Ethereum Price Analysis: Resilience And Potential For Growth

Table of Contents

Recent Ethereum Price Performance and Market Trends

The Ethereum price has experienced significant fluctuations in recent months. Analyzing the ETH price history reveals periods of both substantial gains and corrections, reflecting the overall cryptocurrency market sentiment. Let's examine some key moments:

- Reached $1,700 on [Date]: This marked a significant increase following [mention specific event, e.g., a positive regulatory development or a major network upgrade].

- Dipped to $1,200 on [Date]: This drop coincided with [mention specific event, e.g., a broader market sell-off triggered by macroeconomic factors or negative news regarding the crypto space].

- Recent upward trend: Since [Date], the Ethereum price has shown signs of recovery, potentially driven by [mention specific factors like increased DeFi activity or positive news regarding the Ethereum ecosystem].

[Insert a graph or chart visualizing the Ethereum price fluctuations over the relevant period. Clearly label the axes and highlight key price points mentioned above. This visual representation enhances understanding and improves SEO by making the article more engaging.]

Analyzing the recent ETH price action in conjunction with broader market trends is crucial for predicting future movements. The Ethereum price chart often mirrors the overall crypto market sentiment, but its unique characteristics and ecosystem also contribute to its independent price fluctuations.

Factors Influencing Ethereum Price Volatility

Several factors contribute to the Ethereum volatility, impacting the Ethereum price prediction. These include both macroeconomic conditions and elements specific to the Ethereum ecosystem.

- Global economic conditions: Inflationary pressures and fears of a recession can significantly impact investor risk appetite, affecting the price of all risk assets, including cryptocurrencies like Ethereum.

- Regulatory developments: Changes in government regulations concerning cryptocurrencies can trigger significant price swings. Positive regulatory clarity tends to boost prices, while negative news can lead to sell-offs.

- Bitcoin's price movements: Bitcoin often acts as a bellwether for the entire crypto market. Positive price action in Bitcoin frequently leads to a positive correlation in the Ethereum price, and vice versa.

- Adoption rate of decentralized applications (dApps): The increasing adoption and usage of decentralized applications built on the Ethereum network directly impacts the demand for ETH, influencing its price. High dApp usage generally correlates with higher Ethereum price levels.

The Role of Ethereum's Ecosystem in Price Growth

The thriving Ethereum ecosystem is a significant driver of price growth. The success of decentralized applications (dApps) and Non-Fungible Tokens (NFTs) built on Ethereum directly impacts its value.

- Growth of decentralized finance (DeFi): The explosive growth of DeFi applications on Ethereum, involving lending, borrowing, and yield farming, creates significant demand for ETH.

- Popularity and market cap of Non-Fungible Tokens (NFTs): The popularity of NFTs on Ethereum boosts demand and contributes significantly to the Ethereum price. The high transaction volume related to NFTs directly impacts the network's activity and, subsequently, the price of ETH.

- Development and adoption of Layer-2 scaling solutions: Layer-2 solutions address scalability issues on Ethereum, improving transaction speeds and reducing costs. This enhances the network's functionality and attracts more users, indirectly benefiting the Ethereum price.

- The influence of Ethereum Improvement Proposals (EIPs) and network upgrades: Continuous improvements and upgrades to the Ethereum network, like those proposed through EIPs, improve efficiency and scalability, contributing to long-term price growth. Successful implementations often lead to positive price action.

Technical Analysis of Ethereum Price

While not a definitive predictor, technical analysis offers valuable insights into potential price movements. Examining key indicators can help to identify potential support and resistance levels.

- Support levels: These are price points where buying pressure is expected to outweigh selling pressure, potentially preventing further declines.

- Resistance levels: These are price points where selling pressure is expected to outweigh buying pressure, potentially hindering further upward movements.

- Moving averages: Moving averages (e.g., 50-day and 200-day) smooth out price fluctuations, revealing potential trends. Crossovers of these averages can signal potential shifts in momentum.

- Technical patterns: Identifying technical patterns, like head and shoulders or triangles, can provide additional clues about potential future price movements. However, it's important to remember that these patterns are not foolproof and should be considered alongside other factors.

Analyzing the Ethereum technical analysis, particularly the ETH support levels and ETH resistance levels, provides a complementary perspective to the fundamental analysis discussed earlier.

Long-Term Potential and Future Outlook for Ethereum

Based on the factors analyzed, the Ethereum price shows considerable potential for long-term growth. Several key drivers contribute to this positive outlook.

- Continued adoption of Ethereum in various sectors: As more businesses and organizations adopt Ethereum-based solutions, demand for ETH is likely to increase, driving price appreciation.

- The potential impact of Ethereum 2.0 and future upgrades: The transition to Ethereum 2.0 and future upgrades promise enhanced scalability and efficiency, potentially making Ethereum an even more attractive platform for developers and users. The anticipated positive effects of Ethereum 2.0 price impact could be significant.

