Factors Contributing To D-Wave Quantum (QBTS) Stock's Friday Gain

Table of Contents

Positive News and Press Releases

Positive news and announcements often act as catalysts for stock price increases. Let's examine if any positive press releases or announcements preceded D-Wave Quantum's Friday surge.

Announcements of new contracts or partnerships

Did D-Wave announce any new partnerships or contracts in the days leading up to Friday's rally? Securing significant partnerships is a key indicator of a company's growth trajectory and can significantly influence investor sentiment. For example, a partnership with a major tech firm to develop quantum computing solutions for the financial services industry could spark substantial investor enthusiasm and drive up the stock price.

Positive media coverage

Favorable media coverage plays a significant role in shaping public perception and influencing investment decisions. Did D-Wave receive positive media attention during the week? Articles highlighting the company's technological advancements, market position, or promising future prospects can all contribute to a positive stock price reaction.

- Example: A positive article in a reputable financial publication like the Wall Street Journal could boost investor confidence and lead to increased buying pressure.

- Impact: The tone and style of the media coverage directly affect the market's reaction. Positive and detailed reporting usually translates into a more significant price increase than a brief, less enthusiastic report.

- Quantifiable Impact: A new contract worth tens of millions of dollars, for example, would have a much larger impact than a smaller, less significant deal.

Market Sentiment and Overall Industry Trends

The overall market sentiment and broader trends within the quantum computing industry also significantly influence QBTS's performance.

Broader quantum computing market optimism

Positive developments in the broader quantum computing landscape can lift all boats, including D-Wave. Increased government funding for quantum computing research, breakthroughs by other companies in the field, or advancements in related technologies could instill general optimism and drive investment into the entire sector.

Analyst upgrades or price target increases

Upgrades from financial analysts or increases in price targets reflect growing confidence in a company's future potential. Such pronouncements can trigger a buying spree, pushing the stock price higher.

- Specific Analysts: Tracking prominent analysts covering QBTS and their rating changes is vital. A positive change from a well-respected analyst can be a significant market mover.

- Market Indices: The performance of broader tech indices and the overall market also correlates with QBTS's stock price. A positive trend in the broader market usually benefits individual stocks, including QBTS.

- Correlation: Understanding the correlation between the overall market performance and QBTS's price movements is crucial for making informed investment decisions.

Speculation and Short Covering

Speculation and short covering can also play a role in sudden price spikes.

Potential short squeeze

A short squeeze occurs when investors who bet against a stock (short sellers) are forced to buy it back to limit their losses, thus driving the price up rapidly. If a significant portion of QBTS shares were shorted before the Friday surge, a short squeeze could have significantly contributed to the price increase.

Increased investor interest and trading volume

A substantial increase in trading volume on Friday suggests heightened investor interest and activity. This surge in activity, possibly driven by the news or speculation, could have fueled the price increase.

- Short Interest Data: Examining short interest data before and after the surge can help determine if a short squeeze was indeed a contributing factor. High short interest combined with a sudden price surge strongly suggests a short squeeze.

- Mechanics of Short Selling: Understanding how short selling and short covering work is crucial for interpreting these market events.

- Unusual Trading Patterns: Unusual trading patterns, like a sudden spike in volume or large block trades, might indicate institutional investor activity and contribute to the price movement.

Technical Analysis (Optional)

While this article focuses on fundamental factors, a quick review of technical indicators could offer additional insight. For example, chart patterns like breakouts from resistance levels or other technical signals might provide clues about the price movement.

Conclusion: Analyzing D-Wave Quantum (QBTS) Stock's Friday Gain and Looking Ahead

The Friday surge in D-Wave Quantum (QBTS) stock likely resulted from a combination of factors, including positive news, broader industry optimism, and potentially a short squeeze. While positive announcements and media coverage certainly played a role, understanding the interplay of market sentiment and speculation is equally important. Remember, stock price fluctuations are complex and influenced by numerous factors. It is crucial to consider multiple perspectives when analyzing such events.

To make informed investment decisions regarding D-Wave Quantum (QBTS) stock, monitor D-Wave Quantum (QBTS) stock closely, stay updated on D-Wave Quantum's progress, and continue learning more about investing in D-Wave Quantum (QBTS) stock and the quantum computing industry. This will allow you to better understand future price movements and capitalize on emerging opportunities.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Featured Posts

