Elon Musk's Net Worth: How US Economic Policies Impact Tesla's CEO

Table of Contents

Tax Policies and Elon Musk's Wealth

Elon Musk's immense wealth is heavily tied to Tesla's stock performance, making him acutely sensitive to tax policies impacting capital gains and corporate profits.

Capital Gains Taxes

Changes in capital gains tax rates directly impact Musk's wealth. A lower capital gains tax rate means he retains a larger portion of his profits from selling Tesla stock. Conversely, higher rates reduce his net worth after tax.

- Tax Rate Fluctuations: The US capital gains tax rate isn't static; it varies depending on income bracket and holding period. Changes to these rates have a direct and substantial impact on Musk's taxable income derived from Tesla stock sales.

- Tax Optimization Strategies: High-net-worth individuals like Musk often employ sophisticated tax strategies to minimize their tax burden. These strategies could include charitable donations, tax-advantaged investments, and strategic timing of stock sales. Understanding these strategies is crucial to analyzing the true impact of tax policies on his net worth.

- Tesla Stock Growth and Net Worth Correlation: Tesla's stock price has experienced dramatic growth, significantly boosting Musk's net worth. Any dip in the stock market due to economic uncertainty or regulatory changes directly translates to a decrease in his wealth, largely amplified by the capital gains tax implications. For example, if Tesla's stock price drops by 10%, the potential capital gains tax on any unrealized profits decreases accordingly.

Corporate Tax Rates

Tesla's profitability, a significant driver of its stock price and consequently Musk's wealth, is influenced by US corporate tax rates.

- Lower Corporate Taxes, Higher Profits: Lower corporate tax rates increase Tesla's after-tax profits, boosting the company's valuation and shareholder returns. This directly benefits Musk, who holds a significant stake in the company.

- Tax Loopholes and Incentives: Companies often leverage tax loopholes and incentives, such as those offered for investments in renewable energy and electric vehicle production, to minimize their tax obligations. These strategies can indirectly boost Musk's net worth.

- Tesla's Corporate Tax Payments and Profitability: Analyzing Tesla's reported corporate tax payments and its profitability reveals the direct correlation between tax policies and the company's financial performance, ultimately influencing Musk's wealth. A decrease in corporate tax rates can lead to an increase in profits and, hence, a rise in Tesla's stock price, benefiting Musk's net worth.

Government Regulations and Tesla's Growth

Government regulations play a pivotal role in shaping Tesla's success and, subsequently, Musk's net worth.

Environmental Regulations

Environmental policies, particularly those incentivizing electric vehicle (EV) adoption, have been instrumental in Tesla's rise.

- EV Subsidies and Tax Credits: Government subsidies and tax credits for purchasing EVs directly increase demand, benefiting Tesla significantly. These incentives make Tesla's cars more affordable, increasing sales and bolstering the company's value, which directly impacts Musk’s net worth.

- Stricter Emissions Regulations: Stricter emission standards on traditional gasoline-powered vehicles give Tesla a competitive edge, increasing its market share and contributing to its financial success. This further boosts Musk's net worth.

- Tesla's Market Share and EV Sales: Analyzing Tesla's market share in the EV sector alongside overall EV sales data helps quantify the impact of environmental regulations on the company’s growth and Musk's financial gains. Stronger environmental policies generally correlate to higher Tesla sales and thus a higher net worth for its CEO.

Infrastructure Spending

Government investments in charging infrastructure and renewable energy research directly benefit Tesla and Musk.

- Charging Infrastructure Growth: Increased investment in charging stations across the US expands the reach and accessibility of electric vehicles, furthering Tesla's market penetration and boosting sales. This directly translates to increased stock value and a higher net worth for Musk.

- Renewable Energy Research and Development: Government funding for renewable energy research and development directly benefits Tesla's technology advancements, enhancing the company’s competitiveness and profitability, all contributing to Musk’s financial success.

- Correlation Between Infrastructure and Tesla Sales: The correlation between government investment in charging infrastructure and renewable energy and Tesla's sales figures provides clear evidence of the positive impact of such policies on Musk's net worth. As the infrastructure improves, so do Tesla’s sales, and subsequently Musk’s wealth.

Economic Growth and the Tesla Stock Market

Macroeconomic factors and international trade policies significantly influence Tesla's stock price and, thus, Musk's net worth.

Overall Economic Conditions

Overall economic health plays a crucial role in determining investor confidence in Tesla and its stock price.

- Recessions and Stock Market Volatility: Economic downturns typically lead to decreased investor confidence and stock market volatility, negatively impacting Tesla's stock price and consequently Musk's net worth. During recessions, consumer spending on luxury items like Tesla vehicles often decreases.

- Inflation and Production Costs: Inflation increases production costs, affecting Tesla's profitability. High inflation can also reduce consumer purchasing power, reducing demand for Tesla vehicles.

- Interest Rates and Tesla Valuation: Changes in interest rates influence borrowing costs for Tesla and investors' expectations for future profits, impacting the company's valuation and, consequently, Musk's net worth.

International Trade Policies

International trade policies, including tariffs and trade agreements, directly affect Tesla's global operations.

- Tariffs and Production Costs: Import/export tariffs increase Tesla's production costs, potentially impacting its profitability and stock price. This negatively affects Musk's net worth.

- Trade Wars and International Sales: Trade wars and protectionist measures can hinder Tesla's international sales, affecting its revenue and, subsequently, Musk's wealth.

