From $3K Babysitter To $3.6K Daycare: A Financial Nightmare

Table of Contents

The Crushing Weight of Daycare Expenses

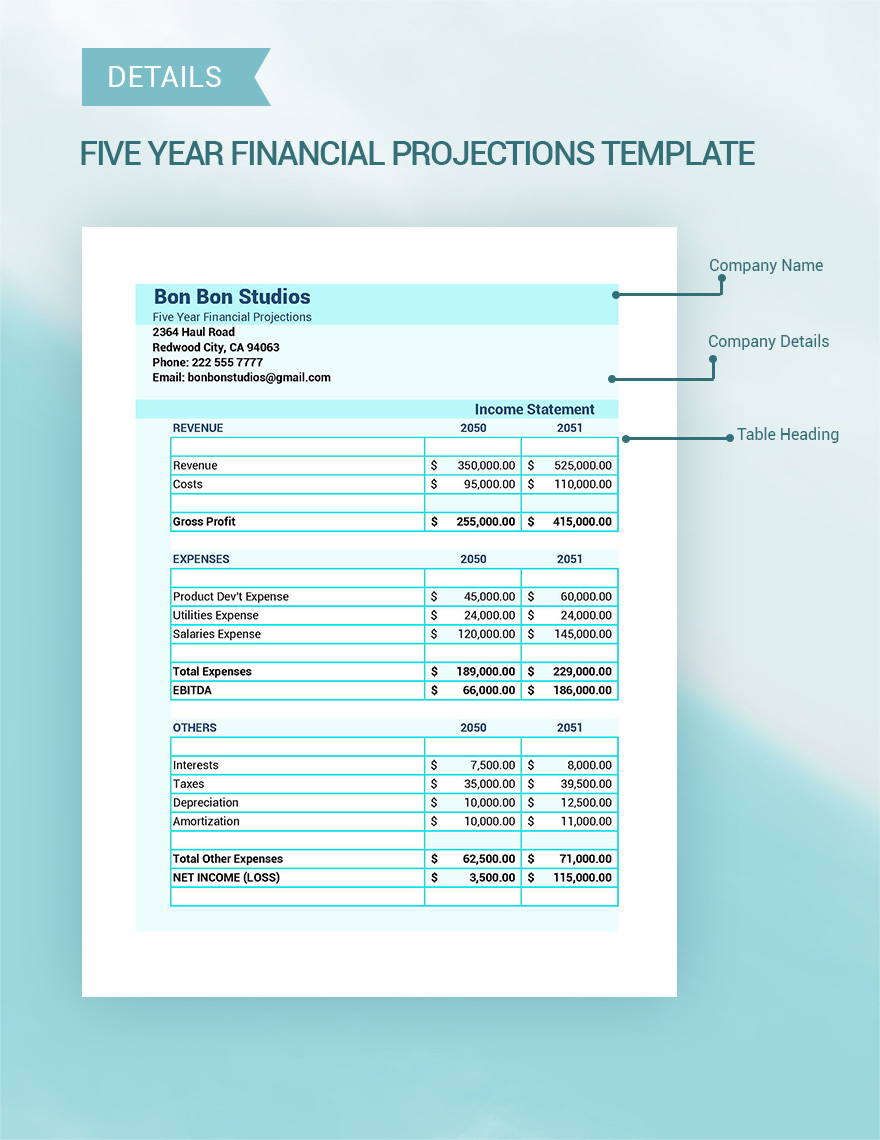

Comparing Babysitter vs. Daycare Costs

The difference between hiring a babysitter and enrolling a child in daycare is often staggering. Babysitters typically charge an hourly rate, offering flexibility but potentially higher costs for extended hours. Daycares, on the other hand, charge daily or weekly fees, which can seem less expensive at first glance. However, hidden costs quickly add up.

- Registration fees: Many daycares charge a significant upfront fee for enrollment.

- Supply fees: Costs for diapers, wipes, and other consumables can significantly increase monthly expenses.

- Extracurricular activity fees: Participation in optional activities like arts and crafts, music classes, or field trips can dramatically increase the overall cost.

According to recent studies, the average annual cost of daycare for an infant can range from $10,000 to $20,000, depending on location and the type of facility. These high childcare costs can represent a substantial portion of a family's income, leaving little room for savings or other essential expenses.

The Impact of Inflation on Childcare

Inflation plays a significant role in driving up daycare costs. As the cost of living increases, daycare centers face higher expenses for rent, utilities, staffing, and supplies. These increased operational costs are often passed on to parents in the form of higher fees.

- Increased wages for childcare providers contribute significantly to rising costs.

- Higher costs for food, cleaning supplies, and educational materials also impact fees.

- Rising rent in urban areas directly correlates with increased daycare prices.

The impact of inflation on childcare expenses is particularly acute for low- and middle-income families, who often struggle to absorb these increases without significant financial strain.

Exploring Alternatives to Traditional Daycare

In-Home Daycares and Their Cost Effectiveness

In-home daycares are often presented as a more affordable alternative to larger daycare centers. While this can be true, it's crucial to weigh the pros and cons.

- Advantages: In-home daycares typically charge lower fees than larger centers, offer a more personalized experience, and often have a more flexible schedule.

- Disadvantages: Licensing and regulatory requirements may vary, the quality of care can be inconsistent, and there may be limited availability.

Careful research and thorough vetting are essential before choosing an in-home daycare.

Family Support Networks and Cost-Sharing

Sharing childcare responsibilities with family members or friends can significantly reduce costs.

- Strategies: This could involve a rotating schedule, sharing transportation costs, or splitting the fees for a part-time caregiver. A shared nanny or babysitter could also be a cost-effective option.

