Ethereum Price Resilience: Upside Potential Ahead

Table of Contents

Ethereum's Technological Advancements Fueling Price Resilience

Ethereum's technological superiority is a cornerstone of its price resilience. Several significant advancements have solidified its position as a leading blockchain platform, attracting developers and investors alike.

The Ethereum Merge and its Impact

The successful transition to a proof-of-stake (PoS) consensus mechanism, often referred to as "the Merge" or "Ethereum 2.0," marked a pivotal moment in Ethereum's history. This upgrade drastically reduced energy consumption, making it significantly more environmentally friendly. Furthermore, the move to PoS has improved transaction speeds and enhanced network security.

- Reduced energy consumption: The shift to PoS reduced Ethereum's energy footprint by over 99%, addressing a major criticism of proof-of-work blockchains.

- Improved transaction speeds: PoS has led to faster transaction finality and increased throughput, improving the overall user experience.

- Enhanced network security: The PoS mechanism strengthens the network's security by requiring validators to stake a significant amount of ETH, deterring malicious actors.

- Positive environmental impact: The dramatic reduction in energy consumption has significantly improved Ethereum's environmental sustainability.

These improvements are not just technical feats; they are fundamental factors contributing to Ethereum's long-term value and its price resilience in a volatile market.

Layer-2 Scaling Solutions

Network congestion and high transaction fees (gas fees) were once significant hurdles for Ethereum. However, the emergence of Layer-2 scaling solutions has dramatically addressed these challenges. Projects like Optimism, Arbitrum, and Polygon offer faster and cheaper transactions by processing them off the main Ethereum blockchain.

- Increased transaction throughput: Layer-2 solutions significantly increase the number of transactions Ethereum can process per second.

- Lower gas fees: Users benefit from drastically reduced transaction costs, making Ethereum more accessible to a wider audience.

- Improved user experience: Faster and cheaper transactions create a smoother and more enjoyable user experience, attracting both individuals and businesses.

The success of these Layer-2 solutions is a testament to Ethereum's adaptability and its commitment to improving its scalability.

Growing DeFi Ecosystem

Ethereum is the undisputed king of decentralized finance (DeFi). The sheer breadth and depth of the DeFi ecosystem built on Ethereum are unparalleled. This vibrant ecosystem is a powerful driver of Ethereum's price resilience and future growth.

- Number of DeFi applications: Thousands of decentralized applications (dApps) operate on Ethereum, offering a wide range of financial services.

- Total Value Locked (TVL): The total value locked in DeFi protocols on Ethereum remains substantial, indicating significant user confidence and investment.

- Innovative DeFi products: The Ethereum DeFi ecosystem is constantly innovating, introducing new and creative financial products and services.

Increased Institutional Adoption and Investor Confidence

The growing adoption of Ethereum by institutional investors and the increased confidence within the developer community further bolster its price resilience.

Gradual Institutional Inflow

Major financial institutions are increasingly recognizing the potential of Ethereum. This institutional inflow is a significant indicator of long-term price stability and future growth.

- Examples of institutional adoption: Several large investment firms and hedge funds have publicly announced significant investments in Ethereum.

- Increased investment in ETH: Institutional investors are increasingly allocating a portion of their portfolios to ETH, driving demand and price support.

- Positive sentiment from financial analysts: Many reputable financial analysts are expressing positive sentiment towards Ethereum, citing its technological advancements and growing adoption.

Growing Developer Activity

The number of active developers working on Ethereum is a strong indicator of its long-term viability and potential. A thriving developer community ensures continuous improvement and innovation within the ecosystem.

- Statistics on developer activity: Data consistently shows a high level of developer activity on the Ethereum network.

- Number of projects built on Ethereum: The number of projects built on Ethereum continues to grow rapidly, signifying its appeal to developers.

- Community engagement: A strong and engaged community is essential for the long-term health and growth of the Ethereum ecosystem.

Addressing Challenges and Mitigating Risks

While Ethereum exhibits remarkable resilience, it's crucial to acknowledge and address potential challenges.

