Facing A Student Loan Default? Understanding The Government's Actions

Table of Contents

Falling behind on your student loan payments can feel overwhelming, but understanding the government's actions in cases of student loan default is crucial. This article will outline the serious consequences of defaulting on federal student loans and explore the government programs designed to help you avoid or resolve this challenging situation. We'll cover everything from wage garnishment to loan rehabilitation, empowering you to take control of your financial future.

What Happens When You Default on Your Student Loans?

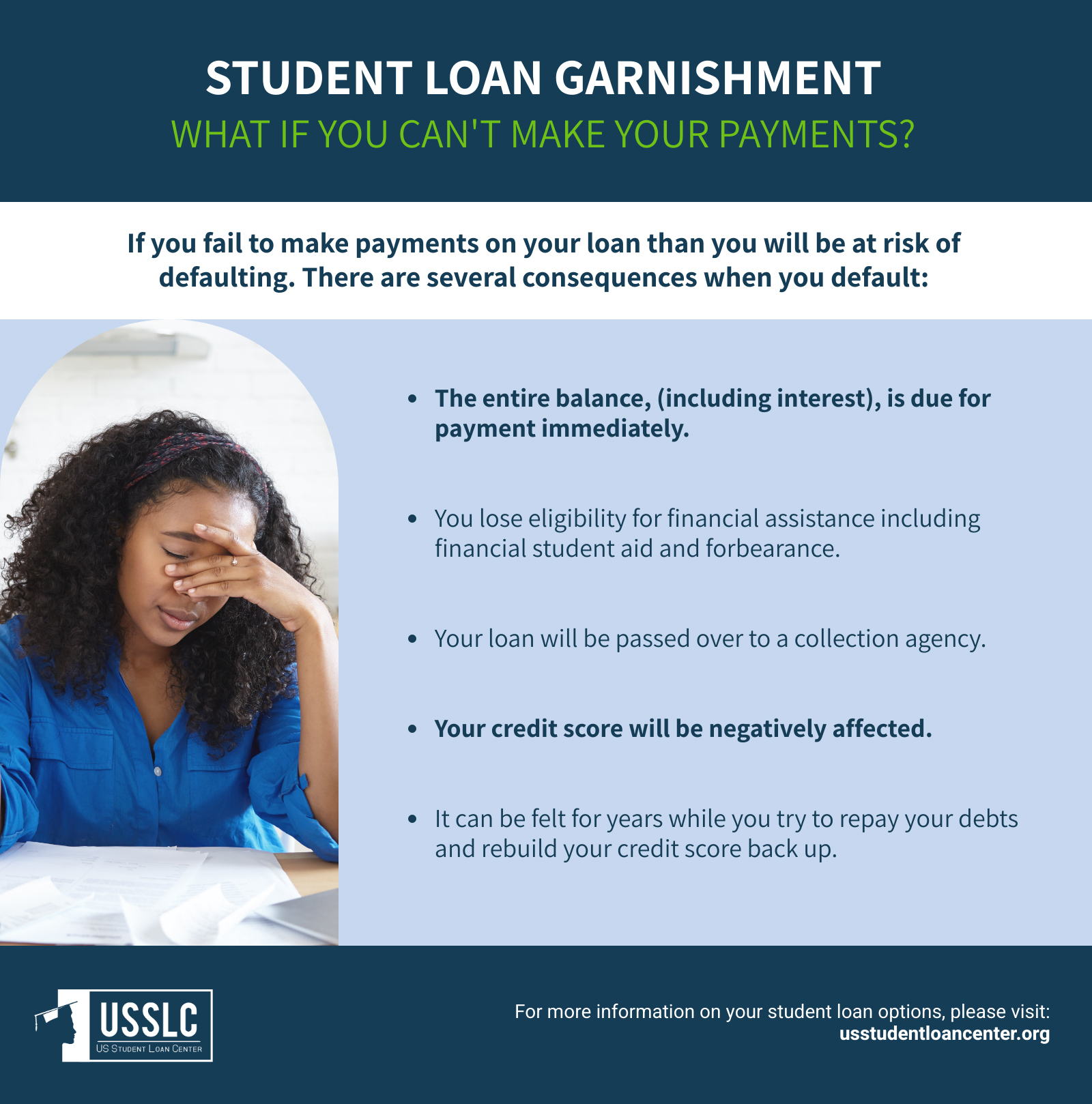

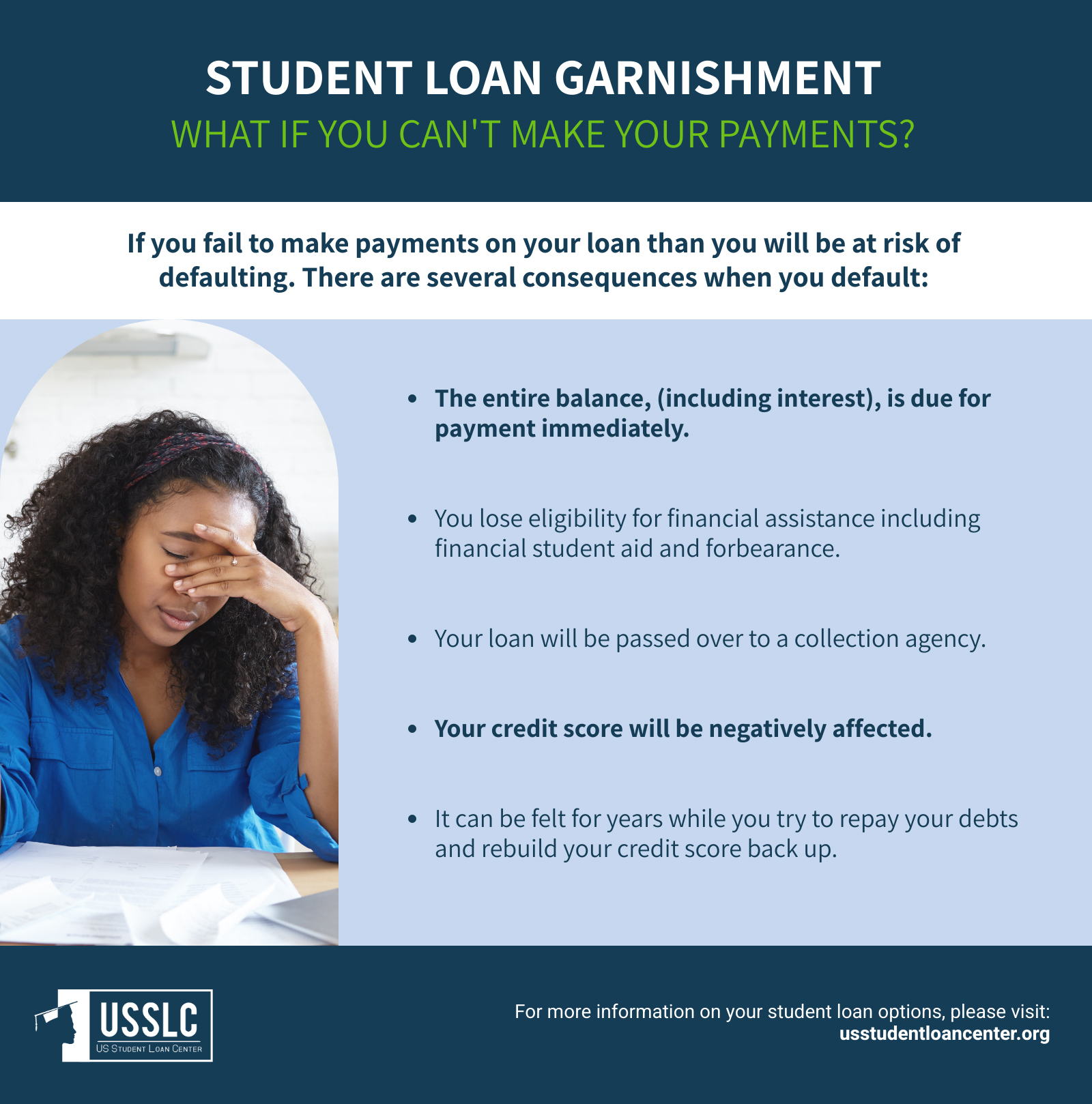

Defaulting on your federal student loans triggers a cascade of negative consequences that can significantly impact your financial well-being for years to come. The government takes aggressive action to recover the outstanding debt.

Negative Impact on Credit Score

Defaulting on student loans has a devastating effect on your credit score. This drastically lowers your credit rating, making it difficult to secure financial products and services in the future.

- Difficulty obtaining loans: Securing loans for a car, mortgage, or even a personal loan becomes significantly harder, if not impossible.

- Higher interest rates: Even if you qualify for a loan, you'll likely face substantially higher interest rates, increasing the overall cost of borrowing.

- Problems renting an apartment: Many landlords conduct credit checks, and a poor credit score due to student loan default can prevent you from renting your desired apartment.

- Challenges finding employment: Some employers, particularly in specific fields, conduct credit checks as part of their hiring process. A defaulted student loan can hinder your job prospects.

Government Collection Actions

The government employs several aggressive collection methods to recover defaulted student loans. These actions can significantly disrupt your life and finances.

