Five Crucial Commodity Market Charts To Monitor This Week

Table of Contents

1. Crude Oil Price Chart: Assessing Global Energy Dynamics

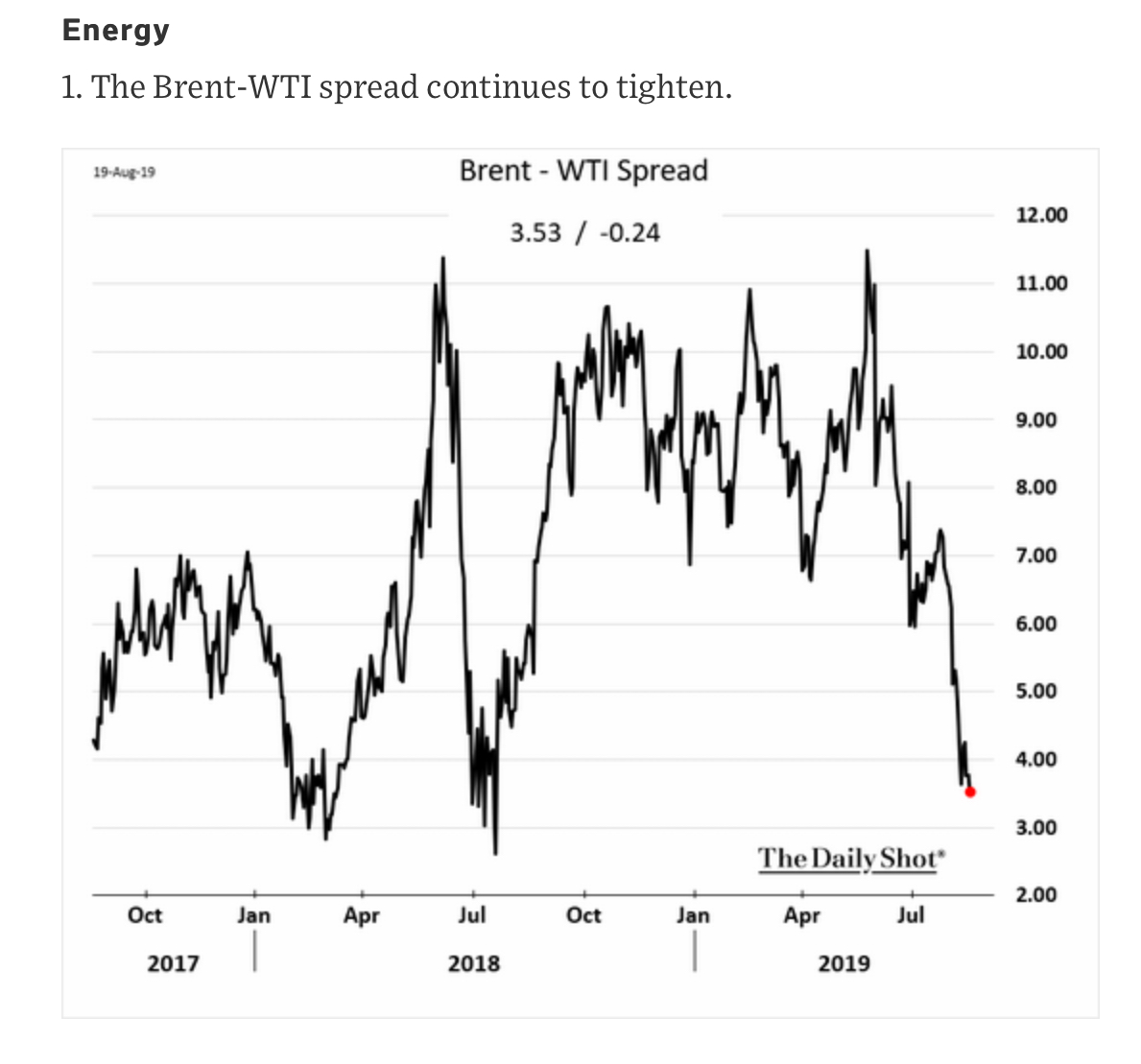

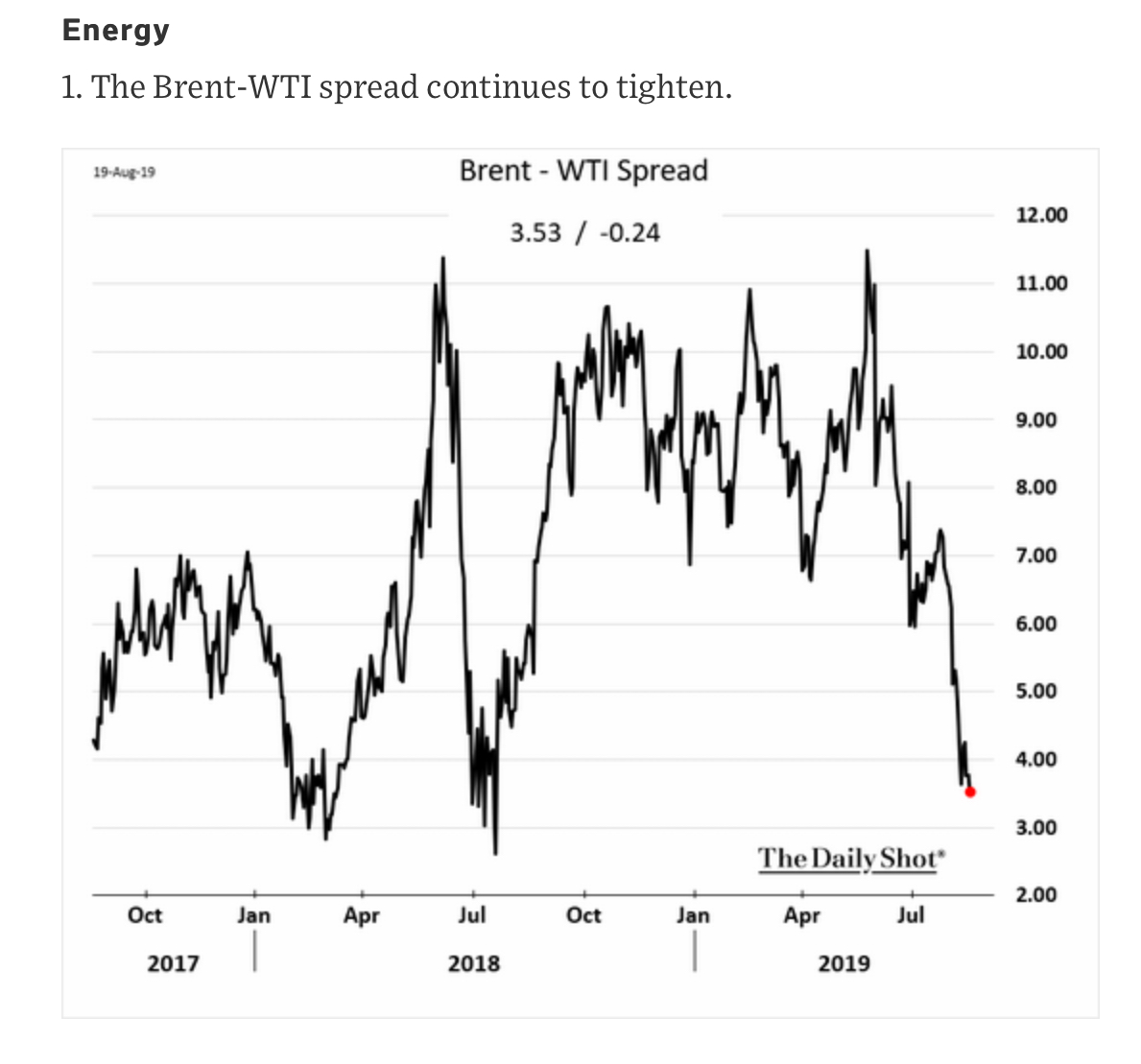

Analyzing the crude oil price chart is paramount for understanding global energy dynamics. We'll focus on West Texas Intermediate (WTI) and Brent crude, the two benchmark crudes. The trajectory of crude oil prices is influenced by a complex interplay of factors.

