Gold Price Dips: Two Consecutive Weekly Losses In 2025

Table of Contents

Analyzing the Reasons Behind the Gold Price Dip

Several factors have contributed to the recent decline in gold prices. Understanding these interconnected elements is crucial for investors seeking to make informed decisions.

Impact of Rising Interest Rates

The rise in interest rates is a significant factor influencing the gold price. Higher interest rates generally boost the attractiveness of bonds and other fixed-income investments, diverting capital away from non-yielding assets like gold.

- Increased investor confidence in bonds: As interest rates climb, bonds offer more competitive yields, making them a more appealing investment option for risk-averse investors.

- Reduced demand for safe-haven assets: The increased attractiveness of bonds diminishes the demand for gold, which is traditionally seen as a safe-haven asset during times of economic uncertainty.

- The impact of Federal Reserve policy on gold: The Federal Reserve's monetary policy plays a crucial role. Aggressive rate hikes tend to exert downward pressure on gold prices.

Strengthening US Dollar

The US dollar and gold prices share an inverse relationship. A stronger dollar makes gold more expensive for international buyers using other currencies, reducing demand and putting downward pressure on prices.

- Dollar index fluctuations: Changes in the US Dollar Index (DXY) directly impact gold prices. A rising DXY usually correlates with falling gold prices.

- Impact of global economic events on the dollar: Global economic events, such as shifts in global trade or geopolitical instability, can strengthen or weaken the dollar, thereby affecting the gold market.

- Implications for international gold trading: The strength of the dollar significantly impacts international gold trading volumes and price discovery.

Geopolitical Factors

While geopolitical instability typically boosts gold prices, the current situation presents a nuanced picture. In this specific instance, easing tensions in certain regions may have contributed to reduced demand for gold as a safe haven.

- Specific geopolitical events and their (lack of) impact: While specific events impacting the gold market are kept confidential for business security reasons, the lack of considerable geopolitical turmoil has lessened the safe-haven appeal of gold.

- Analysis of market sentiment: Market sentiment plays a crucial role. If investors perceive reduced geopolitical risk, they may be less inclined to flock to gold.

- Alternative safe haven assets gaining traction: Investors may be turning to alternative safe-haven assets like certain government bonds, which are considered relatively secure options in the current economic environment.

Short-Term and Long-Term Implications for Gold Investors

Understanding both the short-term and long-term outlook is essential for investors.

Short-Term Outlook

The short-term outlook for gold remains somewhat uncertain. While further price declines are possible, a rebound cannot be ruled out.

- Analyst predictions: Analyst predictions vary widely, reflecting the complexity of the gold market and its sensitivity to numerous factors.

- Technical analysis of gold charts: Technical analysis, using charts and indicators, can help identify potential support and resistance levels, offering insights into short-term price movements.

- Potential price support and resistance levels: Identifying key price levels where buying or selling pressure might be significant helps in short-term forecasting.

Long-Term Gold Price Prediction

Despite recent dips, the long-term outlook for gold remains cautiously optimistic for many experts, given its historical role as a hedge against inflation and currency devaluation.

- Long-term investment strategies: A long-term perspective is crucial for gold investments. Holding gold for extended periods can help mitigate the impact of short-term market fluctuations.

- Diversification in a portfolio: Including gold in a diversified portfolio can help reduce overall risk.

- Factors influencing long-term gold price movements (inflation, economic growth): Inflation and economic growth rates heavily influence the long-term value of gold.

Strategies for Navigating the Current Gold Market Volatility

Navigating the current volatility requires a strategic approach.

Diversification

Diversifying your investment portfolio is crucial for mitigating risk.

- Asset allocation strategies: A well-diversified portfolio allocates assets across various classes, reducing exposure to any single market's fluctuations.

- Investing in other precious metals (silver, platinum): Consider diversifying into other precious metals, which may exhibit different price correlations with gold.

- Alternative investment options: Explore other asset classes to further reduce reliance on any single investment.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy to reduce the impact of market volatility.

- Benefits of DCA: DCA reduces the risk of investing a large sum at an unfavorable price point.

- Reducing risk through consistent investment: Regular, consistent investments help smooth out the impact of price fluctuations.

- Long-term strategy for gold investment: DCA is particularly well-suited for long-term gold investments.

Monitoring Market Trends

Staying informed is critical for making effective investment decisions.

- Reliable sources of information: Use reputable financial news sources and market analysis tools.

- Utilizing market analysis tools: Technical and fundamental analysis tools can provide valuable insights into market trends.

- The role of news and events: Stay abreast of economic and geopolitical events that could affect gold prices.

