Taiwan Dollar's Surge: A Call For Economic Reform

Table of Contents

Factors Contributing to the Taiwan Dollar's Surge

Several interconnected factors have contributed to the recent appreciation of the Taiwan dollar. These factors highlight Taiwan's economic strengths but also underscore the need for strategic adjustments.

Increased Foreign Investment

A significant influx of foreign investment, particularly in the technology sector, is a major driver of the Taiwan dollar's strength. Taiwan's robust semiconductor industry, coupled with government incentives, has attracted substantial investment from global tech giants. This increased demand for the Taiwan dollar to facilitate these investments directly boosts its value.

- Semiconductor industry growth: Taiwan's dominance in semiconductor manufacturing continues to attract massive investments.

- Tech giants' investments: Companies like TSMC and other key players draw significant foreign direct investment (FDI).

- Government incentives attracting foreign capital: Strategic government policies further encourage foreign investment in high-tech sectors.

Strong Export Performance

Taiwan's impressive export performance is another key factor underpinning the strong Taiwan dollar. The global demand for Taiwanese electronics, coupled with competitive pricing and strong global trade relationships, has fueled export growth and increased demand for the Taiwanese currency.

- Global demand for electronics: Taiwan remains a crucial player in the global electronics supply chain.

- Competitive pricing of Taiwanese goods: Taiwanese manufacturers maintain a competitive edge in global markets.

- Strong global trade relationships: Strategic trade partnerships contribute to robust export volumes.

Interest Rate Differentials

Interest rate differentials between Taiwan and other major economies also play a role. The Central Bank of China (CBC)'s monetary policy, including interest rate decisions, influences capital flows. Higher interest rates in Taiwan compared to some other countries attract foreign capital seeking higher returns, thus increasing demand for the Taiwan dollar.

- Central Bank of China (CBC) monetary policy: The CBC's policies directly impact interest rates and capital flows.

- Comparison with interest rates in other major economies: Relative interest rate differences attract or repel foreign investment.

- Attraction of foreign capital seeking higher returns: Higher interest rates make Taiwan an attractive investment destination.

Potential Negative Impacts of a Strong Taiwan Dollar

While a strong Taiwan dollar reflects positive economic fundamentals, its rapid appreciation presents potential downsides that require careful management.

Reduced Export Competitiveness

A strong Taiwan dollar makes Taiwanese exports more expensive in global markets, potentially reducing their competitiveness. This can lead to a decline in export volumes and negatively impact overall economic growth. Strategies to mitigate this include diversification of export markets and enhancing product value.

- Loss of market share to competitors: Higher prices can result in losing market share to competitors with weaker currencies.

- Impact on manufacturing sector profits: Reduced export volumes directly affect the profitability of Taiwanese manufacturers.

- Need for diversification of export markets: Expanding into new markets lessens reliance on price competitiveness.

Impact on Domestic Industries

A strong Taiwan dollar also makes imported goods cheaper, increasing competition for domestic industries. This can harm less competitive local businesses, potentially leading to job losses and requiring government intervention to protect vulnerable sectors.

- Increased competition from imported goods: Cheaper imports can displace locally produced goods.

- Need for government subsidies or protectionist measures: Government support might be needed to level the playing field.

- Potential job losses in affected industries: Businesses unable to compete may be forced to downsize or close, resulting in job losses.

Necessary Economic Reforms

To mitigate the potential negative consequences of the strong Taiwan dollar and ensure sustainable economic growth, several crucial reforms are needed.

Diversification of the Economy

Reducing over-reliance on specific sectors, such as semiconductors, is paramount. Investing in and promoting growth in other industries, such as tourism, renewable energy, and biotechnology, is vital for long-term economic stability. This diversification will create new avenues for growth and reduce vulnerability to shocks in any single sector.

- Investment in renewable energy infrastructure: Transitioning to a green economy creates new opportunities.

- Support for high-tech startups: Fostering innovation in diverse sectors is essential.

- Development of tourism sector: Diversifying the economy reduces reliance on specific industries.

Investment in Human Capital

Investing in education and training is crucial for enhancing workforce skills and boosting productivity. A highly skilled workforce can better adapt to changing economic conditions and compete in a globalized market, effectively countering the negative impacts of a strong Taiwan dollar.

- Increased investment in education and vocational training: A well-educated workforce is essential for competitiveness.

- Attracting and retaining skilled workers: Competitive salaries and attractive working conditions are necessary.

- Promoting lifelong learning: Adaptability to technological advancements is crucial for future success.

