Extreme Price Hike For VMware: AT&T Challenges Broadcom's Acquisition

Table of Contents

AT&T's Concerns Regarding the VMware Price Hike

AT&T's lawsuit against Broadcom centers on the argument that the acquisition will inevitably lead to anti-competitive practices and a substantial increase in VMware licensing costs. Their challenge highlights the potential for Broadcom to leverage its market dominance to stifle competition and extract higher profits from its customers.

- AT&T's Legal Challenge: AT&T's legal action focuses on the assertion that the merger will eliminate a significant competitor and result in less innovation and higher prices for VMware products and services. Their detailed complaint outlines specific concerns about the impact on their own operations and those of other businesses.

- AT&T's Reliance on VMware: AT&T, like many large telecommunications companies, relies heavily on VMware's virtualization technologies for its infrastructure. The potential for increased costs and reduced choice directly impacts their bottom line and operational efficiency.

- Legal Precedents and Likelihood of Success: AT&T's case relies on establishing a clear link between the acquisition and anti-competitive behavior. The success of their challenge hinges on demonstrating to regulatory bodies the substantial harm that the increased VMware pricing and reduced competition will cause. Similar antitrust cases provide both precedent and a framework for the arguments being presented.

The Broadcom-VMware Deal and its Implications for the IT Industry

Broadcom's acquisition strategy often involves consolidating market share in key technology sectors. The VMware acquisition is a prime example of this strategy, aiming to integrate VMware's virtualization and cloud computing capabilities into Broadcom's existing portfolio.

- Broadcom's Acquisition Strategy: Broadcom's aggressive acquisition strategy is well-documented, and the VMware deal represents a significant move to dominate the enterprise software market. Their stated goals often involve increased efficiency and economies of scale, but critics point to potential for reduced competition as a primary driver.

- VMware's Market Position: VMware holds a significant market share in virtualization and cloud computing, making it a highly valuable asset. The acquisition raises concerns about the potential consolidation of power and the impact on businesses who rely on VMware products for their operations.

- Impact on Competition: The merger's impact on competition within the virtualization market is a central concern. Reduced competition could lead to less innovation, fewer choices for businesses, and ultimately higher prices for virtualization solutions.

- Consequences for Businesses: If the deal goes through, businesses currently using VMware products might face higher licensing fees, limited alternatives, and potentially less responsive customer support. The overall cost of their IT infrastructure could increase substantially.

Analyzing the Extreme VMware Price Increase Following the Acquisition Announcement

Since the announcement of the Broadcom-VMware merger, reports have surfaced detailing significant VMware price increases across various products and services. This extreme VMware price hike has fueled concerns about Broadcom's post-acquisition pricing strategy.

- Specific Price Increase Examples: Specific examples of VMware price increases, including percentage increases and affected product lines, should be cited here from reliable sources to support this claim. These examples will strengthen the argument and add credibility.

- Broadcom's Justification: Broadcom’s justifications for these price increases should be analyzed and evaluated against their potential impact on customers. Examining their stated reasons alongside the resulting financial burden will allow for a balanced perspective.

- Financial Burden on Customers: The increased VMware licensing costs can significantly impact businesses' IT budgets, forcing many to reassess their technology strategies and potentially explore alternative solutions. The analysis should explore the potential financial burden on different sized businesses.

- Alternative Virtualization Solutions: The existence and viability of alternative virtualization solutions should be discussed, highlighting how the increased VMware pricing may drive businesses to explore competitive options and potentially foster innovation in the market.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware merger is currently under intense regulatory scrutiny from competition authorities worldwide. The potential for government intervention is significant given the antitrust concerns surrounding the deal and the substantial market power that Broadcom would acquire.

- Regulatory Review Process: A detailed overview of the regulatory processes involved in reviewing such large acquisitions is necessary, including the roles played by different competition authorities (e.g., FTC in the US, CMA in the UK).

- Potential for Regulatory Block: The likelihood of regulatory bodies blocking the acquisition due to antitrust concerns should be assessed, considering the arguments presented by AT&T and other opponents of the deal. Past examples of successful antitrust challenges can provide valuable context.

- Impact of Regulatory Decisions: The potential impact of various regulatory decisions on VMware pricing and competition should be carefully explored. The analysis should cover scenarios where the deal is approved, partially approved, or completely blocked, and how each scenario will affect the market.

Conclusion

This article examined AT&T's challenge to Broadcom's acquisition of VMware, highlighting the significant concerns surrounding the extreme VMware price hike. The potential for reduced competition, the substantial implications for businesses reliant on VMware, and the ongoing regulatory scrutiny are all crucial factors impacting the future of the virtualization market.

Call to Action: Stay informed about the ongoing developments surrounding the Broadcom-VMware acquisition and its impact on VMware pricing. Keep a close watch on further developments regarding the VMware price hike and the challenges to Broadcom's acquisition to understand how this might affect your business. Understanding the implications of this VMware acquisition and the extreme VMware price increases is crucial for businesses in the technology sector, requiring proactive planning and a close eye on alternative solutions.