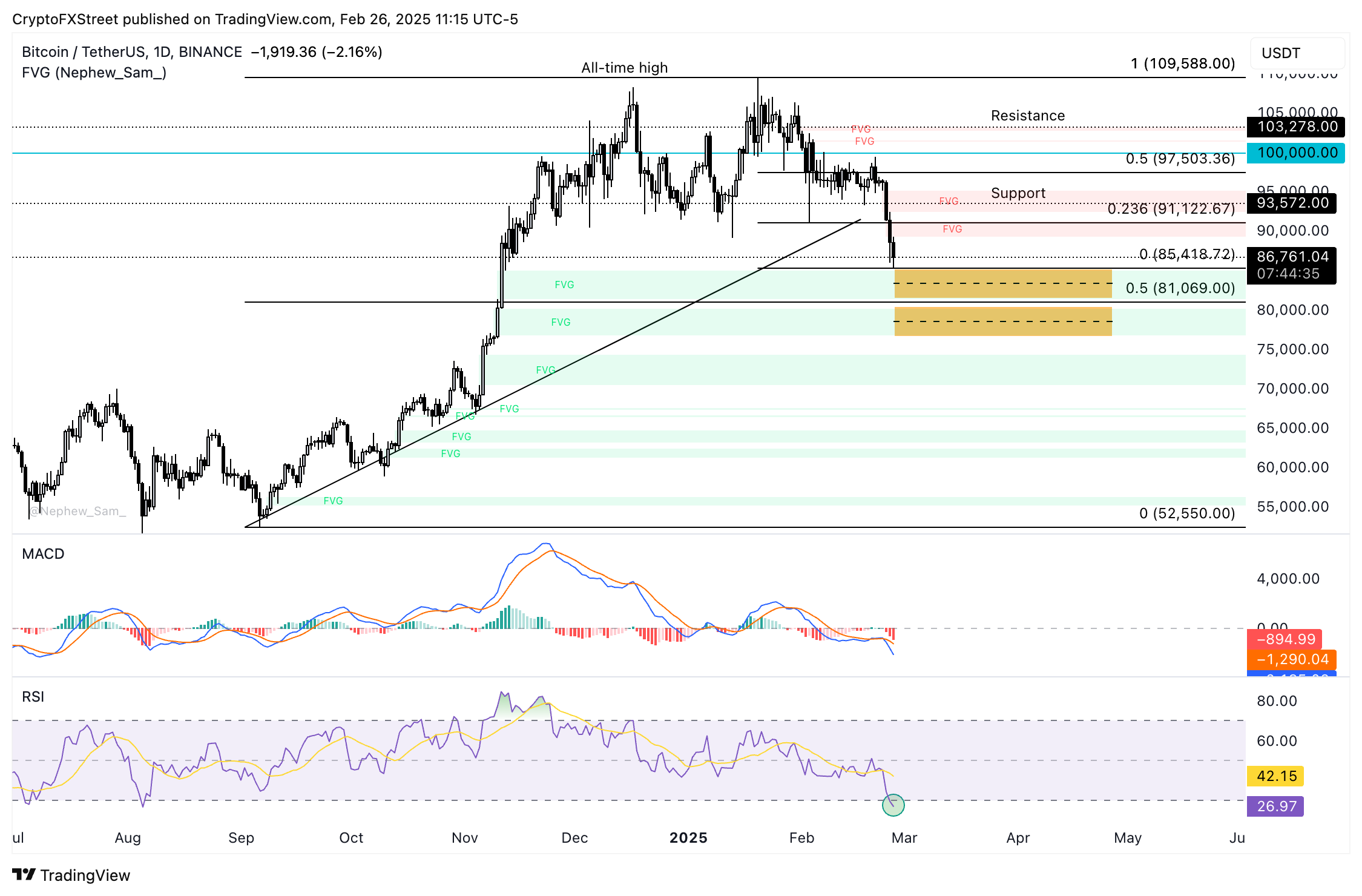

Price Volatility

The cryptocurrency market is inherently volatile. While Ethereum is relatively resilient compared to other cryptocurrencies, price fluctuations are inevitable.

