Form 20-F: ING Group's 2024 Financial Performance And Outlook

Table of Contents

Key Financial Highlights from ING Group's 20-F Filing

ING Group's Form 20-F reveals crucial financial data, providing a snapshot of its performance. Key metrics, including revenue, net income, Earnings per Share (EPS), Return on Equity (ROE), assets, liabilities, and capital ratios, offer a comprehensive picture of the bank's financial health.

-

Revenue Growth: The 20-F will detail the year-over-year revenue growth, highlighting whether ING Group experienced expansion or contraction across its various business lines. Analyzing this against market trends will give a clearer picture of the bank's performance relative to its competitors.

-

Net Income and EPS: Examination of net income and Earnings Per Share (EPS) will reveal the bank's profitability. Any significant changes from the previous year should be analyzed considering factors like market volatility and economic conditions.

-

ROE and Key Balance Sheet Metrics: Return on Equity (ROE) is a critical indicator of management's effectiveness in utilizing shareholder investments. Analyzing assets, liabilities, and capital ratios helps in assessing the bank's financial stability and risk profile. A comparison with previous years’ data is crucial to understand the trajectory of these key financial indicators. Charts illustrating these trends will provide a clear visual representation of ING Group’s financial performance.

Analysis of ING Group's Performance Across Key Business Segments

ING Group operates across diverse segments, including Wholesale Banking, Retail Banking, Investment Management, and Insurance, spanning various geographic regions. Analyzing the performance of each segment helps understand the drivers of the overall financial results.

-

Wholesale Banking: This segment's performance will be assessed based on its contribution to overall revenue and profitability. Factors influencing its performance, such as market conditions in global financial markets and trading activity, need to be considered.

-

Retail Banking: Analyzing the performance of ING Group's retail banking operations requires evaluating factors such as loan growth, deposit growth, and net interest margins. The impact of changing interest rates and competition within the retail banking sector should also be examined.

-

Investment Management and Insurance: The 20-F will provide data to assess the success of these divisions, considering factors such as asset under management growth and the profitability of insurance products.

-

Geographic Segments: The report will likely break down performance by geographic region, allowing for an analysis of the impact of regional economic conditions and regulatory changes on ING Group's operations.

ING Group's 2024 Financial Outlook and Strategic Initiatives

The Form 20-F will offer insights into ING Group’s strategies for future growth and its expectations for the coming year.

-

Growth Strategy: The document will outline ING Group’s plans for expansion and diversification. Analyzing these strategies is crucial for understanding future performance expectations.

-

Risk Management: Understanding the bank's approach to managing key risks, including interest rate risk, credit risk, and operational risk, is crucial in assessing the sustainability of its future performance.

-

Dividend Policy and Future Prospects: The 20-F might offer guidance on future dividend payouts and the company’s outlook on profitability and growth. This is vital information for investors.

-

ESG Initiatives: Increasingly, ESG (Environmental, Social, and Governance) factors play a crucial role in investor decisions. The 20-F should provide details on ING Group’s commitment to sustainability and its progress in meeting its ESG targets.

Key Risks and Challenges Faced by ING Group

ING Group, like other financial institutions, faces numerous risks. The 20-F will disclose these risks, enabling a comprehensive assessment of potential challenges.

-

Interest Rate Risk: Fluctuations in interest rates pose a significant risk to the bank's profitability and financial stability. The 20-F will likely detail how ING Group manages this risk.

-

Credit Risk: The risk of loan defaults is inherent in banking. The Form 20-F will likely outline the bank's strategies for assessing and mitigating this risk.

-

Regulatory Changes: Changes in regulations across different jurisdictions significantly impact financial institutions. The 20-F should address how ING Group adapts to and complies with evolving regulatory landscapes.

-

Geopolitical Risks and Economic Downturn: Global events and economic conditions can significantly influence a bank's performance. The 20-F should highlight how ING Group manages its exposure to these risks.

