Financial Planning: CFP Board CEO's Retirement In 2026

Table of Contents

The Significance of the CFP Board CEO's Retirement Plan

The upcoming retirement of the CFP Board CEO in 2026 holds significant symbolic weight. This individual, at the helm of an organization dedicated to certifying financial planners, embodies the highest standards of financial planning expertise. Their personal retirement planning strategy, therefore, serves as a powerful testament to the importance of long-term financial security and the value of professional advice. A robust and well-structured retirement plan from such a figure reinforces the credibility of the CFP Board's mission and provides a real-world example of best practices.

- Demonstrates the importance of long-term financial planning, showcasing that even experts prioritize proactive preparation.

- Reinforces the value of professional financial advice, highlighting that seeking expert guidance is crucial for successful retirement outcomes.

- Provides a real-world example of successful retirement planning, offering a tangible model for individuals to emulate.

Potential Elements of the CEO's Financial Plan

While the specifics of the CEO's retirement plan remain private, we can speculate on likely components based on established best practices in financial planning.

Diversification of Investments

A sophisticated retirement plan will almost certainly incorporate a diversified investment portfolio. This approach mitigates risk by spreading investments across various asset classes.

- Stocks: Provide growth potential, offering the possibility of higher returns over the long term.

- Bonds: Offer stability and income, reducing overall portfolio volatility.

- Real Estate: Provides long-term appreciation and potential rental income, further diversifying the investment strategy. This might include both residential and commercial properties.

Tax Optimization Strategies

Minimizing tax liabilities is a crucial aspect of effective retirement planning. The CEO's plan likely leverages tax-advantaged accounts to maximize savings and minimize tax burdens in retirement.

- Tax-efficient investment strategies: Employing strategies to reduce the impact of capital gains taxes on investment growth.

- Estate planning: Implementing strategies to minimize inheritance and estate taxes, ensuring a smooth transition of assets to heirs.

- Utilizing tax deductions and credits: Taking advantage of all available tax benefits to reduce taxable income. This could involve contributions to qualified retirement plans, charitable donations, and other deductions.

Healthcare and Long-Term Care Planning

Healthcare costs are a significant concern for retirees. The CEO's retirement plan likely includes a comprehensive strategy to address these expenses.

- Medicare and supplemental insurance: Securing comprehensive coverage to meet healthcare needs in retirement.

- Long-term care insurance options: Planning for potential long-term care expenses, potentially through insurance or other financial arrangements.

- Planning for potential healthcare expenses: Creating a budget to accommodate projected healthcare costs, including medications, treatments, and potential assisted living expenses.

Legacy Planning

Beyond personal financial security, the CEO's retirement plan likely incorporates legacy planning, considering charitable giving and estate distribution.

- Creating a lasting legacy through charitable donations: Establishing charitable trusts or making planned gifts to favored organizations.

- Ensuring smooth transfer of assets to heirs: Drafting a comprehensive estate plan, including wills and trusts, to facilitate a seamless transfer of assets.

- Minimizing estate taxes through effective planning: Utilizing estate planning strategies to minimize the tax burden on beneficiaries.

Key Takeaways and Lessons for Individuals

The potential retirement plan of the CFP Board CEO offers invaluable lessons for individuals embarking on their own retirement planning journey.

- Start planning early: The earlier you begin, the more time your investments have to grow.

- Diversify investments: Spread your investments across different asset classes to minimize risk.

- Consider tax implications: Utilize tax-advantaged accounts and strategies to reduce your tax burden.

- Plan for healthcare costs: Factor in potential healthcare expenses in your retirement budget.

- Consult a qualified financial advisor: Seek professional guidance to create a personalized retirement plan tailored to your individual needs and goals.

Plan Your Retirement with Confidence: Learn from the Experts

The impending retirement of the CFP Board CEO in 2026 provides a powerful case study in effective financial planning. By incorporating the key takeaways—early planning, diversification, tax optimization, healthcare planning, and professional guidance—you can secure your financial future. Don't wait; start your retirement planning journey today. Consult a CFP professional for personalized financial planning advice and secure a comfortable and fulfilling retirement. Remember, professional guidance is crucial for achieving successful retirement planning and achieving your financial goals.

Featured Posts

-

A Boris Johnson Comeback A Realistic Possibility

May 03, 2025

A Boris Johnson Comeback A Realistic Possibility

May 03, 2025 -

Manchester Mourns Poppy Atkinsons Funeral Following Tragic Car Accident

May 03, 2025

Manchester Mourns Poppy Atkinsons Funeral Following Tragic Car Accident

May 03, 2025 -

The High Cost Of Neglecting Childhood Mental Health Investing For A Brighter Future

May 03, 2025

The High Cost Of Neglecting Childhood Mental Health Investing For A Brighter Future

May 03, 2025 -

Rupert Lowes X Posts A Dog Whistle Or A Fog Horn Will His Message Reach Uk Reformers

May 03, 2025

Rupert Lowes X Posts A Dog Whistle Or A Fog Horn Will His Message Reach Uk Reformers

