Ethereum's Crucial Support: Will The Price Fall To $1,500? A Price Prediction

Table of Contents

Analyzing Ethereum's Current Market Conditions

Macroeconomic Factors and Their Impact on ETH

Global economic uncertainty significantly impacts cryptocurrency markets. Inflation, interest rates, and recession fears directly influence investor risk appetite. High inflation often prompts central banks to raise interest rates, making riskier assets like cryptocurrencies less attractive.

- Impact of Recession Fears: A looming recession could lead to investors liquidating holdings, potentially pushing ETH prices lower.

- Regulatory Changes: Stringent regulations in various jurisdictions can dampen investor enthusiasm and impact the Ethereum price.

- Institutional Investment: Increased institutional adoption can provide substantial support to the ETH price, mitigating the effects of negative macroeconomic factors.

[Insert relevant chart showing correlation between macroeconomic indicators (e.g., inflation, interest rates) and ETH price]. This illustrates the close relationship between global economic health and the Ethereum price. Understanding this correlation is vital for accurate Ethereum price prediction.

The State of the Ethereum Network and Development

The Ethereum network's health and ongoing development play a crucial role in its price. Upgrades like the Shanghai upgrade, enabling ETH withdrawals from staking, impact the circulating supply and can influence price.

- Network Activity: High transaction volumes and active developer community signal a thriving ecosystem, potentially boosting the ETH price.

- Transaction Fees (Gas Prices): Lower gas prices make Ethereum more accessible and attractive, positively influencing its price.

- Upcoming Upgrades: Anticipated upgrades and improvements to scalability and efficiency could act as catalysts for price increases. The anticipation of these improvements can also influence the Ethereum price prediction.

The successful execution and adoption of future upgrades will be pivotal in shaping future ETH price movements and thus any reliable Ethereum price prediction.

Sentiment Analysis and Market Psychology

Investor sentiment significantly impacts cryptocurrency prices. Fear, Uncertainty, and Doubt (FUD) can drive down prices, while positive news and hype can lead to rallies. Analyzing social media trends and news coverage provides valuable insights.

- FUD Factors: Negative news, regulatory concerns, or security breaches can create FUD, suppressing the ETH price.

- Positive News Catalysts: Successful network upgrades, partnerships, or increased institutional adoption can boost investor confidence and drive price increases.

- Overall Market Mood: The general sentiment in the broader cryptocurrency market significantly influences ETH's price.

[Insert data from sentiment analysis tools showcasing current investor sentiment towards Ethereum]. This data provides valuable context when assessing the potential for an ETH price fall to $1500.

Technical Analysis of Ethereum's Price Chart

Identifying Key Support and Resistance Levels

Technical analysis helps identify potential price movements by examining historical data and technical indicators. Support and resistance levels indicate price points where buying or selling pressure is expected to be strong.

- Moving Averages: Moving averages can help identify trends and potential reversals, providing signals for buying or selling.

- Support and Resistance Lines: These lines indicate price levels where the price has historically struggled to break through, acting as potential support or resistance.

- $1500 Support Level: This level is crucial; a break below it could signal further downside. However, it also represents a potential buying opportunity for those anticipating a bounce.

[Insert relevant charts and graphs visualizing the technical analysis, clearly marking the $1500 support level and other key indicators]. Visual representation enhances understanding and clarifies the potential price scenarios.

