Net Asset Value (NAV) Of Amundi MSCI World Catholic Principles UCITS ETF Acc: A Detailed Explanation

Table of Contents

How NAV is Calculated for the Amundi MSCI World Catholic Principles UCITS ETF Acc

Understanding the NAV calculation is key to interpreting your investment's performance. The NAV represents the net asset value of a single unit of the ETF. Let's break down the components:

The Components of NAV Calculation:

The Amundi MSCI World Catholic Principles UCITS ETF Acc invests in a globally diversified portfolio of equities, aligning with Catholic ethical principles. The NAV calculation considers:

- Asset Valuation: The market value of each equity held within the ETF is determined at the end of each trading day, using closing prices from major stock exchanges worldwide. This asset valuation is a critical component of the NAV.

- Accrued Income: Any dividends or interest earned by the underlying assets are added to the total asset value before calculating the NAV. This accrued income contributes positively to the overall NAV.

- Expenses and Liabilities: The ETF's expenses, including management fees and other operational costs, are deducted from the total asset value to arrive at the net asset value. Understanding the expense ratio is crucial to interpreting the NAV accurately. Liabilities, if any, are also subtracted.

The Frequency of NAV Calculation:

- Daily Calculation: The NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc is typically calculated daily, reflecting the closing market values of its underlying assets.

- Publication Time: The calculated NAV is usually published at the end of the trading day, allowing investors to assess their daily performance.

- Market Closures: Exceptions can occur during market closures or periods of significant market disruption, where the NAV calculation might be delayed. Understanding this potential for variations is important.

Accessing the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV:

Investors can readily access the daily NAV data for the Amundi MSCI World Catholic Principles UCITS ETF Acc through several channels:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV information. Look for dedicated ETF pages containing daily data.

- Financial News Sources: Many reputable financial news websites and platforms provide real-time and historical NAV data for various ETFs, including this one.

- Brokerage Platforms: Your brokerage account will likely display the current NAV along with other relevant information about your holdings. Checking your brokerage platform's daily data is convenient.

Remember to always check the NAV before executing buy or sell orders to ensure you are acting on the most current information.

Factors Influencing the NAV of Amundi MSCI World Catholic Principles UCITS ETF Acc

Several factors impact the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc, creating fluctuations in the unit price.

Market Fluctuations:

The NAV is highly sensitive to market volatility. Positive or negative changes in the global stock market directly affect the value of the underlying assets and consequently, the NAV. Major economic events, geopolitical instability, and specific company news all contribute to these market fluctuations. Monitoring key economic indicators can help anticipate potential NAV changes.

Currency Exchange Rates:

As the ETF invests globally, currency exchange rate fluctuations can significantly influence the NAV. Changes in the value of different currencies against the Euro (assuming the ETF is denominated in Euros) can affect the translated value of assets held in other currencies. This currency risk is inherent in globally diversified investments.

ETF Expenses and Management Fees:

The management fees and other operating expenses of the ETF are deducted from the total asset value, impacting the NAV over time. The expense ratio, which is usually expressed as a percentage of the assets under management, reveals the ongoing costs associated with the ETF. A lower expense ratio results in a higher NAV, all else being equal.

Dividend Distributions:

Dividend payouts from the underlying companies will affect the NAV. On the ex-dividend date – the day before the dividend is paid – the NAV will typically reflect a decrease, as the ETF no longer holds the dividend amount.

Conclusion: Utilizing NAV Information for Informed Investment Decisions with the Amundi MSCI World Catholic Principles UCITS ETF Acc

Understanding the Net Asset Value (NAV) is essential for making informed investment decisions regarding the Amundi MSCI World Catholic Principles UCITS ETF Acc. Regular monitoring of the daily NAV, alongside other market analyses, provides valuable insights into the ETF’s performance. While daily NAV changes are important, remember they are only one aspect of a comprehensive investment strategy. Consult with a financial advisor before making investment decisions. Remember to regularly check the Net Asset Value (NAV) of the Amundi MSCI World Catholic Principles UCITS ETF Acc to stay informed about your investment and to use this crucial daily NAV information as a basis for your investment choices.

