Extreme Price Hike: AT&T Challenges Broadcom's VMware Acquisition Plan

Table of Contents

AT&T's Concerns Regarding Price Increases

The Alleged "Extreme Price Hike"

AT&T's central concern revolves around the anticipated significant price increases for VMware products and services post-acquisition. They claim the merger would lead to an unacceptable increase in costs, significantly impacting their operations and bottom line.

- Quantifiable Increases: While specific percentage increases haven't been publicly disclosed by AT&T, their statement implies a substantial jump, potentially impacting core VMware offerings like vSphere, vSAN, and NSX.

- Official Statements: AT&T's concerns have been communicated through official channels, although the specifics remain largely undisclosed to avoid compromising their competitive position. This lack of transparency fuels speculation about the magnitude of the potential extreme price hike.

- Operational Impact: These increased costs could force AT&T to cut back on VMware deployments, impacting service delivery and potentially hindering innovation within their infrastructure. The knock-on effect on their customers could be substantial, potentially leading to service disruptions or increased costs passed down the chain.

Impact on AT&T's Competitive Landscape

The potential extreme price hike poses a significant threat to AT&T's competitiveness. Increased costs for VMware solutions could put them at a disadvantage compared to competitors who might utilize alternative virtualization technologies or cloud providers.

- Competitive Disadvantage: Competitors who leverage less expensive virtualization solutions or cloud services could gain a significant price advantage. This could lead to AT&T losing market share in several sectors.

- Price Increases for Customers: To absorb the increased costs associated with the extreme price hike stemming from the VMware acquisition, AT&T might be forced to raise prices for its own services, potentially impacting customer satisfaction and loyalty. This could trigger a domino effect throughout the industry.

- Reduced Innovation: The increased expenditure on VMware products might leave AT&T with less capital to invest in research and development, further hindering their competitiveness in the long run.

Broadcom's Response and Justification

Broadcom's Defense of the Acquisition

Broadcom has defended the acquisition, citing synergies between the two companies and the potential for market expansion. They claim the merger will ultimately benefit customers through innovation and enhanced product offerings.

- Synergies and Expansion: Broadcom highlights potential cost savings through integration and the expansion of their product portfolio into the enterprise software market.

- Pricing Strategy: Broadcom claims its pricing strategy will remain competitive, although they haven't offered specific details. They argue the acquisition will ultimately drive down costs in the long run through increased efficiency.

- Addressing AT&T's Concerns: While Broadcom has acknowledged AT&T's concerns, their response hasn't fully addressed the specific issues surrounding the alleged extreme price hike, leading to ongoing skepticism.

The Potential for Market Consolidation

The acquisition raises concerns about market consolidation and the potential for reduced competition. Broadcom's dominance in several sectors, combined with VMware's leading position in virtualization, could lead to a monopolistic situation.

- Impact on Competitors: Smaller players in the virtualization and enterprise software markets could struggle to compete against a combined Broadcom and VMware entity. This could stifle innovation and limit consumer choice.

- Lack of Choice: The merger could restrict customer options and lead to a decline in the quality of service, potentially resulting in inferior solutions at inflated prices.

- Reduced Innovation: With reduced competition, there's a risk that innovation could suffer, as the combined entity might have less incentive to invest in new technologies and features.

Antitrust Scrutiny and Regulatory Implications

Regulatory Bodies' Role in the Decision

Regulatory bodies, such as the FTC and the EU Commission, are scrutinizing the proposed merger. Their involvement will be crucial in determining whether the acquisition proceeds and under what conditions.

- Ongoing Investigations: Investigations are underway to assess the potential impact of the merger on competition and consumer prices.

- Potential Outcomes: The deal could be approved unconditionally, approved with conditions (such as divestitures), or rejected outright.

- Legal Challenges: AT&T's concerns, and those of other parties, could lead to legal challenges that could further delay or prevent the acquisition.

The Future of VMware and the Tech Industry

The outcome of the AT&T challenge and the regulatory review will significantly impact VMware, Broadcom, and the broader tech industry.

- Deal Approval Scenarios: Approval could lead to increased prices for VMware products, potentially stifling innovation and reducing competition.

- Deal Rejection Scenarios: Rejection could leave VMware independent, preserving competition but potentially limiting Broadcom's market expansion.

- Conditional Approval Scenarios: Conditional approval, requiring divestitures or other concessions, might mitigate some of the antitrust concerns, but the long-term impact remains uncertain. This is particularly relevant in light of the extreme price hike concerns.

Conclusion

AT&T's challenge to Broadcom's VMware acquisition, driven by concerns over an "extreme price hike," highlights significant antitrust concerns and potential disruptions in the tech industry. The outcome will have far-reaching implications for businesses reliant on VMware products and the broader competitive landscape. Further scrutiny by regulatory bodies is crucial to ensure fair pricing and prevent monopolistic practices. The future of this deal and its effect on the tech landscape remains to be seen, but one thing is clear: the alleged extreme price hike sparked by this acquisition is a key factor that needs careful consideration. Stay tuned for further developments in this crucial case of the impact of an extreme price hike on the tech industry. Keep abreast of the latest news and updates surrounding this significant acquisition and its potential impact on VMware pricing.

Featured Posts

-

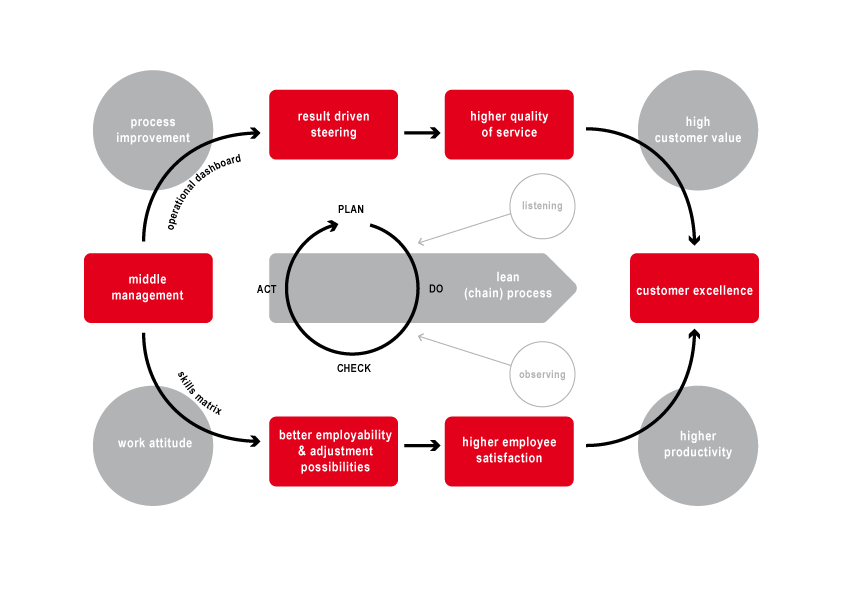

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 24, 2025

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 24, 2025 -

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025 -

Private Credit Jobs 5 Dos And Don Ts To Boost Your Application

Apr 24, 2025

Private Credit Jobs 5 Dos And Don Ts To Boost Your Application

Apr 24, 2025 -

Understanding The Oil Market Price Trends And News April 23 2024

Apr 24, 2025

Understanding The Oil Market Price Trends And News April 23 2024

Apr 24, 2025 -

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

Apr 24, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

Apr 24, 2025