FP Video Analysis: The Ongoing Effects Of Tariff Instability On Domestic And International Markets

Table of Contents

Domestic Market Impacts of Tariff Instability

Tariff instability significantly impacts domestic markets, creating ripple effects throughout the economy. Let's examine key areas of concern.

Increased Prices for Consumers

Tariffs directly increase the cost of imported goods, leading to higher prices for consumers. This is because the tariff adds to the price of the imported product, effectively increasing the cost of production or import. For example, tariffs on steel have increased the price of automobiles and construction materials, affecting numerous consumers.

- Examples of specific tariffs and their impact: Tariffs on imported solar panels have raised the cost of renewable energy projects. Tariffs on certain agricultural products have increased grocery bills for consumers.

- Statistics on price increases: Studies have shown a direct correlation between tariff increases and consumer price inflation, particularly affecting low-income households who spend a larger proportion of their income on essential goods.

- Potential government interventions to mitigate price hikes: Governments can implement subsidies to offset tariff-induced price increases, or explore alternative trade agreements to reduce reliance on import-dependent goods.

Challenges for Domestic Businesses

While tariffs might protect some domestic industries, they can also present significant challenges. The increased cost of imported inputs, for instance, can impact the competitiveness of domestic businesses relying on global supply chains.

- Case studies of businesses affected: Businesses in the manufacturing sector, reliant on imported raw materials, have experienced significant margin squeezes due to rising input costs caused by tariffs. The furniture industry, for example, is heavily impacted by wood tariffs.

- Discussion on the potential for job losses: When domestic industries struggle due to tariff-induced higher costs, they may be forced to reduce production, potentially leading to job losses.

- Analysis of alternative sourcing strategies for businesses: Businesses are actively seeking alternative suppliers, exploring opportunities to diversify their sourcing to mitigate risks associated with tariff instability. This often involves additional costs and logistical complexities.

Government Revenue and Budgetary Implications

Tariffs generate revenue for governments, but this revenue stream can be highly volatile due to tariff instability. The unpredictable nature of tariff changes makes long-term budgetary planning difficult.

- Data on tariff revenue generation: While tariffs can significantly contribute to government revenue in the short term, the long-term effects of trade wars and retaliatory tariffs can reduce overall trade volume, decreasing this revenue stream.

- Analysis of the economic costs and benefits of tariffs: A cost-benefit analysis should consider the potential loss of economic activity due to reduced trade against the revenue generated through tariffs. This trade-off is a crucial factor for policymakers.

- Comparison of tariff policies across different countries: Analyzing the tariff policies of different countries can provide valuable insights into their effectiveness and impact on economic growth. This comparative analysis can inform the development of more effective and sustainable tariff strategies.

International Market Impacts of Tariff Instability

Tariff instability extends far beyond national borders, significantly disrupting international markets and global cooperation.

Disruption of Global Supply Chains

Fluctuating tariffs create uncertainty, disrupting established global supply chains. This uncertainty affects businesses involved in international trade and can lead to delays and increased costs.

- Examples of supply chain disruptions: Tariffs on intermediate goods can cause disruptions, forcing businesses to find alternative suppliers, leading to delays and higher transportation costs.

- Statistics on trade volume changes: Data indicates that periods of high tariff instability are correlated with decreased global trade volumes.

- Discussion on the role of technology in mitigating supply chain disruptions: Technologies like blockchain and AI can help increase transparency and efficiency in supply chains, offering some mitigation against the effects of tariff instability.

Retaliatory Tariffs and Trade Wars

Tariff instability often escalates into trade wars, where countries impose retaliatory tariffs on each other’s goods. This leads to a decline in international cooperation and global trade.

- Examples of past trade wars: The history of trade relations is replete with examples of escalating trade conflicts, highlighting the significant negative economic consequences.

- Discussion on the role of international organizations in resolving trade disputes: The WTO and other international organizations play a crucial role in mediating trade disputes and promoting fair trade practices.

- Analysis of the long-term effects of trade wars on global economic growth: Studies have shown that trade wars can significantly reduce global economic growth and harm all participating countries in the long run.

Impact on Developing Economies

Developing economies are particularly vulnerable to tariff instability due to their greater reliance on exports and limited resources to mitigate trade shocks.

- Case studies of developing countries affected by tariff instability: Many developing countries, reliant on specific exports, are disproportionately impacted by trade wars and tariff fluctuations.

- Discussion on the need for international support for developing economies: International organizations and developed nations must provide greater support to developing countries to help them cope with the effects of tariff instability.

- Analysis of policy options to mitigate the impact of tariff instability on developing countries: Providing financial assistance, supporting diversification efforts, and promoting fair trade practices are essential for mitigating the negative consequences of tariff instability.

