EU To Phase Out Russian Gas: Spot Market In Focus

Table of Contents

The Urgency of Diversification: Moving Beyond Russian Gas Dependence

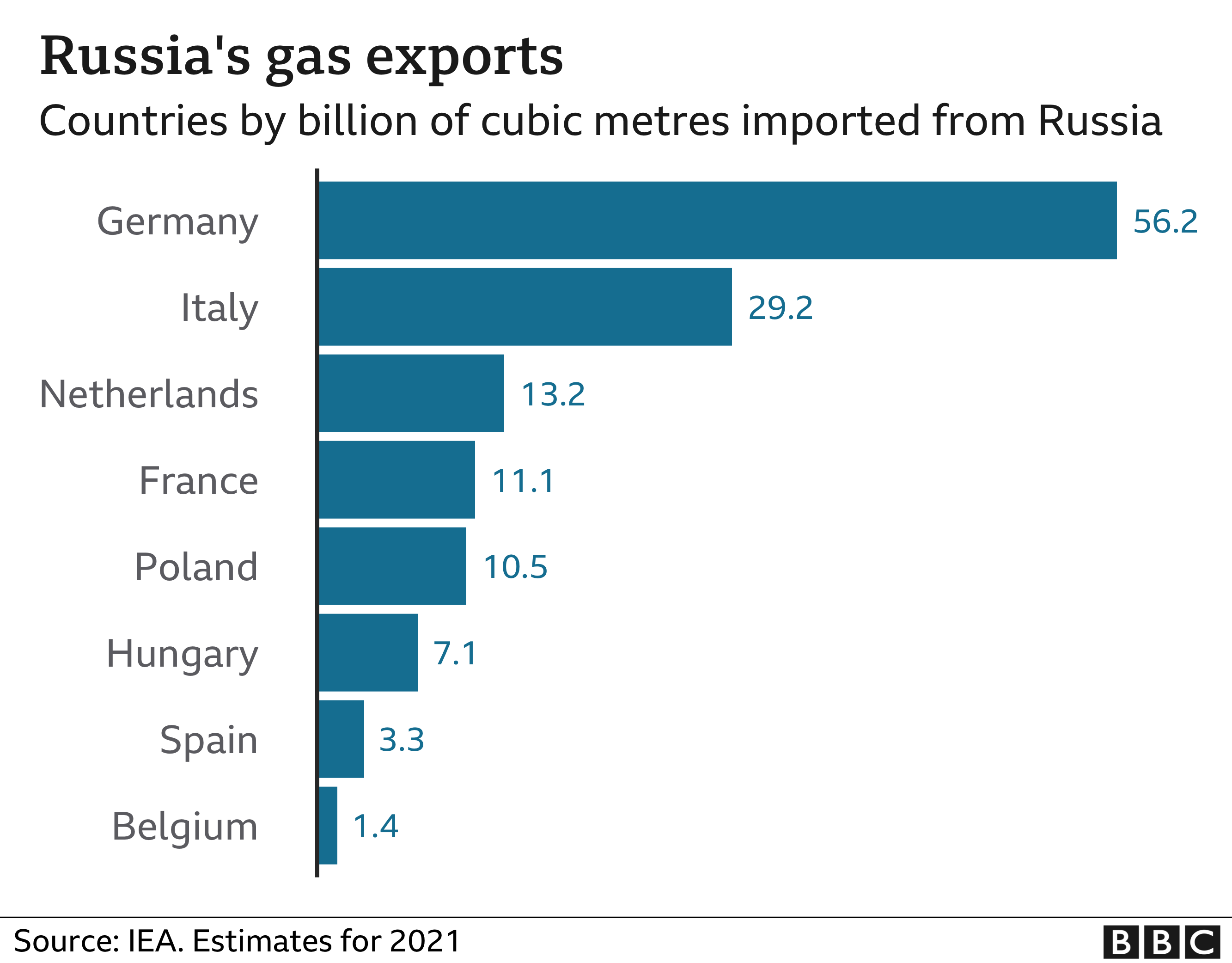

The EU's reliance on Russian gas has long been a vulnerability. The current geopolitical climate has underscored the urgent need for diversification and a reduction in dependence on a single supplier. This necessitates a multifaceted strategy focusing on securing alternative sources and bolstering energy independence.

