Understanding Trump's 10% Tariff: Baseline And Conditions For Deviation

Table of Contents

The Baseline 10% Tariff: Initial Implementation and Targeted Goods

In 2018, the Trump administration announced a 10% tariff on a wide range of imported goods, citing national security concerns and the need to protect American industries. This initial implementation targeted numerous sectors, aiming to bolster domestic production and reduce the trade deficit. The stated rationale was to level the playing field for American businesses, countering what the administration perceived as unfair trade practices from other nations.

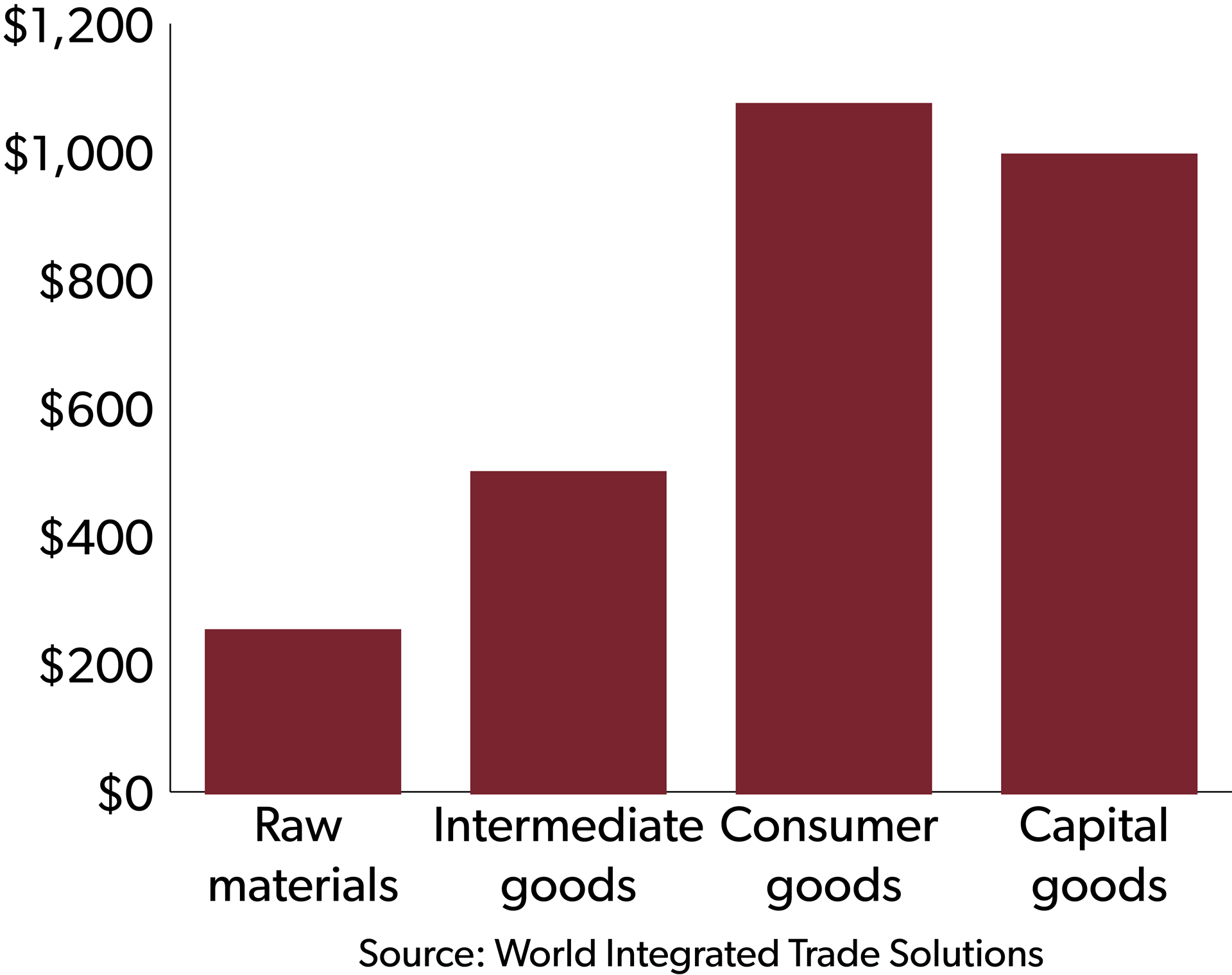

The main categories of goods affected were extensive, encompassing:

-

Steel and Aluminum: These were among the first targets, impacting industries reliant on imported metals.