Conclusion

This FP video analysis has highlighted the significant and far-reaching consequences of tariff instability on both domestic and international markets. From increased prices for consumers and challenges for businesses to disruptions in global supply chains and escalating trade conflicts, the impact is multifaceted and complex. Understanding these effects is crucial for navigating the current economic landscape. Businesses need to develop strategies to mitigate the risks associated with tariff instability, while policymakers must strive for greater predictability and transparency in trade policies. Further research into the long-term effects of tariff instability and the development of effective mitigation strategies is vital. Continue your exploration of the impacts of tariff instability and global trade by reviewing our other resources and further analysis.

Featured Posts

-

Is There A Bbc Agatha Christie Deepfake An Investigation

May 20, 2025

Is There A Bbc Agatha Christie Deepfake An Investigation

May 20, 2025 -

Learn To Write Like Agatha Christie With Bbcs Ai Classes

May 20, 2025

Learn To Write Like Agatha Christie With Bbcs Ai Classes

May 20, 2025 -

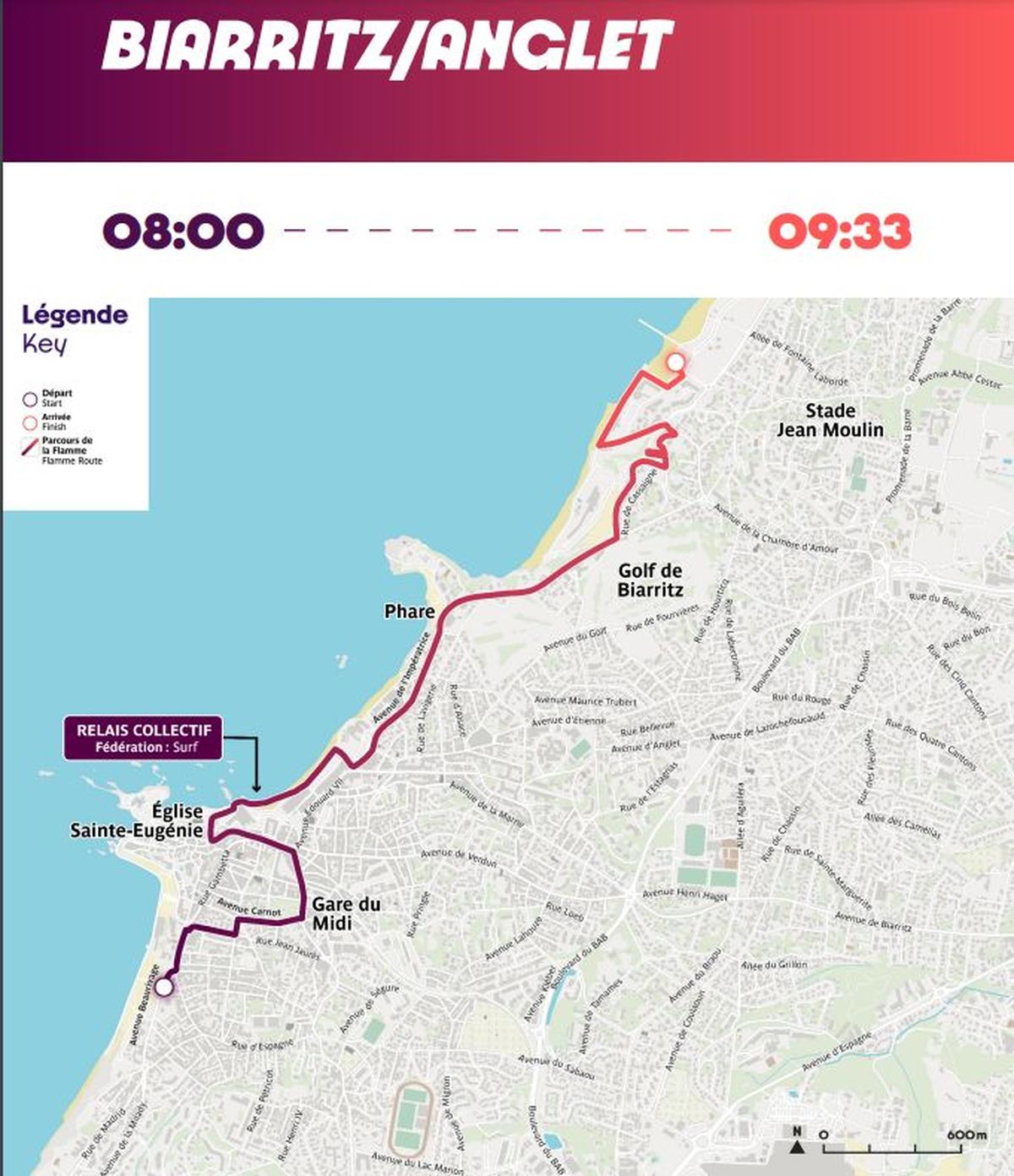

Journees Thematiques A Biarritz Parcours De Femmes Et Egalite

May 20, 2025

Journees Thematiques A Biarritz Parcours De Femmes Et Egalite

May 20, 2025 -

Tadic Incident Fenerbahce Kondigt Harde Aanpak Aan

May 20, 2025

Tadic Incident Fenerbahce Kondigt Harde Aanpak Aan

May 20, 2025 -

Abidjan Accueille Le President Mahama Dialogue Et Cooperation Au C Ur De La Visite D Etat Ghaneenne