Exploring Alternative Suppliers:

The EU is actively pursuing diverse energy sources to replace Russian gas, including:

- Increased LNG imports: The US, Qatar, and other LNG-producing nations are becoming crucial partners, with increased LNG shipments to Europe. This involves expanding regasification terminal capacity and securing long-term supply contracts.

- Expansion of pipeline infrastructure: Strengthening existing pipeline connections with Norway and other European partners is vital for ensuring a reliable and diversified gas supply. This includes upgrading existing infrastructure and exploring new pipeline projects.

- Accelerated development of renewable energy sources: Wind, solar, and other renewable energy sources are crucial for long-term energy security and reducing reliance on fossil fuels. This involves significant investment in renewable energy infrastructure and technology, alongside policy support for renewable energy adoption.

Challenges of Diversification:

Transitioning away from Russian gas is not without its obstacles:

- Increased competition for LNG supplies: The increased global demand for LNG is driving up prices and creating competition among importing nations. Securing sufficient LNG supplies requires proactive engagement with global producers.

- Significant investment required in new infrastructure development: Expanding LNG import terminals, upgrading pipelines, and developing renewable energy infrastructure requires substantial financial investment and logistical planning.

- Potential geopolitical risks associated with relying on new suppliers: Diversifying supply sources introduces new geopolitical considerations, requiring careful assessment and management of potential risks associated with new partnerships.

The EU's diversification strategy involves a multi-pronged approach requiring substantial investment, international cooperation, and technological advancements. Short-term price volatility is expected, and strategic planning is essential for navigating this transition.

The Rise of the Spot Market: Navigating Price Volatility and Supply Uncertainty

The EU Russian gas phase-out has significantly increased the importance of the spot market, characterized by short-term contracts and fluctuating prices. This presents both risks and opportunities for energy buyers and sellers alike.

Understanding Spot Market Dynamics:

The spot market is inherently volatile, with prices influenced by several factors:

- Global supply and demand: Global energy demand, coupled with supply constraints, directly impacts spot prices. Unexpected disruptions to supply chains further exacerbate price volatility.

- Weather patterns: Extreme weather events can significantly impact energy production and consumption, leading to price swings in the spot market.

- Geopolitical events: Geopolitical instability and international relations play a crucial role in shaping market dynamics and price fluctuations.

Risk Management Strategies for Businesses:

Businesses dependent on natural gas must adapt to the increased volatility of the spot market. Effective risk management is paramount:

- Implementing robust risk management plans: This includes incorporating price hedging strategies, such as purchasing futures contracts, to mitigate price risk.

- Diversification of supply sources: Reducing reliance on a single supplier by securing gas from multiple sources helps to reduce vulnerability to supply disruptions.

- Investing in energy efficiency measures: Improving energy efficiency reduces overall gas consumption, minimizing exposure to price fluctuations.

- Exploring alternative fuels and technologies: Switching to alternative fuels or investing in energy-efficient technologies can reduce dependence on natural gas.

The spot market’s volatility demands proactive risk management strategies. Businesses need to carefully evaluate their exposure and adjust accordingly to ensure business continuity.

The Impact on EU Energy Policy and Security

The EU Russian gas phase-out is fundamentally reshaping EU energy policy and security. The transition requires a comprehensive strategy to strengthen energy independence and resilience.

Strengthening Energy Independence:

The EU aims to significantly enhance its energy independence and resilience against future disruptions:

- Diversifying energy sources: Reducing reliance on a single supplier through the diversification of energy sources is critical. This includes expanding LNG imports, strengthening pipeline connections, and increasing renewable energy generation.

- Improving infrastructure: Investing in modern and efficient energy infrastructure, including gas storage facilities, pipelines, and renewable energy grids, is essential for security of supply.