This collaborative approach allows for cost-sharing and reduces the individual financial burden.

Utilizing Subsidies and Government Assistance

Government assistance programs and childcare subsidies can provide crucial financial relief to eligible families.

- Programs: Many countries offer various subsidies and tax credits to offset the high cost of childcare. These programs vary in eligibility requirements and the amount of assistance provided. Research programs offered in your region.

Exploring these resources can make a significant difference in managing expensive daycare costs.

Budgeting and Financial Strategies for Managing High Childcare Costs

Creating a Realistic Childcare Budget

Creating a comprehensive family budget that prioritizes childcare expenses is crucial for effective financial planning.

- Tips: Track all childcare-related expenses, explore options for reducing spending in other areas, and consider setting up a separate savings account for future childcare costs.

Prioritizing childcare in the budget creates a clear financial framework.

Seeking Financial Counseling

When faced with overwhelming childcare expenses, seeking help from a financial advisor or counselor can provide invaluable support.

- Resources: Financial professionals can offer personalized guidance on budgeting, debt management, and exploring financial assistance programs.

Professional guidance can help manage the financial stress associated with high daycare costs.

Conclusion

The high cost of childcare is a significant financial challenge for many families. From comparing babysitter rates to daycare fees, to navigating inflation's impact and exploring alternatives like in-home care or government assistance, finding affordable childcare requires careful planning and resourcefulness. Budgeting strategies, along with potentially seeking financial counseling, are also crucial. Don't let expensive daycare costs become a financial nightmare – take control of your family's budget today by exploring the options outlined above. Start researching available subsidies and creating a realistic childcare budget to ease the burden of these high childcare costs.

Featured Posts

-

Dijon Lac Kir Trois Hommes Agresses Sauvagement

May 09, 2025

Dijon Lac Kir Trois Hommes Agresses Sauvagement

May 09, 2025 -

Golden Knights Defeat Blue Jackets 4 0 Hills Strong Performance Leads The Way

May 09, 2025

Golden Knights Defeat Blue Jackets 4 0 Hills Strong Performance Leads The Way

May 09, 2025 -

Us Attorney Generals Fox News Presence Context And Implications

May 09, 2025

Us Attorney Generals Fox News Presence Context And Implications

May 09, 2025 -

5 Famous Feuds Featuring Stephen King

May 09, 2025

5 Famous Feuds Featuring Stephen King

May 09, 2025 -

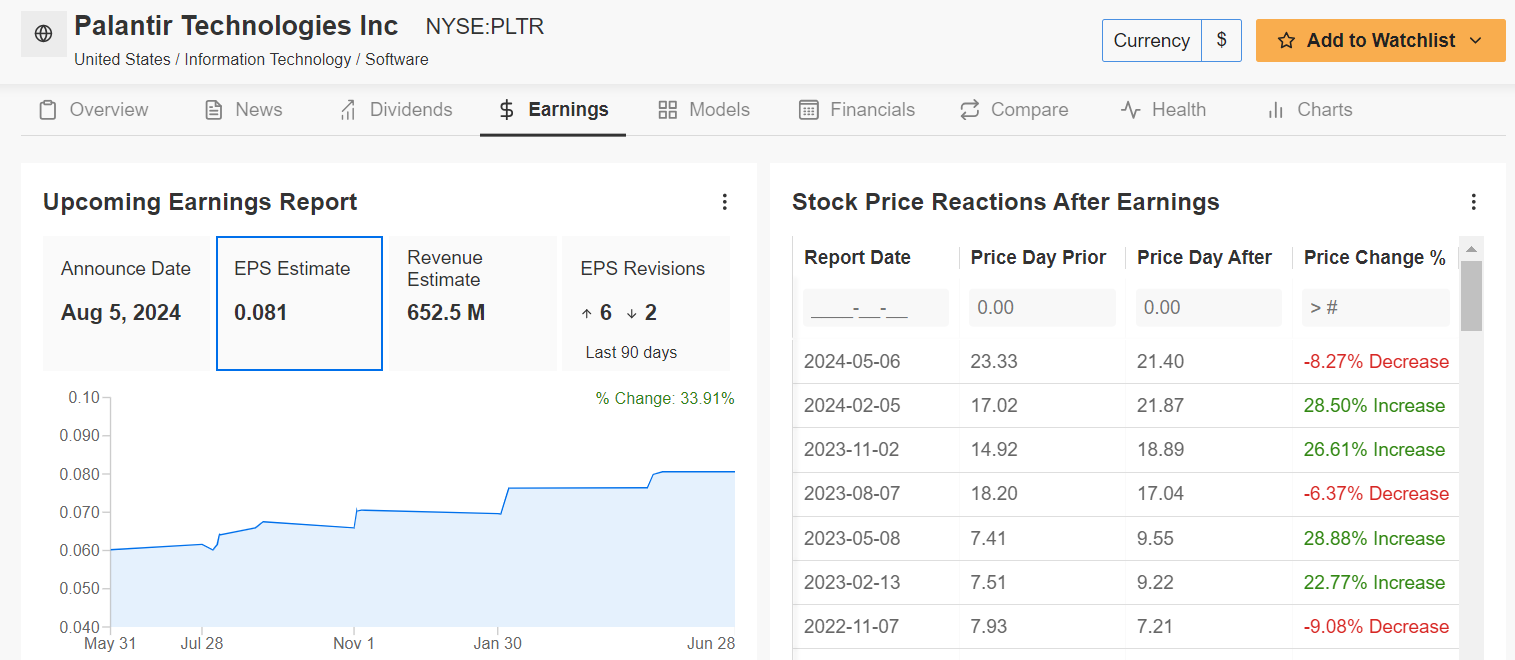

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 09, 2025

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 09, 2025