-

Consumer Goods: A broad category including electronics, textiles, and many everyday items felt the impact of increased import costs.

-

Machinery and Equipment: Imports crucial for various manufacturing sectors were also subject to the tariff.

-

Specific examples of goods subject to the 10% tariff: Washing machines, solar panels, certain types of steel, and various consumer electronics.

-

Countries primarily affected by the tariff: China, Canada, Mexico, and the European Union were among the most significantly affected.

-

Initial reactions from affected industries and governments: Mixed reactions ranged from protests from importers and affected businesses to retaliatory tariffs from other countries.

Exemptions and Deviations from the 10% Tariff: Understanding the Exceptions

While the 10% tariff was broadly applied, a process existed for securing exemptions. Companies and industries could apply for exclusions based on specific circumstances, arguing that the tariff imposed undue hardship or negatively impacted national security interests in other ways. This process involved a detailed application outlining the reasons for exemption and the potential economic consequences of not granting it.

- Factors considered in granting exemptions: The availability of domestic substitutes, the impact on the applicant's business and employment, and national security concerns were all key factors in determining eligibility for exemptions.

- The appeals process for denied exemptions: Businesses could appeal rejected applications, often providing additional evidence or arguments in support of their case. This process was complex and often protracted, adding to the uncertainty surrounding the tariff’s impact.

- Examples of industries that received exemptions and reasons why: Certain medical device manufacturers received exemptions due to concerns about the impact on healthcare costs and patient access. Similarly, exemptions were granted to businesses that demonstrated a lack of readily available domestic substitutes for their imported goods.

The Impact of the 10% Tariff: Economic and Political Consequences

Trump's 10% tariff had significant economic and political repercussions, both domestically and internationally. The short-term effects included increased prices for consumers on certain goods, impacting purchasing power and potentially contributing to inflation. Long-term effects remain a subject of ongoing economic debate, with some arguing that it stimulated domestic production while others point to its negative impact on trade relationships and overall economic growth.

- Specific economic indicators affected by the tariff: Inflation rates, trade deficits, consumer spending, and manufacturing output were all notably influenced.

- Impact on consumer prices and purchasing power: Prices for many imported goods rose, reducing consumer purchasing power, particularly for low-income households.

- International trade relations affected by the tariff: Retaliatory tariffs were imposed by several countries, leading to trade disputes and escalating tensions.

Case Studies: Examining Specific Instances of Tariff Application

Analyzing specific cases helps illustrate the variability in applying Trump's 10% tariff. The process was not uniform, leading to different outcomes across industries and products.

- Specific case studies with detailed explanation of deviations: One example might involve a particular type of steel where an exemption was granted due to a scarcity of domestic alternatives, while another might detail a consumer goods sector where the tariff led to significant price increases and reduced market share for American businesses.

- Analysis of the success or failure of the tariff implementation in those cases: Some sectors might have shown signs of increased domestic production, while others may have experienced significant job losses and business closures.

- Lessons learned from each case study: These examples highlight the complexities involved in implementing trade protectionist measures and the difficulty of predicting their overall effects.

Conclusion

This article examined the complexities of Trump's 10% tariff, detailing the baseline rate, the conditions that led to exemptions, and the overall impact. Understanding the baseline rate and the exceptions reveals the nuanced reality of protectionist trade policies and their far-reaching consequences. The economic and political ramifications were significant, impacting international trade relations and domestic industries alike. The varied application of the tariff across different sectors underscores the challenges of implementing such policies effectively and fairly.

For a more comprehensive understanding of the economic and political fallout of protectionist measures, further research into the specifics of Trump's 10% tariff and similar trade policies is encouraged. Delving deeper into the case studies presented will provide a more complete understanding of the complexities surrounding Trump's 10% tariff and its effects on global trade.