-

D Wave Quantum Inc Qbts Stock Plunge In 2025 Reasons And Analysis

May 20, 2025

D Wave Quantum Inc Qbts Stock Plunge In 2025 Reasons And Analysis

May 20, 2025 -

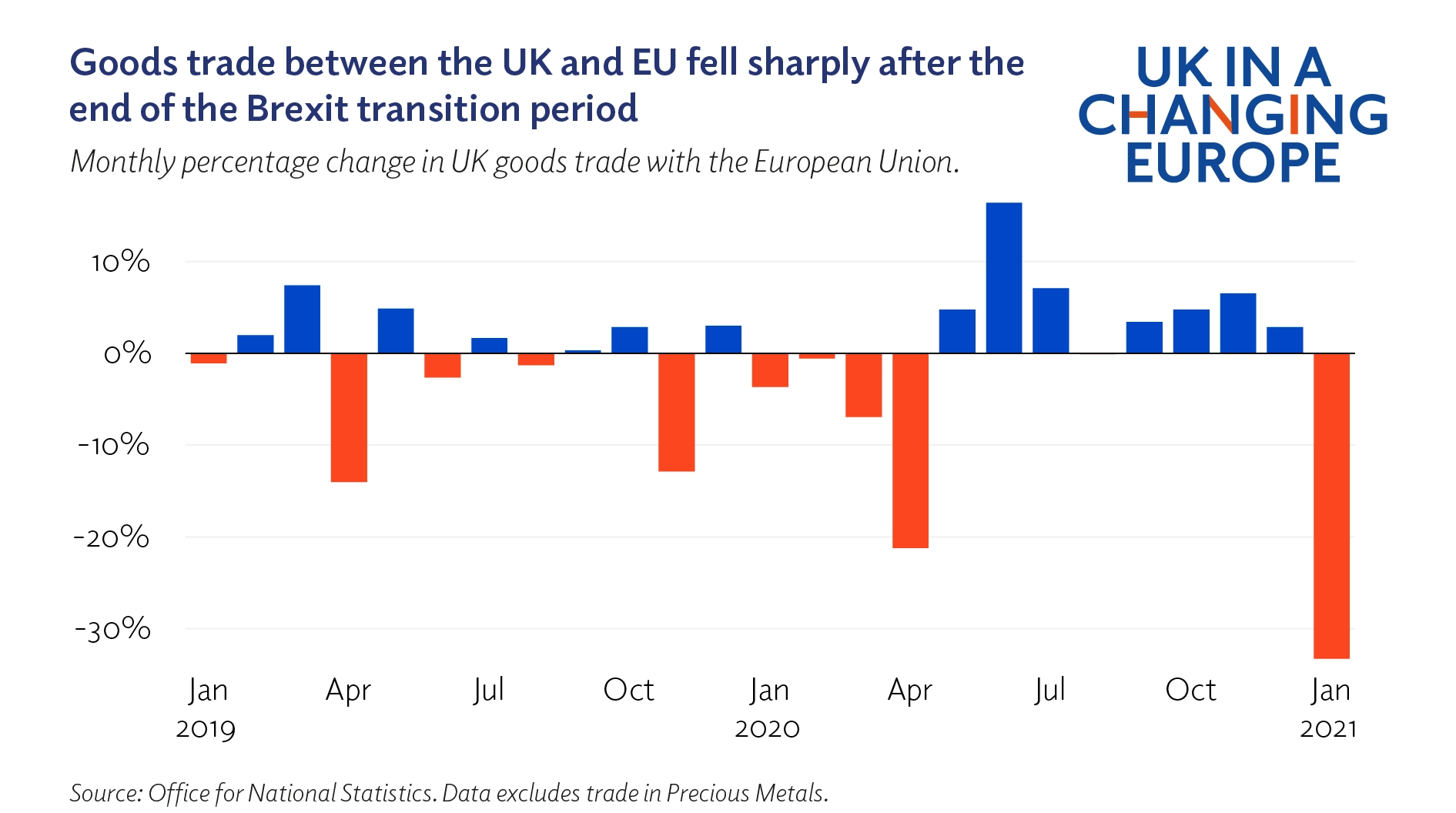

The Impact Of Brexit On Uk Luxury Goods Exports An Industry Perspective

May 20, 2025

The Impact Of Brexit On Uk Luxury Goods Exports An Industry Perspective

May 20, 2025 -

Solo Travel Destinations Inspiring Ideas For Your Next Trip

May 20, 2025

Solo Travel Destinations Inspiring Ideas For Your Next Trip

May 20, 2025 -

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025 -

Ghana Cote D Ivoire Succes De La Visite Diplomatique Du President Mahama A Abidjan

May 20, 2025

Ghana Cote D Ivoire Succes De La Visite Diplomatique Du President Mahama A Abidjan

May 20, 2025

Latest Posts

-

Huuhkajat Ja Mm Unelma Valmennuksen Merkitys

May 20, 2025

Huuhkajat Ja Mm Unelma Valmennuksen Merkitys

May 20, 2025 -

Jalkapallo Huuhkajien Avauskokoonpanossa Kolme Muutosta

May 20, 2025

Jalkapallo Huuhkajien Avauskokoonpanossa Kolme Muutosta

May 20, 2025 -

Uusi Valmennus Huuhkajille Onnistutaanko Mm Karsinnoissa

May 20, 2025

Uusi Valmennus Huuhkajille Onnistutaanko Mm Karsinnoissa

May 20, 2025 -

Huuhkajien Avauskokoonpano Paljastettu Merkittaeviae Muutoksia

May 20, 2025

Huuhkajien Avauskokoonpano Paljastettu Merkittaeviae Muutoksia

May 20, 2025 -

Huuhkajien Valmennusuudistus Tavoitteena Mm Kisat

May 20, 2025

Huuhkajien Valmennusuudistus Tavoitteena Mm Kisat

May 20, 2025