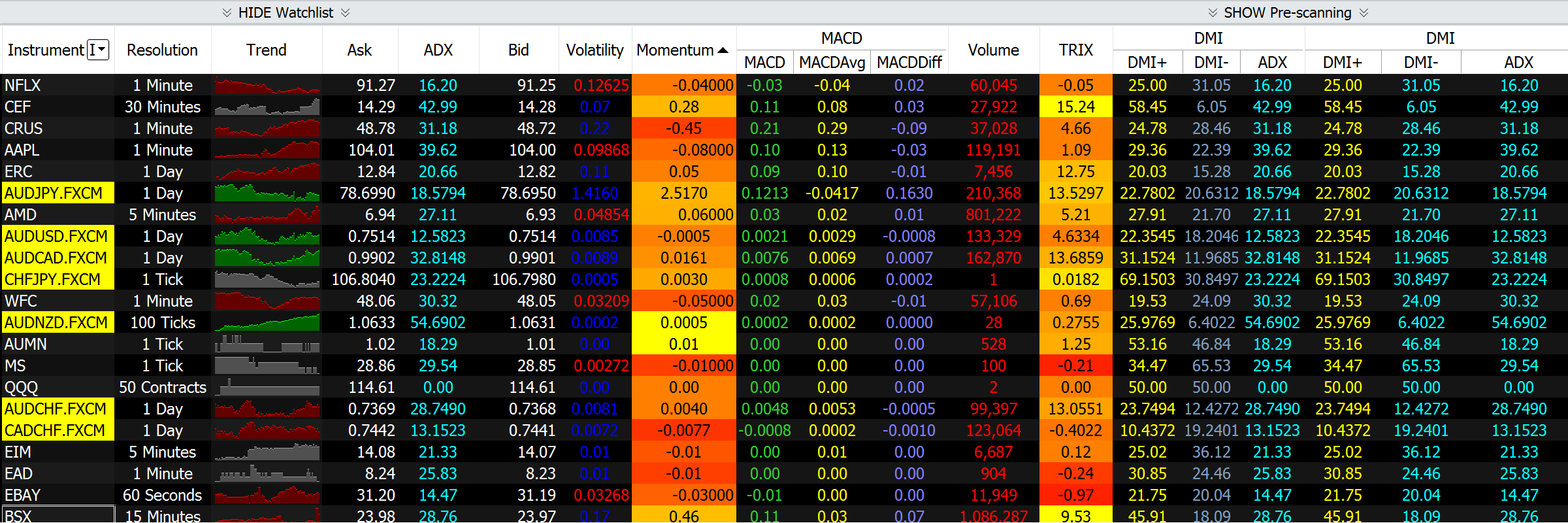

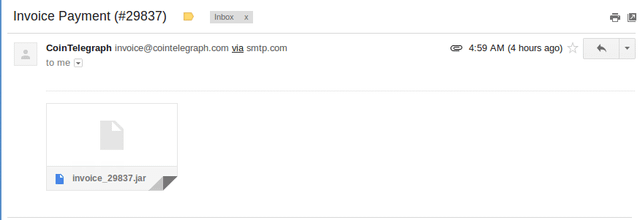

Essential Commodity Market Charts: Your Weekly Watchlist

Table of Contents

Energy Commodity Charts: Tracking Oil and Natural Gas Prices

The energy sector is a cornerstone of the global economy, and understanding its price fluctuations is crucial. This section focuses on two critical energy commodities: crude oil and natural gas.

Crude Oil (WTI & Brent):

WTI (West Texas Intermediate) and Brent crude oil are global benchmarks, setting the price for a significant portion of the world's oil supply. Their prices are influenced by a complex interplay of factors, including OPEC+ production quotas, geopolitical instability (e.g., sanctions, conflicts), and global demand driven by economic growth and seasonal changes. Effective charting techniques for analyzing crude oil prices include moving averages (e.g., 50-day, 200-day), the Relative Strength Index (RSI) to identify overbought or oversold conditions, and pinpointing support and resistance levels to predict potential price reversals.

- Identify trends and potential breakouts: Look for clear upward or downward trends and anticipate significant price movements based on technical indicators and news events.

- Impact of inventory levels: Monitor crude oil inventory reports from agencies like the EIA (Energy Information Administration) to understand supply and demand dynamics. Higher-than-expected inventories can signal downward pressure on prices.

