G-7 To Review De Minimis Tariffs On Chinese Imports: What To Expect

Table of Contents

Understanding De Minimis Tariffs and Their Impact

Definition and Function of De Minimis Tariffs

De minimis tariffs refer to the value threshold below which imported goods are exempt from import duties or other tariffs. These thresholds are set by individual countries and are designed to simplify customs procedures for small shipments. They primarily impact small-scale imports, particularly those facilitated by e-commerce platforms. The current thresholds vary significantly across G7 nations, creating complexities for international trade.

- Examples of goods commonly affected: Small consumer electronics, clothing items, books, and personal care products.

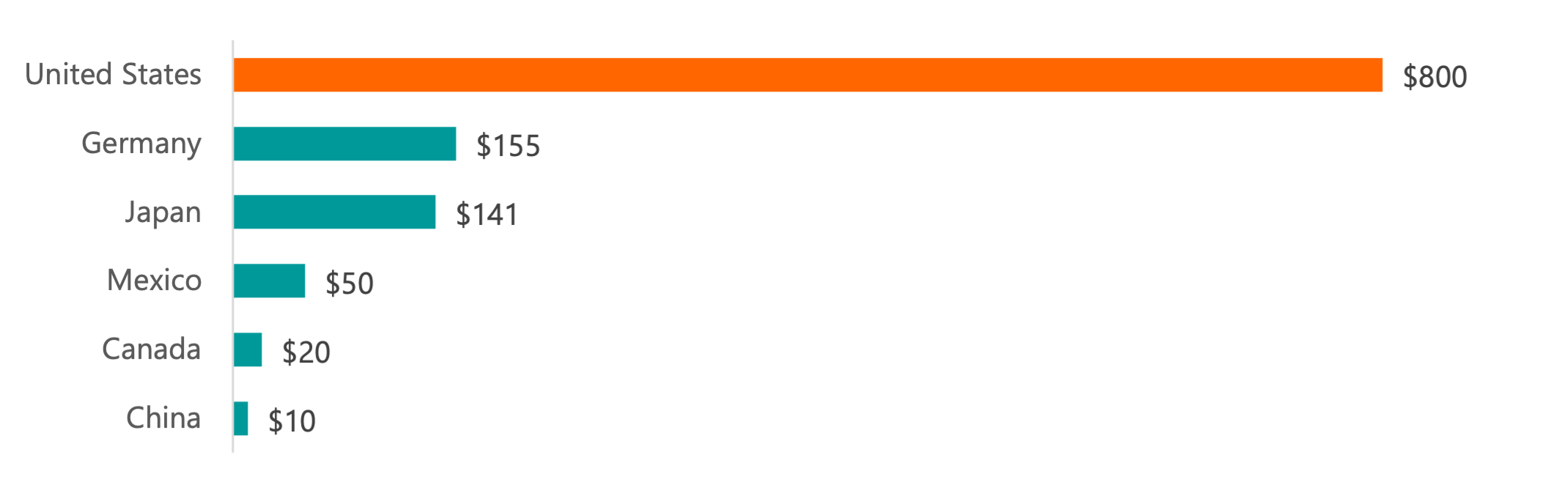

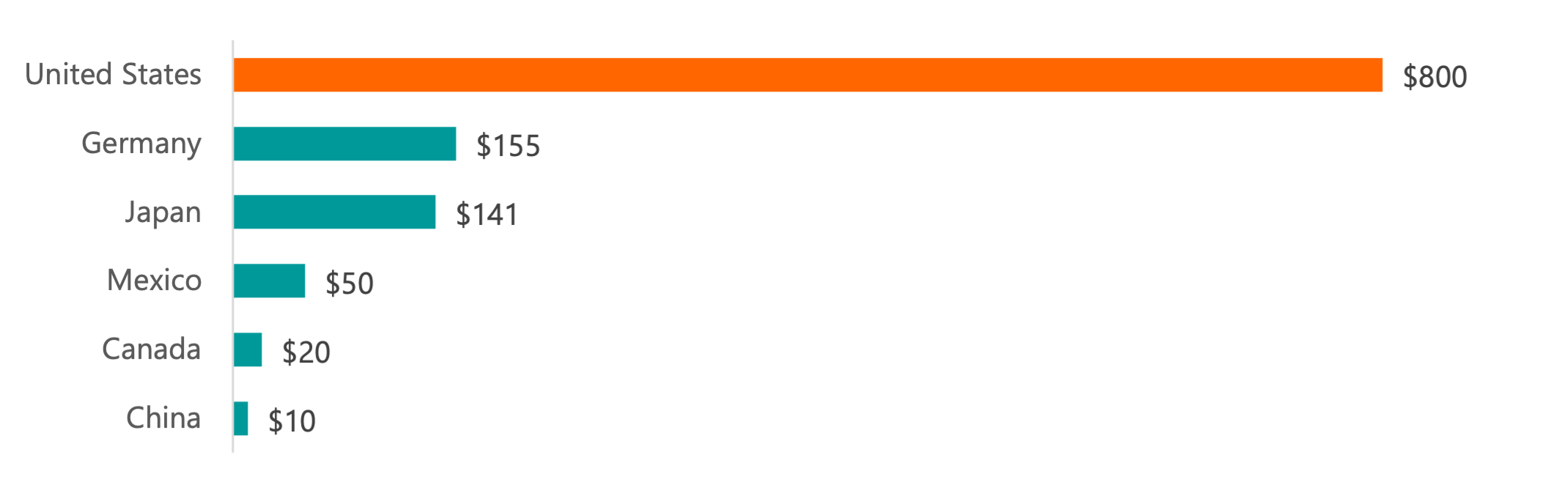

- Differences between de minimis levels across various G7 nations: The US might have a higher threshold than Japan, leading to discrepancies in import costs for the same product. This variation makes it challenging for businesses to navigate international trade.

- Impact on e-commerce and cross-border trade: De minimis tariffs significantly influence cross-border e-commerce, as they determine whether small online purchases are subject to import duties. Changes to these thresholds can directly affect the cost and viability of such transactions.

The Current Situation with Chinese Imports

Currently, G7 nations apply varying de minimis tariff levels to Chinese imports. These levels often reflect existing trade tensions and disputes between individual G7 members and China. The lack of harmonization among G7 countries creates an uneven playing field for businesses.

- Specific examples of Chinese imports impacted: A wide range of goods, including electronics, textiles, and manufactured goods, are affected by these tariffs.