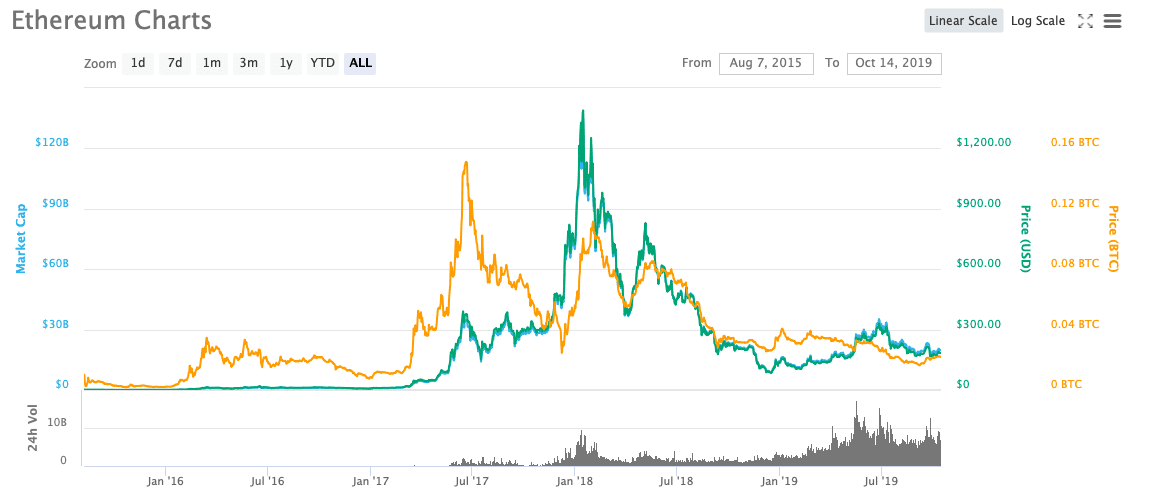

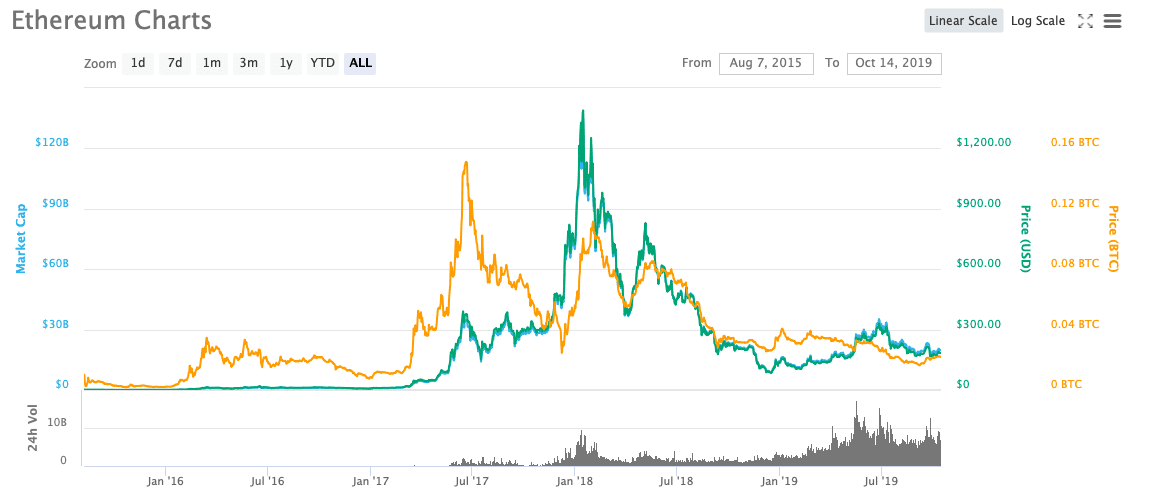

Evaluating Historical Price Trends and Patterns

Studying past price behavior helps identify patterns that could predict future movements. Analyzing past bull and bear cycles reveals recurring trends and potential turning points.

- Past Bull and Bear Cycles: Examining the duration and intensity of past cycles helps gauge the potential duration and depth of any future bear market.

- Periods of Consolidation: Periods of sideways price movement (consolidation) can signal a period of accumulation before a significant price change.

- Notable Price Events: Analyzing past events that caused significant price spikes or drops helps assess potential triggers for future price changes.

Comparing past trends with the current market conditions helps to refine any Ethereum price prediction.

Alternative Price Scenarios and Probabilities

Bullish Scenario (ETH price above $1500)

A bullish scenario suggests that several positive factors could push ETH's price above $1500.

- Positive Developments: Successful network upgrades, increased institutional adoption, and positive macroeconomic shifts could drive price appreciation.

- Driving Forces: Strong investor sentiment, positive news coverage, and increased demand could propel the price above the $1500 mark.

- Likely Price Targets: Depending on the strength of the bullish momentum, price targets could range from $1800 to significantly higher levels.

Bearish Scenario (ETH price falls below $1500)

Conversely, a bearish scenario outlines factors that could push ETH below the $1500 support.