- Relevant news sources: Stay updated with news from reputable sources like Reuters, Bloomberg, and the Wall Street Journal for real-time information influencing crude oil prices.

Natural Gas Prices:

Natural gas prices exhibit strong seasonality, peaking during colder months due to increased heating demand. Storage levels play a crucial role: low storage levels can lead to price spikes, while ample storage can dampen price volatility. Weather patterns, particularly severe winters or unusually warm spells, have a significant impact on natural gas prices. Chart analysis should focus on identifying seasonal patterns, volatility periods, and the correlation between storage levels and prices.

- Analyze charts for seasonal patterns and price volatility: Expect higher prices during peak demand seasons and potential price corrections during periods of lower demand.

- Impact of alternative energy sources: The rise of renewable energy sources, such as solar and wind power, can influence long-term natural gas demand and prices.

- Reliable price forecasts: Consult forecasts from energy analysts and agencies like the EIA to get an outlook on natural gas price trends.

Metal Commodity Charts: Monitoring Precious and Industrial Metals

Metals are another critical commodity class, with precious metals acting as safe-haven assets and industrial metals closely tied to economic growth.

Gold and Silver Prices:

Gold and silver are considered safe-haven assets, meaning their prices tend to rise during times of economic uncertainty, inflation, or geopolitical turmoil. Inflationary pressures and interest rate adjustments by central banks significantly influence their prices. Higher inflation generally boosts the demand for gold and silver as a hedge against inflation's eroding purchasing power, while rising interest rates can make holding non-interest-bearing assets like gold less attractive.

- Price correlations: Analyze the price relationship between gold and other assets, such as the US dollar and government bonds, to understand market sentiment and investment flows.

- Technical analysis: Use technical indicators and chart patterns to identify potential buying or selling opportunities.

- Jewelry demand: Keep in mind that jewelry demand plays a role in the overall demand for gold and silver.

Industrial Metal Prices (Copper, Aluminum):

Copper and aluminum are crucial industrial metals, with their prices closely linked to global economic growth. Manufacturing activity, construction, and infrastructure projects heavily rely on these metals, so economic slowdowns or booms will impact their prices. Supply chain disruptions, often caused by geopolitical events or natural disasters, can dramatically affect availability and price.

- Correlation with global economic indicators: Monitor Purchasing Managers' Indices (PMI) and other economic indicators to gauge the health of the manufacturing and construction sectors.

- Supply chain risks: Be aware of potential supply disruptions that can lead to price spikes.

- Industrial metal reports: Refer to reports from organizations like the International Copper Study Group and the Aluminum Association for insights into market trends.

Agricultural Commodity Charts: Observing Grain and Soft Commodity Markets

Agricultural commodities are essential for food production and global food security. Their prices are heavily influenced by weather patterns, global supply and demand dynamics, and government policies.

Grain Prices (Corn, Wheat, Soybeans):

Weather patterns during planting and harvesting seasons significantly affect grain production. Favorable weather can lead to abundant harvests and lower prices, while droughts or extreme weather events can cause crop failures and price spikes. Global supply and demand, influenced by factors such as population growth, animal feed demand, and biofuel production, also greatly impacts grain prices.

- Crop yield forecasts: Follow crop yield forecasts from the USDA (United States Department of Agriculture) and other agricultural agencies to anticipate potential price fluctuations.

- Government policies and subsidies: Understand how government policies and agricultural subsidies can influence supply and prices.

- Global trade disputes: Be aware of the impact of international trade disputes on grain imports and exports.

Soft Commodity Prices (Sugar, Coffee, Cocoa):

Soft commodity prices are influenced by factors specific to their regions of production. Weather conditions, diseases, and pests can significantly impact crop yields. Consumer demand and global trade flows also play crucial roles, along with currency fluctuations which impact the cost of imports and exports.

- Seasonal trends and price cycles: Analyze the seasonal price cycles and trends specific to each soft commodity.

- Currency fluctuations: Consider how currency exchange rates can affect the cost of these goods in international markets.

- Agricultural market reports: Consult reports from organizations like the International Coffee Organization and the International Cocoa Organization for up-to-date information.

