Dubai Holding Increases REIT IPO To $584 Million: Details Inside

Table of Contents

The Significance of the Increased IPO Size

The initial IPO size was already substantial, but the increase to $584 million speaks volumes about investor confidence and the projected success of the offering. This significant jump suggests several key factors:

- Stronger-than-expected investor interest: The increased size indicates a higher-than-anticipated demand from both domestic and international investors, reflecting confidence in Dubai's real estate market and the underlying assets of the REIT.

- Enhanced potential for higher returns: A larger pool of capital allows Dubai Holding to pursue more ambitious projects and potentially generate higher returns for investors, leading to a more attractive investment proposition.

- Attracting larger, institutional investors: The expanded IPO size is likely to attract significant investment from large institutional investors who often require larger investment vehicles to meet their portfolio diversification needs. This injection of capital further strengthens the REIT's position.

- A substantial boost for the Dubai real estate sector: The substantial capital infusion will further stimulate the already vibrant Dubai real estate sector, creating a positive ripple effect across related industries such as construction, hospitality, and retail. This increased activity contributes significantly to the UAE's overall economic growth.

Details of the REIT Offering

Dubai Holding's REIT offering is expected to include a diversified portfolio of high-quality commercial and potentially residential properties located in prime locations across Dubai. This strategic mix aims to provide investors with stable and consistent income streams. Key highlights anticipated include:

- Specific properties: While the exact list might not yet be publicly available, expect a mix of iconic buildings and high-yield assets.

- Projected rental income and occupancy rates: The REIT prospectus will detail projected rental income based on market analysis and current occupancy rates, showcasing the anticipated return on investment.

- Dividend distribution policy: A clear dividend distribution policy outlines how profits will be shared with investors, a crucial factor for income-seeking investors.

- Risk factors: A thorough assessment of potential risks will be included, providing transparency and allowing investors to make informed decisions, acknowledging potential market fluctuations and other inherent risks in real estate investments.

Market Reaction and Analyst Predictions

The announcement of the increased IPO size has been met with largely positive reactions from the market. Early trading suggests strong investor confidence.

- Stock market performance: A positive initial market response is expected, with a likely surge in the stock price immediately following the official listing.

- Analyst ratings and price targets: Financial analysts are likely to issue positive ratings and set price targets based on their assessment of the REIT's potential performance.

- Regional comparisons: Comparisons to other successful REIT IPOs in the region will be drawn, highlighting the potential for strong returns.

- Future performance predictions: Experts foresee positive long-term growth, driven by Dubai’s sustained economic expansion and attractive investment climate. However, external factors impacting the global economy should always be taken into account.

Dubai's Growing Real Estate Market and the REIT Boom

The Dubai Holding increased REIT IPO fits within the broader narrative of Dubai's booming real estate market, which is increasingly attractive to both local and international investors.

- Recent trends: Dubai's real estate market has witnessed consistent growth, driven by robust economic performance and government initiatives aimed at attracting foreign investment.

- Government policies: Government policies, such as visa reforms and infrastructure investments, have created a favorable environment for property investment, further fueling the market's growth.

- REIT diversification: REITs provide a unique opportunity for investors to diversify their portfolios by investing in a basket of high-quality real estate assets, reducing individual property risk.

- Global comparison: Dubai's real estate market and its REIT sector is increasingly considered a strong competitor to established markets worldwide.

Conclusion: Investing in the Future with the Dubai Holding REIT IPO

The Dubai Holding increased REIT IPO, now at $584 million, represents a significant milestone for both the company and the Dubai real estate market. The increased size reflects strong investor confidence and the potential for substantial returns. While investment inherently carries risk, this offering presents a compelling opportunity to participate in the continued growth of Dubai's dynamic real estate sector. Learn more about the exciting investment opportunities presented by the Dubai Holding's increased REIT IPO and explore how you can participate in the growth of Dubai's dynamic real estate market. Don't miss out on this chance to benefit from the Dubai Holding REIT IPO.