Featured Posts

-

Riot Platforms Stock Riot A Deep Dive Into Recent Performance

May 02, 2025

Riot Platforms Stock Riot A Deep Dive Into Recent Performance

May 02, 2025 -

The Prisoner Of Azkaban Exploring Chris Columbus Absence From The Film

May 02, 2025

The Prisoner Of Azkaban Exploring Chris Columbus Absence From The Film

May 02, 2025 -

This Country A Travelers Handbook

May 02, 2025

This Country A Travelers Handbook

May 02, 2025 -

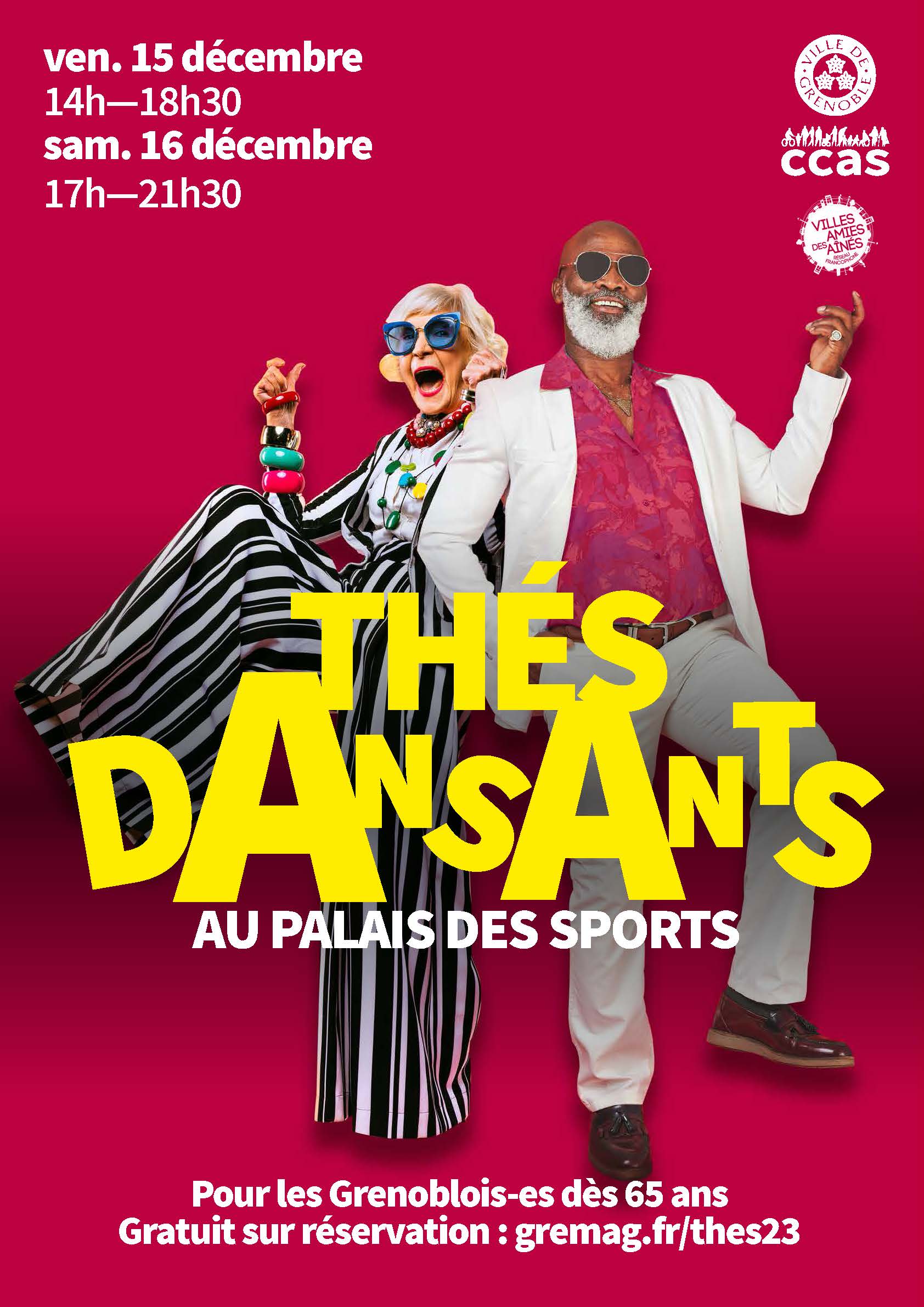

Accompagnement Numerique Pour L Organisation De Thes Dansants

May 02, 2025

Accompagnement Numerique Pour L Organisation De Thes Dansants

May 02, 2025 -

Kampen Start Kort Geding Tegen Enexis Stroom Voor Duurzaam Schoolgebouw In Gevaar

May 02, 2025

Kampen Start Kort Geding Tegen Enexis Stroom Voor Duurzaam Schoolgebouw In Gevaar