Conclusion: Essential Commodity Market Charts: Your Weekly Watchlist

Regularly monitoring these essential commodity market charts is crucial for informed decision-making in trading and investing. Understanding the factors influencing price movements in energy, metals, and agricultural commodities allows for better risk management and potentially higher returns. This weekly watchlist provides a foundational overview. Remember to conduct thorough research and consider seeking professional financial advice before making any investment decisions.

Call to Action: Check back regularly for updated weekly watchlists of essential commodity market charts to stay ahead of the curve. Subscribe to our newsletter or follow us on social media for the latest insights and analysis to enhance your trading strategies and risk management techniques. Mastering the art of interpreting essential commodity market charts will significantly improve your trading success.

Featured Posts

-

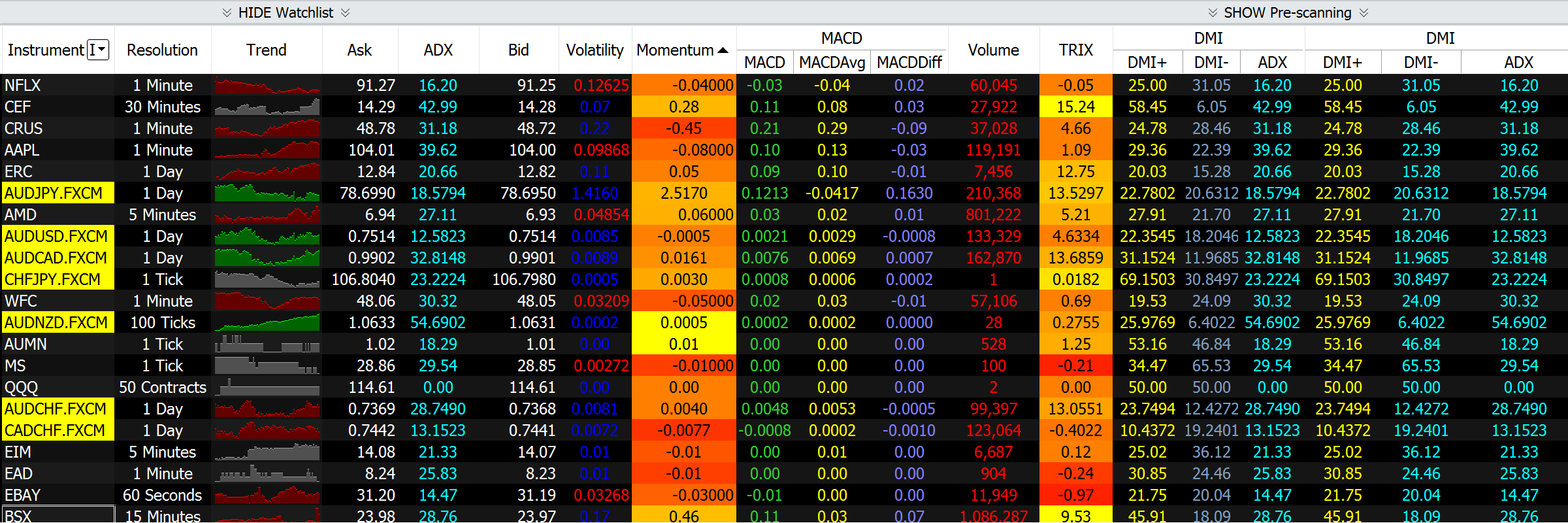

Nhl Playoffs Key Insights Into The First Round Matchups

May 05, 2025

Nhl Playoffs Key Insights Into The First Round Matchups

May 05, 2025 -

Diego Pacheco Vs Christian Mbilli Highly Anticipated May Showdown

May 05, 2025

Diego Pacheco Vs Christian Mbilli Highly Anticipated May Showdown

May 05, 2025 -

Colonial Downs To Host Virginia Derby Stones Announcement Imminent

May 05, 2025

Colonial Downs To Host Virginia Derby Stones Announcement Imminent

May 05, 2025 -

Basel Trip Abor And Tynnas Journey From Germany

May 05, 2025

Basel Trip Abor And Tynnas Journey From Germany

May 05, 2025 -

Ufc Des Moines Fight By Fight Predictions And Betting Preview

May 05, 2025

Ufc Des Moines Fight By Fight Predictions And Betting Preview

May 05, 2025

Latest Posts

-