- The role of institutional investment: Increased institutional investment in Ethereum could significantly boost its price. As larger players enter the market, their demand for ETH is likely to drive prices higher.

The Ethereum future price is likely to be influenced by a complex interplay of these long-term factors. While predicting the exact ETH long-term forecast is impossible, the overall outlook remains positive.

Conclusion

This Ethereum price analysis reveals a complex interplay of factors influencing ETH's value. While short-term Ethereum price fluctuations are inevitable, the robust ecosystem, ongoing development, and increasing adoption point to a strong potential for long-term growth. Understanding these factors is critical for navigating the Ethereum market successfully. Continue to monitor the Ethereum price and stay informed about key developments to make informed investment decisions. Regularly review our Ethereum price analysis for updated insights and strategic guidance.

Featured Posts

-

Nuggets Westbrook Leads Happy Birthday Performance For Jokic

May 08, 2025

Nuggets Westbrook Leads Happy Birthday Performance For Jokic

May 08, 2025 -

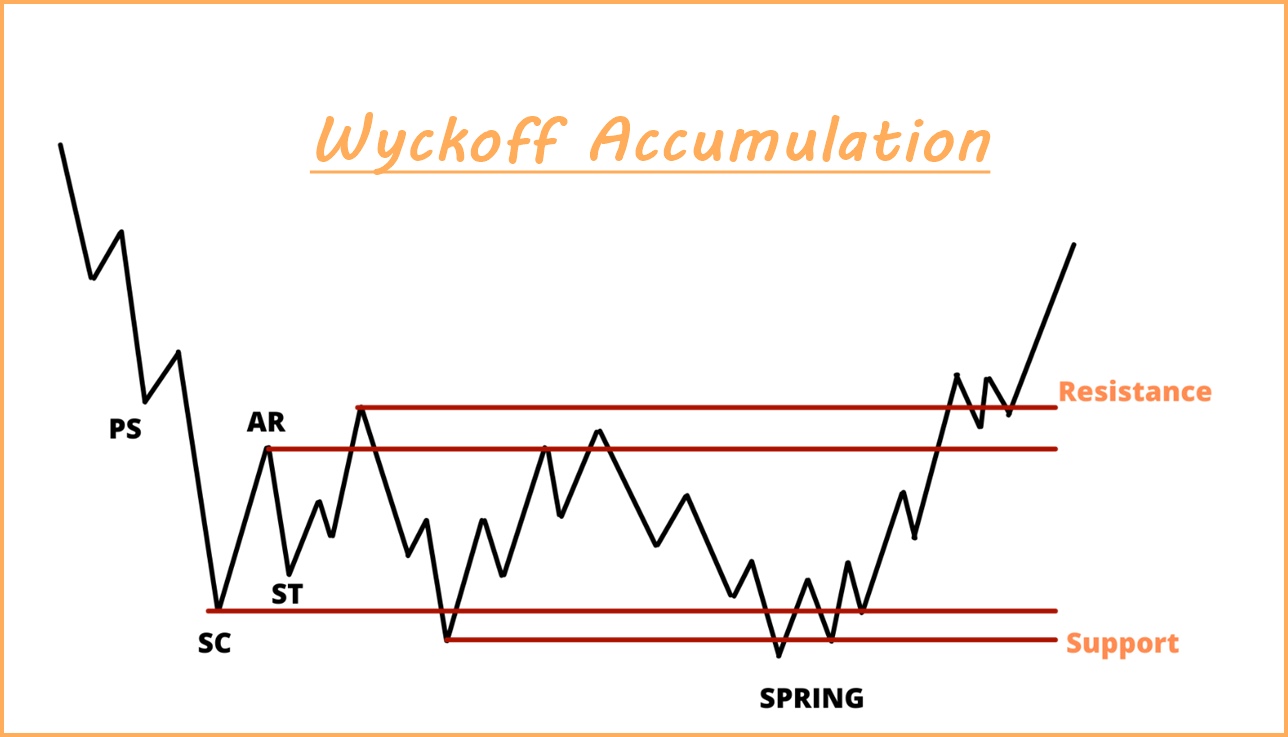

Ethereum Nears 2 700 Wyckoff Accumulation Analysis

May 08, 2025

Ethereum Nears 2 700 Wyckoff Accumulation Analysis

May 08, 2025 -

Thunder Vs Trail Blazers March 7th Game Time Tv Channel And Live Stream

May 08, 2025

Thunder Vs Trail Blazers March 7th Game Time Tv Channel And Live Stream

May 08, 2025 -

Kripto Para Mirasi Kayip Sifrelerin Yasal Sonuclari

May 08, 2025

Kripto Para Mirasi Kayip Sifrelerin Yasal Sonuclari

May 08, 2025 -

The Great Decouplings Impact On Businesses And Investors

May 08, 2025

The Great Decouplings Impact On Businesses And Investors

May 08, 2025