Ethereum Price Forecast: Is $2,700 The Next Target After Accumulation?

Table of Contents

Recent Ethereum Price Action and Accumulation

The recent price action of Ethereum suggests a period of accumulation, a phase where large investors are buying ETH without significantly impacting the price. This analysis of the Ethereum price forecast hinges on the validity of this accumulation thesis.

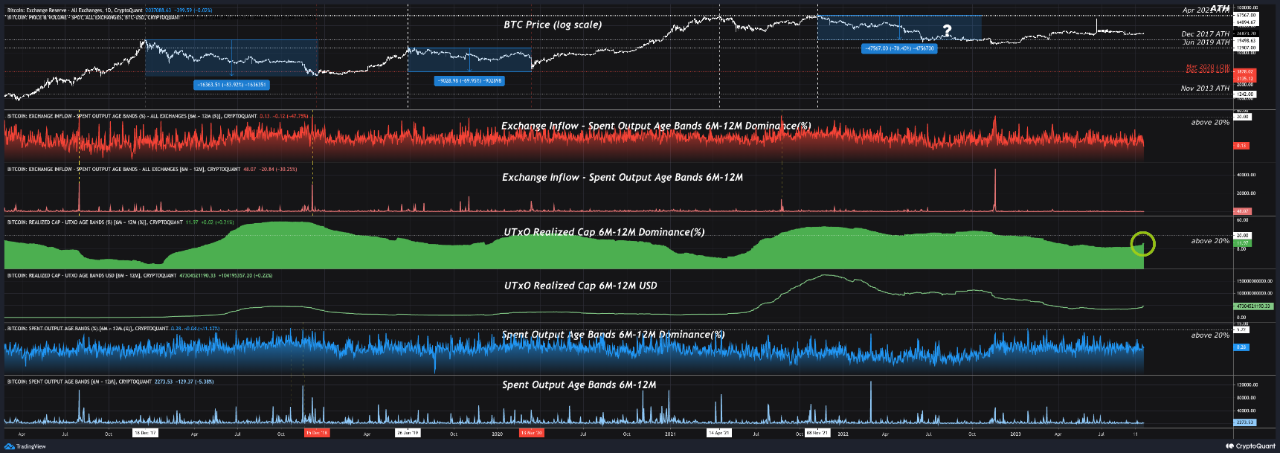

Analyzing On-Chain Metrics

Several on-chain metrics support the accumulation narrative. Analyzing these helps us refine our Ethereum price prediction.

- Exchange Reserves: A decrease in the amount of ETH held on centralized exchanges indicates less selling pressure and potential accumulation by larger holders. Data from Glassnode and similar platforms can reveal crucial trends.

- Active Addresses: An increase in the number of unique addresses interacting with the Ethereum network signals growing user engagement and network activity, bolstering the long-term outlook.

- Transaction Volume: Sustained high transaction volume despite price stability indicates underlying demand and potentially accumulating buyers.

Analyzing these metrics using tools like Glassnode, Santiment, and Etherscan provides valuable insights into the strength of the ongoing accumulation. Visualizing this data through charts and graphs enhances our understanding and provides a more nuanced Ethereum price prediction.

Market Sentiment and Investor Confidence

Gauging market sentiment is crucial for any accurate Ethereum price forecast. Currently, there's a mix of bullish and bearish sentiment surrounding ETH's future.

- Bullish Sentiment: Many analysts point to the growing DeFi ecosystem, upcoming Ethereum network upgrades, and increasing institutional adoption as catalysts for price appreciation. Positive news coverage and social media discussions often reflect this bullish sentiment.

- Bearish Sentiment: Concerns about regulatory uncertainty, competition from other Layer-1 blockchains, and macroeconomic headwinds often temper bullish predictions. News about regulatory crackdowns or significant market corrections can fuel fear, uncertainty, and doubt (FUD), impacting investor confidence. Understanding the interplay of these sentiments helps us build a robust Ethereum price prediction.

Factors that Could Drive Ethereum to $2,700

Several factors could contribute to Ethereum reaching the $2,700 price target. Our Ethereum price forecast considers these key drivers:

Upcoming Ethereum Network Upgrades

Significant network upgrades like the Shanghai upgrade (already completed) and future developments are vital for long-term growth and could significantly impact the Ethereum price forecast.

- Improved Scalability: Upgrades aimed at enhancing scalability, such as sharding, can lead to lower transaction fees and faster processing times, making Ethereum more attractive to users and developers.