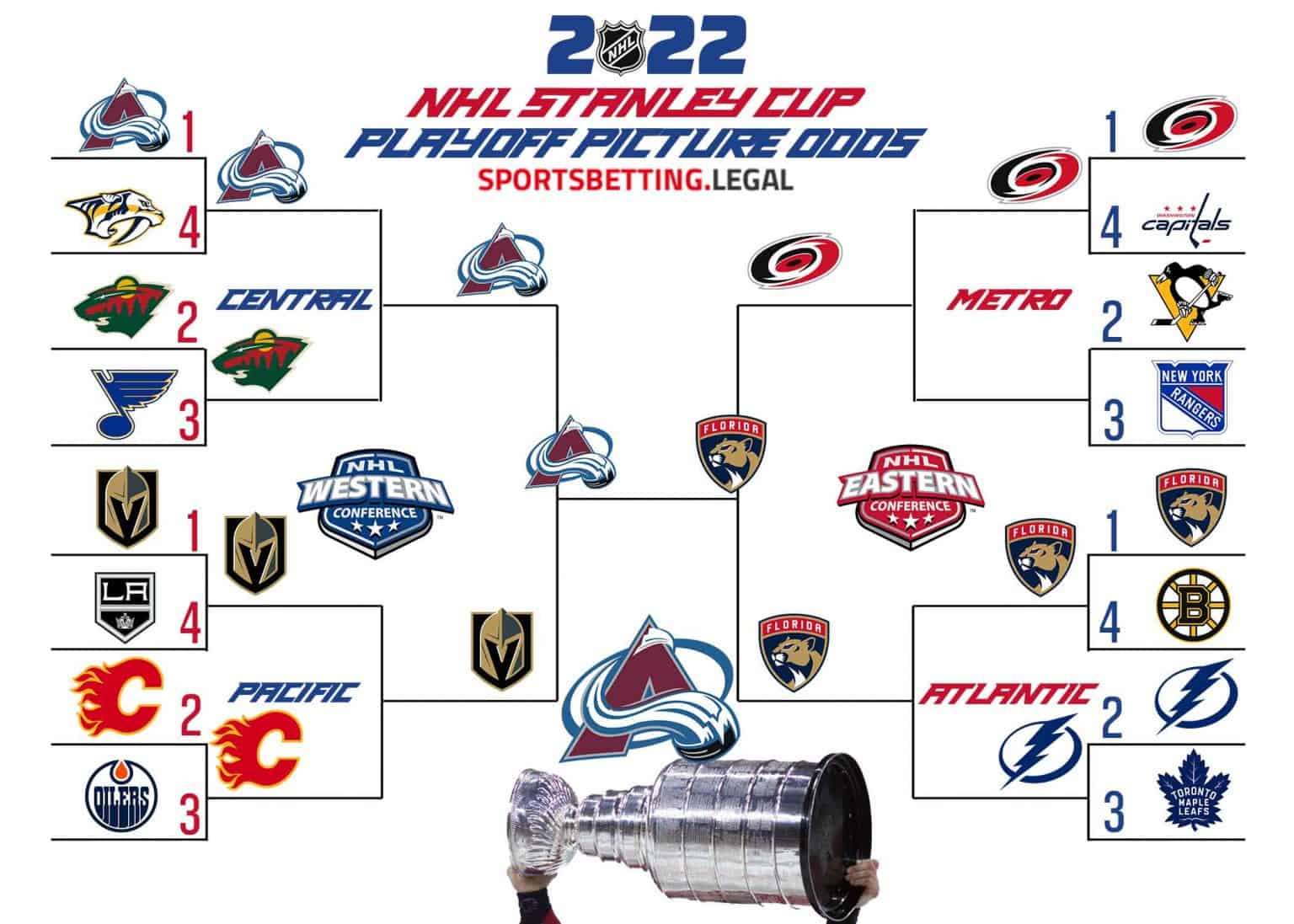

Millions Lost Executive Office365 Accounts Targeted In Cybercrime Scheme

May 06, 2025

Millions Lost Executive Office365 Accounts Targeted In Cybercrime Scheme

May 06, 2025 -

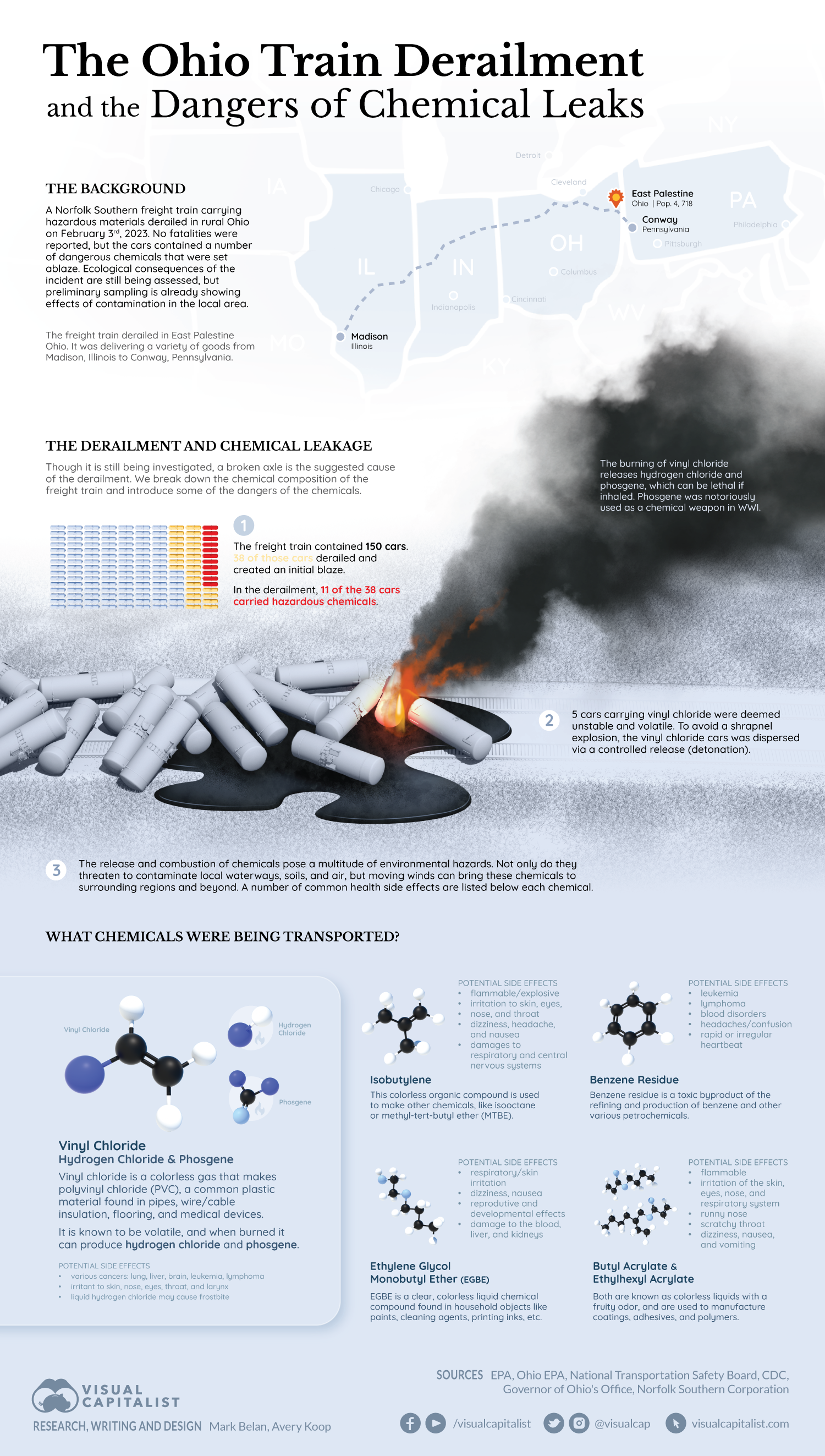

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

May 06, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

May 06, 2025 -

Toxic Chemical Residue From Ohio Train Derailment Building Contamination For Months

May 06, 2025

Toxic Chemical Residue From Ohio Train Derailment Building Contamination For Months

May 06, 2025 -

Office365 Executive Email Compromise Millions In Losses Reported

May 06, 2025

Office365 Executive Email Compromise Millions In Losses Reported

May 06, 2025 -

T Mobile To Pay 16 Million For Data Security Failures Over Three Years

May 06, 2025

T Mobile To Pay 16 Million For Data Security Failures Over Three Years

May 06, 2025