Economic Uncertainty: CEOs Cite Trump Tariffs As Major Threat

Table of Contents

The Direct Impact of Trump Tariffs on Business Operations

The immediate consequences of Trump-era tariffs are felt directly in the operational realities of many businesses. Increased costs and supply chain disruptions are two of the most significant challenges.

Increased Costs and Reduced Profit Margins

Tariffs directly increase the cost of imported goods and materials. This is particularly impactful for businesses reliant on global supply chains, significantly impacting their profitability. Industries like manufacturing and agriculture, heavily dependent on imported components and raw materials, have been particularly hard hit.

- Higher input costs lead to decreased profitability. The added tariff costs are often absorbed by businesses, directly reducing profit margins. This can make it challenging to maintain competitiveness and reinvest in growth.

- Difficulty in passing increased costs onto consumers due to market competition. While some companies attempt to pass increased costs onto consumers through higher prices, fierce market competition often prevents this, further squeezing profit margins.

- Reduced investment in expansion and innovation. Facing reduced profitability, businesses often cut back on investments in expansion, research and development, and other crucial growth-driving initiatives. This ultimately harms long-term economic growth.

Supply Chain Disruptions and Delays

Trump tariffs significantly complicate international trade and logistics, leading to supply chain disruptions and delays. The increased complexity and uncertainty in sourcing materials and managing global logistics add to the overall economic uncertainty.

- Increased lead times for raw materials and finished goods. Navigating the complexities of tariffs and customs procedures leads to significant delays in receiving essential materials and finished goods.

- Uncertainty in sourcing reliable suppliers. Businesses are forced to reassess their supplier networks, seeking alternative sources to mitigate risk, leading to increased uncertainty and potentially higher costs.

- Higher transportation costs due to rerouting and alternative suppliers. Companies may need to reroute shipments or source goods from more distant locations, resulting in increased transportation expenses.

The Broader Economic Uncertainty Created by Trade Wars

The impact of Trump tariffs extends far beyond the immediate costs and operational challenges. These trade policies create a broader environment of economic uncertainty, impacting investor confidence and fueling fears of a global economic slowdown.

Investor Sentiment and Market Volatility

The uncertainty surrounding trade policies significantly impacts investor confidence. The unpredictable nature of trade disputes creates a risk-averse environment, leading to reduced investment.

- Reduced investment due to unpredictability and risk aversion. Investors are hesitant to commit capital in an environment characterized by unpredictable policy changes and potential disruptions to global trade.

- Increased market volatility and fluctuations. Trade disputes and tariff announcements often trigger significant market fluctuations, creating instability and making long-term planning difficult.

- Negative impact on long-term economic growth. Reduced investment and increased market volatility hinder long-term economic growth by discouraging innovation, expansion, and job creation.

Global Economic Slowdown and Recessionary Fears

The interconnected nature of the global economy means that the impact of Trump tariffs extends far beyond national borders. Reduced international trade, a direct consequence of these policies, contributes to slower economic growth and increased recessionary fears.

- Reduced international trade leading to slower economic growth. Tariffs act as barriers to trade, reducing the overall volume of goods and services exchanged internationally, hindering economic expansion.

- Increased risk of a global recession due to interconnected economies. The interconnected nature of the global economy means that economic shocks in one region can quickly spread to others, increasing the risk of a global recession.

- Impact on employment and consumer spending. Slower economic growth can lead to job losses, reduced consumer confidence, and decreased spending, further exacerbating the economic downturn.

CEO Responses and Adaptation Strategies

Faced with increased costs and economic uncertainty, CEOs are implementing various strategies to adapt and mitigate the negative impacts of Trump-era tariffs.

Restructuring and Cost-Cutting Measures

Many CEOs are responding to the challenges by implementing restructuring and cost-cutting measures to maintain profitability and survive in a more difficult economic climate.

- Layoffs and workforce reductions. Companies may resort to layoffs and workforce reductions to decrease labor costs in the face of reduced profits.

- Reduced capital expenditure and investment. Investment in new projects and expansion is often curtailed to conserve cash and navigate economic uncertainty.

- Increased automation to reduce labor costs. Automation is increasingly seen as a way to reduce labor costs and enhance efficiency in a challenging economic environment.

