Finding The Best Tribal Loans With Bad Credit: A Guide To Direct Lenders

Table of Contents

Understanding Tribal Loans and Their Advantages

Tribal loans are short-term loans offered by lenders affiliated with Native American tribes. These loans operate under tribal sovereignty, potentially allowing them to bypass some state regulations governing traditional payday loans and installment loans. This doesn't mean they're unregulated; responsible lenders still adhere to ethical lending practices.

Advantages of Tribal Loans for Borrowers with Bad Credit:

- Potentially Higher Approval Rates: Tribal lenders may have less stringent credit requirements than traditional banks or credit unions, increasing your chances of approval even with a low credit score.

- Flexible Repayment Options: Some tribal lenders offer flexible repayment plans tailored to your individual financial situation, making it easier to manage your debt.

- Faster Funding: Compared to traditional loans, tribal loans often provide faster funding, getting you the money you need quickly.

Potential Disadvantages and Risks:

- High Interest Rates: Tribal loans often carry high interest rates, so it's crucial to compare offers carefully. Always check the APR (Annual Percentage Rate) to understand the total cost of borrowing.

- Risk of Debt Traps: If not managed carefully, these high-interest loans can lead to a cycle of debt. Ensure you can comfortably afford the repayments before borrowing.

- Reputable Lender Selection is Crucial: The industry includes some disreputable lenders; thorough research is essential.

Finding Reputable Direct Tribal Lenders

Choosing a reputable direct lender is paramount to avoid loan scams and predatory lending practices. Working directly with the lender eliminates the middleman and offers better transparency.

Tips for Identifying Legitimate Direct Tribal Lenders:

- Check for Licenses and Registrations: Verify if the lender is properly licensed and registered to operate in your state.

- Read Online Reviews and Testimonials: Check independent review sites for feedback from previous borrowers. Look for consistent positive feedback and a lack of widespread negative complaints.

- Verify Contact Information: Ensure the lender has a physical address and readily available contact information. Be wary of lenders who only communicate through email or untraceable phone numbers.

- Look for Transparent Fee Structures: The lender should clearly outline all fees and charges associated with the loan. Avoid lenders who are vague or obscure about their fees.

Risks of Using Third-Party Lenders or Loan Brokers:

Using third-party lenders or brokers often involves additional fees and can increase the risk of encountering scams. Stick to direct lenders for maximum transparency and control over the loan process. Avoid sites promising guaranteed loan approvals – these are often red flags.

Factors to Consider When Applying for a Tribal Loan with Bad Credit

Applying for a tribal loan requires careful consideration of several factors. Don't rush into a decision; take the time to compare offers and understand the terms completely.

- Compare Interest Rates and Fees: Carefully compare the APR (Annual Percentage Rate) and all associated fees across different lenders to find the most affordable option.

- Credit Score's Role: While tribal loans may be more lenient, your credit score still influences the interest rate you'll receive. A higher score will generally lead to better terms.

- Loan Terms and Repayment Schedule: Thoroughly review the loan agreement, paying close attention to the repayment schedule and the total amount you'll need to repay. Ensure you can comfortably meet the repayment obligations.

- Responsible Borrowing: Before applying, create a realistic budget to ensure you can afford the loan repayments without jeopardizing your financial stability.

The Application Process for Tribal Loans: A Step-by-Step Guide

Applying for a tribal loan online is typically straightforward. Most lenders offer a simple online application process.

Steps:

- Find a Reputable Lender: Use the tips above to locate a trustworthy direct lender.

- Complete the Online Application: Provide accurate personal and financial information.

- Upload Required Documents: Prepare the necessary documents, such as proof of income and identification.

- Wait for Approval: The approval process varies, but many lenders provide a quick response.

- Receive Funds: Once approved, the funds are usually deposited into your bank account quickly.

Potential Challenges and Solutions:

- Rejection: If rejected, review your application for errors, improve your credit score, or consider alternative loan options.

- High Fees: If the fees seem excessively high, compare with other lenders before proceeding.

Alternatives to Tribal Loans for Bad Credit

While tribal loans can be a viable option, exploring alternatives is wise.

- Credit Unions: Credit unions often offer more favorable loan terms than banks, particularly for members with bad credit.

- Peer-to-Peer Lending Platforms: These platforms connect borrowers with individual lenders, offering potential for lower interest rates.

- Government Assistance Programs: Depending on your circumstances, government assistance programs may be available to help with financial difficulties.

These alternatives may have stricter requirements, but they can potentially offer more manageable repayment terms than some high-interest tribal loans.