Conclusion

The surge of the Taiwan dollar presents both opportunities and challenges. While a strong currency reflects economic strength, its rapid appreciation necessitates proactive measures to ensure sustainable growth. By diversifying the economy, investing in human capital, and implementing strategic reforms, Taiwan can mitigate the potential negative impacts of the strong Taiwan dollar and secure a prosperous future. Addressing these issues decisively is crucial for managing the Taiwan dollar's value and fostering long-term economic prosperity. The future of the Taiwan dollar and Taiwan's economic health hinges on effective economic reform. Understanding and addressing these challenges is crucial for navigating the future of the Taiwanese currency and ensuring sustained economic growth.

Featured Posts

-

The Next Superman Movie Predictions Based On James Gunns Dcu Plans

May 08, 2025

The Next Superman Movie Predictions Based On James Gunns Dcu Plans

May 08, 2025 -

Xrp Price Prediction Post Sec Lawsuit Analysis And Future Outlook

May 08, 2025

Xrp Price Prediction Post Sec Lawsuit Analysis And Future Outlook

May 08, 2025 -

Four More Human Smugglers Arrested In Latest Fia Operation

May 08, 2025

Four More Human Smugglers Arrested In Latest Fia Operation

May 08, 2025 -

Westbrook Trade Buzz A Nuggets Players Reaction

May 08, 2025

Westbrook Trade Buzz A Nuggets Players Reaction

May 08, 2025 -

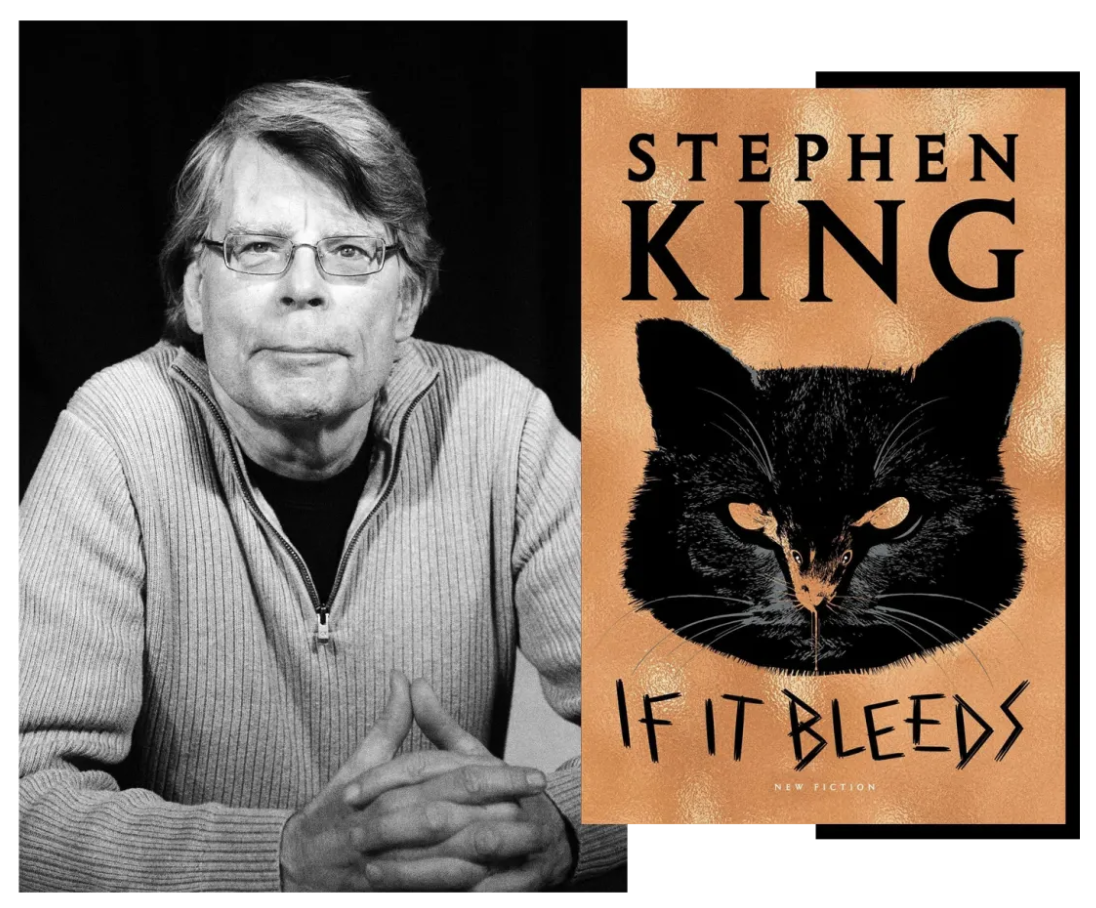

New Movie The Life Of Chuck Gets Stephen Kings Seal Of Approval

May 08, 2025

New Movie The Life Of Chuck Gets Stephen Kings Seal Of Approval

May 08, 2025