Gold Fields' Strategic Expansion: A$3.7 Billion Gold Road Acquisition

Table of Contents

The gold mining industry witnessed a seismic shift with Gold Fields' A$3.7 billion acquisition of Gold Road Resources. This monumental deal, representing a significant strategic expansion for Gold Fields, underscores the company's ambitious growth plans and its commitment to solidifying its position within the Australian gold sector. This article analyzes the strategic implications of this acquisition, examining its impact on Gold Fields' Australian gold portfolio, its underlying rationale, and the financial aspects of this substantial investment.

Gold Fields, a globally recognized gold producer, and Gold Road Resources, a prominent Australian gold miner, represent key players in the dynamic gold market. The acquisition significantly enhances Gold Fields’ presence in Australia, a region known for its rich gold reserves and stable mining environment. This deal directly impacts the Australian gold landscape and provides valuable insights into the broader gold mining industry's strategic maneuvering.

Strengthening Gold Fields' Australian Gold Portfolio

The acquisition dramatically bolsters Gold Fields' Australian gold portfolio, resulting in a significant increase in production capacity, reserves, and geographical diversification.

Enhanced Production and Reserves

The addition of Gold Road Resources' assets, most notably the Gruyere gold mine, substantially expands Gold Fields' production and reserves.

- Production Increase: The acquisition is expected to add hundreds of thousands of ounces of gold to Gold Fields' annual production. Precise figures will depend on operational integration and ongoing exploration efforts.

- Reserve Expansion: Significant increases in gold reserves are anticipated, extending the mine life of existing operations and providing a strong foundation for future production. This translates into a more secure long-term production outlook.

- Geographical Diversification: The acquisition strengthens Gold Fields' presence in Western Australia, reducing its operational reliance on specific geographic locations and enhancing its overall operational resilience.

Synergies and Operational Efficiencies

Integrating Gold Road's assets into Gold Fields' existing Australian operations promises substantial cost savings and operational efficiencies.

- Shared Infrastructure: Combining infrastructure such as processing plants and transportation networks will reduce redundant capital expenditure and operating costs.

- Streamlined Processes: Consolidating operations and implementing standardized procedures will enhance overall efficiency and reduce administrative overhead.

- Workforce Integration: Careful planning for workforce integration will ensure that Gold Fields leverages the expertise and experience of both organizations, while optimizing staffing levels for maximum efficiency.

Strategic Rationale Behind the Acquisition

Gold Fields' acquisition of Gold Road Resources is a strategic move driven by multiple factors, aiming to strengthen its market position, enhance growth prospects, and mitigate risks.

Market Position and Growth

This acquisition substantially enhances Gold Fields' market share and positions it for significant future growth within the global gold market.

- Increased Market Capitalization: The acquisition is expected to increase Gold Fields' market capitalization, attracting investors seeking exposure to the gold market.

- Enhanced Growth Prospects: The combined resources and operational capabilities of the two companies create a platform for significant future expansion and growth.

- Long-Term Strategic Goals: This acquisition directly contributes to Gold Fields' long-term strategic goal of becoming a leading global gold producer, solidifying its presence in key gold-producing regions.

Diversification and Risk Mitigation

The acquisition significantly diversifies Gold Fields' portfolio, reducing its reliance on specific mines or regions and mitigating operational risks.

- Reduced Risk: Diversifying its asset base across multiple geographically distinct locations reduces the impact of potential disruptions at any single site.