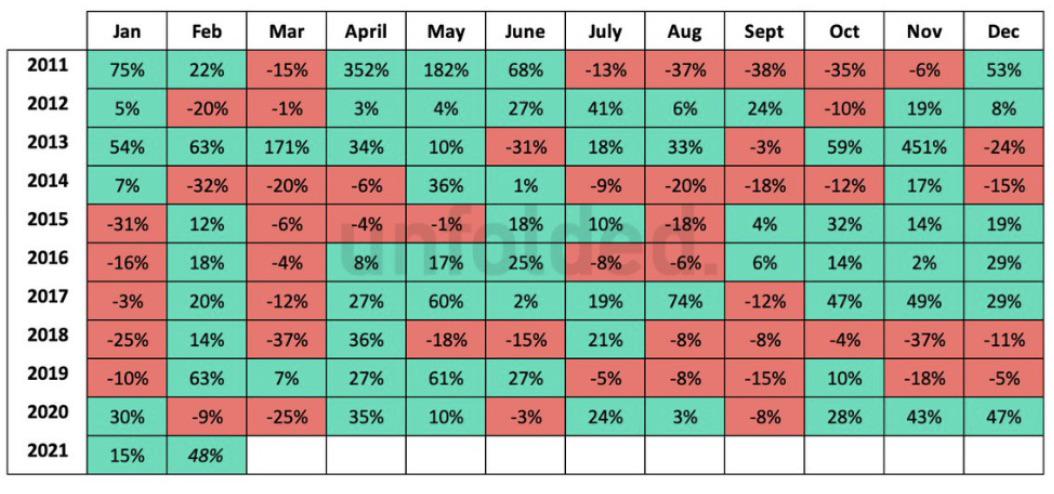

- Historical price data: Analyzing past price movements can help investors understand the potential for future volatility.

- Comparison to other cryptocurrencies: Comparing Ethereum's price volatility to that of other cryptocurrencies provides valuable context.

- Risk management strategies: Investors should employ appropriate risk management strategies to mitigate potential losses.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, creating uncertainty. However, Ethereum's adaptability suggests it can navigate these regulatory challenges.

- Regulatory developments: Staying informed about ongoing regulatory developments is crucial for investors and developers.

- Potential impacts: Understanding the potential impacts of new regulations on Ethereum is essential for risk assessment.

- Industry response: The cryptocurrency industry is actively engaging with regulators to shape a fair and conducive regulatory environment.

Conclusion

Ethereum's technological advancements, growing adoption by institutional investors and developers, and demonstrable resilience in the face of challenges suggest a strong potential for future price appreciation. The successful Ethereum Merge, the flourishing DeFi ecosystem, and the ever-increasing number of Layer-2 scaling solutions all contribute to a robust and promising future for Ethereum. Understanding Ethereum price resilience is crucial for navigating the dynamic cryptocurrency market. Further research into Ethereum's technological advancements and growing ecosystem can help you make informed decisions about its potential as an investment. Stay updated on the latest developments surrounding Ethereum price resilience to capitalize on future opportunities.

Featured Posts

-

Ethereum Price Prediction Buy Signal Flashes On Weekly Chart

May 08, 2025

Ethereum Price Prediction Buy Signal Flashes On Weekly Chart

May 08, 2025 -

Greenland Under Increased Us Intelligence Scrutiny

May 08, 2025

Greenland Under Increased Us Intelligence Scrutiny

May 08, 2025 -

Lotto 6aus49 Ziehung Mittwoch 9 April 2025 Die Aktuellen Ergebnisse

May 08, 2025

Lotto 6aus49 Ziehung Mittwoch 9 April 2025 Die Aktuellen Ergebnisse

May 08, 2025 -

Bitcoin Buying Volume On Binance A Six Month Low Broken

May 08, 2025

Bitcoin Buying Volume On Binance A Six Month Low Broken

May 08, 2025 -

Arsenal Manager Arteta Under Fire Collymores Criticism

May 08, 2025

Arsenal Manager Arteta Under Fire Collymores Criticism

May 08, 2025