Conclusion: Finding the Right Tribal Loan for Your Needs

Finding the best tribal loans with bad credit requires careful research and responsible decision-making. Choosing a reputable direct lender is key to avoiding scams and ensuring transparent loan terms. While tribal loans offer potential advantages like faster funding and potentially higher approval rates, it’s crucial to be aware of the potential for high interest rates and the risk of falling into a debt trap. Carefully weigh the advantages and disadvantages and compare them to alternative loan options before proceeding. Start your search for the best tribal loans with bad credit from reputable direct lenders today! Remember, responsible borrowing is paramount – ensure you can comfortably manage repayments before committing to any loan.

Featured Posts

-

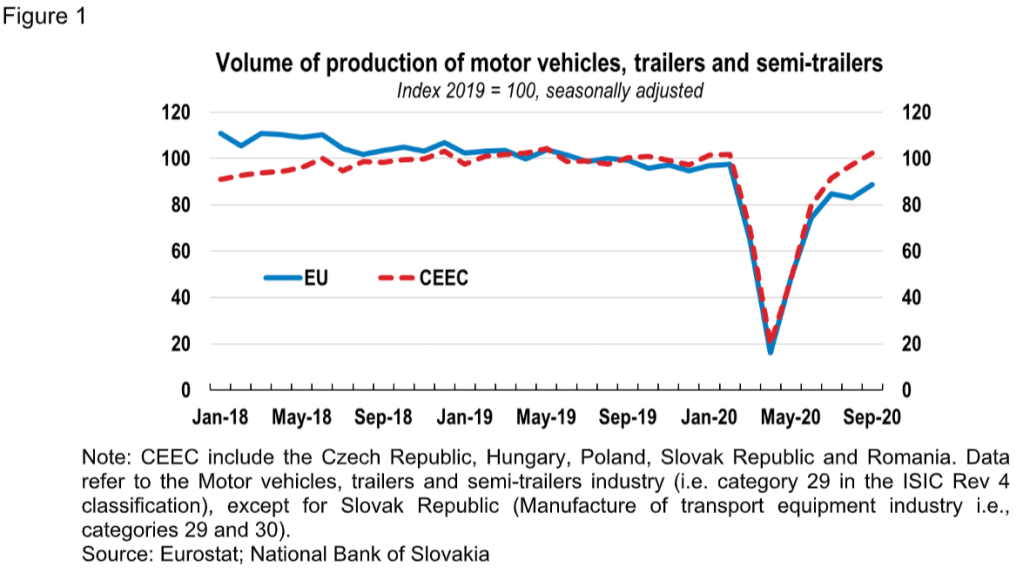

Europes Car Industry Faces Headwinds Amidst Economic Crisis

May 28, 2025

Europes Car Industry Faces Headwinds Amidst Economic Crisis

May 28, 2025 -

Rod Stewart Lifetime Achievement Award Recipient

May 28, 2025

Rod Stewart Lifetime Achievement Award Recipient

May 28, 2025 -

A List Legal Battle Intensifies New Developments In The Lively Baldoni Case

May 28, 2025

A List Legal Battle Intensifies New Developments In The Lively Baldoni Case

May 28, 2025 -

Cherki Transfer Man United Ahead Of Liverpool

May 28, 2025

Cherki Transfer Man United Ahead Of Liverpool

May 28, 2025 -

Paul Skenes Pittsburgh Pirates Opening Day Starter

May 28, 2025

Paul Skenes Pittsburgh Pirates Opening Day Starter

May 28, 2025

Latest Posts

-

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025 -

Autoroute A69 Une Nouvelle Tentative Pour Contourner L Opposition Judiciaire

May 30, 2025

Autoroute A69 Une Nouvelle Tentative Pour Contourner L Opposition Judiciaire

May 30, 2025 -

Securite Routiere Augmentation Des Depistages Antidrogue Chez Les Conducteurs De Cars Scolaires

May 30, 2025

Securite Routiere Augmentation Des Depistages Antidrogue Chez Les Conducteurs De Cars Scolaires

May 30, 2025 -

Controverse A69 L Action Des Ministres Et Parlementaires Pour Debloquer Le Projet

May 30, 2025

Controverse A69 L Action Des Ministres Et Parlementaires Pour Debloquer Le Projet

May 30, 2025 -

Depistage Drogues Chauffeurs Scolaires Le Gouvernement Renforce Les Controles

May 30, 2025

Depistage Drogues Chauffeurs Scolaires Le Gouvernement Renforce Les Controles

May 30, 2025