Featured Posts

-

Avrupa Borsalari Karisik Bir Guen Gecirdi Guenuen Oenemli Gelismeleri

May 24, 2025

Avrupa Borsalari Karisik Bir Guen Gecirdi Guenuen Oenemli Gelismeleri

May 24, 2025 -

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025 -

Escape To The Country How Nicki Chapman Made 700 000 On A Property Investment

May 24, 2025

Escape To The Country How Nicki Chapman Made 700 000 On A Property Investment

May 24, 2025 -

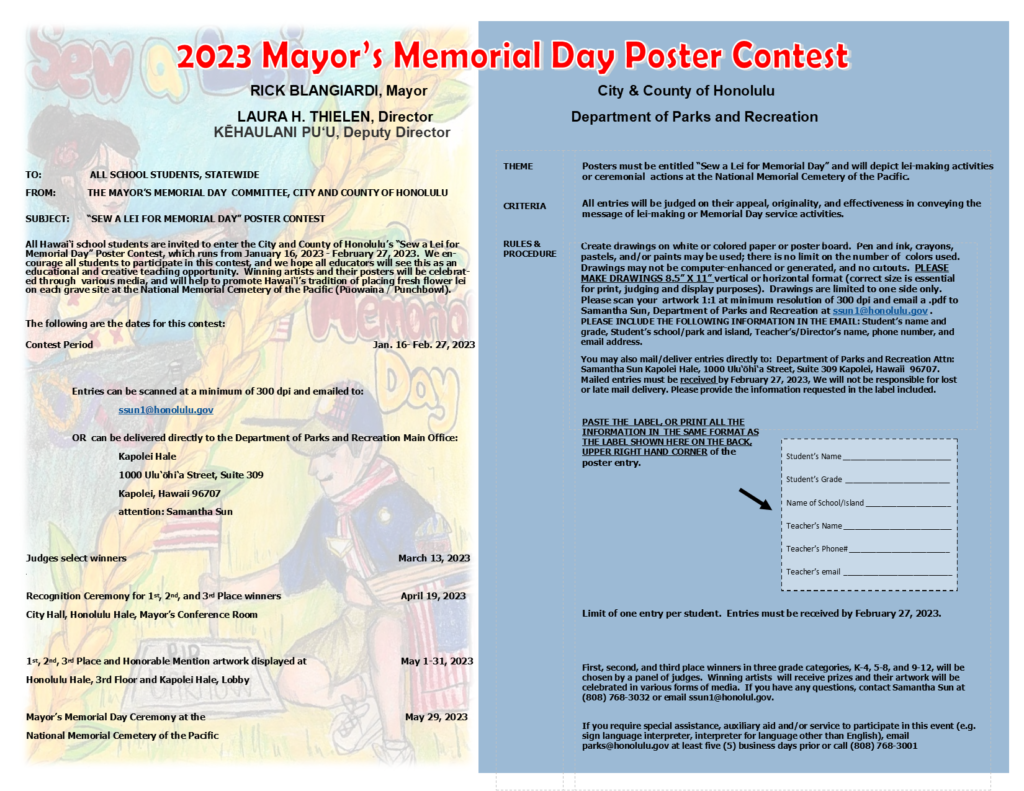

Hawaii Keiki Showcase Artistic Talents Sew A Lei For Memorial Day Poster Contest

May 24, 2025

Hawaii Keiki Showcase Artistic Talents Sew A Lei For Memorial Day Poster Contest

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav Updates And Analysis

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav Updates And Analysis

May 24, 2025

Latest Posts

-

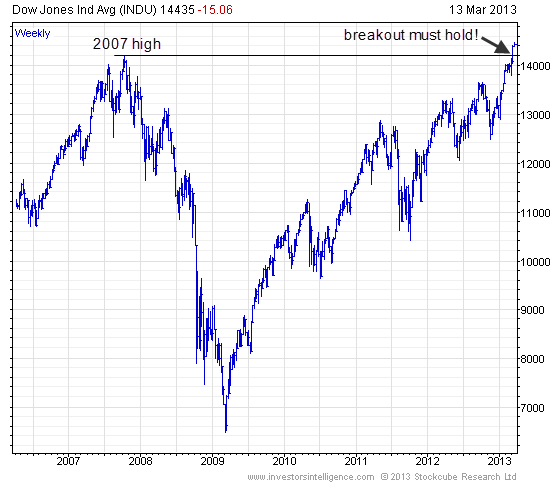

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025 -

She Still Waiting By The Phone A Study In Patience And Perseverance

May 24, 2025

She Still Waiting By The Phone A Study In Patience And Perseverance

May 24, 2025 -

The Phone Rings A Look At She Still Waiting By The Phone

May 24, 2025

The Phone Rings A Look At She Still Waiting By The Phone

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025