Conclusion

ING Group's 2024 financial performance, as presented in its Form 20-F, provides a comprehensive overview of the bank's current standing and future outlook. Analysis of key financial metrics, segment performance, strategic initiatives, and potential risks offers a nuanced perspective on its financial health. Understanding these aspects is vital for investors, analysts, and stakeholders in making informed decisions. For a complete understanding of ING Group's financial health and strategic direction, review the full Form 20-F document and stay informed on their future announcements related to the Form 20-F.

Featured Posts

-

Aims Group Partners With World Trading Tournament Wtt

May 21, 2025

Aims Group Partners With World Trading Tournament Wtt

May 21, 2025 -

Can Porsche Succeed The Challenges Of Balancing Performance And Luxury In A Global Market

May 21, 2025

Can Porsche Succeed The Challenges Of Balancing Performance And Luxury In A Global Market

May 21, 2025 -

Australian Transcontinental Run British Ultrarunners Bid For Record

May 21, 2025

Australian Transcontinental Run British Ultrarunners Bid For Record

May 21, 2025 -

Musique Le Hellfest Investit Le Noumatrouff De Mulhouse

May 21, 2025

Musique Le Hellfest Investit Le Noumatrouff De Mulhouse

May 21, 2025 -

Alissons Form Arne Slot And Luis Enrique Offer Liverpool Insights

May 21, 2025

Alissons Form Arne Slot And Luis Enrique Offer Liverpool Insights

May 21, 2025

Latest Posts

-

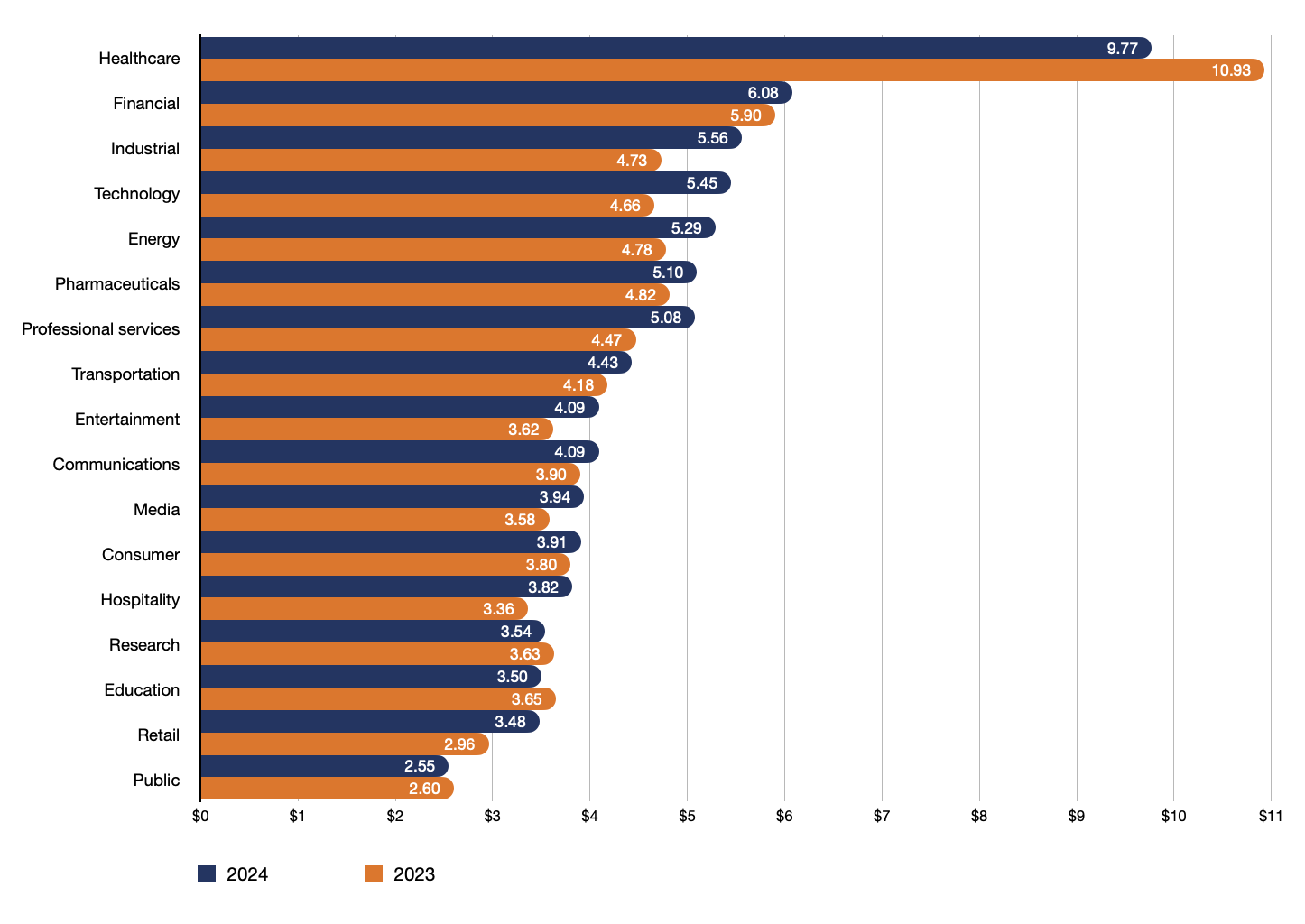

Data Breach Costs T Mobile 16 Million Three Year Security Lapse Results In Fine

May 21, 2025

Data Breach Costs T Mobile 16 Million Three Year Security Lapse Results In Fine

May 21, 2025 -

16 Million Penalty For T Mobile Three Years Of Unreported Data Breaches

May 21, 2025

16 Million Penalty For T Mobile Three Years Of Unreported Data Breaches

May 21, 2025 -

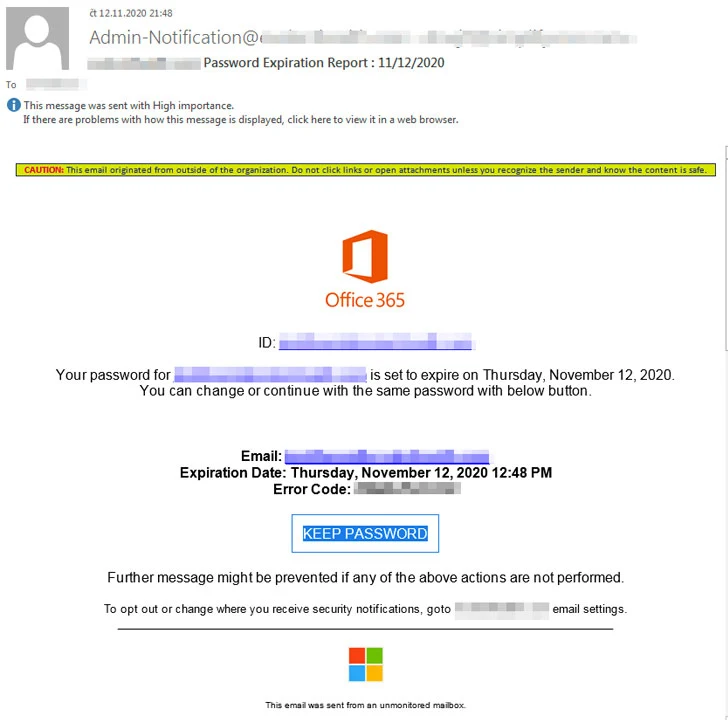

Hacker Makes Millions Targeting Executive Office365 Accounts

May 21, 2025

Hacker Makes Millions Targeting Executive Office365 Accounts

May 21, 2025 -

Unlocking Podcast Potential Ais Role In Transforming Repetitive Documents

May 21, 2025

Unlocking Podcast Potential Ais Role In Transforming Repetitive Documents

May 21, 2025 -

Federal Investigation Millions Stolen Through Compromised Office365 Accounts

May 21, 2025

Federal Investigation Millions Stolen Through Compromised Office365 Accounts

May 21, 2025