Fremantle Q1 Revenue: 5.6% Decrease Due To Reduced Buyer Spending

Table of Contents

Detailed Analysis of Fremantle's Q1 2024 Revenue Figures

Fremantle's Q1 2024 revenue totalled €XXX million (replace with actual figure), representing a €YY million (replace with actual figure) decrease compared to Q1 2023's revenue of €ZZZ million (replace with actual figure). This 5.6% year-over-year decline underscores a challenging financial start to the year. The decrease wasn't evenly distributed across all revenue streams. While precise breakdowns may not be publicly available immediately, analysts suggest a potential downturn in licensing agreements and a possible slowdown in advertising revenue, areas heavily impacted by reduced buyer spending.

[Insert chart/graph here visually comparing Q1 2023 and Q1 2024 revenue figures, clearly labelled and showing the percentage decrease.]

Keywords: Fremantle financial results, Q1 financial performance, revenue analysis, year-over-year comparison, Fremantle revenue figures.

Impact of Reduced Buyer Spending on Fremantle's Content Production

Reduced buyer spending directly translates to a tightening of Fremantle's content production budget. This impacts the company's ability to commission and produce new projects across various genres. The consequences are multifaceted:

- Fewer new projects greenlit: With less capital available, Fremantle may be forced to prioritize projects with higher perceived returns, potentially delaying or cancelling less commercially viable but creatively ambitious ventures.

- Budget cuts across existing productions: Existing projects might experience budget cuts, resulting in scaled-down productions, impacting quality and potentially delaying release schedules.

- Increased pressure on profitability: Fremantle may need to focus on more cost-effective production methods, potentially impacting the overall quality or creative vision of its content.

Specific examples, if available, should be mentioned here (e.g., "Reports suggest the postponement of the planned second season of [show name] due to budget constraints"). Sectors such as scripted drama, which often demands high production costs, are likely to be particularly affected.

Keywords: Content production budget, buyer demand, media market trends, production delays, Fremantle productions, budget constraints, content commissioning.

Industry-Wide Trends Contributing to the Revenue Decrease

Fremantle's Q1 revenue decrease reflects broader trends impacting the entire media industry. Several key factors contribute to the reduced buyer spending:

- Economic slowdown: Global economic uncertainty, inflation, and potential recessionary pressures directly impact consumer spending, including discretionary spending on entertainment.

- Shifting content consumption habits: The rise of streaming platforms has dramatically altered content consumption patterns. While offering vast libraries, these platforms also compete fiercely for subscribers, leading to price sensitivity among viewers.

- Increased competition: The media landscape is highly competitive, with numerous established players and new entrants vying for audience attention and advertising revenue. This intense competition puts downward pressure on pricing and profitability.

These factors create a perfect storm affecting Fremantle's ability to secure lucrative deals and maintain its profit margins.

Keywords: Media industry trends, economic impact on media, streaming competition, content consumption habits, market analysis, media market saturation.

Fremantle's Strategic Response to the Revenue Decline

Fremantle is actively responding to the challenging market conditions through several strategic initiatives:

- Cost optimization and efficiency measures: The company is likely implementing cost-cutting measures across various departments, streamlining operations, and seeking more efficient production methods.

- Focus on high-demand content: Fremantle will likely prioritize creating content that aligns with current audience preferences and trends, maximizing the chances of success and securing strong distribution deals.

- Strategic partnerships and acquisitions: Exploring partnerships and potential acquisitions could provide access to new markets, technologies, or content libraries, diversifying revenue streams.

- Exploration of new revenue models: Adapting to the changing landscape might involve exploring new revenue models, such as direct-to-consumer offerings or innovative licensing agreements.

These strategies aim to ensure Fremantle's resilience and long-term sustainability in a rapidly evolving media industry.

Keywords: Fremantle strategy, cost-cutting measures, media diversification, strategic partnerships, industry adaptation, revenue diversification.

Analyzing Fremantle's Q1 Revenue and the Future Outlook

Fremantle's 5.6% Q1 revenue decrease reflects the impact of reduced buyer spending on the media industry. The company's strategic response focuses on adapting to changing market conditions through cost optimization, strategic partnerships, and a focus on high-demand content. While the outlook for the coming quarters remains uncertain, Fremantle's proactive approach suggests a commitment to navigating these challenges. Understanding the impact of reduced buyer spending is crucial for navigating the evolving media landscape. To stay informed about Fremantle's performance and future developments, follow Fremantle's Q2 revenue announcement and track Fremantle's response to reduced buyer spending. Subscribe to our updates for further insights into the evolving media industry.