- Data on trade volumes affected by current tariffs: Quantifying the exact trade volume affected requires specific data from each G7 nation, but it's significant enough to warrant the current review.

- Any previous changes to these tariffs and their results: Previous adjustments to de minimis tariffs have often led to adjustments in trade patterns and, in some cases, retaliatory measures from other countries.

The G-7 Review Process and Potential Outcomes

Reasons for the Review

The G7's decision to review de minimis tariffs on Chinese imports stems from a multitude of factors. Concerns about fair trade practices, the need for consistent revenue generation, and national security considerations are all likely playing a role. The current inconsistencies between various G7 nations' approaches require harmonization.

- Arguments for raising tariffs: Proponents argue that higher tariffs could level the playing field for domestic businesses, increase government revenue, and address concerns about unfair trade practices from China.

- Arguments for lowering tariffs: Conversely, reducing tariffs could stimulate cross-border e-commerce, reduce consumer prices, and encourage greater trade between China and G7 nations.

- The potential influence of lobbying groups: Various industry groups and businesses will undoubtedly lobby to influence the outcome of the review, advocating for policies that benefit their interests.

Possible Scenarios and Their Implications

The G7 review could result in several outcomes: raising, lowering, or maintaining the current de minimis thresholds. Each scenario has distinct implications:

- Raising thresholds: This could increase import costs for consumers, potentially impacting inflation. Small businesses importing from China would face higher costs.