- Tesla's International Sales and Trade Policy Impacts: Analyzing Tesla's international sales figures alongside data on relevant trade policies helps determine the effect of these policies on the company's performance and the resulting impact on Musk's net worth. Increased trade barriers typically lead to decreased international sales and a lower net worth for Musk.

Conclusion

Elon Musk's net worth is inextricably linked to US economic policies. Tax policies, government regulations, and overall economic conditions significantly influence Tesla's performance and, consequently, Musk's wealth. Understanding this complex interplay is crucial for comprehending the dynamics of both the individual's financial success and the broader economic landscape. To stay updated on how US economic policies continue to impact Elon Musk’s net worth and the future of Tesla, continue following our insightful analyses. Learn more about the factors influencing Elon Musk's net worth and its correlation to US economic policy.

Featured Posts

-

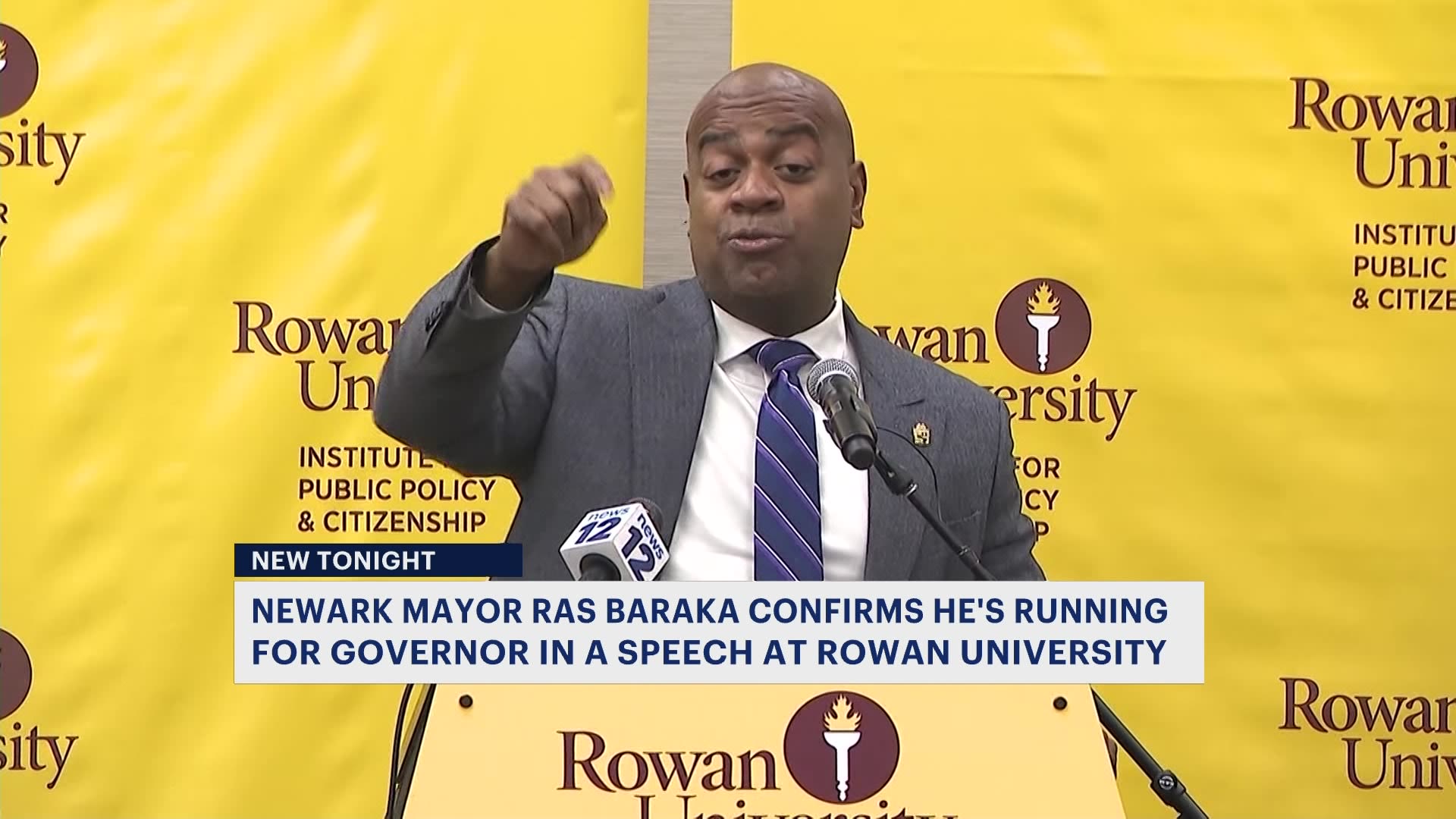

Ice Protest Leads To Newark Mayor Ras Barakas Arrest

May 10, 2025

Ice Protest Leads To Newark Mayor Ras Barakas Arrest

May 10, 2025 -

Has Chris Martins Influence Shaped Dakota Johnsons Acting Career

May 10, 2025

Has Chris Martins Influence Shaped Dakota Johnsons Acting Career

May 10, 2025 -

Ashhr Laeby Krt Alqdm Almdkhnyn Hqayq Sadmt

May 10, 2025

Ashhr Laeby Krt Alqdm Almdkhnyn Hqayq Sadmt

May 10, 2025 -

Snls Bad Harry Styles Impression His Reaction

May 10, 2025

Snls Bad Harry Styles Impression His Reaction

May 10, 2025 -

Investing In Palantir Technologies A Look Ahead To May 5th And Beyond

May 10, 2025

Investing In Palantir Technologies A Look Ahead To May 5th And Beyond

May 10, 2025