Dutch Stock Market Slumps: Trade War With US Intensifies

Table of Contents

Impact of US Tariffs on Dutch Exports

Increased US tariffs on Dutch goods directly affect the export revenue and profitability of Dutch companies. These tariffs, imposed as part of the escalating trade war, represent a significant challenge to the Netherlands' export-oriented economy. The impact is multifaceted:

- Decreased demand for Dutch exports in the US market. Higher prices due to tariffs make Dutch products less competitive, leading to reduced sales volumes.

- Reduced profit margins for Dutch exporters. Companies are forced to absorb some of the tariff increase to maintain market share, squeezing their profitability. Alternatively, they may pass on the increased costs to consumers, potentially further reducing demand.

- Potential job losses in affected sectors. Reduced demand and profitability can lead to production cuts and layoffs, particularly in industries heavily reliant on US exports.

- Examples of specific industries impacted: The agricultural sector, notably dairy farmers and flower exporters, are significantly affected. The technology sector also faces challenges, with Dutch tech companies exporting to the US experiencing decreased sales.

While precise data on the immediate impact of specific tariffs on Dutch companies requires ongoing analysis, reports from organizations like the Netherlands Bureau for Economic Policy Analysis (CPB) and the Dutch Central Bank (De Nederlandsche Bank) should be consulted for up-to-date information. These sources often provide detailed breakdowns of the impact of trade wars on specific sectors of the Dutch economy.

Uncertainty and Investor Sentiment

The escalating trade war creates significant uncertainty, leading to decreased investor confidence and a wave of selling in the Dutch stock market. This uncertainty directly contributes to the observed Dutch stock market slumps.

- Reduced foreign direct investment (FDI) in the Netherlands. Investors are hesitant to commit capital to a market perceived as increasingly risky due to the trade war's unpredictable nature.

- Volatility in the Euro against the US dollar. Currency fluctuations add further complexity for businesses involved in international trade, increasing uncertainty and impacting profitability.

- Increased risk aversion among investors. Investors are shifting towards safer assets, leading to capital flight from the Dutch stock market.

- Impact on consumer confidence and spending. Uncertainty about the future economic outlook can lead to reduced consumer spending, further dampening economic growth and impacting company performance.

Examples of investor reaction include a shift towards less risky investments like government bonds and a decrease in investment in Dutch equities. Major investment banks are revising their growth forecasts for the Netherlands downward, reflecting this cautious sentiment.

The Role of the European Union in Mitigating the Impact

The EU's response to the trade war is crucial in mitigating the negative impact on the Netherlands. However, the effectiveness of these measures is still being evaluated.

- EU-wide trade strategies to counter US tariffs. The EU is exploring various strategies, including retaliatory tariffs and seeking multilateral solutions through the WTO.

- Support measures for affected Dutch businesses. The EU may offer financial assistance and other support programs to help affected businesses adapt to the new challenges.

- Potential for increased trade with other EU members. The EU could encourage increased trade among its member states to offset the reduction in US trade.

- Limitations of EU intervention. The EU's ability to fully counter the impact of US tariffs is limited, as the US remains a major trading partner for the Netherlands.

The long-term effectiveness of the EU's response depends on the broader geopolitical landscape and the evolution of the trade dispute. Continued monitoring of EU initiatives and their impact on the Dutch economy is essential.

Specific Sectors Most Affected

Several sectors within the Dutch economy are experiencing particularly significant impacts from the trade war:

- Agriculture: The dairy and flower industries, major exporters to the US, face considerable challenges due to increased tariffs.

- Manufacturing: Specific manufacturing sectors, particularly those reliant on US markets for components or finished goods, face production disruptions and potential job losses.

- Technology: Dutch technology companies exporting to the US are seeing reduced sales and profitability due to increased tariffs.

- Financial services: Dutch banks and financial institutions are impacted indirectly through reduced economic activity and increased market uncertainty.

Understanding the specific vulnerabilities of each sector is vital in formulating effective mitigation strategies at both the national and EU levels.

Conclusion

The intensifying trade war between the US and other nations is significantly impacting the Dutch stock market, creating uncertainty and negatively affecting several key sectors. These Dutch stock market slumps underscore the interconnectedness of global economies and highlight the vulnerability of even relatively stable markets to large-scale geopolitical events. The EU's response is crucial in mitigating the consequences, but the long-term effects remain to be seen. Careful analysis of the evolving situation and the related Dutch stock market slumps is vital.

Call to Action: Stay informed about the developments in the Dutch Stock Market Slumps and the ongoing trade war to make informed investment decisions and navigate this period of market volatility effectively. Regularly monitor news and expert analyses concerning the Dutch stock market and its relationship with the US trade war to better understand potential future impacts. Consider diversifying your investment portfolio to mitigate risks associated with this ongoing global economic uncertainty.

Featured Posts

-

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc A Detailed Explanation

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc A Detailed Explanation

May 24, 2025 -

Keiki Memorial Day Art Contest Celebrating Hawaiis Artistic Talent Through Lei Making

May 24, 2025

Keiki Memorial Day Art Contest Celebrating Hawaiis Artistic Talent Through Lei Making

May 24, 2025 -

Porsches Presence At Indonesia Classic Art Week 2025

May 24, 2025

Porsches Presence At Indonesia Classic Art Week 2025

May 24, 2025 -

Avrupa Borsalari Kapanis Karisik Bir Performans

May 24, 2025

Avrupa Borsalari Kapanis Karisik Bir Performans

May 24, 2025

Latest Posts

-

The Countrys Hottest New Business Locations A Geographic Overview

May 24, 2025

The Countrys Hottest New Business Locations A Geographic Overview

May 24, 2025 -

Malaysias Najib Razak Implicated In French Submarine Bribery Case

May 24, 2025

Malaysias Najib Razak Implicated In French Submarine Bribery Case

May 24, 2025 -

Traders Pare Bets On Boe Cuts Pound Rises After Uk Inflation Data

May 24, 2025

Traders Pare Bets On Boe Cuts Pound Rises After Uk Inflation Data

May 24, 2025 -

Sse Cuts Spending 3 Billion Reduction Amidst Economic Slowdown

May 24, 2025

Sse Cuts Spending 3 Billion Reduction Amidst Economic Slowdown

May 24, 2025 -

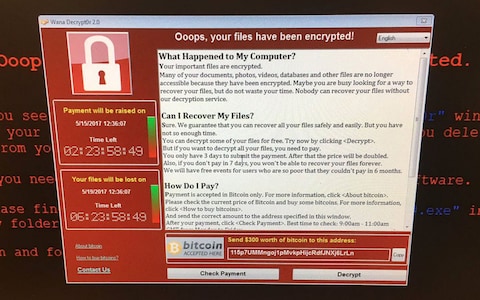

Marks And Spencer Cyber Attack 300 Million Loss Announced

May 24, 2025

Marks And Spencer Cyber Attack 300 Million Loss Announced

May 24, 2025