Fiscal Support And Inflation: The ECB's Assessment Post-Pandemic

Table of Contents

The ECB's Pandemic Response: Unprecedented Fiscal Stimulus

The ECB's response to the pandemic was swift and extensive, deploying unprecedented fiscal stimulus measures to prevent a deeper economic downturn.

Quantitative Easing (QE) and its Impact on Liquidity and Inflation

Quantitative easing (QE) programs involved the large-scale purchase of government bonds and other assets to inject liquidity into the financial system.

- Scale and Scope: The Pandemic Emergency Purchase Programme (PEPP) alone totaled €1.85 trillion, dwarfing previous QE efforts.

- Intended Consequences: The aim was to lower long-term interest rates, stimulate lending, and support economic activity.

- Unintended Consequences: Critics argue that QE contributed to inflationary pressures by increasing money supply beyond the capacity of the economy to absorb it. The impact on inflation remains a subject of ongoing debate.

- Alternative Viewpoints: Some economists contend that the inflationary impact of QE was limited, emphasizing other factors like supply chain disruptions as the primary drivers of inflation.

Targeted Fiscal Measures and their Role in Mitigating Economic Downturn

Alongside QE, various targeted fiscal measures were implemented across the Eurozone to support businesses and households.

- Examples: These included wage subsidies, loan guarantees, and direct cash transfers to individuals.

- Effectiveness: These programs were generally successful in mitigating the economic fallout, preventing widespread bankruptcies and job losses.

- Inflationary Pressures: However, the significant increase in government spending inevitably contributed to increased aggregate demand, potentially fueling inflationary pressures.

Inflationary Pressures Post-Pandemic: Supply Chain Disruptions and Demand-Pull Inflation

The post-pandemic period witnessed a surge in inflation driven by a confluence of factors.

Supply Chain Bottlenecks and their Contribution to Price Increases

Global supply chains faced significant disruptions due to lockdowns, port congestion, and labor shortages.

- Role in Inflation: These bottlenecks led to shortages of goods, pushing prices upwards.

- Impacted Sectors: Various sectors, including semiconductors, automobiles, and consumer goods, were significantly affected.

- Long-Term Effects: The lingering effects of supply chain disruptions continue to contribute to inflationary pressures.

Increased Consumer Demand and its Impact on Inflationary Pressures

Pent-up demand and government stimulus fueled a surge in consumer spending.

- Surge in Demand: Consumers, having saved during lockdowns, unleashed pent-up demand, driving up prices for goods and services.

- Government Stimulus: Fiscal support measures further boosted aggregate demand, exacerbating inflationary pressures.

- ECB Challenges: The ECB faced the challenge of managing demand-pull inflation without stifling economic recovery.

The ECB's Policy Response to Inflation: Balancing Growth and Price Stability

Faced with rising inflation, the ECB shifted towards a more restrictive monetary policy.

Monetary Policy Tightening: Interest Rate Hikes and Asset Purchase Reduction

The ECB implemented a series of interest rate hikes and began reducing its asset purchases.

- Shift to Restrictive Policy: This marked a significant departure from the ultra-loose monetary policy adopted during the pandemic.

- Interest Rate Hikes: The rate hikes aimed to curb inflation by increasing borrowing costs and reducing aggregate demand.

- Impact on Growth: These measures, while intended to control inflation, also risked slowing economic growth.

Communication Strategy and Forward Guidance

Effective communication was crucial in managing inflation expectations.

- Managing Expectations: Clear communication about the ECB's policy intentions aimed to anchor inflation expectations.

- Forward Guidance: Providing forward guidance on future policy moves helped shape market expectations and reduce uncertainty.

- Challenges: Balancing transparency with the need to avoid market volatility presented a significant challenge for the ECB.

Long-Term Outlook: Sustainable Growth and Inflation Control

The Eurozone faces several challenges in maintaining sustainable growth while controlling inflation.

Challenges and Risks Facing the Eurozone Economy

Several factors pose risks to economic stability.

- Geopolitical Risks: The war in Ukraine and other geopolitical tensions impact energy prices and supply chains.

- Energy Price Volatility: Fluctuations in energy prices significantly influence inflation and economic growth.

- ECB Capacity: The ECB's capacity to manage these risks effectively remains a key concern.

The Importance of Fiscal Sustainability and Coordinated Policy Responses

Fiscal sustainability and coordinated policy responses are crucial for long-term stability.