- Lowering thresholds: This could lead to lower prices for consumers and increased competition, but it might also impact domestic industries and reduce government revenue.

- Maintaining current thresholds: This would provide stability but doesn't address existing inconsistencies and concerns about fairness.

- Retaliatory measures from China: Significant changes to de minimis tariffs could provoke retaliatory measures from China, escalating trade tensions.

- Changes to supply chains: Businesses might need to adjust their supply chains to adapt to new tariff levels, potentially shifting sourcing away from China.

Impact on Businesses and the Global Economy

Challenges for Businesses

The uncertainty surrounding the de minimis tariff review presents significant challenges for businesses. Adapting to potential changes requires proactive strategies.

- Supply chain diversification: Businesses may need to diversify their supply chains, reducing reliance on Chinese imports.

- Cost adjustments: Companies need to prepare for potential price increases or decreases depending on the outcome of the review.

- Risk management strategies: Implementing robust risk management strategies is critical to mitigate potential negative impacts.

- Lobbying efforts: Businesses may choose to participate in lobbying efforts to influence the review's outcome.

Broader Economic Implications

The G7's decision will have far-reaching consequences for the global economy.

- Impact on global trade volumes: Changes to de minimis tariffs could significantly impact trade flows between China and G7 nations.

- Potential inflationary pressures: Higher tariffs could contribute to inflationary pressures, particularly if they affect essential goods.

- Effects on international economic relations: The review's outcome will have significant implications for broader international economic relations and trust between nations.

- Opportunities for other countries: Changes in de minimis tariffs on Chinese imports might create opportunities for businesses in other countries to gain market share.

Conclusion: Navigating the Future of G-7 De Minimis Tariffs on Chinese Imports

The G-7's review of de minimis tariffs on Chinese imports presents a critical juncture in global trade. The potential outcomes – whether raising, lowering, or maintaining the thresholds – will significantly impact businesses, consumers, and the global economy. The review highlights the complex interplay between trade policy, national interests, and the need for a stable international trading environment. Understanding the intricacies of de minimis tariffs and their implications is crucial for businesses to navigate the evolving landscape.

Key Takeaways: The review will likely influence consumer prices, supply chains, and international relations. Businesses need to prepare for potential changes and develop adaptive strategies.

Call to Action: Stay informed on the evolving landscape of G-7 de minimis tariffs on Chinese imports. Regularly monitor official announcements and adjust your import strategies accordingly to mitigate potential risks and seize emerging opportunities. Proactive planning and adaptation are crucial for navigating the future of G-7 de minimis tariffs on Chinese imports and maintaining a competitive edge in the global market.

Featured Posts

-

Apple Stock Aapl Key Price Levels To Watch

May 25, 2025

Apple Stock Aapl Key Price Levels To Watch

May 25, 2025 -

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Guide

May 25, 2025

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Guide

May 25, 2025 -

The Busiest Days To Fly Around Memorial Day 2025 A Travel Planners Guide

May 25, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travel Planners Guide

May 25, 2025 -

The Short Lived Black Lives Matter Plaza A Case Study In Political Change

May 25, 2025

The Short Lived Black Lives Matter Plaza A Case Study In Political Change

May 25, 2025 -

Cyberattack Costs Marks And Spencer 300 Million

May 25, 2025

Cyberattack Costs Marks And Spencer 300 Million

May 25, 2025

Latest Posts

-

Urgent Flash Flood Warning Extended For Cayuga County Through Tuesday

May 25, 2025

Urgent Flash Flood Warning Extended For Cayuga County Through Tuesday

May 25, 2025 -

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025 -

Flash Flood Emergency Prevention Response And Recovery

May 25, 2025

Flash Flood Emergency Prevention Response And Recovery

May 25, 2025 -

How To Recognize And React To A Flash Flood Emergency

May 25, 2025

How To Recognize And React To A Flash Flood Emergency

May 25, 2025 -

Responding To A Flash Flood Emergency A Survival Guide

May 25, 2025

Responding To A Flash Flood Emergency A Survival Guide

May 25, 2025