Featured Posts

-

Analyzing The Impact Of The 2025 Nhl Trade Deadline On Playoff Contenders

May 10, 2025

Analyzing The Impact Of The 2025 Nhl Trade Deadline On Playoff Contenders

May 10, 2025 -

Former Becker Jailer To Chair Nottingham Attacks Investigation

May 10, 2025

Former Becker Jailer To Chair Nottingham Attacks Investigation

May 10, 2025 -

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025 -

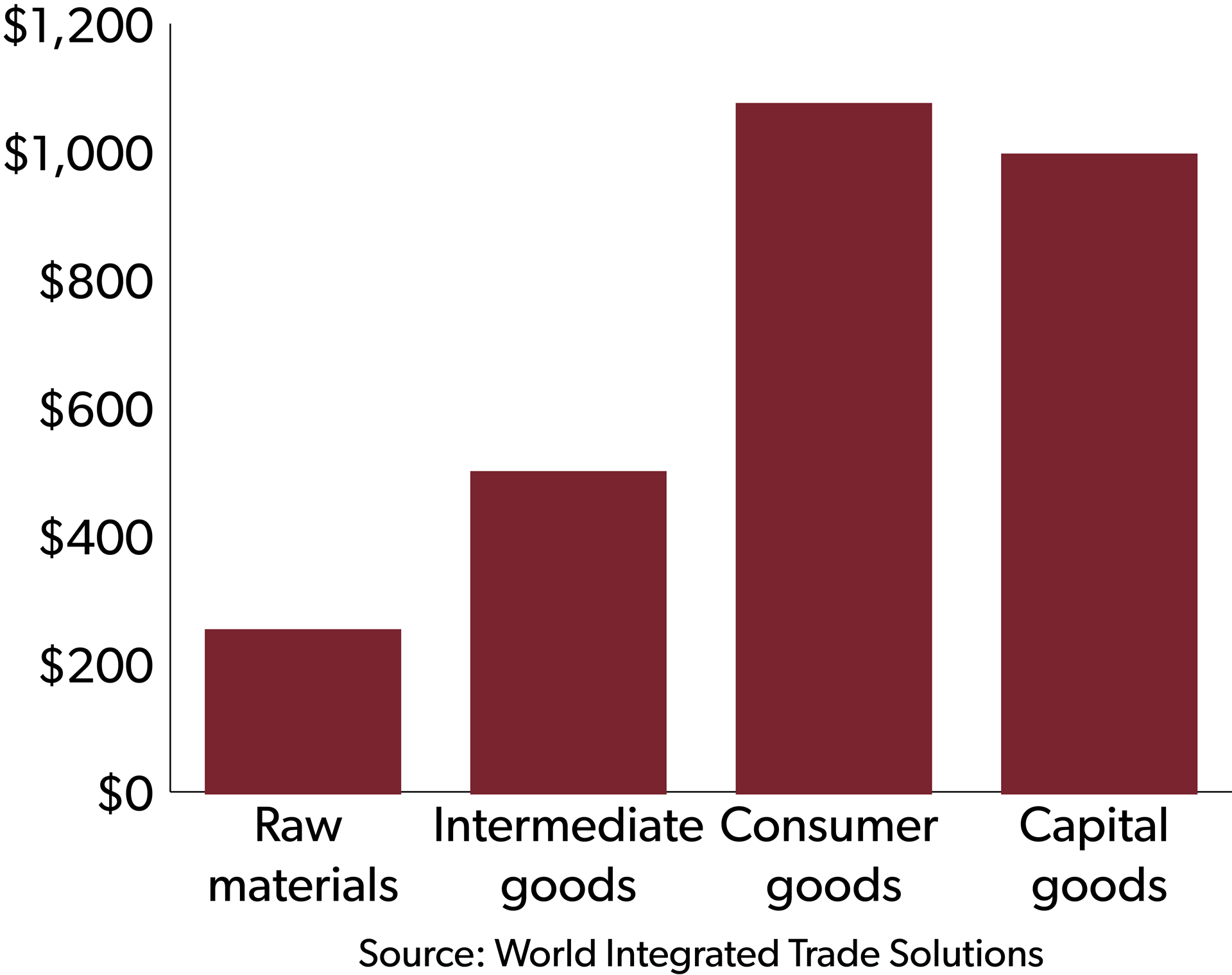

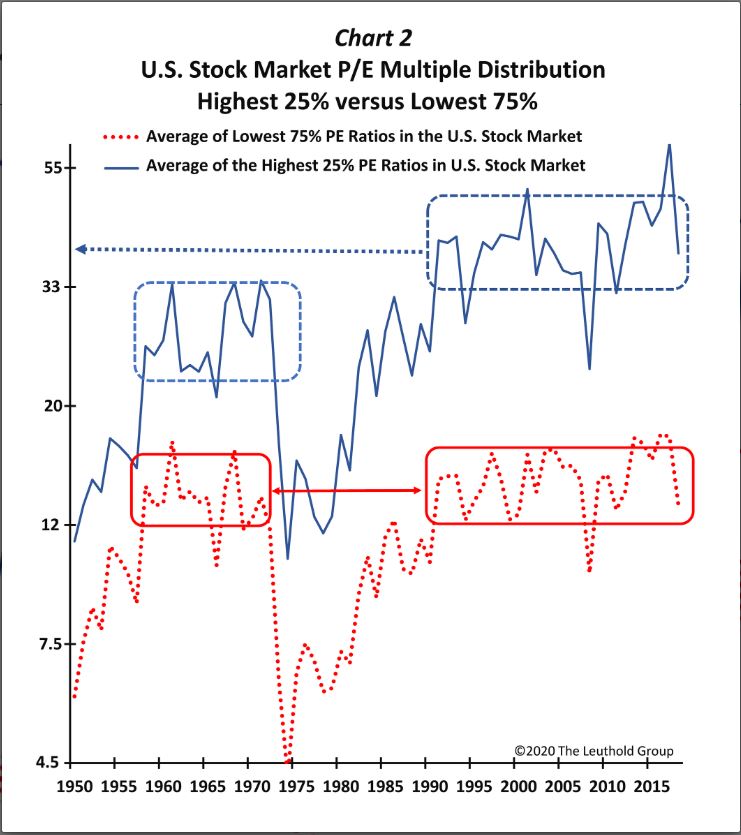

Bof As Reassurance Why Current Stock Market Valuations Arent A Worry

May 10, 2025

Bof As Reassurance Why Current Stock Market Valuations Arent A Worry

May 10, 2025 -

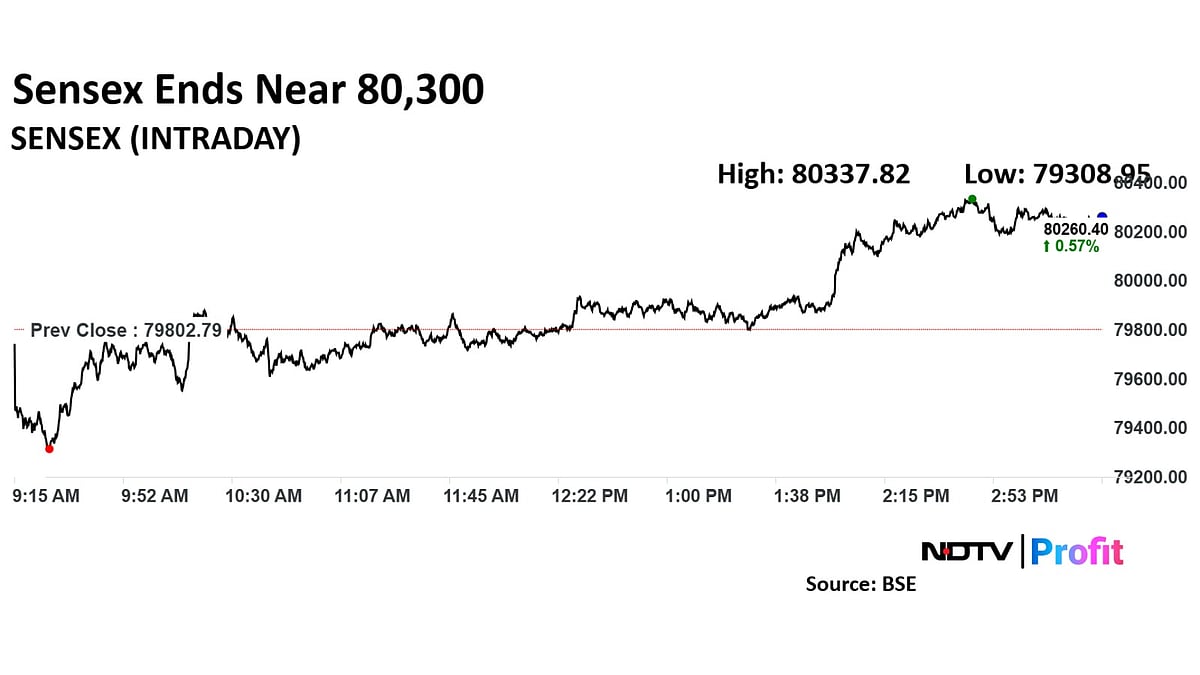

Choppy Trading Session Sensex And Nifty 50 End Unchanged

May 10, 2025

Choppy Trading Session Sensex And Nifty 50 End Unchanged

May 10, 2025