- Fiscal Sustainability: Sustainable fiscal policies are essential to avoid exacerbating inflationary pressures.

- Coordinated Responses: Effective coordination between the ECB and national governments is crucial.

- Challenges of Coordination: Achieving such coordination across diverse member states presents significant challenges.

Conclusion: Fiscal Support, Inflation, and the ECB's Ongoing Assessment

The relationship between fiscal support, inflation, and the ECB's policy responses is complex and multifaceted. The ECB's post-pandemic assessment highlights the challenges of balancing economic growth with price stability in a rapidly changing global environment. Navigating the ongoing impact of supply chain disruptions, geopolitical uncertainty, and the legacy of expansive fiscal policies requires careful monitoring and adaptive policy responses. Stay informed about the ECB's ongoing assessment of Fiscal Support and Inflation and its implications for the Eurozone economy by regularly visiting the ECB's website for updates and publications. Understanding the interplay between fiscal support and inflation is critical for navigating the complexities of the Eurozone's economic future.

Featured Posts

-

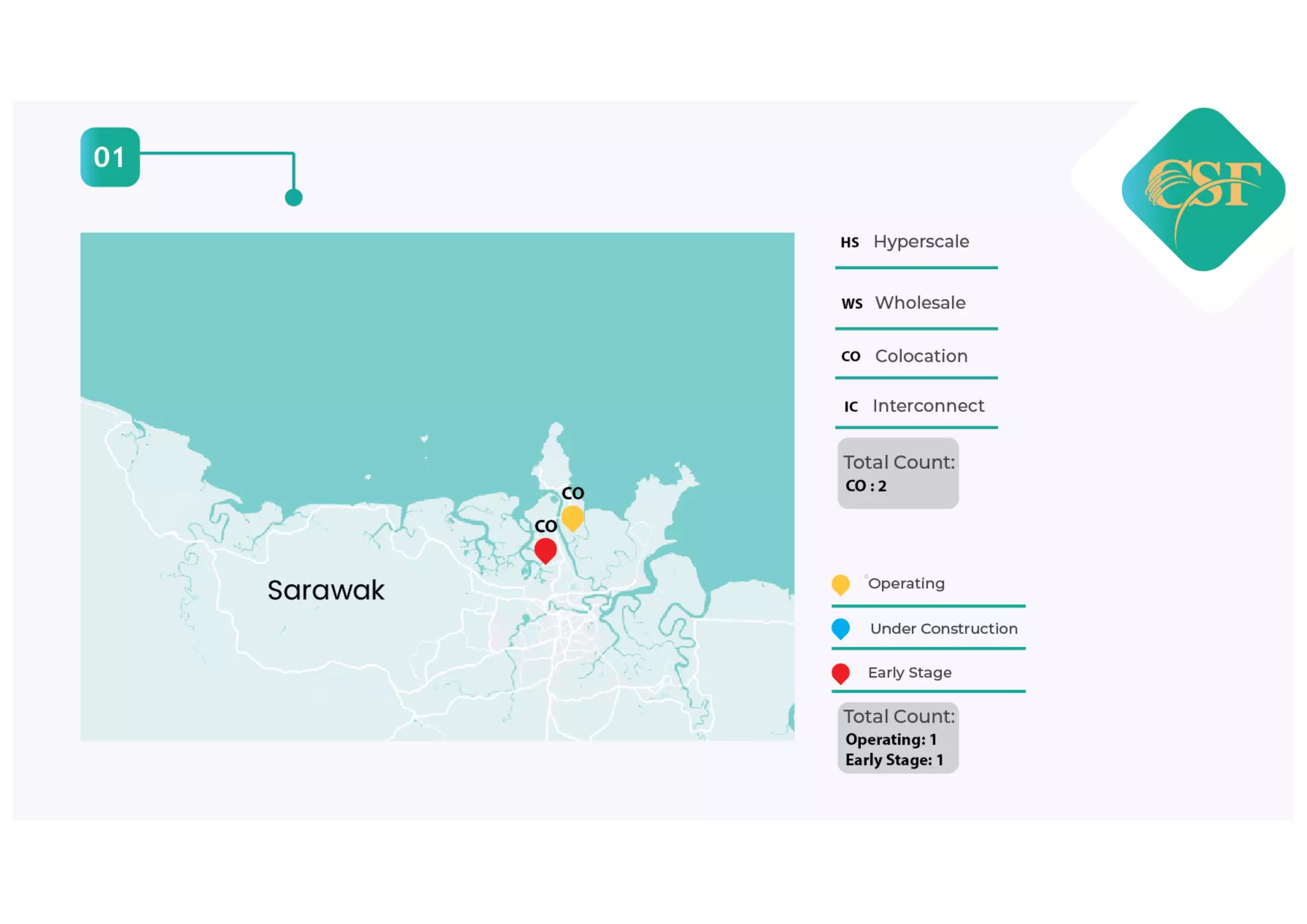

Negeri Sembilans Emerging Role In Malaysias Data Center Landscape

Apr 29, 2025

Negeri Sembilans Emerging Role In Malaysias Data Center Landscape

Apr 29, 2025 -

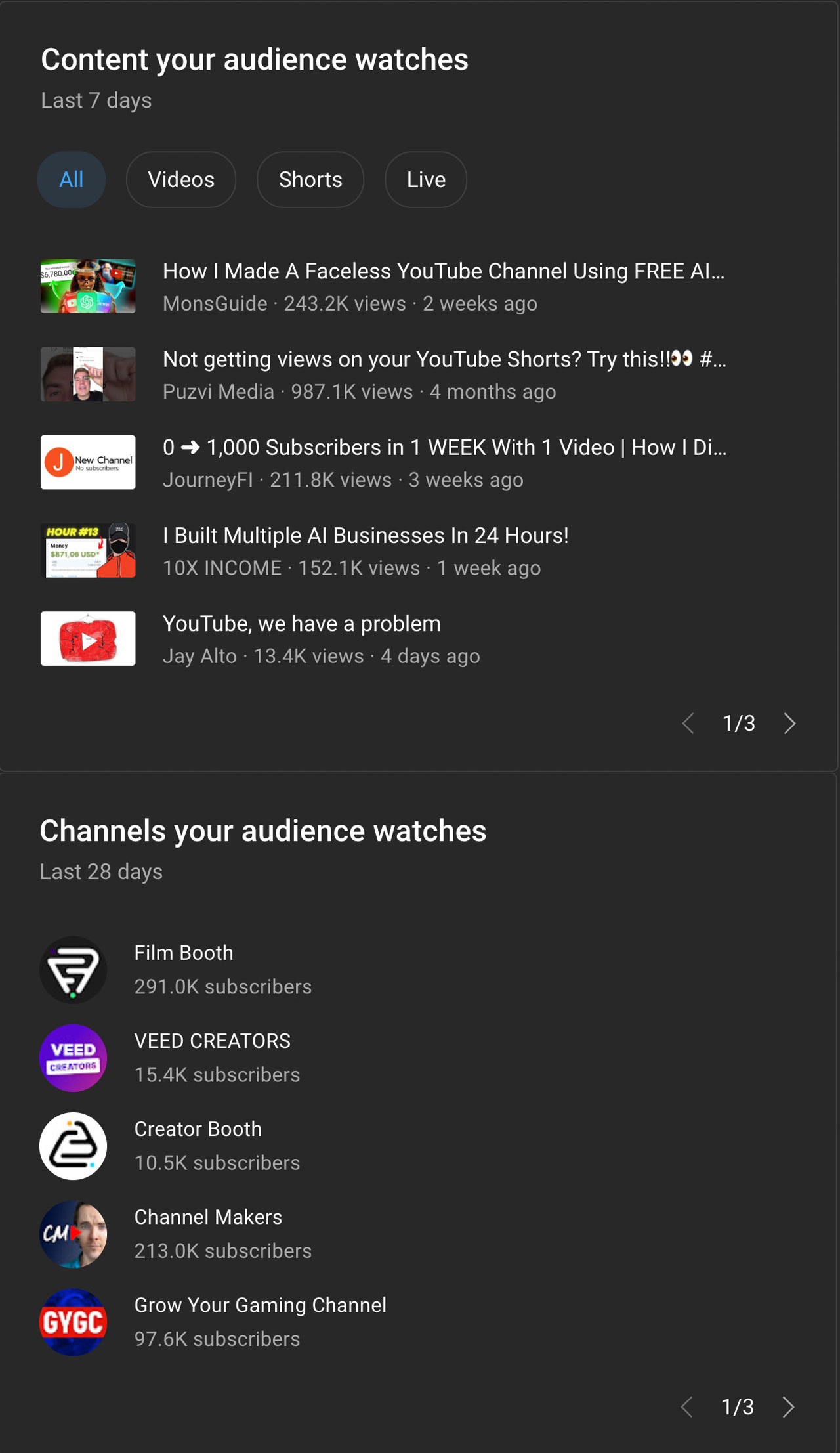

Why Older Viewers Are Choosing You Tube For Their Entertainment

Apr 29, 2025

Why Older Viewers Are Choosing You Tube For Their Entertainment

Apr 29, 2025 -

Los Angeles Palisades Fires A List Of Celebrities Who Lost Properties

Apr 29, 2025

Los Angeles Palisades Fires A List Of Celebrities Who Lost Properties

Apr 29, 2025 -

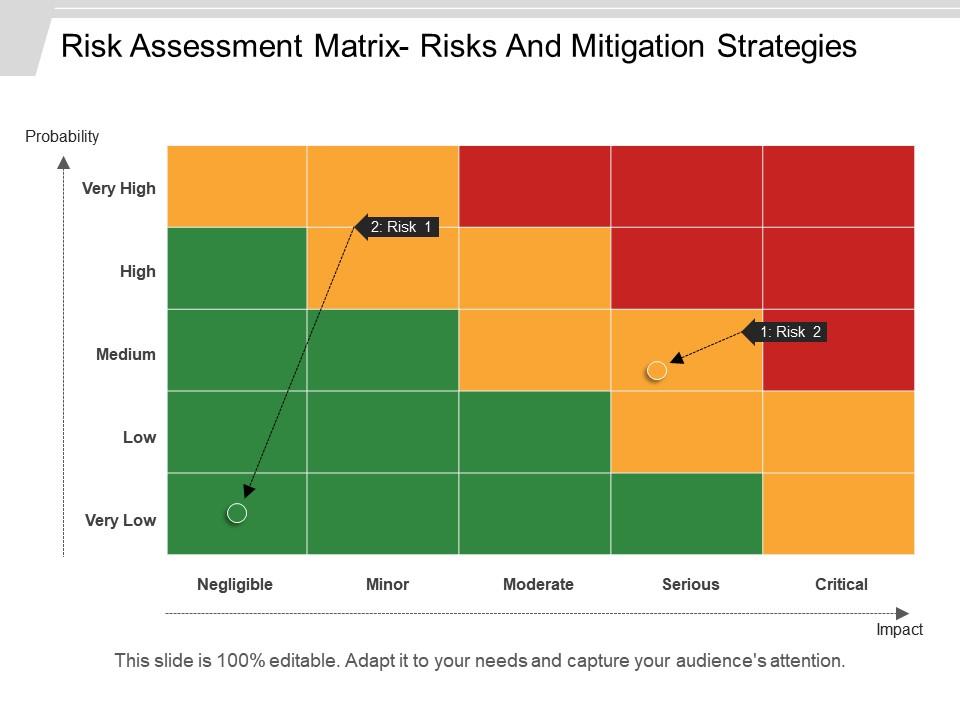

Electric Vehicle Dependence On Dysprosium Risks And Mitigation Strategies

Apr 29, 2025

Electric Vehicle Dependence On Dysprosium Risks And Mitigation Strategies

Apr 29, 2025 -

Complete Nyt Spelling Bee Solution March 13 2025

Apr 29, 2025

Complete Nyt Spelling Bee Solution March 13 2025

Apr 29, 2025

Latest Posts

-

You Tube A New Home For Classic Tv Shows And Mature Audiences

Apr 29, 2025

You Tube A New Home For Classic Tv Shows And Mature Audiences

Apr 29, 2025 -

Older Adults And You Tube A Growing Trend Of Classic Show Viewing

Apr 29, 2025

Older Adults And You Tube A Growing Trend Of Classic Show Viewing

Apr 29, 2025 -

Why Older Viewers Are Returning To You Tube For Classic Shows

Apr 29, 2025

Why Older Viewers Are Returning To You Tube For Classic Shows

Apr 29, 2025 -

You Tubes Resurgence Older Viewers Finding Familiar Favorites

Apr 29, 2025

You Tubes Resurgence Older Viewers Finding Familiar Favorites

Apr 29, 2025 -

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025