Featured Posts

-

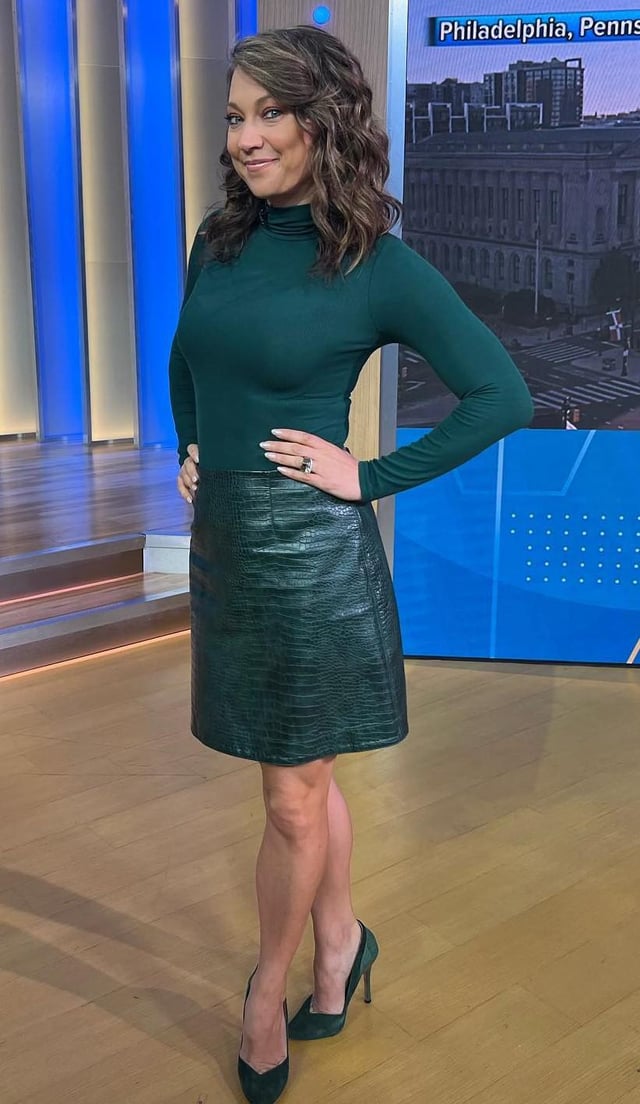

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025 -

Hmrc Tax Codes Understanding Your New Savings Related Code

May 20, 2025

Hmrc Tax Codes Understanding Your New Savings Related Code

May 20, 2025 -

Bgts Blockbusters A Comprehensive Look

May 20, 2025

Bgts Blockbusters A Comprehensive Look

May 20, 2025 -

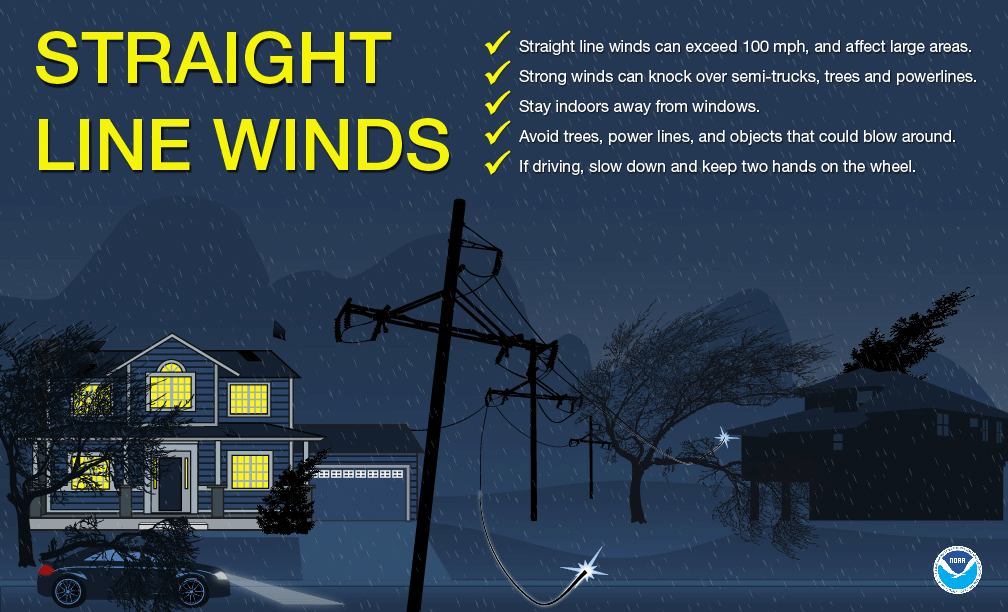

High Winds And Fast Moving Storms Safety Tips And Precautions

May 20, 2025

High Winds And Fast Moving Storms Safety Tips And Precautions

May 20, 2025 -

Assessing Climate Risk Before Applying For A Home Loan

May 20, 2025

Assessing Climate Risk Before Applying For A Home Loan

May 20, 2025

Latest Posts

-

Liverpool Juara Liga Inggris 2024 2025 Para Pelatih Di Balik Kesuksesan The Reds

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Para Pelatih Di Balik Kesuksesan The Reds

