Ethereum Price Analysis: Bullish Activity And Upside Targets

Table of Contents

Technical Analysis of Ethereum's Price Action

Chart Patterns and Indicators

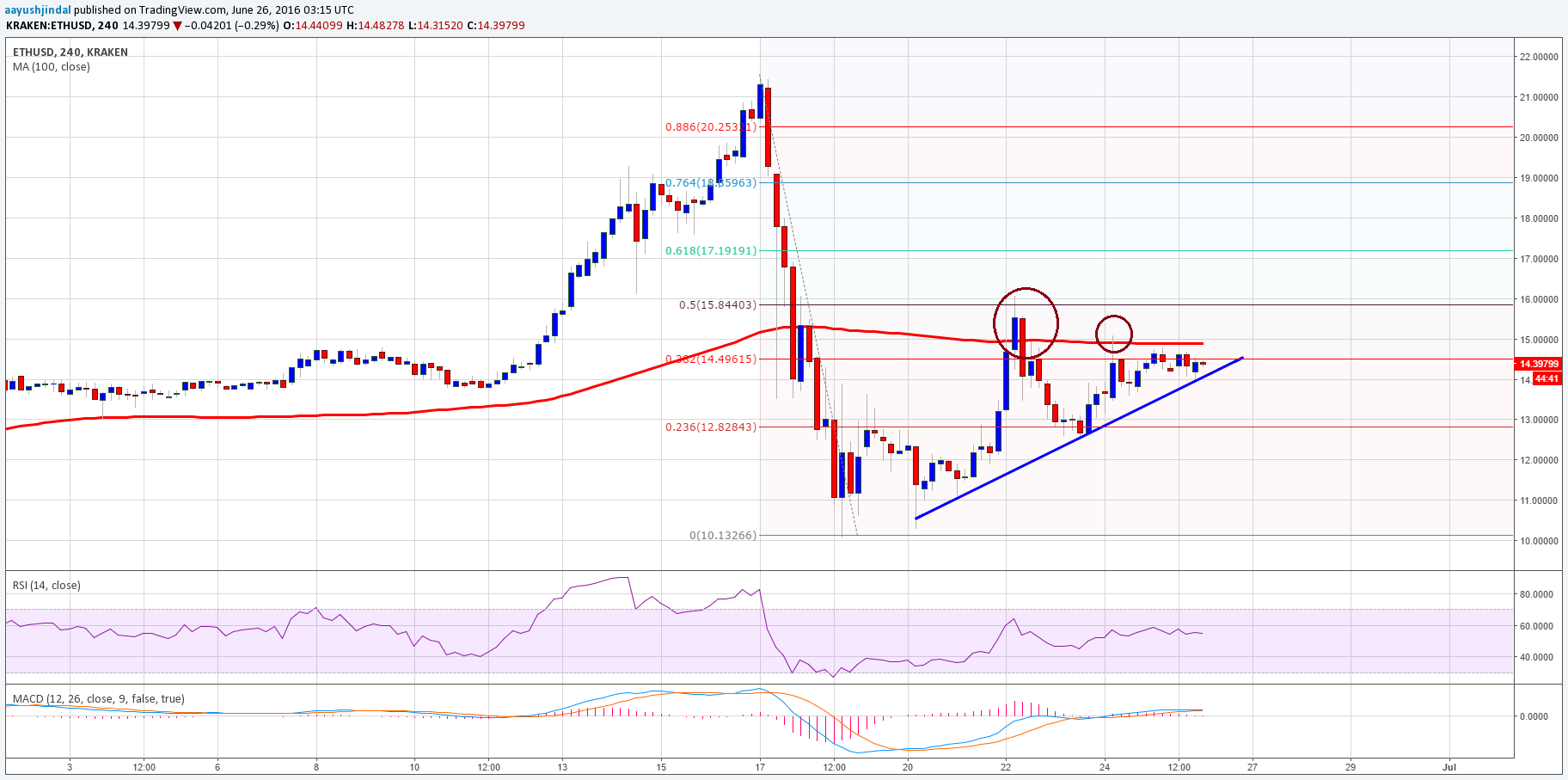

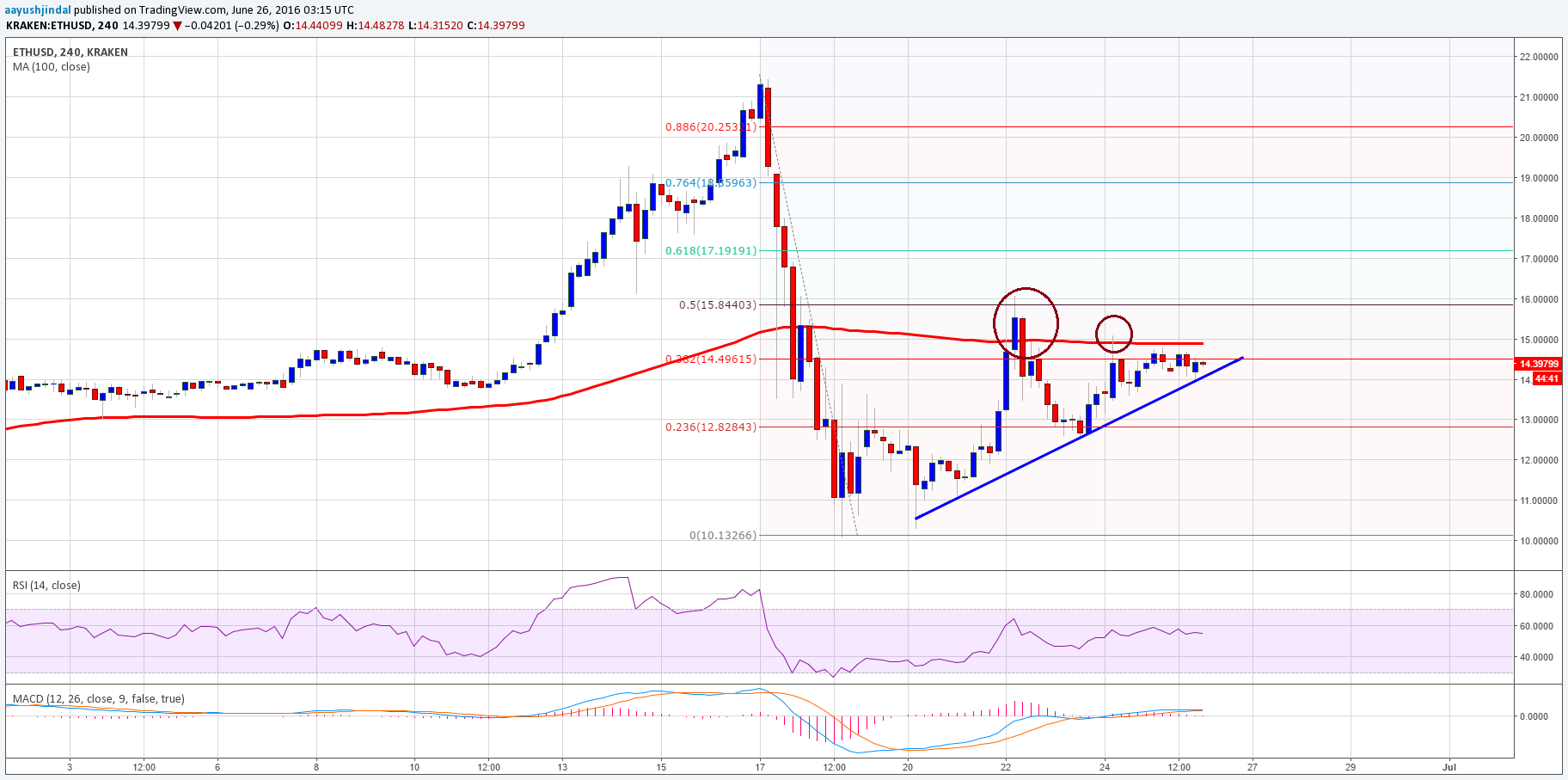

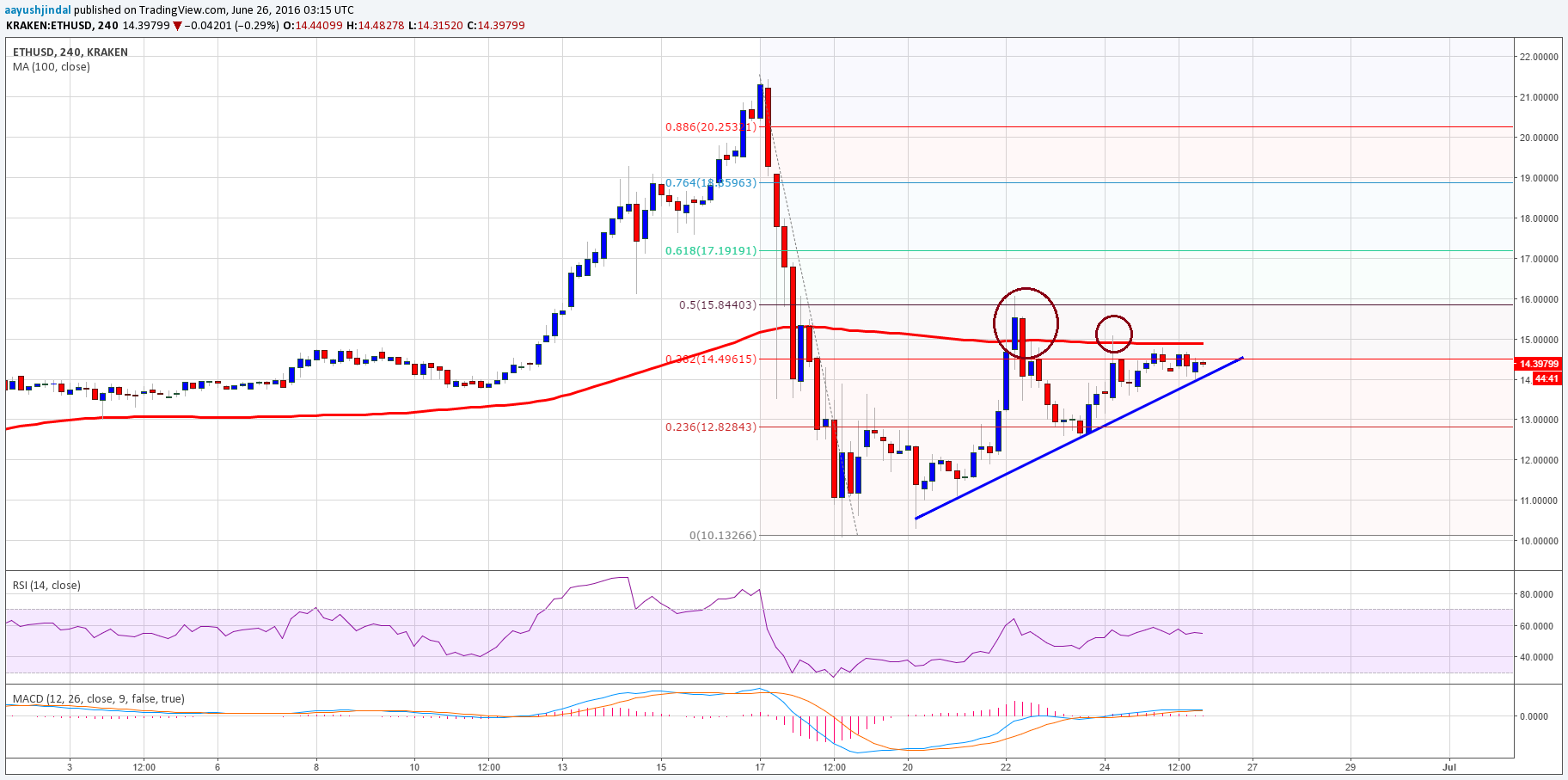

Analyzing Ethereum's price charts reveals compelling bullish signals. Recent candlestick patterns, such as bullish engulfing patterns and hammer candles, suggest a shift in market sentiment. Furthermore, key moving averages like the 50-day and 200-day MA are converging, often a precursor to significant price movements. The Relative Strength Index (RSI) is showing signs of breaking above oversold territory, while the Moving Average Convergence Divergence (MACD) is exhibiting a bullish crossover, adding further weight to the bullish narrative.

- Key Support and Resistance Levels: Currently, support lies around $1,600, while resistance is positioned near $2,000. A break above $2,000 could trigger a significant price increase.

- Breakout Potential: The current price action suggests a potential breakout above the immediate resistance. Increased trading volume accompanying such a breakout would validate this bullish scenario.

- Volume Trends: Increased trading volume during upward price movements confirms the strength of the rally and suggests sustained buying pressure. Conversely, low volume during price increases could indicate a weaker trend, prone to corrections.

Key Support and Resistance Levels

Identifying and understanding key support and resistance levels is crucial for any Ethereum price prediction. Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels, conversely, represent price points where selling pressure is expected to be stronger, potentially halting upward momentum.

- Past Price Reactions: Historically, Ethereum has bounced back from the $1,600 support level multiple times. This suggests a strong psychological support zone.

- Impact of Breaching Levels: A decisive break above $2,000 resistance could open the path to higher price targets, potentially leading to a significant price rally. Conversely, a break below $1,600 support could trigger further declines.

- Potential Price Targets: Based on technical analysis, short-term price targets range from $2,000 to $2,500, with longer-term targets potentially reaching $3,000 or higher, depending on market conditions and further bullish activity.