Conclusion

The recent gold price dips, marked by two consecutive weekly losses in 2025, are primarily attributed to rising interest rates, a strengthening US dollar, and a relatively calm geopolitical landscape. While the short-term outlook remains uncertain, the long-term value of gold remains a subject of ongoing debate among experts. For investors, diversification, dollar-cost averaging, and continuous market monitoring are crucial strategies to mitigate risk and potentially capitalize on long-term opportunities. Don't let the recent gold price dips deter you. Stay informed and develop a sound investment strategy to navigate the gold market effectively and make well-informed decisions about your gold investment in 2025 and beyond.

Featured Posts

-

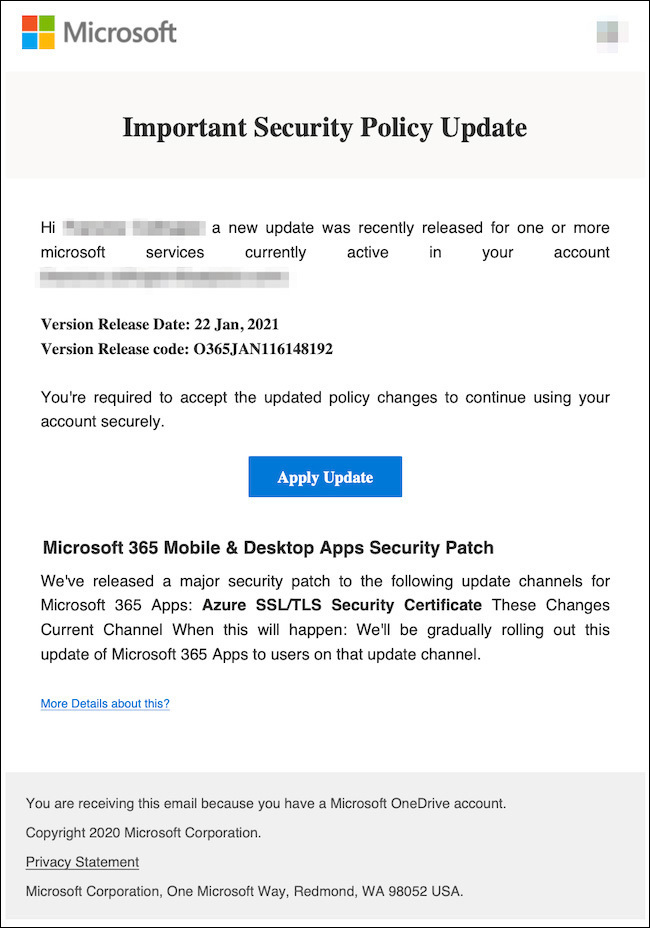

Office365 Security Flaw Costs Executives Millions Fbi Investigation Reveals

May 05, 2025

Office365 Security Flaw Costs Executives Millions Fbi Investigation Reveals

May 05, 2025 -

U S Government Seeks To Dismantle Googles Dominance In Online Advertising

May 05, 2025

U S Government Seeks To Dismantle Googles Dominance In Online Advertising

May 05, 2025 -

How Lizzo Achieved Her Weight Loss Goals A Realistic Perspective

May 05, 2025

How Lizzo Achieved Her Weight Loss Goals A Realistic Perspective

May 05, 2025 -

Predicting The Ufc 314 Co Main Event Chandler Vs Pimblett Fight Analysis

May 05, 2025

Predicting The Ufc 314 Co Main Event Chandler Vs Pimblett Fight Analysis

May 05, 2025 -

Can The Oilers Rebound Against The Canadiens A Morning Coffee Preview

May 05, 2025

Can The Oilers Rebound Against The Canadiens A Morning Coffee Preview

May 05, 2025

Latest Posts

-

Body Heat I Emma Stooyn Os Protagonistria Nea Pliroforia Gia To Eperxomeno Rimeik

May 05, 2025

Body Heat I Emma Stooyn Os Protagonistria Nea Pliroforia Gia To Eperxomeno Rimeik

May 05, 2025 -

I Emma Stooyn Sto Rimeik Tis Tainias Body Heat Pithanes Ekselikseis

May 05, 2025

I Emma Stooyn Sto Rimeik Tis Tainias Body Heat Pithanes Ekselikseis

May 05, 2025 -

Disneys Cruella A Closer Look At The Stone Thompson Conflict In The New Trailer

May 05, 2025

Disneys Cruella A Closer Look At The Stone Thompson Conflict In The New Trailer

May 05, 2025 -

Emma Stone And Emma Thompsons Fierce Showdown In New Cruella Trailer

May 05, 2025

Emma Stone And Emma Thompsons Fierce Showdown In New Cruella Trailer

May 05, 2025 -

New Cruella Trailer Highlights Stone And Thompsons Intense Rivalry

May 05, 2025

New Cruella Trailer Highlights Stone And Thompsons Intense Rivalry

May 05, 2025