May 01, 2025

Project Muse Cultivating Shared Reading Experiences

May 01, 2025 -

Bet Mgm 150 Bonus Use Code Rotobg 150 For Nba Playoffs

May 01, 2025

Bet Mgm 150 Bonus Use Code Rotobg 150 For Nba Playoffs

May 01, 2025 -

Ripple Xrp Investment Weighing The Risks And Rewards For Potential Millionaires

May 01, 2025

Ripple Xrp Investment Weighing The Risks And Rewards For Potential Millionaires

May 01, 2025 -

Channel 4s Million Pound Giveaway Christopher Stevens Verdict

May 01, 2025

Channel 4s Million Pound Giveaway Christopher Stevens Verdict

May 01, 2025

Latest Posts

-

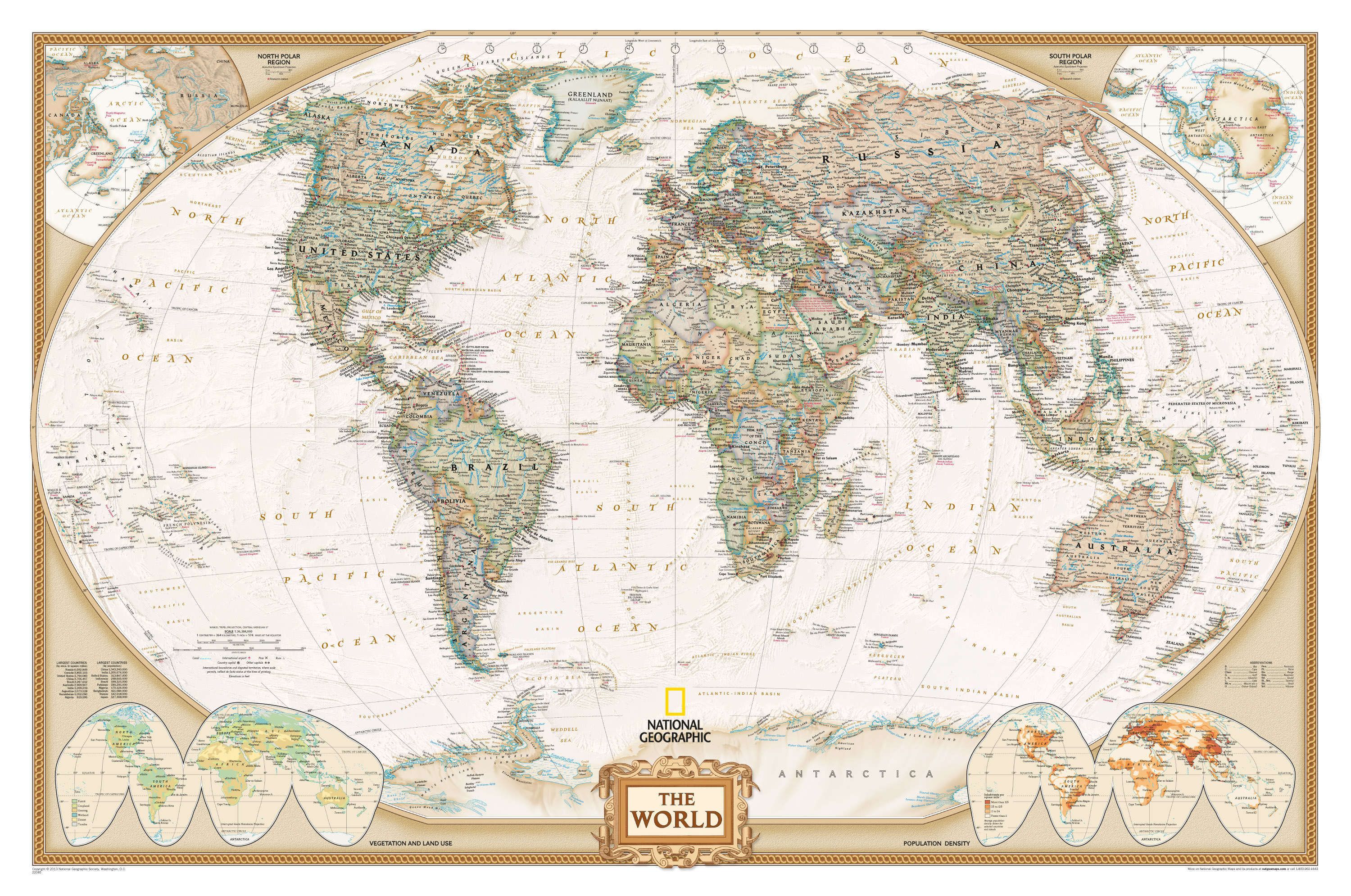

Pinpointing Success A Geographic Analysis Of The Countrys New Business Hot Spots

May 02, 2025

Pinpointing Success A Geographic Analysis Of The Countrys New Business Hot Spots

May 02, 2025 -

Rust A Retrospective Review Following The On Set Accident

May 02, 2025

Rust A Retrospective Review Following The On Set Accident

May 02, 2025 -

Stock Market Valuation Concerns Bof As Response To Investor Anxiety

May 02, 2025

Stock Market Valuation Concerns Bof As Response To Investor Anxiety

May 02, 2025 -

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025 -

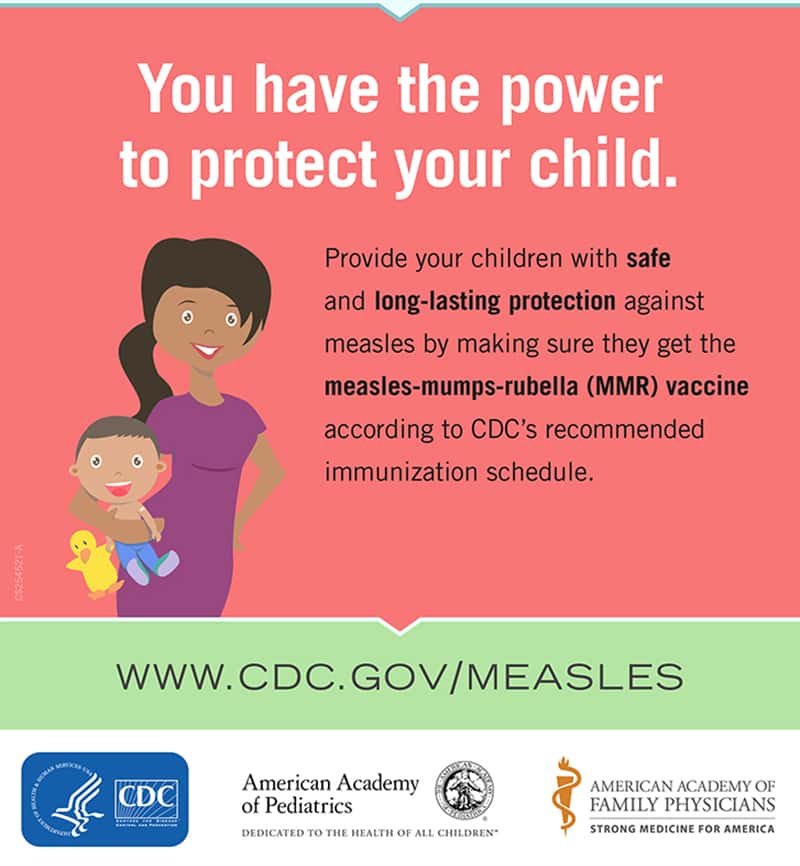

Us Vaccine Safety And The Current Measles Epidemic

May 02, 2025

Us Vaccine Safety And The Current Measles Epidemic

May 02, 2025