Fundamental Factors Driving Ethereum's Bullish Trend

Ethereum Network Upgrades and Developments

Ethereum's ongoing upgrades and developments significantly contribute to its bullish outlook. The Shanghai upgrade, for instance, unlocked staked ETH, increasing liquidity and potentially boosting the price. Furthermore, advancements in scaling solutions like sharding promise to enhance transaction speed and reduce costs, making Ethereum more attractive to users and developers.

- Enhanced Transaction Speed and Reduced Costs: Upgrades directly improve the user experience, making Ethereum more competitive against other blockchain networks.

- Increased Network Security: Network upgrades often enhance the security and stability of the Ethereum blockchain, increasing investor confidence.

- Effect on Developer Activity and dApp Growth: Improvements attract more developers, leading to increased decentralized application (dApp) development, furthering the adoption and value of Ethereum.

Growing Adoption of Ethereum in DeFi and NFTs

The flourishing DeFi and NFT ecosystems on Ethereum are key drivers of its price appreciation. Ethereum's robust and secure platform has become the preferred choice for many DeFi protocols and NFT marketplaces.

- Growth of DeFi Protocols: The total value locked (TVL) in Ethereum-based DeFi protocols continues to grow, indicating strong demand and adoption.

- Growth of NFT Marketplaces: Ethereum remains a dominant force in the NFT market, with leading marketplaces like OpenSea operating on its blockchain.

- Correlation Between Growth and ETH Price: The continued growth in DeFi and NFT activity directly correlates with increased demand for ETH, driving up its price.

Macroeconomic Factors and Institutional Interest

While cryptocurrency markets are often volatile, broader macroeconomic factors and increasing institutional interest play a significant role in shaping Ethereum's price.

- Inflation and Interest Rates: Changes in inflation and interest rates can impact investor sentiment toward riskier assets like cryptocurrencies, influencing the Ethereum price.

- Regulatory Changes: Government regulations and policies concerning cryptocurrencies can significantly influence market dynamics and impact the ETH price.

- Institutional Investments and Partnerships: Growing institutional investment and partnerships with major corporations lend credibility to Ethereum, potentially driving price appreciation.

Potential Upside Targets for Ethereum Price

Short-Term Price Targets

Based on the current technical and fundamental analysis, short-term price targets for Ethereum range from $2,000 to $2,500.

- Justification: This prediction is supported by bullish chart patterns, positive indicator readings, and the ongoing positive developments within the Ethereum ecosystem.

- Potential Resistance Levels: The $2,000 level presents a significant resistance point. Breaking through this level would strengthen the bullish outlook and potentially push prices towards $2,500.

Long-Term Price Targets

Looking ahead, the long-term price potential for Ethereum is significant, given its position as a leading blockchain platform and the continuous growth of the Ethereum ecosystem.

- Assumptions: These long-term predictions assume continued adoption of Ethereum in DeFi, NFTs, and other emerging technologies. They also account for ongoing network upgrades and increased institutional interest.

- Impact of Future Advancements and Adoption: Widespread adoption and future technological advancements could drive Ethereum's price significantly higher over the long term, potentially reaching $3,000 and beyond.

Conclusion

This Ethereum price analysis highlights a bullish outlook driven by a confluence of technical and fundamental factors. Positive chart patterns, improving indicators, network upgrades, and growing adoption in DeFi and NFTs suggest a strong potential for price appreciation. Short-term price targets range from $2,000 to $2,500, while long-term projections are significantly higher, depending on market conditions and future developments. While conducting your own research is crucial before investing, this Ethereum price analysis suggests significant potential returns for those considering investing in Ethereum. Start your Ethereum investment journey today! Learn more about Ethereum price predictions and potential returns through further in-depth Ethereum price analysis.

Featured Posts

-

Partly Cloudy Skies Your Guide To Todays Weather

May 08, 2025

Partly Cloudy Skies Your Guide To Todays Weather

May 08, 2025 -

Ethereum Price Analysis Bullish Activity And Upside Targets

May 08, 2025

Ethereum Price Analysis Bullish Activity And Upside Targets

May 08, 2025 -

Arsenal Psg Macini Sifresiz Canli Izlemenin Yollari

May 08, 2025

Arsenal Psg Macini Sifresiz Canli Izlemenin Yollari

May 08, 2025 -

New X Men Comic Reveals Rogues Cyclops Inspired Power

May 08, 2025

New X Men Comic Reveals Rogues Cyclops Inspired Power

May 08, 2025 -

Get A Sneak Peek Kryptos Role In The New Superman Movie

May 08, 2025

Get A Sneak Peek Kryptos Role In The New Superman Movie

May 08, 2025