Keywords: Crude oil price, oil market, OPEC, WTI, Brent crude, energy prices, oil demand

-

OPEC+ Production Decisions: The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) significantly impact global oil supply. Their production quotas and agreements directly influence price fluctuations. Monitoring their announcements and adherence to these agreements is crucial for predicting oil price movements.

-

Global Demand Fluctuations: Global economic growth, particularly in major economies like China and the US, significantly influences oil demand. Strong economic growth usually translates to higher oil demand, pushing prices upwards. Recessions or slowdowns have the opposite effect.

-

Geopolitical Events: Geopolitical instability in oil-producing regions can disrupt supply chains and lead to price spikes. Conflicts, sanctions, and political uncertainty all contribute to volatility in the crude oil market.

-

Alternative Energy Sources: The growing adoption of renewable energy sources like solar and wind power is gradually impacting oil demand. This transition to cleaner energy sources puts downward pressure on long-term oil prices, although the shift is gradual.

-

Speculative Trading: Speculative trading plays a significant role in oil price volatility. Traders' expectations and market sentiment can amplify price swings, irrespective of underlying fundamentals.

2. Natural Gas Price Chart: Tracking the Energy Transition

The natural gas price chart provides insights into another critical segment of the energy market. Factors impacting natural gas prices are diverse and interconnected.

Keywords: Natural gas price, natural gas market, LNG, energy transition, gas storage, heating season

-

Storage Levels: Natural gas storage levels, particularly in the Northern Hemisphere, significantly influence prices, especially during the winter heating season. Low storage levels can lead to price spikes as demand increases.

-

Weather Patterns: Extreme weather conditions, both hot and cold, can dramatically impact natural gas demand. Cold winters increase heating demand, driving prices higher, while unusually warm winters can depress prices.

-

LNG Exports: The export of liquefied natural gas (LNG) plays a crucial role in the global natural gas market. Changes in LNG export volumes and trade flows affect supply and demand dynamics, influencing prices globally.

-

Government Policies: Government policies regarding natural gas production, exploration, and regulation can significantly impact prices. Subsidies, taxes, and environmental regulations all play a role.

-

Renewable Energy Competition: The growth of renewable energy sources like wind and solar power is slowly but surely increasing competition for natural gas in the electricity generation sector.

3. Gold Price Chart: A Safe Haven in Uncertain Times

Gold often acts as a safe-haven asset, making the gold price chart vital for understanding investor sentiment during times of uncertainty.

Keywords: Gold price, gold market, safe haven asset, inflation hedge, interest rates, gold investment

-

Inflation Hedge: Gold is often seen as an inflation hedge because its price tends to rise during periods of high inflation. As purchasing power declines, investors often flock to gold as a store of value.

-

Interest Rates: Interest rate changes by central banks influence gold prices. Higher interest rates generally increase the opportunity cost of holding gold (as investors can earn higher returns on interest-bearing assets), often leading to lower gold prices.

-

US Dollar Movements: The US dollar and gold prices often have an inverse relationship. A weakening US dollar typically boosts gold prices, as gold is priced in USD, making it cheaper for holders of other currencies.

-

Geopolitical Risks: Geopolitical instability and uncertainty tend to drive investors towards gold as a safe haven, boosting demand and prices.

4. Agricultural Commodity Price Chart (e.g., Corn): Assessing Food Security

Monitoring agricultural commodity prices, like corn, is essential for understanding food security and global food markets.

