Elliott Eyes Exclusive Bet On Russian Gas Pipeline

Table of Contents

Understanding Elliott Management's Investment Strategy

Elliott Management is renowned for its aggressive and often controversial investment approach. They frequently target undervalued companies, pushing for significant changes in management, strategy, or even outright sale to maximize returns. Their interventions are often characterized by detailed due diligence, sophisticated financial modeling, and a willingness to engage in protracted legal battles. This particular investment in a Russian gas pipeline, however, presents a unique challenge, given the current geopolitical instability and sanctions imposed on Russia.

The motivation behind this specific investment remains somewhat unclear. Is it a long-term strategic play, anticipating a future normalization of relations and a rise in gas demand? Or is it a shorter-term, high-risk, high-reward speculation designed to capitalize on short-term market fluctuations? Only time will tell. Their past investments provide clues:

- Examples of previous successful investments in the energy sector: Successful restructuring of energy companies, leading to increased profitability and shareholder value.

- Examples of previous unsuccessful investments: Investments that failed due to unforeseen market downturns or geopolitical instability.

- Elliott's expertise in navigating complex geopolitical situations: Their experience in dealing with regulatory hurdles and international legal frameworks could prove crucial in this venture.

The Russian Gas Pipeline: A Risky but Potentially Lucrative Asset

While the exact pipeline targeted by Elliott remains undisclosed for confidentiality reasons, it's likely a major artery in Russia's extensive gas export network, potentially one supplying Europe or Asia. This pipeline's significance lies in its capacity to transport vast quantities of natural gas, a crucial energy source globally. However, the current geopolitical landscape presents a significant obstacle.

- Key characteristics of the pipeline (e.g., length, capacity, ownership structure): [Insert details about the pipeline if known; otherwise, use general characteristics of similar pipelines].

- Major export destinations served by the pipeline: [Insert details about export destinations if known].

- Potential risks associated with investing in Russian energy infrastructure: Sanctions, potential nationalization, operational disruptions due to political instability, and fluctuating gas prices.

- Potential for future expansion or upgrades: [Discuss potential for expansion, upgrades, or new infrastructure based on market forecasts and geopolitical developments].

Market Analysis and Predictions: The Future of Elliott's Russian Gas Pipeline Bet

Predicting the future of this investment requires a careful analysis of the natural gas market. Current forecasts suggest fluctuating prices, influenced by global demand, supply chain disruptions, and geopolitical tensions. The investment's success hinges on several factors:

- Projected natural gas prices for the next 5-10 years: [Insert market forecasts, citing relevant sources].

- Potential impacts on competing energy sources (e.g., LNG, renewable energy): [Discuss how the investment might affect the competitiveness of other energy sources].

- Predictions about the success or failure of the investment: This investment carries substantial risk. Success depends heavily on the resolution of geopolitical tensions and the stability of the global energy market.

Ethical Considerations and Public Perception: Elliott's Role in the Russian Energy Sector

Elliott's investment in a Russian gas pipeline raises significant ethical concerns. Critics may point to the potential for indirectly supporting the Russian government, particularly given the ongoing conflict in Ukraine and the associated sanctions.

- Potential criticisms of the investment: Concerns about supporting a regime accused of human rights abuses and contributing to geopolitical instability.

- Elliott's response to potential criticism: [Discuss potential responses Elliott might offer to address criticism, focusing on their investment strategy and risk mitigation measures].

- Potential for positive social or environmental impact through the investment: This section could be strengthened by exploring arguments for the investment potentially generating revenue used for social or environmental initiatives, though this is likely to be limited given the ethical considerations involved.

Conclusion: The Stakes Are High: Assessing Elliott's Exclusive Bet on the Russian Gas Pipeline

Elliott Management's exclusive bet on a Russian gas pipeline represents a high-stakes gamble in a volatile geopolitical environment. The investment’s success depends on numerous factors including market conditions, geopolitical stability, and effective risk management. While the potential returns are significant, the ethical considerations and potential risks are considerable.

Stay tuned for updates on Elliott Management's bold gamble on this Russian gas pipeline investment and its impact on the volatile global energy market. Keep reading for the latest analysis and insights into Russian gas pipeline investment, Elliott Management's energy portfolio, and geopolitical risks in energy investment.

Featured Posts

-

Understanding Trumps 10 Tariff Baseline And Conditions For Deviation

May 10, 2025

Understanding Trumps 10 Tariff Baseline And Conditions For Deviation

May 10, 2025 -

Makron I Tusk Oboronnoe Sotrudnichestvo Novye Perspektivy

May 10, 2025

Makron I Tusk Oboronnoe Sotrudnichestvo Novye Perspektivy

May 10, 2025 -

Elon Musks Brother Kimbal His Views On Tariffs And More

May 10, 2025

Elon Musks Brother Kimbal His Views On Tariffs And More

May 10, 2025 -

R5 1078 2025

May 10, 2025

R5 1078 2025

May 10, 2025 -

Draisaitls Injury And The Edmonton Oilers Playoff Hopes

May 10, 2025

Draisaitls Injury And The Edmonton Oilers Playoff Hopes

May 10, 2025

Latest Posts

-

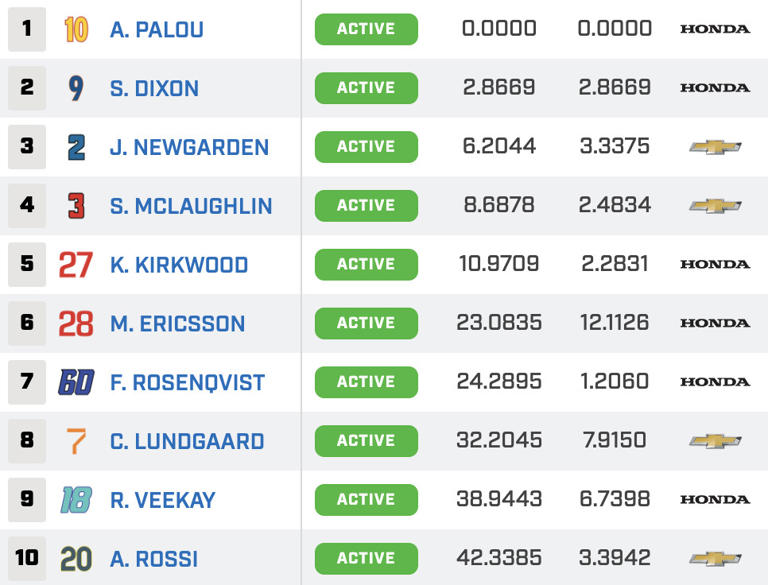

De Francescos St Pete Return Highlights Palous Indy Car Win

May 11, 2025

De Francescos St Pete Return Highlights Palous Indy Car Win

May 11, 2025 -

Barber Motorsports Park Colton Hertas Quest For Qualifying And Race Pace

May 11, 2025

Barber Motorsports Park Colton Hertas Quest For Qualifying And Race Pace

May 11, 2025 -

Indy Car Season Opener Palou Triumphs De Francesco Back In Action At St Pete

May 11, 2025

Indy Car Season Opener Palou Triumphs De Francesco Back In Action At St Pete

May 11, 2025 -

Can Colton Herta Find The Speed He Needs At Barber Paddock Buzz

May 11, 2025

Can Colton Herta Find The Speed He Needs At Barber Paddock Buzz

May 11, 2025 -

St Petersburg Indy Car Race Palou Takes The Victory De Francesco Returns

May 11, 2025

St Petersburg Indy Car Race Palou Takes The Victory De Francesco Returns

May 11, 2025