Featured Posts

-

Juergen Klopps Return To Liverpool Before Season Finale

May 21, 2025

Juergen Klopps Return To Liverpool Before Season Finale

May 21, 2025 -

Dexters Resurrection The Return Of Two Iconic Villains

May 21, 2025

Dexters Resurrection The Return Of Two Iconic Villains

May 21, 2025 -

Hulus The Amazing World Of Gumball Premiere Teaser Trailer Released

May 21, 2025

Hulus The Amazing World Of Gumball Premiere Teaser Trailer Released

May 21, 2025 -

Us Navys Four Star Admiral Found Guilty Corruption Scandal Explained

May 21, 2025

Us Navys Four Star Admiral Found Guilty Corruption Scandal Explained

May 21, 2025 -

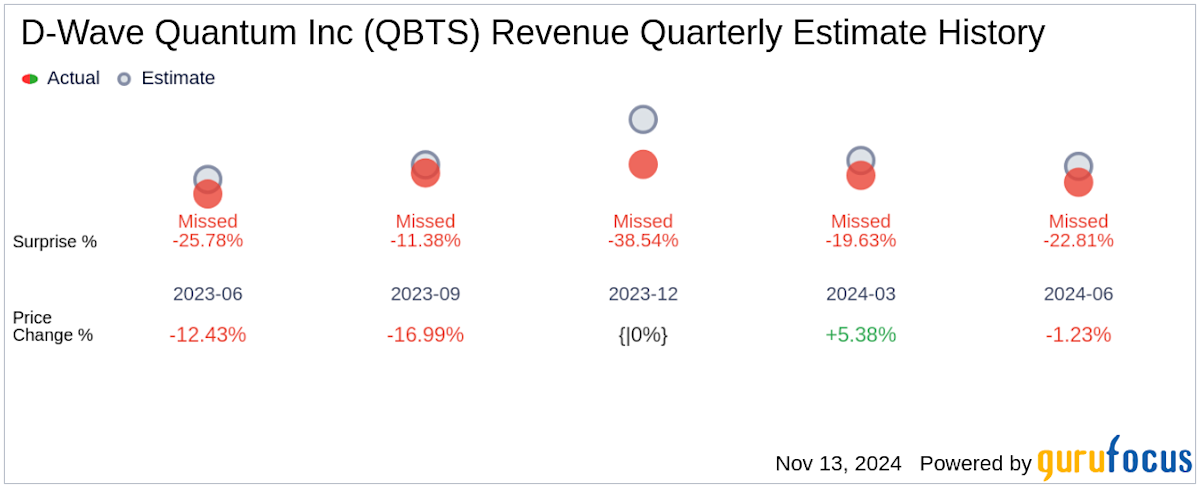

D Wave Quantum Qbts Stock Performance A Look At Mondays Activity

May 21, 2025

D Wave Quantum Qbts Stock Performance A Look At Mondays Activity

May 21, 2025

Latest Posts

-

Germanys Nations League Squad Goretzka Included By Nagelsmann

May 21, 2025

Germanys Nations League Squad Goretzka Included By Nagelsmann

May 21, 2025 -

Goretzka In Nagelsmanns Nations League Squad

May 21, 2025

Goretzka In Nagelsmanns Nations League Squad

May 21, 2025 -

Germany Nations League Squad Goretzka Included By Nagelsmann

May 21, 2025

Germany Nations League Squad Goretzka Included By Nagelsmann

May 21, 2025 -

Goretzka Returns Nagelsmann Names Him In Germanys Nations League Squad

May 21, 2025

Goretzka Returns Nagelsmann Names Him In Germanys Nations League Squad

May 21, 2025 -

Germany Italy Quarterfinal A Preview

May 21, 2025

Germany Italy Quarterfinal A Preview

May 21, 2025