- Promoting energy efficiency: Improving energy efficiency across various sectors reduces overall energy demand, enhancing the EU's energy security.

- Strengthening regional cooperation: Collaboration among EU member states on energy policy, infrastructure development, and resource sharing is critical for achieving energy independence.

The Role of Renewable Energy:

Renewable energy sources are central to the EU's long-term energy security and sustainability goals:

- Accelerating the deployment of renewable energy: Investing in renewable energy generation capacity is key to reducing dependence on fossil fuels.

- Investing in renewable energy infrastructure and technology: This involves significant investments in renewable energy technologies, grids, and storage solutions.

- Policy support and incentives: Policy frameworks, including financial incentives and regulatory support, are crucial to encourage the rapid adoption of renewable energy technologies.

The EU's long-term energy security hinges on a transition to a more diversified and sustainable energy mix, with a significant focus on renewable energy.

Conclusion

The EU's phase-out of Russian gas is a transformative undertaking with significant implications for the global energy market. The increasing prominence of the spot market underscores the need for robust risk management strategies and a diversified energy portfolio. By accelerating its transition to renewable energy sources and strengthening its energy independence, the EU can effectively navigate this challenge and build a more secure and sustainable energy future. Understanding the complexities of the EU Russian gas phase-out and the dynamics of the spot market is crucial for all stakeholders. Stay informed and proactively develop strategies to mitigate risks and ensure a secure energy supply for your business or organization.