- Enhanced Security: Improvements in the network's security further bolster investor confidence and reduce the risk of attacks, potentially driving up the price. This is a key factor in many Ethereum price predictions.

- New Features: The introduction of new features and functionalities can attract new users and applications, further driving demand for ETH.

These upgrades are extensively documented on the Ethereum Foundation website and various developer resources.

Increased Institutional Adoption

Growing institutional adoption is a significant factor in our Ethereum price forecast. Major financial institutions are increasingly allocating assets to ETH, leading to increased demand.

- Grayscale Investments: Grayscale's significant holdings in ETH demonstrate institutional confidence in the long-term prospects of the cryptocurrency.

- Pension Funds and Endowments: The entry of traditional institutional investors into the crypto market signals a shift towards mainstream acceptance of Ethereum.

This trend is documented through various financial news outlets and investment reports.

DeFi Growth and Ecosystem Expansion

The explosive growth of the decentralized finance (DeFi) ecosystem built on Ethereum is a powerful driver of demand for ETH.

- Total Value Locked (TVL): The consistent growth of TVL in DeFi protocols on Ethereum showcases the increasing utility and adoption of the network.

- Popular DeFi Applications: The success of various DeFi applications, such as lending platforms, decentralized exchanges (DEXs), and yield farming protocols, drives demand for ETH as collateral and for transaction fees.

Data on TVL and DeFi application usage is readily available through platforms like DefiLlama.

Potential Headwinds and Risks

Despite the bullish factors, several potential headwinds could hinder Ethereum's price appreciation. A realistic Ethereum price forecast must acknowledge these risks.

Regulatory Uncertainty

Regulatory uncertainty poses a significant challenge to the growth of the crypto market, including Ethereum.

- SEC Actions: Regulatory actions from agencies like the SEC in the US can create uncertainty and potentially dampen investor enthusiasm.

- Global Regulatory Landscape: The varying regulatory approaches adopted by different countries can lead to fragmented markets and hinder the global adoption of cryptocurrencies.

Staying informed about regulatory developments is crucial for accurately forecasting the price of ETH.

Competition from Other Blockchains

Ethereum faces increasing competition from other blockchain networks offering similar functionalities.

- Layer-1 Competitors: Projects like Solana, Cardano, and Avalanche are vying for market share, potentially diverting attention and investment away from Ethereum.

- Layer-2 Solutions: The growth of Layer-2 scaling solutions, while beneficial to Ethereum, could also lead to some decentralization concerns.

Analyzing the competitive landscape is crucial for forming a well-rounded Ethereum price forecast.

Macroeconomic Factors

Broader macroeconomic conditions significantly influence the price of cryptocurrencies, including Ethereum.

- Inflation and Interest Rates: High inflation and rising interest rates can negatively impact investor sentiment and lead to a risk-off environment, affecting the price of ETH.

- Economic Downturns: Economic recessions or periods of uncertainty can also cause investors to pull back from riskier assets like cryptocurrencies.

Conclusion

Reaching $2,700 is not a guaranteed outcome, but our Ethereum price forecast suggests a plausible path based on the ongoing accumulation, upcoming upgrades, and increasing institutional adoption. However, regulatory uncertainty, competition from other blockchains, and macroeconomic conditions could act as headwinds. The interplay of these bullish and bearish factors ultimately determines the trajectory of the Ethereum price. While the $2,700 target remains ambitious, understanding the factors driving Ethereum's price and staying informed about its development is crucial. Continue your research on the Ethereum price forecast and participate in the discussion!

Featured Posts

-

Hornets Season Evaluating Potential Replacements For Gibson

May 08, 2025

Hornets Season Evaluating Potential Replacements For Gibson

May 08, 2025 -

Kripto Piyasalari Icin Doenuem Noktasi Spk Nin Yeni Duezenlemeleri

May 08, 2025

Kripto Piyasalari Icin Doenuem Noktasi Spk Nin Yeni Duezenlemeleri

May 08, 2025 -

Sergio Hernandez El Nuevo Entrenador Del Flamengo

May 08, 2025

Sergio Hernandez El Nuevo Entrenador Del Flamengo

May 08, 2025 -

Berkshire Hathaways Investment Boosts Japan Trading House Share Prices

May 08, 2025

Berkshire Hathaways Investment Boosts Japan Trading House Share Prices

May 08, 2025 -

The Hunger Games Directors New Stephen King Horror Movie 2025 Release Date

May 08, 2025

The Hunger Games Directors New Stephen King Horror Movie 2025 Release Date

May 08, 2025