Extreme Price Increase: Broadcom's VMware Acquisition Faces Backlash From AT&T

Table of Contents

AT&T's Concerns Regarding Extreme Price Increases

AT&T's apprehension stems from the potential for Broadcom, a leading provider of networking infrastructure, to leverage its control over VMware's virtualization technologies to significantly increase prices for essential networking equipment and services. This fear is not unfounded, considering Broadcom's history and market dominance. Their specific concerns can be summarized as follows:

- Increased costs for vital networking infrastructure: AT&T, and other telecom providers, rely heavily on VMware's virtualization technologies and Broadcom's networking solutions. A combined entity could lead to significantly inflated prices for these crucial components, impacting operational costs dramatically.

- Reduced bargaining power for telecom companies: With fewer viable competitors, telecom companies like AT&T would have significantly less bargaining power when negotiating prices for essential network infrastructure, leaving them vulnerable to price gouging.

- Potential for monopolization in key technology sectors: The merger could lead to a near-monopoly in crucial technology sectors, limiting innovation and choice for telecom companies and ultimately, consumers.

- Negative impact on AT&T's profitability and competitiveness: Higher costs for infrastructure directly translate to lower profitability and reduced competitiveness for AT&T, potentially impacting service quality and investment in network upgrades.

These price increases could severely hamper AT&T's ability to invest in crucial infrastructure upgrades, potentially slowing the rollout of 5G and other advanced technologies, and ultimately impacting the quality of service provided to customers.

The Antitrust Scrutiny Facing the Broadcom-VMware Deal

The Broadcom-VMware deal is currently facing intense antitrust scrutiny from regulatory bodies globally. The concerns raised by AT&T, alongside those of other competitors and consumer advocacy groups, are significantly influencing the regulatory process. The potential hurdles include:

- Investigations by regulatory bodies in the US and other regions: The Federal Trade Commission (FTC) in the US, along with similar bodies in Europe and other jurisdictions, are conducting thorough investigations into the potential anti-competitive effects of the merger.

- Potential legal challenges from competitors: Other major players in the technology and telecom industries are likely to file legal challenges to block the merger, citing concerns about reduced competition and innovation.

- The argument that the merger reduces competition and innovation: A key argument against the merger centers on the reduction in competition it would bring, potentially stifling innovation and leading to higher prices for consumers.

- The role of AT&T's objections in influencing regulatory decisions: AT&T's vocal opposition and detailed arguments are playing a pivotal role in shaping the regulatory response, adding weight to the concerns raised by antitrust regulators.

The likelihood of the deal being approved remains uncertain, given the significant antitrust concerns and the powerful opposition it faces. The outcome will be determined by the outcome of these investigations and any subsequent legal battles.

The Broader Impact on the Telecom Industry and Consumers

The potential price increases stemming from the Broadcom-VMware acquisition wouldn't be confined to telecom companies; they would ripple through the entire industry and directly impact consumers. The consequences could include:

- Higher prices for internet, phone, and other telecom services: Increased costs for infrastructure would inevitably lead to higher prices for consumers, impacting affordability and accessibility of essential communication services.

- Limited innovation due to reduced competition: A less competitive market would stifle innovation, potentially slowing the development and deployment of new technologies and services.

- Potential for decreased quality of service: With reduced incentives to invest in infrastructure improvements, consumers might experience a decline in service quality and reliability.

- Impact on the overall digital economy: Higher telecom costs would ripple through the broader digital economy, impacting businesses and consumers alike.

Alternative Solutions and Future of the Telecom Landscape

Addressing the concerns raised by AT&T and others requires exploring alternative solutions. These include:

- Government regulations to prevent monopolies: Strengthened antitrust regulations could prevent mergers that stifle competition and lead to extreme price increases.

- Increased competition in the market: Promoting competition through policies that encourage the entry of new players into the market could counteract the effects of the merger.

- Development of open-source alternatives: Investing in and promoting the development of open-source alternatives to VMware and Broadcom technologies could create more competitive options.

The Broadcom-VMware acquisition could significantly reshape the future of the telecom landscape, potentially leading to a less competitive, more expensive, and less innovative environment for both businesses and consumers. The outcome will depend heavily on the success of antitrust challenges and the implementation of measures to maintain competition.

Conclusion

The proposed acquisition of VMware by Broadcom presents significant concerns regarding extreme price increases and the potential suppression of competition within the telecom industry. AT&T's strong backlash highlights the potential negative consequences for both businesses and consumers. Higher prices for essential networking equipment, reduced innovation, and a decline in service quality are all real possibilities. The ongoing antitrust scrutiny underscores the gravity of these concerns.

The acquisition of VMware by Broadcom raises serious concerns regarding extreme price increases and stifled competition. Stay informed about the ongoing developments in this case, and voice your opinion to regulators regarding the potential impact of this merger on fair competition and consumer prices. Let's keep monitoring the implications of this Broadcom VMware acquisition and fight against potentially harmful price increases.