May 21, 2025 -

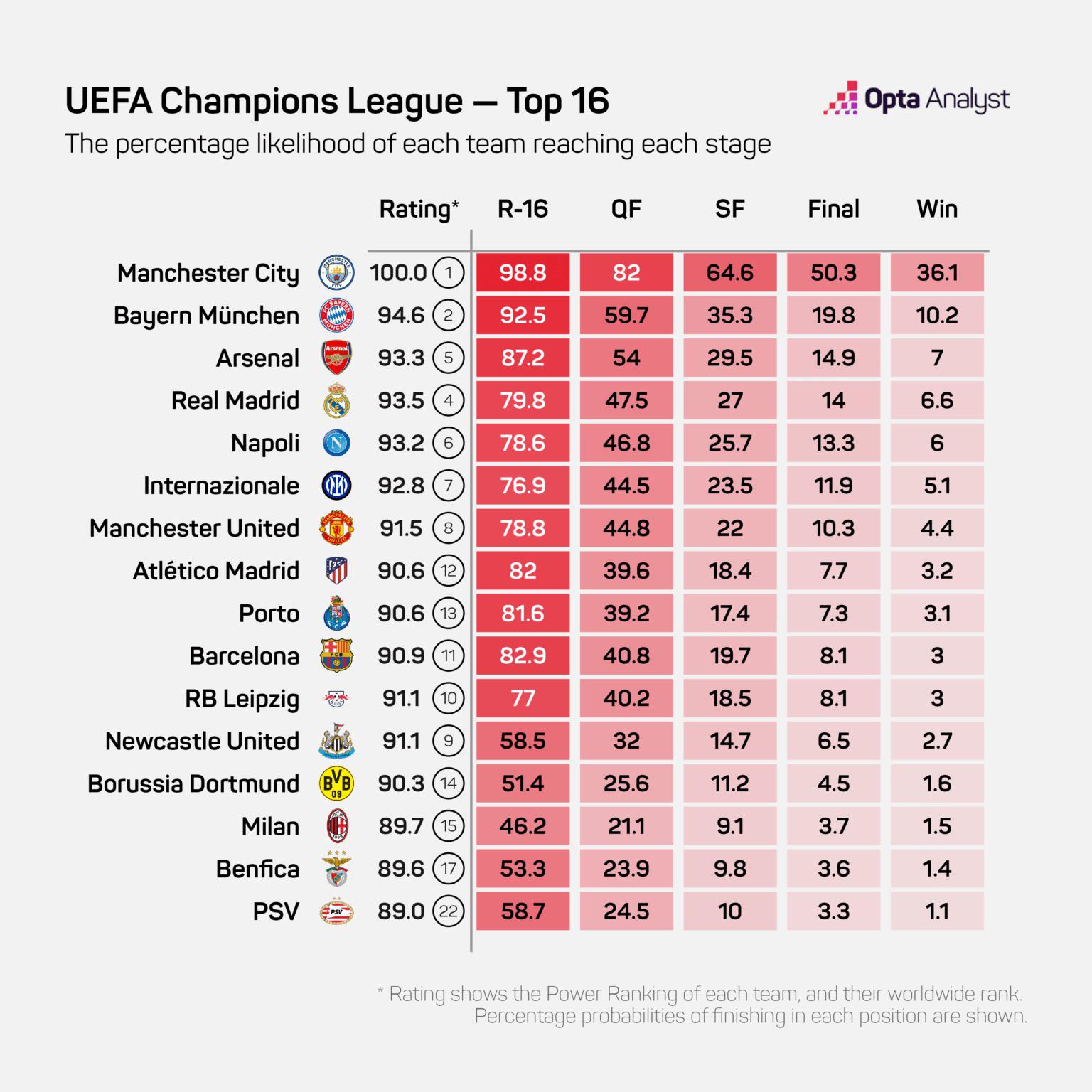

Sejarah Juara Premier League Siapa Yang Akan Menjuarai Liga Inggris 2024 2025

May 21, 2025

Sejarah Juara Premier League Siapa Yang Akan Menjuarai Liga Inggris 2024 2025

May 21, 2025 -

Daftar Juara Premier League 10 Tahun Terakhir And Peluang Liverpool Di Musim 2024 2025

May 21, 2025

Daftar Juara Premier League 10 Tahun Terakhir And Peluang Liverpool Di Musim 2024 2025

May 21, 2025 -

Prediksi Juara Liga Inggris 2024 2025 Bisakah Liverpool Raih Gelar

May 21, 2025

Prediksi Juara Liga Inggris 2024 2025 Bisakah Liverpool Raih Gelar

May 21, 2025 -

Liverpool Juara Premier League 2024 2025 Analisis Dan Sejarah Pemenang

May 21, 2025

Liverpool Juara Premier League 2024 2025 Analisis Dan Sejarah Pemenang

May 21, 2025