Dubai Holding's REIT IPO: A $584 Million Offering

Table of Contents

Understanding Dubai Holding's REIT IPO

What is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate. Investing in a REIT allows individuals to participate in the real estate market without directly owning properties. REITs offer several key advantages:

- Passive Income: REITs typically distribute a significant portion of their income as dividends, providing investors with a regular stream of passive income. This makes them an attractive option for those seeking a stable investment with consistent returns.

- Diversification Strategy: Investing in a REIT diversifies your portfolio, reducing your overall risk. Instead of concentrating your investment in a single property, you gain exposure to a diversified portfolio of real estate assets.

- Professional Management: REITs are managed by experienced professionals who handle all aspects of property ownership, from acquisition and management to maintenance and tenant relations. This simplifies property investment significantly.

- Liquidity: REIT shares are traded on stock exchanges, offering investors greater liquidity compared to directly owning properties. This means you can easily buy and sell your shares when needed. This is a key component of a successful real estate investment.

REITs are a popular vehicle for real estate investment, offering a blend of passive income and diversification benefits.

Key Details of the Offering

Dubai Holding's $584 million REIT IPO offers a substantial opportunity to participate in Dubai's burgeoning real estate market. Key details of the offering include:

- Size of the offering: $584 million

- Type of properties included: The REIT portfolio will likely include a diverse range of high-quality income-generating properties across Dubai, potentially encompassing residential, commercial, and retail spaces. Specific details regarding the exact portfolio composition will be released closer to the listing date.

- IPO Price: The price per share will be announced closer to the listing date.

- Listing Date: The expected listing date on a major stock exchange will be officially communicated.

- Targeted use of funds: Proceeds from the IPO will likely be used to fund new development projects, reduce existing debt, and further enhance the REIT’s portfolio.

- Expected Dividend Yield: While the precise dividend yield is to be confirmed, investors can anticipate a competitive return based on the projected performance of the underlying assets.

Potential risks associated with the investment: As with any investment, there are inherent risks. These could include fluctuations in the Dubai real estate market, changes in interest rates, and overall economic conditions. Thorough due diligence is crucial before investing.

Investment Highlights and Potential Returns

Attractive Features for Investors

Investing in Dubai Holding's REIT presents several attractive features for investors:

- High Potential Returns: Dubai's robust economic growth and thriving real estate market suggest significant potential for capital appreciation and high yield.

- Stable Income Streams: The REIT's diversified portfolio of income-generating properties is expected to provide a steady stream of dividend income. This makes it an attractive option for income-oriented investors.

- Diversification Opportunities: Investing in this REIT provides diversification within the Dubai real estate sector, mitigating risk.

- Exposure to a Prime Market: Dubai’s reputation as a global hub for business and tourism creates a strong foundation for sustained real estate growth.

Market Analysis and Growth Prospects

Dubai's real estate market continues to demonstrate strong growth potential, driven by several key factors:

- Expo 2020 Legacy: The lasting impact of Expo 2020 continues to stimulate economic activity and attract foreign investment, driving up demand for real estate.

- Tourism Boom: Dubai's thriving tourism sector fuels the demand for hospitality and residential properties.

- Infrastructure Development: Ongoing infrastructure projects enhance connectivity and further contribute to the appeal of Dubai as an investment destination.

- Government Initiatives: Supportive government policies and initiatives aimed at promoting real estate development and investment.

These factors paint a positive picture of the long-term growth prospects for the Dubai real estate market and the REIT within it.

- Projected growth of the Dubai real estate market: Analysts predict continued growth, though specific figures vary. It’s wise to consult multiple independent market reports before making investment decisions.

- Competitive advantages of Dubai Holding's REIT: The scale and diversity of Dubai Holding's portfolio, along with its established reputation, offer significant competitive advantages.

- Comparison to other REITs in the region: Comparing this REIT's projected performance to other regional REITs will inform investment choices.

- Potential risks and mitigation strategies: Identifying and mitigating potential risks, such as market volatility, is crucial for successful investment.

How to Participate in the Dubai Holding REIT IPO

Eligibility and Application Process

To participate in the Dubai Holding REIT IPO, interested investors must meet certain eligibility criteria, which will be specified in the official IPO prospectus. The application process will likely involve submitting an application form through a designated broker or financial institution.