Featured Posts

-

The Red Soxs Bullpen Solution A Deep Dive Into The Recent Cardinals Trade

May 18, 2025

The Red Soxs Bullpen Solution A Deep Dive Into The Recent Cardinals Trade

May 18, 2025 -

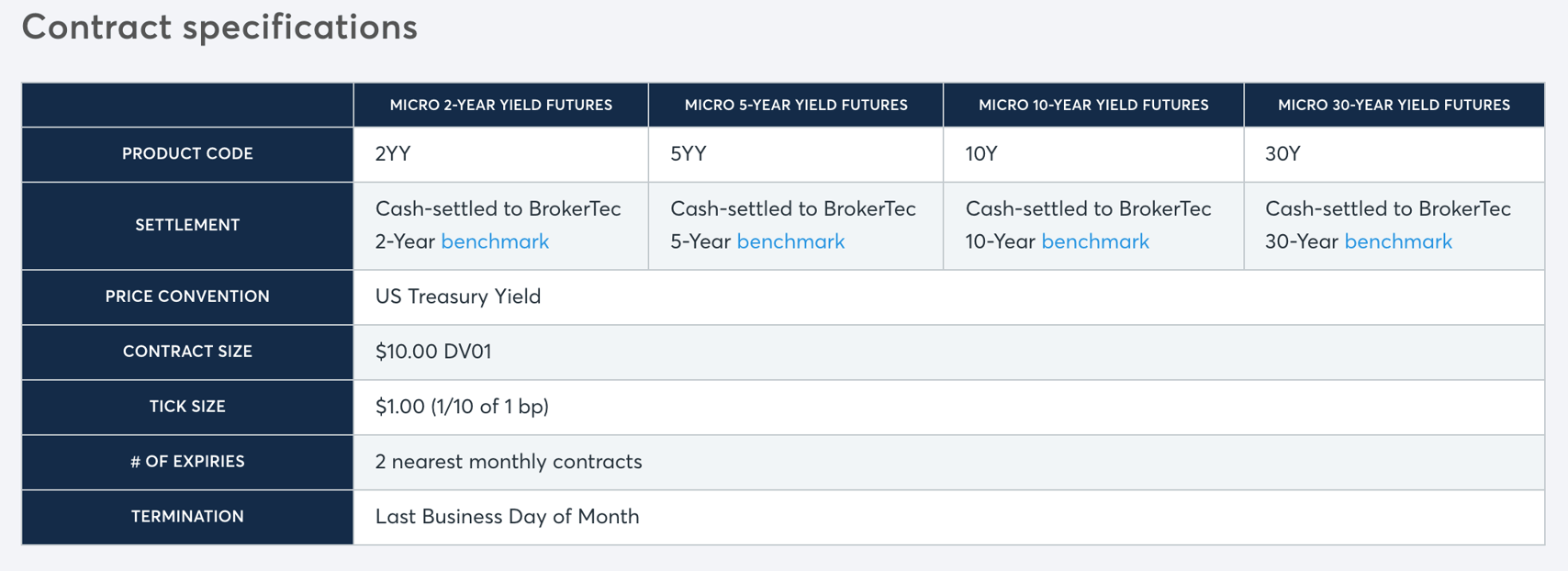

Lutnick Built Fmx Challenges Cme Treasury Futures Trading Begins

May 18, 2025

Lutnick Built Fmx Challenges Cme Treasury Futures Trading Begins

May 18, 2025 -

Taylor Swift Re Recordings Ranked A Comprehensive Guide To The Taylors Version Albums

May 18, 2025

Taylor Swift Re Recordings Ranked A Comprehensive Guide To The Taylors Version Albums

May 18, 2025 -

Tesla Fights Back Against Shareholder Lawsuits Following Musk Pay Package

May 18, 2025

Tesla Fights Back Against Shareholder Lawsuits Following Musk Pay Package

May 18, 2025 -

Angels 1 0 Victory Over White Sox A Masterclass By Jose Soriano

May 18, 2025

Angels 1 0 Victory Over White Sox A Masterclass By Jose Soriano

May 18, 2025

Latest Posts

-

Your Guide To Easy A On Bbc Three Hd

May 18, 2025

Your Guide To Easy A On Bbc Three Hd

May 18, 2025 -

Where To Watch Easy A Bbc Three Hd Tv Listings

May 18, 2025

Where To Watch Easy A Bbc Three Hd Tv Listings

May 18, 2025 -

Bbc Three Hd Tv Schedule Catch Easy A

May 18, 2025

Bbc Three Hd Tv Schedule Catch Easy A

May 18, 2025 -

Easy A On Bbc Three Hd When And Where To Watch

May 18, 2025

Easy A On Bbc Three Hd When And Where To Watch

May 18, 2025 -

Taran Killam On His Important Relationship With Amanda Bynes

May 18, 2025

Taran Killam On His Important Relationship With Amanda Bynes

May 18, 2025