- Wage Garnishment: The government can garnish your wages, directly deducting a percentage of your paycheck to repay the debt. The amount garnished depends on your income and the amount owed. This can leave you with significantly reduced funds to cover essential living expenses.

- Tax Refund Offset: The government can seize your federal and state tax refunds to apply towards your student loan debt. This means you receive no refund, delaying or preventing your ability to manage other financial obligations.

- Bank Levy: The government has the authority to seize funds directly from your bank accounts. This can leave you with insufficient funds to cover essential expenses and can result in overdraft fees.

- Offset of Social Security Benefits: In certain circumstances, the government may be able to offset a portion of your Social Security benefits to recover the debt. This is typically a last resort after other collection methods have been exhausted.

Government Programs to Help Avoid or Resolve Student Loan Default

While the consequences of student loan default are severe, the government offers several programs designed to help borrowers avoid or resolve defaulted loans.

Loan Rehabilitation

Loan rehabilitation is a process that can restore your defaulted federal student loans to good standing. It involves making nine on-time payments within a specific timeframe.

- Requirements: The exact requirements might vary slightly depending on your loan servicer but generally involve consistent, on-time payments.

- Benefits: Successful rehabilitation removes the default status from your credit report, restoring your eligibility for deferment and forbearance programs.

- Credit Score Impact: After successfully completing rehabilitation, your credit score will gradually improve over time, although the negative impact of the default may remain on your credit report for up to seven years.

Income-Driven Repayment Plans

Income-driven repayment plans adjust your monthly payment based on your income and family size. These plans can significantly lower your monthly payments, making them more manageable. Several options exist:

- IBR (Income-Based Repayment): One of the older plans, offering potentially lower monthly payments.

- ICR (Income-Contingent Repayment): Another older plan, similar to IBR but with slightly different calculations.

- PAYE (Pay As You Earn): This plan caps your monthly payment at 10% of your discretionary income.

- REPAYE (Revised Pay As You Earn): Similar to PAYE, but with slightly different eligibility requirements and calculations. This plan is currently the most widely used income-driven repayment plan.

Eligibility criteria for each plan vary, and it's crucial to understand the terms and conditions before enrolling.

Consolidation

Consolidating multiple federal student loans into a single loan can simplify your repayment process and potentially secure better terms, like a lower interest rate. This can make managing your debt easier and potentially reduce your overall monthly payments.

Preventing Student Loan Default: Proactive Steps

Taking proactive steps can significantly reduce your risk of defaulting on your student loans.

Budgeting and Financial Planning

Creating a detailed budget and carefully tracking your expenses are fundamental to managing your student loans effectively. A clear understanding of your income and expenses helps you allocate funds for loan repayments and avoid falling behind.

Communication with Loan Servicers

Open communication with your loan servicer is crucial. If you anticipate difficulty making your payments, contact your servicer immediately to explore available options before you default.

Exploring Deferment and Forbearance Options

Deferment and forbearance are temporary options that can pause or reduce your payments during periods of financial hardship. These are short-term solutions, and it’s important to understand the terms and conditions and that interest may still accrue during these periods.

Conclusion

Defaulting on student loans has severe consequences, including a damaged credit score and aggressive government collection actions like wage garnishment and tax refund offset. However, the government also offers programs like loan rehabilitation and income-driven repayment plans to help borrowers avoid or resolve default. Proactive steps, such as budgeting, communication with your loan servicer, and exploring deferment or forbearance options, are vital in preventing student loan default.

Facing the possibility of student loan default? Don't wait until it's too late. Explore your options and take proactive steps to protect your financial future. Contact your loan servicer immediately, and research available government programs to avoid student loan default today!

Featured Posts

-

Palmeiras Derrota A Bolivar 2 0 Resumen Y Goles Del Encuentro

May 17, 2025

Palmeiras Derrota A Bolivar 2 0 Resumen Y Goles Del Encuentro

May 17, 2025 -

Coquimbo Unido Y Everton Vina Empatan 0 0 Analisis Del Partido

May 17, 2025

Coquimbo Unido Y Everton Vina Empatan 0 0 Analisis Del Partido

May 17, 2025 -

Midair Collision Averted An Exclusive Account From The Air Traffic Controller Involved

May 17, 2025

Midair Collision Averted An Exclusive Account From The Air Traffic Controller Involved

May 17, 2025 -

14 6 Billion Deficit Projected For Ontario Impact Of Tariffs And Economic Implications

May 17, 2025

14 6 Billion Deficit Projected For Ontario Impact Of Tariffs And Economic Implications

May 17, 2025 -

Numero De Mortos Em Acidente Com Onibus Universitario Aumenta

May 17, 2025

Numero De Mortos Em Acidente Com Onibus Universitario Aumenta

May 17, 2025