May 20, 2025

Abidjan Accueille Le President Mahama Dialogue Et Cooperation Au C Ur De La Visite D Etat Ghaneenne

May 20, 2025

Latest Posts

-

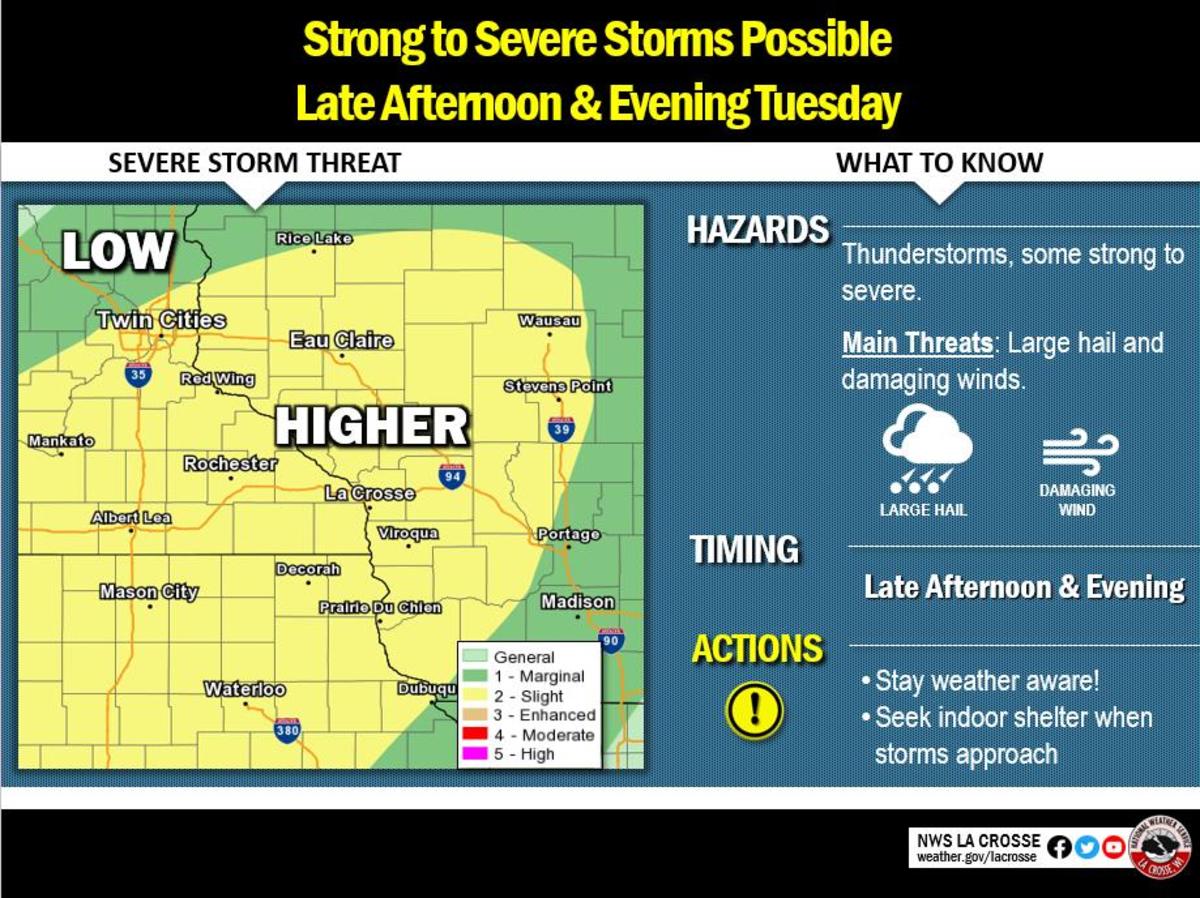

Updated Forecast Precise On And Off Times For Rain

May 20, 2025

Updated Forecast Precise On And Off Times For Rain

May 20, 2025 -

Severe Weather Alert Strong Winds And Storms Approaching

May 20, 2025

Severe Weather Alert Strong Winds And Storms Approaching

May 20, 2025 -

Your First Alert Strong Wind And Severe Storms Expected

May 20, 2025

Your First Alert Strong Wind And Severe Storms Expected

May 20, 2025 -

Analyzing Big Bear Ai Stock A Practical Guide For Investors

May 20, 2025

Analyzing Big Bear Ai Stock A Practical Guide For Investors

May 20, 2025 -

Preparing For School Delays During Winter Weather Advisories

May 20, 2025

Preparing For School Delays During Winter Weather Advisories

May 20, 2025