Diversification and Supply Chain Restructuring

To mitigate risk, many companies are diversifying their supply chains and seeking to reduce their reliance on single sources or countries. This, however, presents its own challenges.

- Sourcing materials from multiple countries. Businesses are actively seeking alternative suppliers in multiple countries to reduce their dependence on any single nation.

- Investing in domestic production. Some companies are investing in domestic production to reduce reliance on imported goods and minimize tariff exposure.

- Increased negotiation power with suppliers. Diversification can potentially give companies more leverage when negotiating prices and terms with suppliers.

Conclusion

The lingering effects of Trump-era tariffs continue to generate significant economic uncertainty, deeply impacting CEO confidence and business operations. Increased costs, supply chain disruptions, and broader market volatility all stem from the instability created by these trade policies. CEOs are responding with cost-cutting, diversification, and supply chain restructuring, but the long-term consequences remain a significant concern. Understanding the ongoing impact of economic uncertainty, particularly as it relates to Trump tariffs, is crucial for navigating the complexities of the current market. Stay informed on the latest developments in trade policy and their effects on the global economy to better prepare your business for the challenges ahead. Further research into the long-term effects of trade wars and the development of effective mitigation strategies is essential for promoting sustainable economic growth.

Featured Posts

-

Trumps Stance On Ukraines Nato Membership A Detailed Analysis

Apr 26, 2025

Trumps Stance On Ukraines Nato Membership A Detailed Analysis

Apr 26, 2025 -

Are Chinese Cars A Threat To Established Automakers

Apr 26, 2025

Are Chinese Cars A Threat To Established Automakers

Apr 26, 2025 -

Federal Trade Commission Launches Probe Into Open Ai And Chat Gpt

Apr 26, 2025

Federal Trade Commission Launches Probe Into Open Ai And Chat Gpt

Apr 26, 2025 -

Harvards Transformation A Conservative Professors Roadmap

Apr 26, 2025

Harvards Transformation A Conservative Professors Roadmap

Apr 26, 2025 -

Congressional Stock Trading Ban Trumps Time Interview Reveals His Position

Apr 26, 2025

Congressional Stock Trading Ban Trumps Time Interview Reveals His Position

Apr 26, 2025

Latest Posts

-

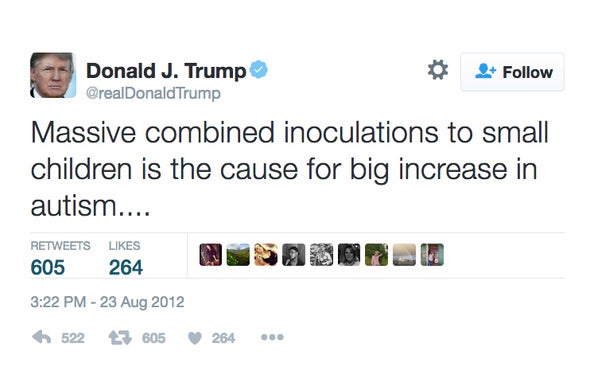

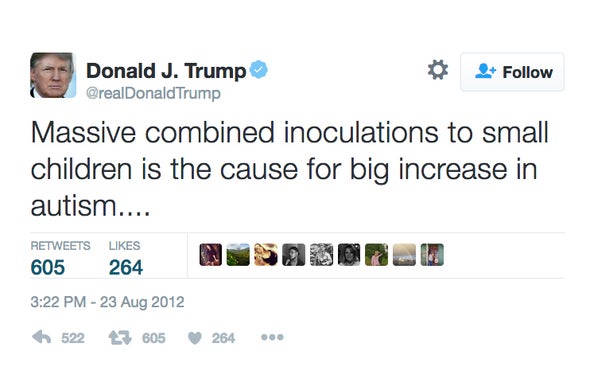

Anti Vaccine Advocate Review Of Autism Vaccine Connection Sparks Outrage Nbc 10 Philadelphia Reports

Apr 27, 2025

Anti Vaccine Advocate Review Of Autism Vaccine Connection Sparks Outrage Nbc 10 Philadelphia Reports

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Claims

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025 -

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc Chicago Sources

Apr 27, 2025

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc Chicago Sources

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Connection

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Connection

Apr 27, 2025