Featured Posts

-

Instagram Launches Rival Video Editor To Attract Tik Tok Creators

Apr 24, 2025

Instagram Launches Rival Video Editor To Attract Tik Tok Creators

Apr 24, 2025 -

Tesla Q1 Earnings Net Income Plunges 71 Amidst Political Headwinds

Apr 24, 2025

Tesla Q1 Earnings Net Income Plunges 71 Amidst Political Headwinds

Apr 24, 2025 -

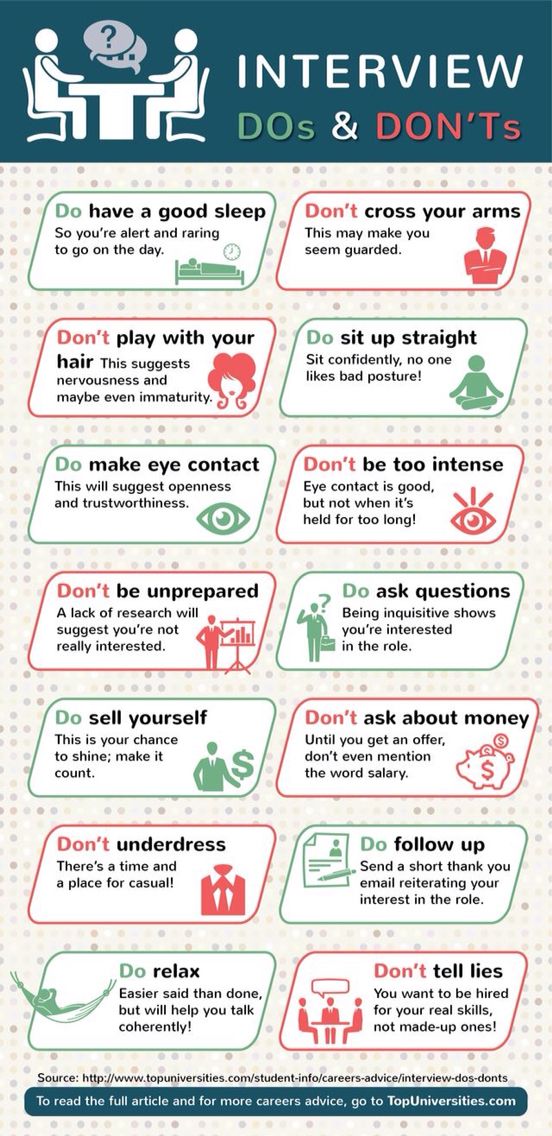

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 24, 2025 -

Open Ai To Acquire Google Chrome Chat Gpt Chiefs Bold Claim

Apr 24, 2025

Open Ai To Acquire Google Chrome Chat Gpt Chiefs Bold Claim

Apr 24, 2025 -

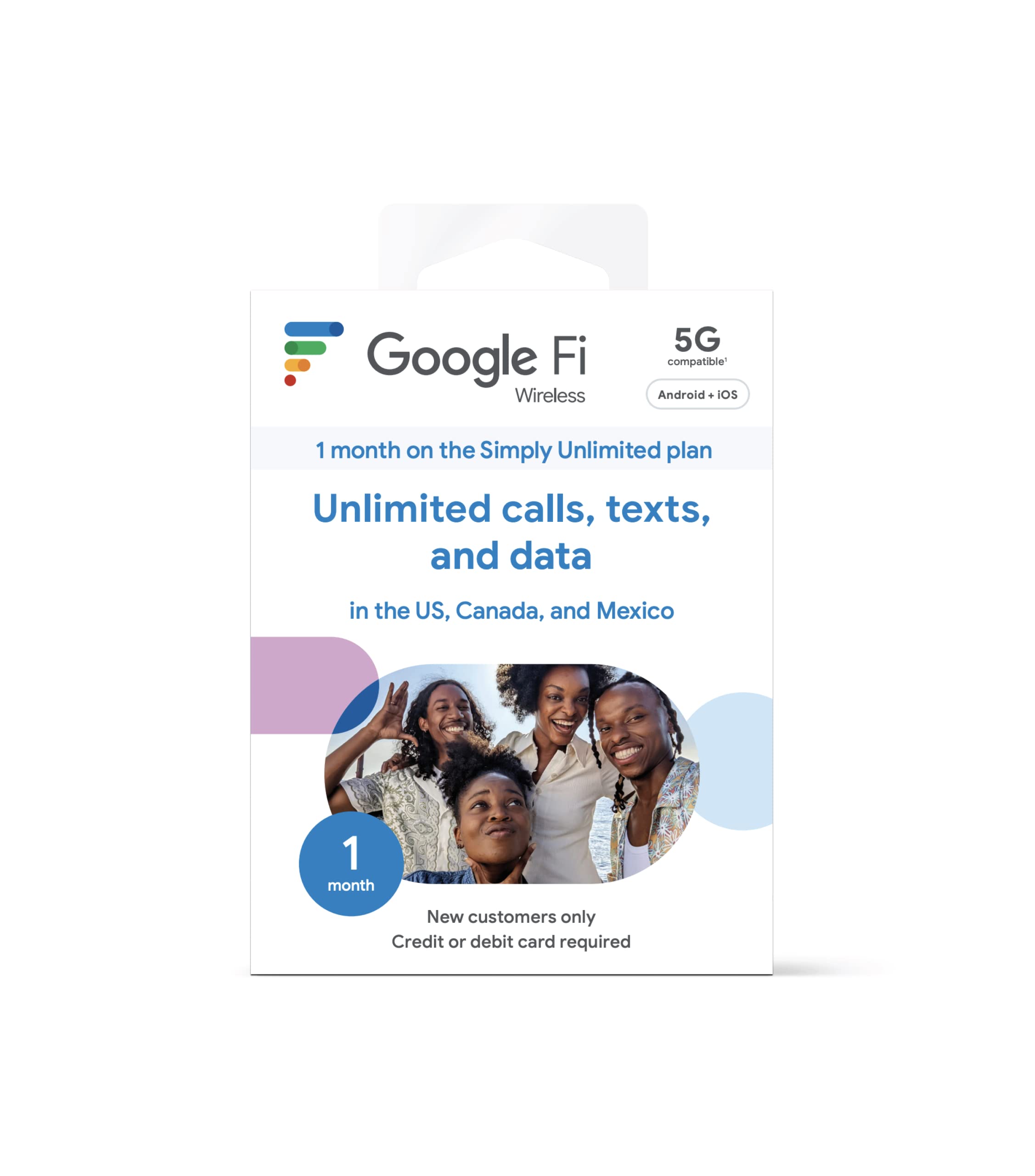

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025