- Negative Developments: Negative regulatory changes, a prolonged bear market in the broader crypto space, or a major security incident could lead to price drops.

- Potential Support Levels Below $1500: Identifying potential support levels below $1500 helps gauge the potential depth of any price decline.

- Risk Assessment: Investors should assess their risk tolerance before investing in volatile assets like ETH.

Neutral Scenario (ETH price consolidates around $1500)

A neutral scenario involves price consolidation around the $1500 support level.

- Reasons for Consolidation: This could be due to a lack of strong bullish or bearish catalysts, resulting in a period of sideways trading.

- Timeframes: Consolidation periods can last for weeks or even months, depending on various factors.

- Possible Outcomes: This period of consolidation could eventually resolve into a bullish breakout or a bearish breakdown.

Conclusion

Analyzing Ethereum's current market conditions, technical indicators, and potential price scenarios indicates the possibility of the ETH price falling to $1500. However, the probability of each scenario depends on various factors. While a drop to $1500 is possible, a bullish breakout or sideways consolidation are also realistic outcomes. Remember, the cryptocurrency market is inherently volatile. This analysis provides insight but should not be considered financial advice.

Call to action: Stay informed about Ethereum price movements and conduct thorough research before making any investment decisions. Continue monitoring Ethereum's price and support levels for further updates on this crucial support level and the potential for future price movements. Learn more about Ethereum price predictions and strategies by [linking to relevant resources].

Featured Posts

-

Ray Epps V Fox News Analyzing The January 6th Falsehoods Lawsuit

May 08, 2025

Ray Epps V Fox News Analyzing The January 6th Falsehoods Lawsuit

May 08, 2025 -

Istoriska Pobeda Na Pik Seged Protiv Pariz Sen Zhermen Vo L Sh

May 08, 2025

Istoriska Pobeda Na Pik Seged Protiv Pariz Sen Zhermen Vo L Sh

May 08, 2025 -

Taiwan Dollars Surge A Call For Economic Reform

May 08, 2025

Taiwan Dollars Surge A Call For Economic Reform

May 08, 2025 -

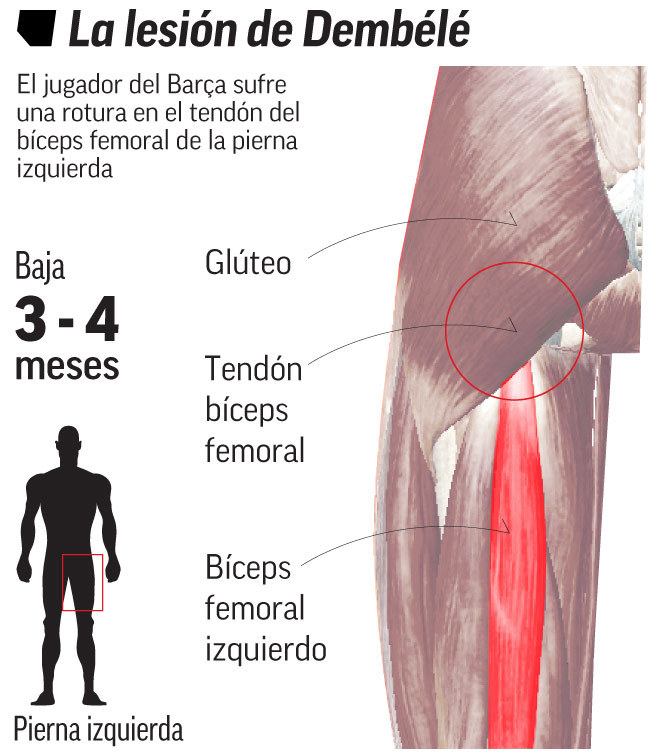

Arsenal News Dembele Injury Blow Throws Artetas Plans Into Disarray

May 08, 2025

Arsenal News Dembele Injury Blow Throws Artetas Plans Into Disarray

May 08, 2025 -

El Psg Se Impone A Lyon En Un Encuentro Disputado En Casa Del Lyon

May 08, 2025

El Psg Se Impone A Lyon En Un Encuentro Disputado En Casa Del Lyon

May 08, 2025