Keywords: Corn price, soybean price, agricultural commodities, food prices, crop yields, weather conditions, food security

-

Weather Conditions: Weather plays a dominant role in agricultural commodity production. Droughts, floods, and extreme temperatures can significantly impact crop yields, leading to price volatility.

-

Global Supply and Demand: Global supply and demand dynamics are crucial. Factors like population growth, changes in consumption patterns, and trade policies influence prices.

-

Biofuel Production: The use of agricultural commodities in biofuel production competes with food consumption, impacting prices. Increased biofuel demand can push agricultural commodity prices higher.

-

Trade Policies and Tariffs: Government policies regarding trade, such as tariffs and export restrictions, can significantly influence global supply and demand, thus impacting prices.

5. Industrial Metal Price Chart (e.g., Copper): Monitoring Global Economic Growth

Copper is often considered a barometer of global economic health, making its price chart a valuable indicator of economic activity.

Keywords: Copper price, industrial metals, economic growth, manufacturing activity, construction, metal prices

-

Manufacturing Activity: Copper is a crucial component in many manufacturing processes. Strong manufacturing activity generally leads to higher copper demand and prices.

-

Construction Spending: The construction industry is a major consumer of copper. Increased construction activity boosts copper demand, supporting price increases.

-

Global Economic Growth: Copper demand is closely linked to overall global economic growth. Robust global economic growth typically translates to higher copper prices.

-

Supply Chain Disruptions: Disruptions to global supply chains can impact copper availability, leading to price fluctuations. Geopolitical events and logistical issues can contribute to these disruptions.

Conclusion

This week's commodity market presents a dynamic landscape requiring close attention to key indicators. Monitoring these five crucial commodity market charts—crude oil, natural gas, gold, corn, and copper—will provide valuable insights into prevailing market trends and potential investment opportunities. Understanding the interplay of factors affecting these commodities is key to successful commodity trading. Stay informed and make smart trading decisions by regularly reviewing these crucial commodity market charts. Continuously monitor these essential commodity market charts for a comprehensive understanding of market dynamics and make well-informed decisions about your commodity trading strategies.

Featured Posts

-

Will Big Oil Increase Production Opec Meeting In Focus

May 05, 2025

Will Big Oil Increase Production Opec Meeting In Focus

May 05, 2025 -

Lily Piquet Verstappen The Latest Addition To The Motor Racing Family

May 05, 2025

Lily Piquet Verstappen The Latest Addition To The Motor Racing Family

May 05, 2025 -

Myke Wright Lizzos Partner Exploring His Net Worth And Profession

May 05, 2025

Myke Wright Lizzos Partner Exploring His Net Worth And Profession

May 05, 2025 -

Fox Sports Indy Car Coverage What To Expect This Season

May 05, 2025

Fox Sports Indy Car Coverage What To Expect This Season

May 05, 2025 -

Eviter Les Catastrophes La Methode De La Guillotine Affutee

May 05, 2025

Eviter Les Catastrophes La Methode De La Guillotine Affutee

May 05, 2025

Latest Posts

-

Ddgs Dont Take My Son Diss Track Sparks Online Debate

May 06, 2025

Ddgs Dont Take My Son Diss Track Sparks Online Debate

May 06, 2025 -

Ddg Fires Shots At Halle Bailey In Dont Take My Son Diss Track

May 06, 2025

Ddg Fires Shots At Halle Bailey In Dont Take My Son Diss Track

May 06, 2025 -

Ddg Attacks Halle Bailey In New Song Dont Take My Son

May 06, 2025

Ddg Attacks Halle Bailey In New Song Dont Take My Son

May 06, 2025 -

The Story Behind Rather Be Alone A Collaboration By Leon Thomas And Halle Bailey

May 06, 2025

The Story Behind Rather Be Alone A Collaboration By Leon Thomas And Halle Bailey

May 06, 2025 -

Halle Bailey Responds To Ddgs Dont Take My Son Diss Track

May 06, 2025

Halle Bailey Responds To Ddgs Dont Take My Son Diss Track

May 06, 2025