Earnings Drive BSE Share Price Rally In Indian Bourse

Table of Contents

Strong Q2 Earnings Fuel Market Optimism

The second quarter of the financial year has witnessed a stellar performance from numerous listed companies on the BSE. This impressive showing of Q2 earnings has fueled market optimism and significantly contributed to the ongoing share price rally. Several key sectors have demonstrated exceptional growth, exceeding expectations and boosting investor confidence.

-

Key Sectors Showing Strong Growth: The Information Technology (IT), Pharmaceuticals (Pharma), and Fast-Moving Consumer Goods (FMCG) sectors have been particularly impressive. Strong global demand for IT services, coupled with a robust domestic market for pharmaceuticals and FMCG products, has propelled these sectors to outperform expectations.

-

Specific Examples of Exceptional Performances:

- Company X: Exceeded earnings expectations by 15%, leading to a 10% share price increase. Their innovative product launch and strategic partnerships were key drivers of this success.

- Company Y: Reported a 20% surge in revenue growth and a significant improvement in profitability, boosting investor confidence and driving a 7% rise in its share price.

- Sector Z (Financials): Outperformed expectations due to increased lending activity and improved asset quality, contributing significantly to the overall BSE rally. This sector's positive performance indicates a growing economy and increased investor trust in the financial stability of the nation.

Impact of Positive Investor Sentiment on BSE Share Prices

Positive Q2 earnings reports have significantly influenced investor confidence, serving as a catalyst for the BSE share price rally. This positive sentiment is evident in increased trading volume and the active participation of both foreign institutional investors (FIIs) and domestic institutional investors (DIIs).

-

Increased FII/DII Investments: Improved corporate earnings and the positive economic outlook have encouraged increased investments from both FIIs and DIIs, further pushing up the BSE share prices.

-

Higher Trading Volume: The surge in trading volume reflects heightened market activity and increased investor participation, indicating strong confidence in the market's future trajectory. This increased activity is a direct consequence of positive investor sentiment.

-

Positive Media Coverage: Positive media coverage of the strong earnings and the resulting share price increase has further amplified investor sentiment, creating a self-reinforcing cycle of positive news and market growth.

Analysis of Specific Sectors Contributing to the BSE Rally

Several sectors have played a pivotal role in driving the BSE share price rally. A deeper analysis reveals the specific factors that have contributed to their exceptional performance.

-

IT Sector: Growth is driven by sustained global demand for IT services, particularly in cloud computing, cybersecurity, and data analytics. Leading companies like Infosys and TCS have reported excellent Q2 results, contributing significantly to the sector's positive performance.

-

Pharmaceutical Sector: The sector benefited from increased demand for both generic and innovative drugs, coupled with successful new product launches. Companies like Sun Pharma and Cipla have demonstrated strong growth, fueling investor optimism in this sector.

-

FMCG Sector: Growth is fueled by rising consumer spending and an expanding middle class. Leading FMCG companies have reported robust sales volumes, driven by increased demand for essential and discretionary products. This reflects strong domestic consumption and overall economic health.

Sustained Growth Potential for BSE Share Prices

The recent BSE share price rally is primarily attributable to strong Q2 earnings, positive investor sentiment, and the exceptional performance of specific sectors. While market volatility is always a possibility, the current trends suggest significant potential for continued growth. The positive economic indicators, coupled with the strong performance of Indian companies, point towards a sustained positive outlook for the BSE.

Stay informed about the latest developments in the Indian Bourse and capitalize on the potential for future BSE share price rallies. Track key earnings reports, monitor market trends, and make informed investment decisions to navigate the dynamic Indian stock market effectively. Understanding the factors driving BSE share price movements, like strong corporate earnings and positive investor sentiment, is crucial for successful investment strategies.

Featured Posts

-

Trumps Movie Tariff A Deep Dive Into The Potential Consequences

May 07, 2025

Trumps Movie Tariff A Deep Dive Into The Potential Consequences

May 07, 2025 -

Cavaliers Defeat Nets Mitchell Leads The Charge

May 07, 2025

Cavaliers Defeat Nets Mitchell Leads The Charge

May 07, 2025 -

Lewis Capaldis Album Extends Winning Streak Continued Success Story

May 07, 2025

Lewis Capaldis Album Extends Winning Streak Continued Success Story

May 07, 2025 -

Las Vegas John Wick Become The Baba Yaga

May 07, 2025

Las Vegas John Wick Become The Baba Yaga

May 07, 2025 -

Salmond Sit Down Aces President Nikki Fargas On Community 2025 Season And More

May 07, 2025

Salmond Sit Down Aces President Nikki Fargas On Community 2025 Season And More

May 07, 2025

Latest Posts

-

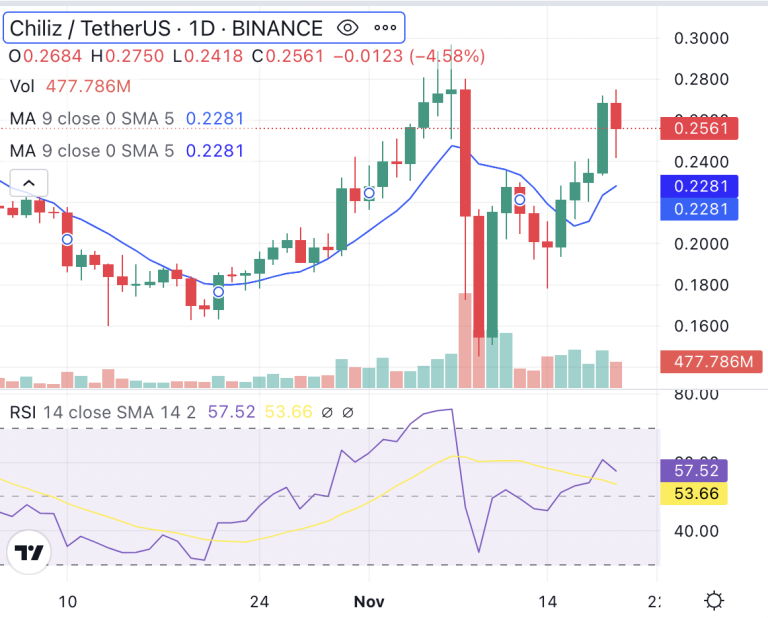

Is A 2 700 Ethereum Price Possible Examining The Wyckoff Accumulation

May 08, 2025

Is A 2 700 Ethereum Price Possible Examining The Wyckoff Accumulation

May 08, 2025 -

Invest Before It Soars Van Ecks Top Cryptocurrency Prediction 185

May 08, 2025

Invest Before It Soars Van Ecks Top Cryptocurrency Prediction 185

May 08, 2025 -

Ethereums Path To 2 700 A Wyckoff Accumulation Perspective

May 08, 2025

Ethereums Path To 2 700 A Wyckoff Accumulation Perspective

May 08, 2025 -

Top Cryptocurrency Pick Van Eck Forecasts 185 Price Increase

May 08, 2025

Top Cryptocurrency Pick Van Eck Forecasts 185 Price Increase

May 08, 2025 -

Ethereum Price Forecast Is 2 700 The Next Target After Accumulation

May 08, 2025

Ethereum Price Forecast Is 2 700 The Next Target After Accumulation

May 08, 2025