Brokerage Services and Support

Navigating the IPO process is often simplified with the help of experienced brokers and financial advisors. They provide expert guidance on investment strategies, eligibility requirements, and the application procedure.

- Step-by-step guide to applying for shares: Detailed instructions will be available in the IPO prospectus and through participating brokers.

- Important deadlines and dates: Be sure to note all key dates, including the opening and closing of the subscription period.

- Contact information for further inquiries: Contact information for inquiries will be provided in the official IPO documentation.

Conclusion

Dubai Holding's $584 million REIT IPO presents a significant investment opportunity for those looking to gain exposure to Dubai's dynamic real estate market. The potential for high returns, coupled with the benefits of REIT investment, makes this IPO an attractive proposition. The expected stable income streams and the potential for capital appreciation align with diverse investment strategies. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

Don't miss this investment opportunity! Learn more about the Dubai Holding REIT IPO today and explore how you can secure your shares. (Insert link to relevant resources if available). Invest in Dubai Holding’s REIT and participate in the future of Dubai's real estate growth.

Featured Posts

-

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025 -

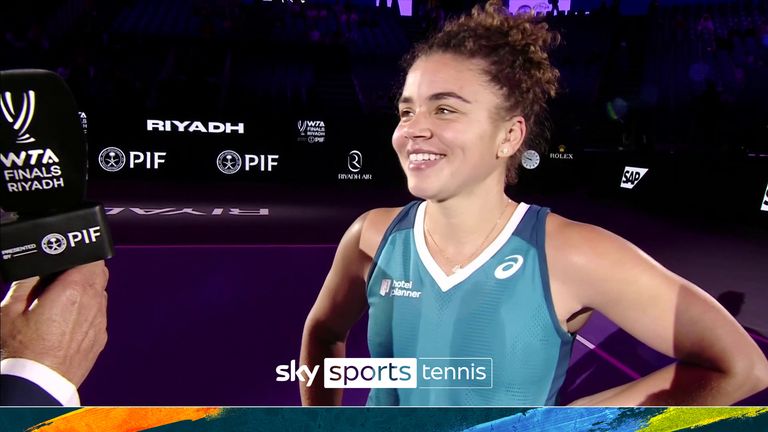

Jasmine Paolini A Winning Streak And A Place In Tennis History

May 20, 2025

Jasmine Paolini A Winning Streak And A Place In Tennis History

May 20, 2025 -

The Rise Of Otc Birth Control A New Era In Reproductive Rights Post Roe

May 20, 2025

The Rise Of Otc Birth Control A New Era In Reproductive Rights Post Roe

May 20, 2025 -

Mick Schumachers F1 Prospects Haekkinen Offers Hope

May 20, 2025

Mick Schumachers F1 Prospects Haekkinen Offers Hope

May 20, 2025 -

Rusenje Daytonskog Sporazuma Ko Gubi A Ko Dobija

May 20, 2025

Rusenje Daytonskog Sporazuma Ko Gubi A Ko Dobija

May 20, 2025

Latest Posts

-

The Gretzky Trump Connection A Question Of Loyalty And Lasting Image

May 20, 2025

The Gretzky Trump Connection A Question Of Loyalty And Lasting Image

May 20, 2025 -

Mondays Market Crash Analyzing D Wave Quantum Inc S Qbts Sharp Fall

May 20, 2025

Mondays Market Crash Analyzing D Wave Quantum Inc S Qbts Sharp Fall

May 20, 2025 -

Did Gretzkys Association With Trump Tarnish His Untouchable Legacy

May 20, 2025

Did Gretzkys Association With Trump Tarnish His Untouchable Legacy

May 20, 2025 -

D Wave Quantum Qbts Stock Drop Reasons Behind Mondays Decline

May 20, 2025

D Wave Quantum Qbts Stock Drop Reasons Behind Mondays Decline

May 20, 2025 -

Gretzkys Loyalty Examining The Impact Of Trump Ties On His Legacy

May 20, 2025

Gretzkys Loyalty Examining The Impact Of Trump Ties On His Legacy

May 20, 2025