Ethereum Nears $2,700: Wyckoff Accumulation Analysis

Table of Contents

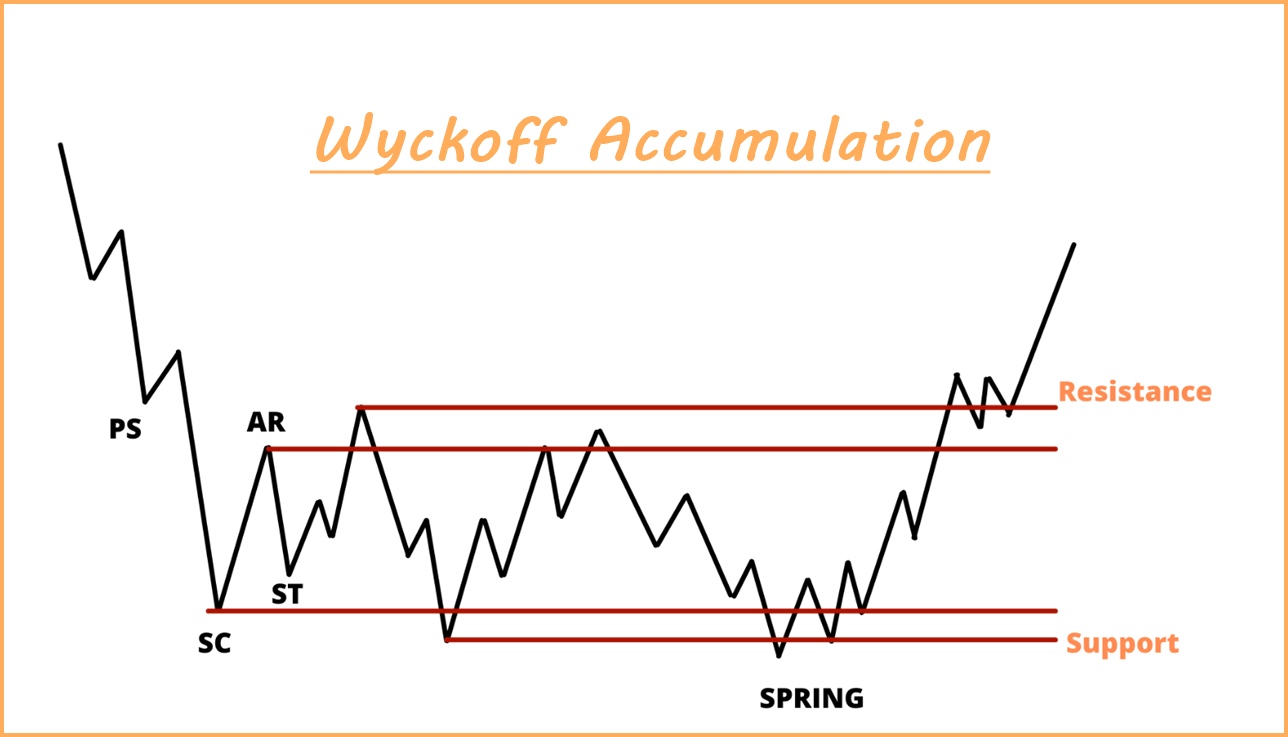

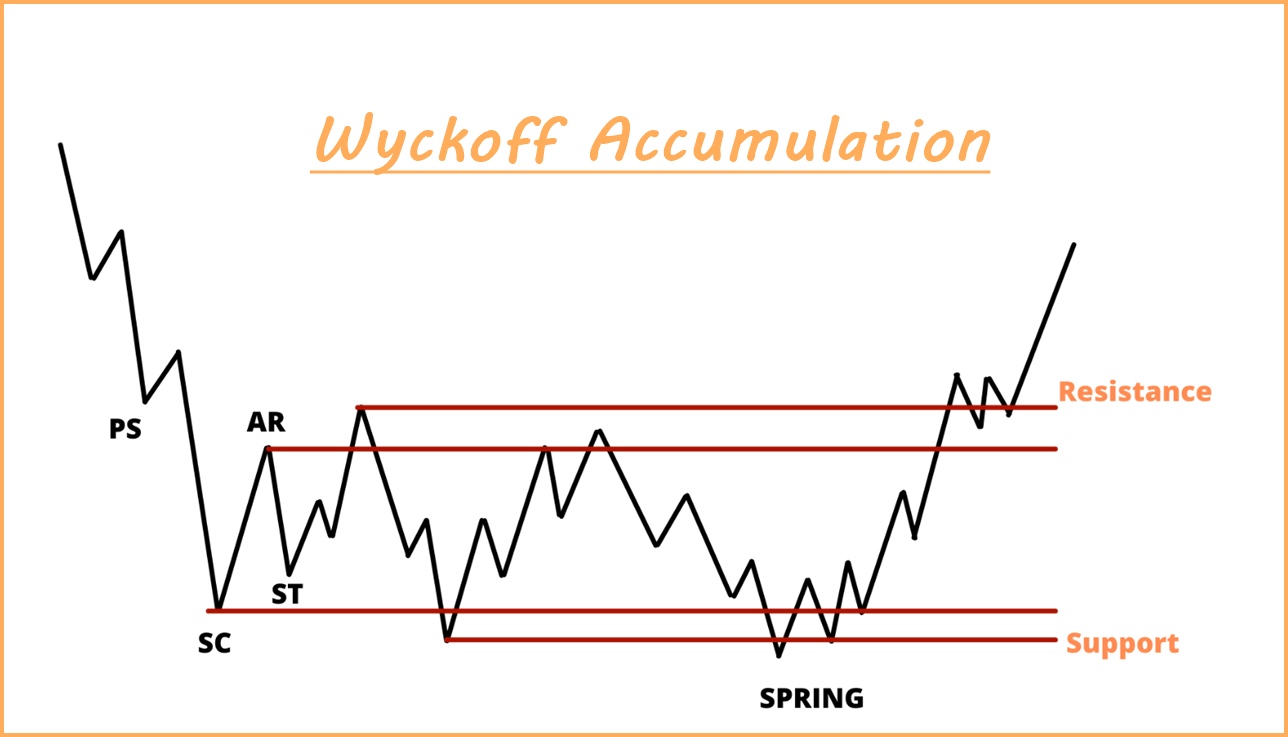

Understanding Wyckoff Accumulation in Ethereum's Price Chart

What is Wyckoff Accumulation?

The Wyckoff method is a technical analysis technique used to identify potential price reversals in financial markets. It focuses on understanding the market's behavior, specifically the interplay between supply and demand, to anticipate significant price movements. Unlike many other methods that focus solely on price, Wyckoff analysis incorporates volume and market sentiment to provide a more holistic view. Key phases in a Wyckoff Accumulation include:

- Spring: A small test of the support level designed to shake out weak holders.

- Sign of Weakness (SOW): A slight decline in price accompanied by a decrease in volume, indicating weakening selling pressure.

- Sign of Strength (SOS): A rally in price with increased volume, signalling a potential shift in market sentiment.

- Last Point of Support (LPS): The final test of support before a significant price increase.

- Markup: The phase where the price begins a substantial upward trend.

Visual aids, like annotated charts depicting these phases, would significantly improve understanding. Keywords: Wyckoff schematics, Wyckoff phases, Wyckoff analysis, price reversal, support and resistance.

Identifying Potential Wyckoff Accumulation Signs in Ethereum:

Analyzing Ethereum's recent price action reveals several potential indicators of Wyckoff Accumulation. (Insert a relevant chart here showing Ethereum's price action). Note the period of sideways trading, characterized by relatively low volume and a lack of significant price breakthroughs. This consolidation phase might represent the accumulation phase within the Wyckoff model. Key observations:

- Support Levels: The price consistently bounced off a crucial support level (specify the level from the chart), suggesting strong buying pressure at that point.

- Low Volume: The relatively low trading volume during this sideways period further supports the accumulation hypothesis. High volume during a price drop typically indicates strong selling pressure, but this hasn't been the case here.