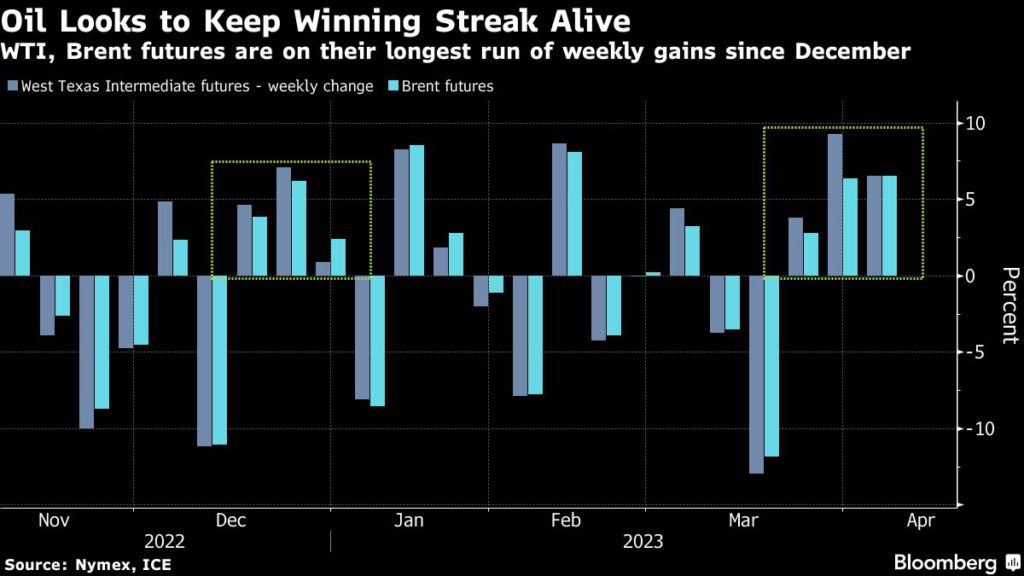

- Commodity Price Fluctuations: Having a diversified portfolio of assets and resources helps mitigate the impact of fluctuations in gold prices.

Financial Implications and Funding of the Acquisition

The A$3.7 billion acquisition required careful consideration of the transaction structure and funding strategies.

Transaction Structure and Financing

The acquisition involved a negotiated agreement, with the purchase price being funded through a combination of financing options.

- Funding Sources: Gold Fields likely utilized a mix of debt financing and equity contributions to fund the acquisition. The specific allocation will be detailed in official company statements.

- Debt-to-Equity Ratio: The acquisition will likely impact Gold Fields’ debt-to-equity ratio; however, the company's financial strength and robust credit rating should allow for effective debt management.

Shareholder Value and Return on Investment

Gold Fields anticipates that the acquisition will create significant value for shareholders.

- Share Price Impact: While short-term market fluctuations are possible, the long-term expectation is for an increased share price reflecting the enhanced value and growth potential of the enlarged company.

- Increased Profitability and Dividends: The synergies and increased production resulting from the acquisition are expected to lead to improved profitability and potentially increased shareholder dividends in the future.

Conclusion: Gold Fields' A$3.7 Billion Gold Road Acquisition: A Bold Move for the Future

The Gold Fields' acquisition of Gold Road Resources represents a bold strategic move, significantly strengthening its Australian gold portfolio and enhancing its global market position. The acquisition's substantial increase in production, reserves, and geographical diversification, along with the potential for significant operational synergies and enhanced shareholder value, solidify its position as a key player in the global gold mining industry. The financial implications have been carefully managed, and the long-term benefits for shareholders are considerable. Learn more about this significant acquisition in the Australian gold market and Gold Fields' continued strategic expansion by visiting [link to Gold Fields website].

Featured Posts

-

Five Key Charts To Watch In Global Commodity Markets This Week

May 05, 2025

Five Key Charts To Watch In Global Commodity Markets This Week

May 05, 2025 -

Addressing The Westbrook Situation A Statement From The Nuggets

May 05, 2025

Addressing The Westbrook Situation A Statement From The Nuggets

May 05, 2025 -

Absence De Consultation Publique Sur Les Decisions Cles De Defense En France

May 05, 2025

Absence De Consultation Publique Sur Les Decisions Cles De Defense En France

May 05, 2025 -

Analyzing Fan Reactions To Russell Westbrooks Performance Nuggets Vs Warriors

May 05, 2025

Analyzing Fan Reactions To Russell Westbrooks Performance Nuggets Vs Warriors

May 05, 2025 -

Five South Bengal Districts Under Heatwave Warning

May 05, 2025

Five South Bengal Districts Under Heatwave Warning

May 05, 2025

Latest Posts

-

Chris Pratts Unfiltered Response To Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025

Chris Pratts Unfiltered Response To Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025 -

Maria Shrivers Comments On Patrick Schwarzenegger And His White Lotus Character

May 06, 2025

Maria Shrivers Comments On Patrick Schwarzenegger And His White Lotus Character

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Role Maria Shriver Speaks Out

May 06, 2025

Patrick Schwarzeneggers White Lotus Role Maria Shriver Speaks Out

May 06, 2025 -

Understanding The Postponement Of Patrick Schwarzenegger And Abby Champions Wedding

May 06, 2025

Understanding The Postponement Of Patrick Schwarzenegger And Abby Champions Wedding

May 06, 2025 -

Maria Shriver On Patrick Schwarzeneggers White Lotus Role The Truth Revealed

May 06, 2025

Maria Shriver On Patrick Schwarzeneggers White Lotus Role The Truth Revealed

May 06, 2025