May 02, 2025

Latest Posts

-

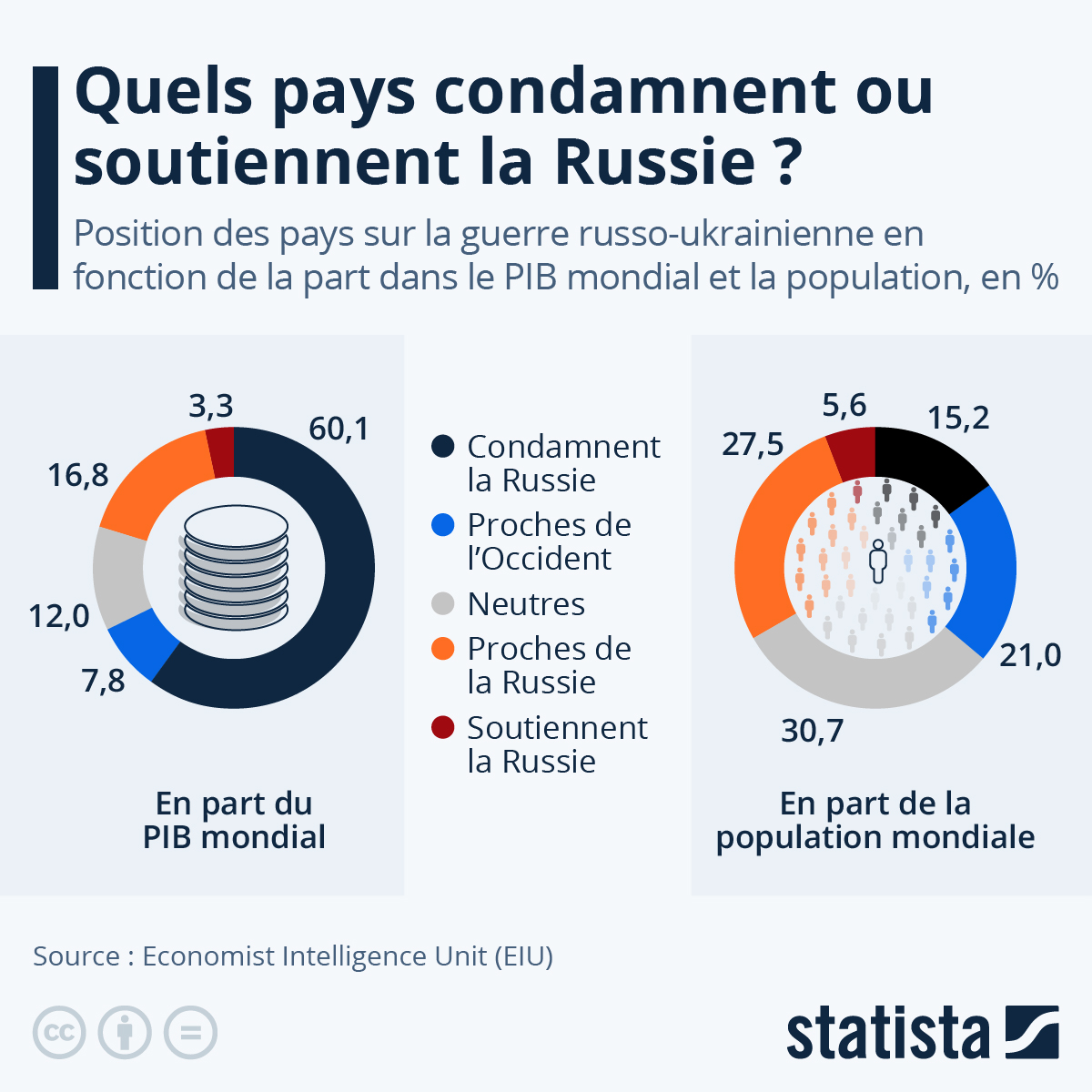

Macron Prepare De Nouvelles Sanctions Contre La Russie

May 03, 2025

Macron Prepare De Nouvelles Sanctions Contre La Russie

May 03, 2025 -

France Russie Macron Promet Une Pression Renforcee Sur Moscou

May 03, 2025

France Russie Macron Promet Une Pression Renforcee Sur Moscou

May 03, 2025 -

La Russie Face A La Pression De Macron Developpement Imminent

May 03, 2025

La Russie Face A La Pression De Macron Developpement Imminent

May 03, 2025 -

Macron Intensifie La Pression Sur La Russie Les Prochains Jours Seront Decisifs

May 03, 2025

Macron Intensifie La Pression Sur La Russie Les Prochains Jours Seront Decisifs

May 03, 2025 -

Reakcja Zacharowej Na Sytuacje Wokol Emmanuela I Brigitte Macron This Is Polish Not Russian And Should Be Excluded

May 03, 2025

Reakcja Zacharowej Na Sytuacje Wokol Emmanuela I Brigitte Macron This Is Polish Not Russian And Should Be Excluded

May 03, 2025