- Price Consolidation: The extended period of sideways movement indicates a balance between buyers and sellers, a typical characteristic of the accumulation phase. Keywords: Ethereum chart analysis, Ethereum support levels, Ethereum trading volume, sideways trading, price consolidation.

Potential Buying Climax and Subsequent Testing of Support

A buying climax, a critical aspect of Wyckoff Accumulation, signifies a period of intense buying pressure often followed by a slight pullback. In Ethereum's case (refer to the chart), a potential buying climax could be identified around (specify the date/price range from the chart). This was followed by a retest of the previously established support level. The strength of the bounce off this support level would be a crucial indicator of the accumulation phase’s validity. Keywords: Buying climax, Ethereum support, price action, technical analysis.

Analyzing the Ethereum Market Sentiment and Volume

Market Sentiment Analysis:

The overall market sentiment towards Ethereum has been cautiously optimistic recently. Positive news regarding developments in the Ethereum ecosystem, such as increased DeFi activity and network upgrades, has contributed to this sentiment. However, broader macroeconomic factors and the overall crypto market volatility must be considered. Keywords: Ethereum market sentiment, crypto news, Ethereum market analysis, investor sentiment.

Volume Analysis:

Volume plays a crucial role in confirming a Wyckoff Accumulation pattern. (Insert a chart showing Ethereum trading volume). The relatively low volume during the sideways price movement, as previously discussed, supports the accumulation thesis. A subsequent increase in volume during a price increase would be a strong confirmation signal. Keywords: Ethereum trading volume, volume analysis, on-chain analysis.

Potential Implications and Risk Assessment

Upside Potential:

If the Wyckoff Accumulation pattern plays out successfully, Ethereum could see a significant price increase. Potential price targets could be projected based on various technical analysis methods, including Fibonacci retracements and previous resistance levels. (Mention potential price targets with caution and clearly state their speculative nature.)

Downside Risk:

It's crucial to acknowledge the inherent risks. The pattern may fail to materialize, leading to a price decline. External factors, such as regulatory changes or broader market downturns, could also negatively impact Ethereum's price.

Risk Management Strategies:

Traders should employ appropriate risk management techniques. This includes using stop-loss orders to limit potential losses and diversifying their portfolios. Never invest more than you can afford to lose. Keywords: Ethereum price prediction, risk management, stop-loss orders, trading strategy.

Conclusion: Ethereum's Future and the Wyckoff Accumulation Hypothesis

Our analysis suggests that Ethereum might be undergoing a Wyckoff Accumulation phase. The observed sideways price movement, low volume, and support level tests align with this pattern. However, confirming this hypothesis requires further observation and monitoring of price action and volume. The potential upside is significant, but considerable downside risk exists. Therefore, it's crucial to conduct thorough due diligence before making any investment decisions. Conduct your own thorough research on Ethereum and the Wyckoff method before making any investment decisions. Keep monitoring the Ethereum price for confirmation of this potential Wyckoff accumulation pattern. Keywords: Ethereum investment, Ethereum trading, Wyckoff accumulation confirmation, cryptocurrency investment.

Featured Posts

-

Ethereums Crucial Support Will The Price Fall To 1 500 A Price Prediction

May 08, 2025

Ethereums Crucial Support Will The Price Fall To 1 500 A Price Prediction

May 08, 2025 -

Microsoft Activision Merger Ftcs Appeal And Potential Outcomes

May 08, 2025

Microsoft Activision Merger Ftcs Appeal And Potential Outcomes

May 08, 2025 -

Sony Ps 5 Pro Disassembly Examining The Liquid Metal Cooling Implementation

May 08, 2025

Sony Ps 5 Pro Disassembly Examining The Liquid Metal Cooling Implementation

May 08, 2025 -

Save With Uber One Now Available In Kenya With Exclusive Deals

May 08, 2025

Save With Uber One Now Available In Kenya With Exclusive Deals

May 08, 2025 -

2 000 Ethereum Price A Realistic Target After Recent Gains

May 08, 2025

2 000 Ethereum Price A Realistic Target After Recent Gains

May 08, 2025