May 03, 2025 -

Justice Department Ends School Desegregation Order What This Means For Schools Nationwide

May 03, 2025

Justice Department Ends School Desegregation Order What This Means For Schools Nationwide

May 03, 2025

Latest Posts

-

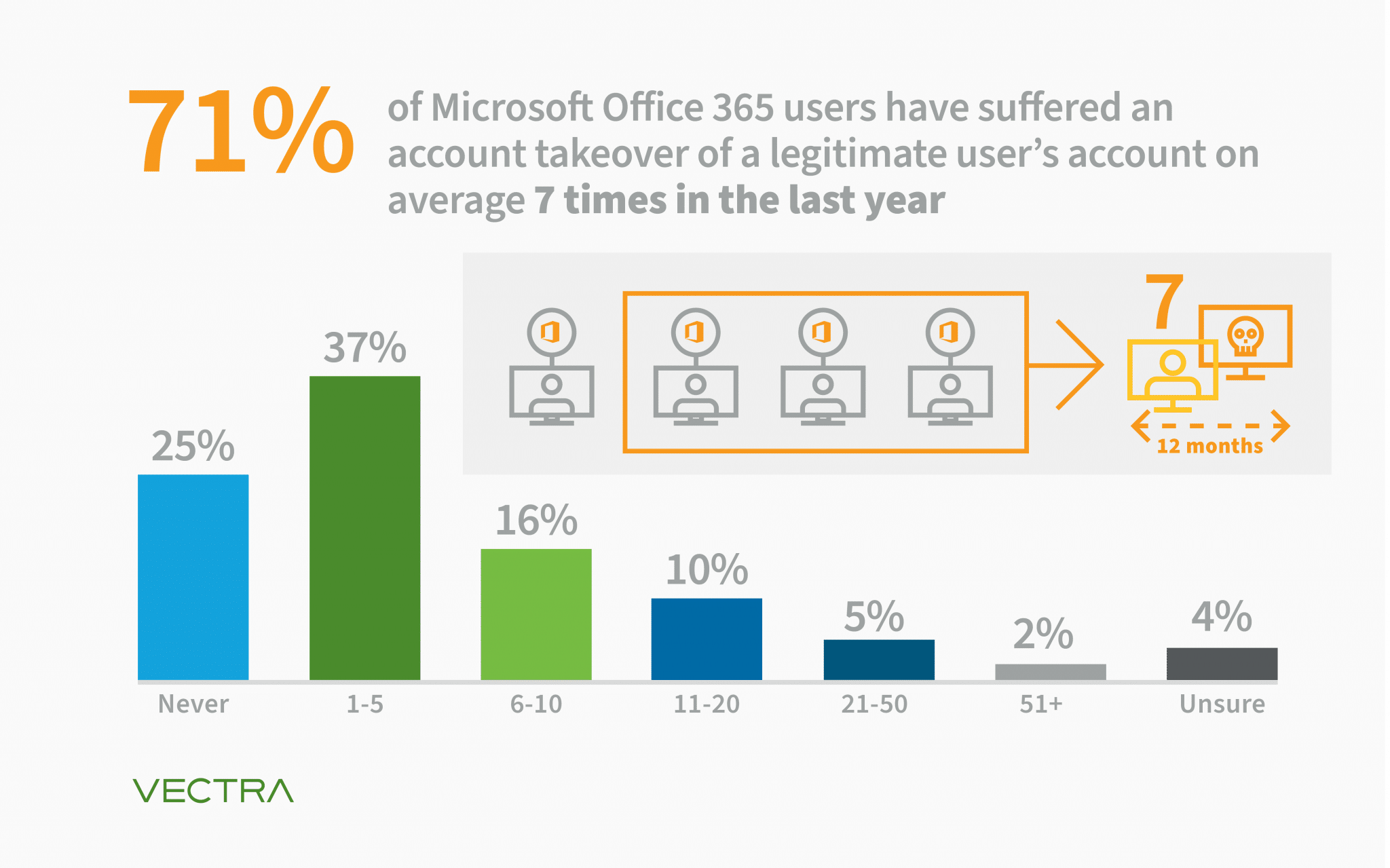

Millions In Losses Inside The Executive Office365 Hacking Scheme

May 04, 2025

Millions In Losses Inside The Executive Office365 Hacking Scheme

May 04, 2025 -

Office365 Security Breach Millions Lost In Executive Account Hacks

May 04, 2025

Office365 Security Breach Millions Lost In Executive Account Hacks

May 04, 2025 -

Federal Investigation Cybercriminal Made Millions Targeting Executive Office365

May 04, 2025

Federal Investigation Cybercriminal Made Millions Targeting Executive Office365

May 04, 2025 -

Millions Stolen Through Executive Office365 Account Compromise

May 04, 2025

Millions Stolen Through Executive Office365 Account Compromise

May 04, 2025 -

Ai Driven Podcast Creation Processing Repetitive Documents For Profound Insights

May 04, 2025

Ai Driven Podcast Creation Processing Repetitive Documents For Profound Insights

May 04, 2025